At the UN's COP28 climate summit on 2 December 2023, 118 governments made a commitment to triple the world's renewable energy capacity by 2030, with the ultimate goal of eliminating CO2-emitting fossil fuels from the global energy system by 2050 (Abnett et al. 2023). Despite this ambitious pledge, several challenges loom that could impede its realisation. Firstly, the high cost of capital required for building renewable power plants poses a significant hurdle. Elevated interest rates can amplify borrowing expenses, potentially inflating project costs, a concern particularly acute for developing nations already grappling with higher capital costs for their renewable ventures (Steffen 2020, Worland 2023). Another challenge arises from the intermittent nature of solar and wind power, necessitating investment in storage solutions. Furthermore, the procurement of critical minerals is anticipated to become more expensive due to market concentration and an anticipated surge in demand, further elevating the investment costs associated with renewable technologies (Boer et al. 2023). These factors collectively threaten to elevate the overall costs of renewable energy beyond initial expectations.

While transitioning to clean power incurs substantial costs and the existing cost of support for renewables have already been high (Newberry 2018), strategies exist to mitigate these expenses. One potential strategy involves engaging in demand response. A noteworthy but underutilised tool in this regard is real-time pricing (RTP), a dynamic pricing scheme that aligns consumer energy prices more closely with wholesale prices. RTP has the potential to incentivise consumers to shift their electricity consumption to periods of lower cost and higher abundance while reducing consumption during periods of higher cost and scarcity.

Despite the potential benefits of RTP, there is limited empirical evidence on how it influences investment, supply, storage, electricity demand, and the overall costs and benefits of renewable energy integration. In a recent collaborative paper with Matthias Fripp and Michael Roberts (Imelda et al. 2023), we present a novel model designed to assess the impact of RTP on the social benefits of intermittent renewables. By integrating a flexible demand system into a long-term planning model, we explore optimal investment and compare the effects of RTP to flat pricing in high-renewable and fossil systems, accounting for diverse assumptions about demand and technology costs. The model is specifically calibrated for Hawai'i, one of the most ambitious US states aiming to achieve 100% renewable electricity by 2045.

The model simultaneously solves for investment, real-time operation, and a demand system with varying inter-hour elasticities, providing a comprehensive view of long-term dynamic equilibrium. The dynamic equilibrium nature of the model represents a novel contribution to the existing literature. Applied to Oahu, Hawai'i, the model addresses challenges specific to the island, offering insights relevant to larger, more complex systems. Contributions include estimating costs, benefits, and the optimal generation mix for a 100% renewable energy system, comparing it to conventional fossil-fuel and unconstrained systems.

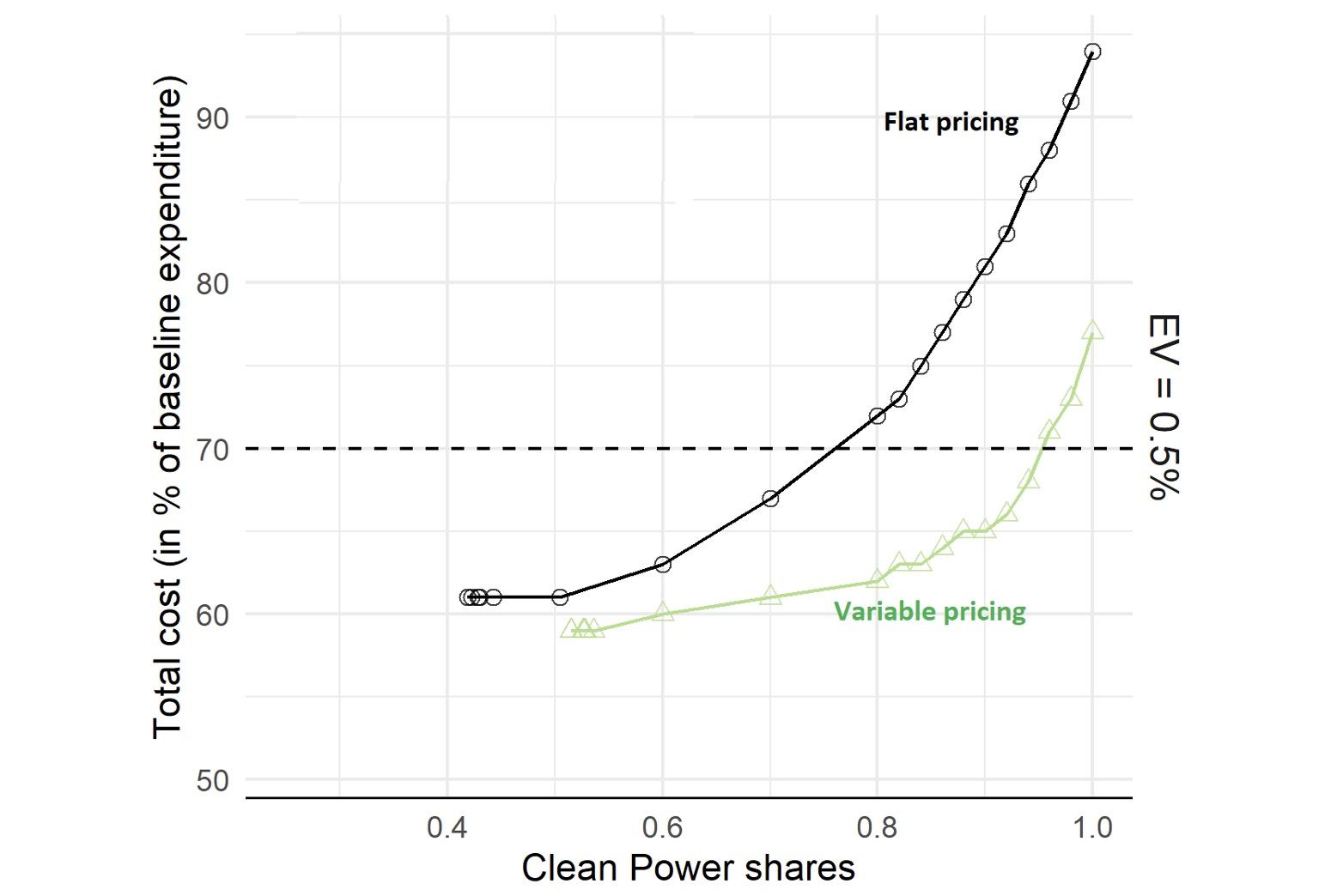

Figure 1 illustrates how the social cost of clean power increases as the share of clean power rises from the optimal level (around 60% in this particular scenario) to 100%. The graphs compare cost increases with flat pricing versus RTP, assuming that the share of electric vehicles (EV) on the road remains at a mere 0.5%, reflecting the actual shares in 2016 (additional results from various scenarios are available in the paper). To achieve 60% clean power, the cost is 63% of the baseline expenditure with flat pricing, whereas with RTP, it costs only 60%. In other words, RTP reduces the cost by 3 percentage points while to achieve 100% clean power, RTP reduces the cost by 16 percentage points. As RTP lowers the system cost, it increases the optimal renewable share of power, even excluding pollution externalities.

Figure 1 Social cost of clean power with flat pricing vs. variable pricing (RTP)

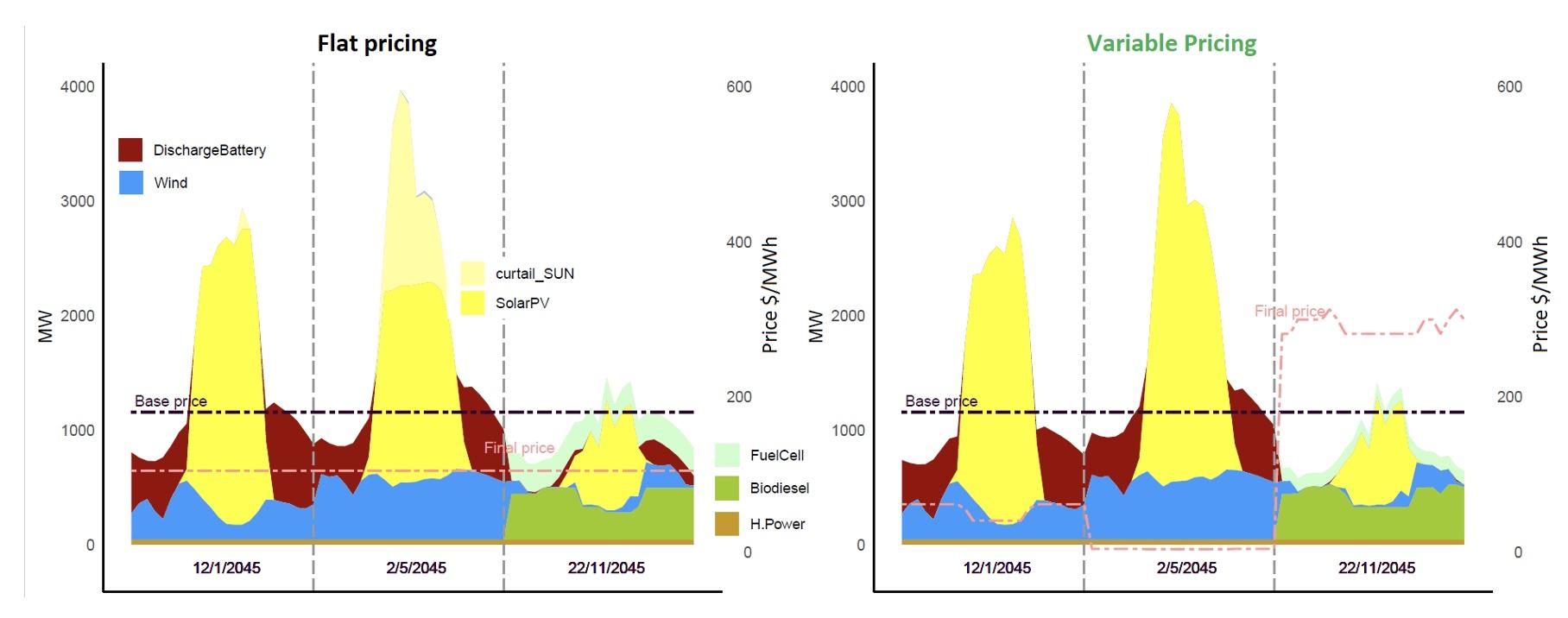

Figure 2 illustrates the optimised power system across three sample days in 2045, showcasing a scenario with 100% clean power (additional outcomes from diverse scenarios are detailed in the paper). In instances with flat prices, there is a substantial curtailment of solar energy, particularly evident on the middle day depicted. Conversely, in RTP scenarios, prices drop to zero or near-zero levels on such days, prompting a shift of extra demand into these hours. Moreover, there is a noticeable reduction in hydrogen fuel cell production under RTP compared to flat prices.

Figure 2 Optimised power system with flat pricing vs. variable pricing (RTP)

While critical high-cost periods are infrequent, low or zero marginal cost times prevail in high-renewable scenarios. The figure vividly demonstrates the wide variability in prices in high-renewable RTP scenarios, exhibiting more variation between days than within them. Days characterised by abundant renewable resources often feature zero prices throughout the day, not solely during sunny periods. Conversely, on the most challenging-to-serve day, prices remain high (approximately 35 cents per kWh) consistently, extending beyond peak demand hours. The added value from RTP stems from the effective utilisation of energy during periods abundant with resources. This pattern is likely true for most areas with seasonal variation, leading to more overbuilding and thus revealing greater value from RTP. The value of RTP is higher with more elastic demand.

Modelled versus actual outcomes

Some may wonder if the finely resolved long-run competitive equilibrium prices realistically depict what would occur in actual practice. In practice, there will be times with too little generation and storage capital relative to the long-run competitive equilibrium, which would cause higher average prices and greater volatility. At other times there will be too much capital, which would cause prices and price variability to be too low. Capacity markets or other requirements and allowances for investment from public utilities commissions will factor into this overall level of investment. Regardless, RTP would bring about more efficient pricing conditional on the given portfolio of assets at any given time and ought to help facilitate appropriate ongoing capital adjustments.

Resistance to real-time pricing

Despite its potential benefits for consumers and its usefulness for integrating intermittent clean power affordably, there is institutional resistance to real-time pricing tariffs. Some of this resistance comes from both utility customers and state public utility commissions, fearing extreme price spikes. Solutions to extreme price spikes exist, including hedging and implementing reasonable price caps on RTP tariffs. Our model typically indicates a peak price of $500 MWh or less on the hardest-to-serve day, making this a viable cap to encourage investments and demand responses while limiting risks to customers.

Current regulatory practices often favour high-cost, centralised solutions, implicitly rewarding more capital expenditure. RTP, if both buying and selling from customers is permitted, opens the system to free entry, benefiting large-scale commercial customers and potential providers of devices enabling demand response, like thermal storage. However, the benefits may be challenging for disparate consumers and potential entrants to navigate and engage in regulatory processes effectively.

Conclusion

Our study posits that RTP can serve as a facilitator for the strategic planning of high-renewable electricity systems, ultimately enhancing the overall efficiency of the system. The advantages of RTP are that:

- consumers stand to benefit by actively managing and adjusting their electricity consumption in response to price signals, thereby reducing their electricity bills; and

- the electricity system gains from demand response mechanisms triggered by higher prices, potentially mitigating the necessity for additional investments in generation and network infrastructure.

The efficient properties of demand response are recognisable, and RTP is just one approach to achieve it. RTP may face challenges, including issues related to consumer acceptance, metering technology, regulatory frameworks, and distributional effects (Reguant and Fabra 2022). Alternative methods for implementing demand response, such as time-of-use rates paired with critical ‘energy drought’ pricing on difficult-to-serve days and ‘discount days’ on surplus energy days, may capture most potential benefits. The simplicity and transparency of such a pricing mechanism could be more appealing, although its efficiency in high-renewable settings warrants investigation, especially if proven to be more institutionally viable than RTP.

References

Abnett, K, V Volcoviciand D Stanway (2023), “Countries promise clean energy boost at COP28 to push out fossil fuels", Reuters.com, 2 December.

Boer, L, A Pescatori, and M Stuermer (2023), “Energy Transition Metals: Bottleneck for Net-Zero Emissions?”, Journal of the European Economic Association.

Imelda, M, M Fripp and M Roberts (2023), “Real-Time Pricing and the Cost of Clean Power”, forthcoming in American Economic Journal: Economic Policy.

Newbery, D (2018) “Evaluating the case for supporting renewable electricity", VoxEU.org, 20 July.

Reguant, M and N Fabra (2022) “Assessing the distributional effects of real-time pricing for electricity", VoxEU.org, 15 October.

Steffen, B (2020). “Estimating the cost of capital for renewable energy projects”, Energy Economics 88: 104783.

Worland, J (2023), “What High Interest Rates Mean for U.S. Renewable Energy”, Time.com, 18 May.