DP4070 Microeconomic Sources of Equity Risk

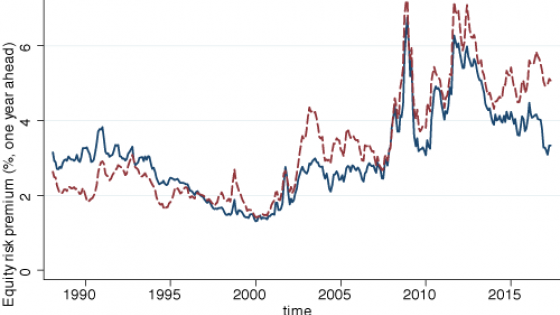

Surprisingly there are very few estimates of the equity risk premium period-by-period that satisfy a no-arbitrage condition, despite the vast literature on the subject. This is mainly due to the difficulties of estimation. Using the stochastic discount factor (SDF) model based on observable macroeconomic factors - as opposed to unobservable (latent) affine factors - and a new econometric methodology, we provide new estimates of the equity risk premium for the US and the UK based on monthly data 1975-2001. We obtain estimates of the risk premium for many of the best-known versions of consumption CAPM including time-separable power utility and time-nonseparable Epstein-Zin utility. We also show why many of the formulations of these models are unable to provide estimates of the risk premium. A related, and rapidly growing, literature that adopts a more statistical approach focuses on the empirical relation between the return on equity (or the Sharpe ratio) and return volatility. We argue that SDF theory implies that this relation is misconceived.