2023 witnessed the return of the spectre of banking crisis. In the US, three regional and specialised banks failed in rapid sequence and in Switzerland, a globally systemic bank stood on the brink, for the first time since Lehman Brothers. This was a wake-up call after a decade of relative calm, marked by a succession of reforms designed to prepare for an orderly resolution of a systemically important bank. While initial market jitters and fears of systemic repercussions were palpable, they soon subsided following the Swiss government's intervention, as it orchestrated the takeover of Credit Suisse by UBS.

Lessons from the crisis in the US were quickly drawn and have been analysed in some detail including in a recent rapid-response report by CEPR (Acharya et al. 2023). In contrast, the Credit Suisse crisis has received less scrutiny. Nevertheless, it raises several pivotal questions about the ‘too big to fail’ (TBTF) regime, and a direct comparison with the situation of US banks is not straightforward.

For Switzerland, the downfall of Credit Suisse sent shockwaves comparable to, if not worse than, the grounding of Swissair some two decades before. Both the political and technical aspects of coming to terms with this crisis are still unfolding. In line with their commitment to address the implications of the Swiss TBTF regime, the Federal Department of Finance established an independent Expert Group on Banking Stability. While the primary mandate of this expert group was forward-looking, given the ongoing investigation by a Swiss Parliamentary Commission into the precise sequence of events leading up to the crisis, it conducted hearings with relevant institutions, supervisors, and market participants both domestically and abroad. The full report (Eggen et al. 2023) was published on 1 September 2023 and can be downloaded here.

In this column we present findings that focus on the ‘why’ and ‘how’ of the crisis, emphasising the lessons with broader implications beyond Switzerland. The report holds many detailed recommendations which are specific to the Swiss framework.

Credit Suisse was different

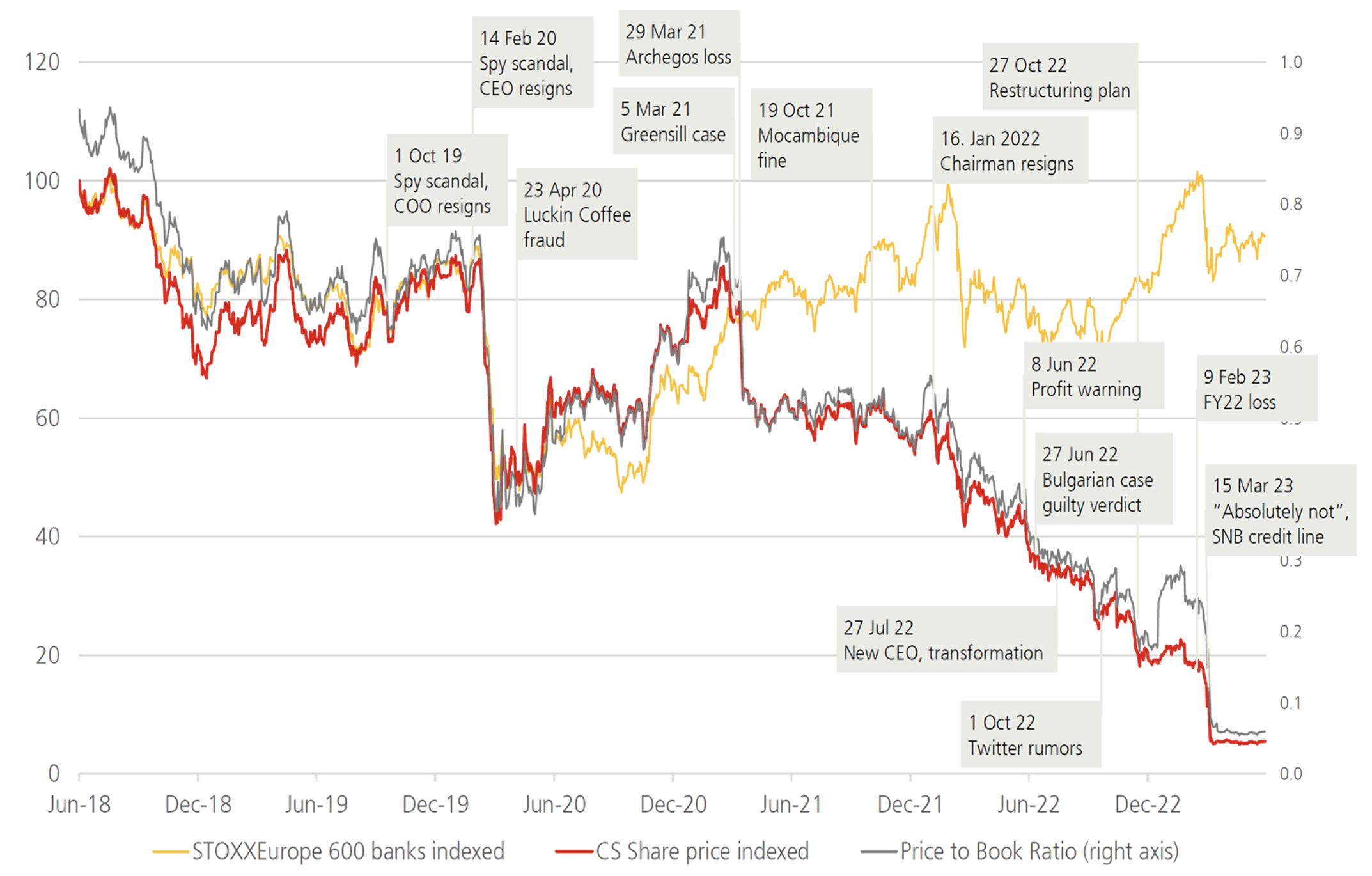

The initial point to note is that Credit Suisse was undeniably unique in its predicament. It was on the brink of resolution during the weekend of March 19th, but this crisis had been years in the making, characterised by persistent losses, scandals, flawed strategies, and poor risk management practices. These issues had eroded its reputation and shaken confidence in the viability of its business model. Consequently, the share price of Credit Suisse had plummeted by over 90% since 2021, while during the same period, the STOXX Europe index of banks had seen an increase of approximately 10% (see Figure 1). Thus, it is fair to assert that the failure of Credit Suisse was an idiosyncratic event.

Nevertheless, its downfall and resolution may still have had dramatic impact on other financial institutions. The memory of Lehman Brothers suddenly seemed very fresh and was certainly also on the minds of the troika of Swiss authorities – the Federal Councillor, the Chairwomen of the Financial Supervisor (FINMA) and the President of the Swiss central bank (SNB) – who managed the crisis during the resolution weekend. In the run up to the weekend they had considered several options:

- A resolution of Credit Suisse, declaring the point of non-viability and triggering the bail-in and conversion of bail-in-able bonds (about CHF 48 billion, see Table 1). This would have followed the script of the resolution plan.

- A temporary public sector ownership. This is not foreseen in the Swiss TBTF regime and would have required emergency law.

- A merger of Credit Suisse with UBS.

In the end, the merger was considered the least risky option. UBS offered $3 billion to acquire Credit Suisse with additional public support. Credit Suisse’s AT1 bonds (CHF 16 billion) were wiped out, since they contained a clause which allowed for a full write-down if public support was provided.

The public support package consisted of liquidity assistance totalling CHF 250 billion from the SNB. CHF 100 billion was backed by a federal default guarantee, referred to as a public liquidity backstop (PLB). A PLB had been under discussion and review for years, but there had been principled resistance against any public sector involvement. Therefore, it had to be enacted as emergency legislation because any type of solution, including a sale of the entire bank, requires sufficient liquidity to be credibly feasible.

In addition to the PLB, the federal government assumed a loss guarantee capped at CHF 9 billion. On August 11, UBS returned the guarantees, on which the federal government had earned about CHF 200 million.

Lessons from the fall of Credit Suisse for other jurisdictions include 1) the need for a robust mechanism to assure sufficient funding in resolution and 2) the benefit of flexibility and having several options for restructuring.

Figure 1

Source: UBS

A conundrum: Sound from a regulatory perspective and on the brink of collapse

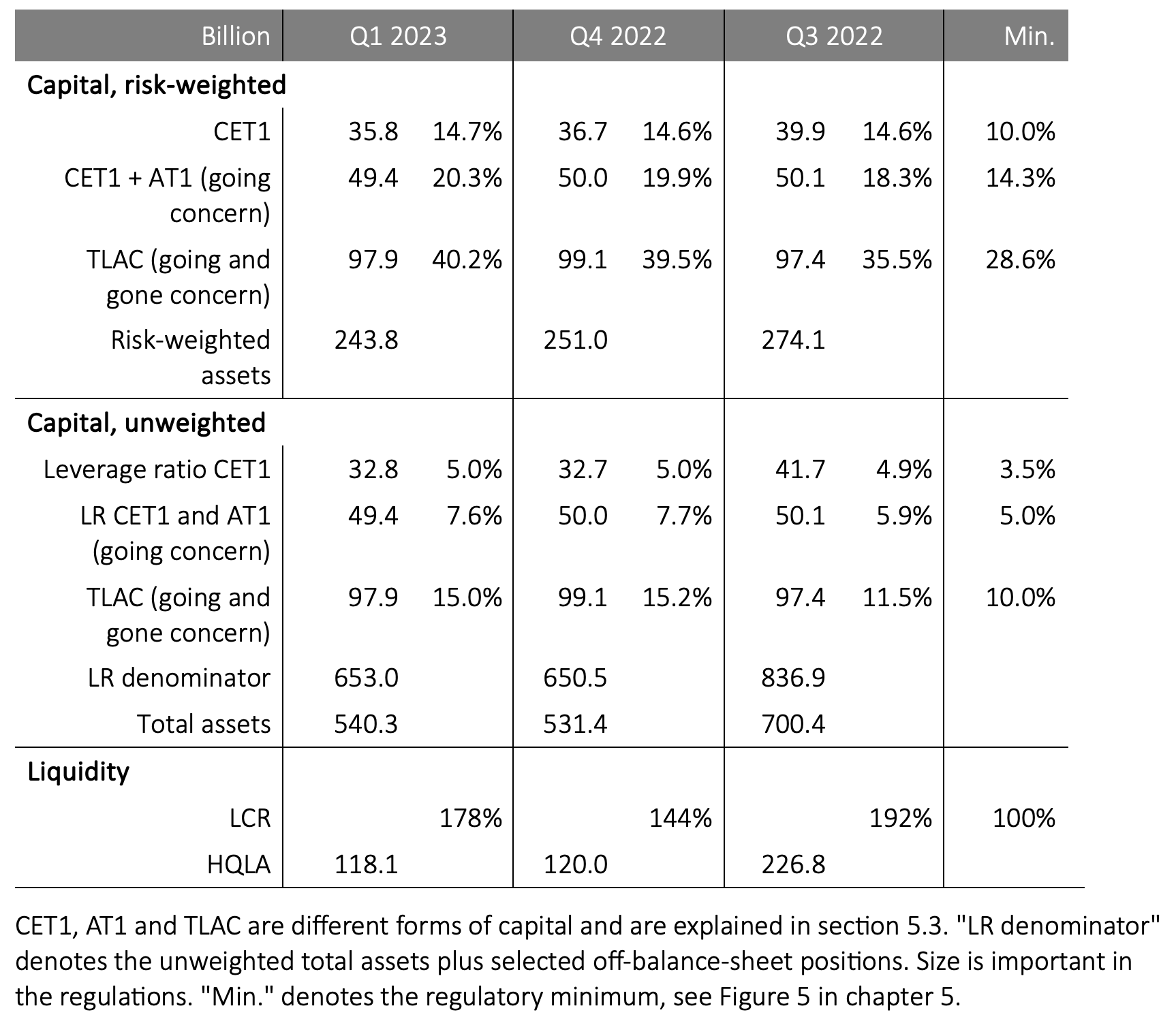

Credit Suisse failed ultimately failed in a crisis of confidence: a bank run had started a few months earlier among wealthy clients and eventually expanded to the Swiss retail clients. One of the puzzles of Credit Suisse’s failure is that it comfortably meet all regulatory capital and liquidity requirements. Table 1 shows that CET 1 was stable at almost 15% and the leverage ratio for total loss absorbing capacity was 15%, both ratios about one-third higher than the requirements. Similarly, liquidity ratios were way above the requirements, despite the dip in the fourth quarter 2022.

Table 1 Capital and liquidity metrics of Credit Suisse

Four possible explanations for this apparent contradiction

In principle, there are four possible explanations for this apparent contradiction of a ‘sound’ bank that fails.

- The first possibility is that this was a pure bank run, a sunspot or any such random event that causes a number of bank customers to withdraw their deposits, which in turn encourages even more customers to withdraw deposits. The bank quickly becomes illiquid, and the bank run becomes a self-fulfilling prophecy. Certainly, the banking crisis in the US was not helpful for Credit Suisse since markets and clients were nervous. Yet it would be inappropriate to depict the crisis at Credit Suisse as a crisis of confidence that came out of the blue. After all, as shown above, markets and clients had been withdrawing their assets and their trust for a long time.

- The second possibility is that the regulatory indicators were not suitable for identifying this type of crisis of confidence in a timely manner. Regulatory indicators show whether capital and liquidity buffers are available at a certain point in time. They may be sufficient to buffer a (calibrated) stress event, but they provide no information about the credibility of the bank’s strategy, the business model, the profit outlook, the quality of the management and the board of directors.

- The third explanation for the puzzle is that regulatory indicators may have provided an incomplete picture of capital and liquidity that was available. For example, the indicators may ‘add up’ for the group, but the liquidity and capital might not be sufficiently fungible within the group. This could happen if foreign supervisory authorities ring-fence capital in local subsidiaries limiting the upstreaming parent company. In the case of Credit Suisse, some market analysis feared that ‘trapped capital’ would limit the dividend capacity of the parent bank. They also raised questions around the accounting and regulatory treatment of participations, which suggested that de facto capital may have been less than the regulatory numbers showed. Market participants were questioning the relevance and transparency of the published indicators, which may have contributed to the loss in confidence.

The lessons are that bank supervisors should make use of market signals in addition to regulatory metrics in their evaluation of a bank's viability and that transparency about the quality of capital is crucial.

Did the TBTF regime fail?

Credit Suisse was the first large scale stress test of the TBTF regime, but the solution chosen was not to go for a resolution, i.e. full bail-in. This raised questions whether the orderly resolution of a global systemically important bank (GSIB), which had been prepared over the last decade, would have worked in principle. Were there any technical hurdles for the bail-in? Was the contagion risk too high?

Note that the fact that the restructuring option was not chosen in the case of Credit Suisse does not mean that resolution planning had failed. In fact, the authorities emphasise that the bail-in would in principle have been possible. Within the Crisis Management Group, they had prepared this option over several months. The involved domestic and foreign authorities expressed the view that the preparation had been sufficient and that implementation of a global restructuring of Credit Suisse would have been supported and recognised by the members of the Crisis Management Group. The Swiss troika ultimately determined that the merger with UBS entailed fewer execution risks and was therefore preferrable. Of course, the option of a merger with a domestic bank would now no longer be available if ever UBS was in an existential crisis.

The main lesson is that the TBTF regime is not broken.

Nevertheless, the Expert Group identified an execution risk in a bail-in resolution: in some jurisdictions, notably in the US, the conversion could be a lengthy process, not possible to complete over a weekend due to the demands of the US securities act. Even were SEC to provide an exemption, the process would take longer. In the case of Credit Suisse this risk seems to have been contained but it remains an question that needs to be addressed at the level of the FSB to remove uncertainty on this ‘technical’ hurdle to any bail-in of a globally active bank.

Conclusion

Reforms of international financial framework usually take place in the wake of financial crises. Yet every crisis is unique and certainly Credit Suisse’s troubles were unique. Nevertheless, it holds broader lessons for the TBTF regime.

Capital was the dog that did not bark; Credit Suisse failed despite being highly capitalised, a fact underlined by the $29 billion negative goodwill disclosed by UBS. But questions about the quality and transparency of capital may have contributed to the loss of confidence and the role and design of AT1 bonds should be subject to further scrutiny.

For Switzerland, the Expert Group draws many additional lessons and recommends reforms in crisis management, broadening of liquidity provision, and a significant strengthening of the tools and authorities of the financial supervisor.

References

Acharya, V M P Richardson, K L Schoenholtz and B Tuckman (2023), SVB and Beyond: The Banking Stress of 2023, Rapid Response Report, CEPR Press.

Eggen M, H Gerspach, E Hüpkes, E Jaisli, Y Lengwiler, R de Planta, R Sigg, and B Weder di Mauro (2023), The need for reform after the demise of Credit Suisse.