First posted on:

Roger Farmer's Economic Window, 12 March 2018.

Last Thursday, Jean-Philippe Bouchaud and I held the first meeting of the Rebuilding Macroeconomics project’s Instability Hub. There were roughly twenty people, some in attendance in person and some attending through Zoom. As expected, what emerged was an eclectic mix of ideas, some better presented or better formed than others. The overarching theme that emerged from this meeting, is that macroeconomics needs to deal with the issue of non-ergodicity.

Ergodicity is a technical term used by statisticians to reflect the idea that we can learn something about the future by looking at the past. It is an idea that is essential to our use of probability models to forecast the future and it is the failure of economic systems to display this property that makes our forecasts so fragile.

This idea emerged in several different ways at the meeting. First, the post-Keynesians point to the fact that the mainstream has not satisfactorily incorporated Keynes’ ideas on probability theory. Second, psychologists point to the fact that the Von-Neumann Morgenstern model of expected utility is a very bad characterization of human action in uncertain situations. Third, the agent-based modelers and the econo-physicists are perplexed that anyone would imagine that ergodicity would be a good characterization of the social world when it was abandoned in the physical sciences decades ago. So how do we make progress?

One possible avenue is to change our model of human behaviour. We must stop assuming that people are expected utility maximizers and assume instead that they act in ways that we will learn about from the behavioural psychologists. While it is certainly possible that an approach of that kind might be productive, I am skeptical. Even if one takes a reductionist approach to science, it is not true that our knowledge of the world can be reconstructed from the bottom up. At each level of aggregation, natural scientists have learned that they must use new theories to understand emergent properties that arise from the interactions of constituent parts. Just as chemistry is more than aggregate physics so we should expect macroeconomics to be more than aggregate microeconomics.

Agent-based modelers have gone some way in this direction; but they have not gone far enough and ABMs are similar to the macro models we were constructing in the 1950s in the sense that the behaviours of the agents in these models are reflexive and crude. They are more sophisticated than 1950s aggregate macroeconomics in the sense that at least there are multiple agents each with possibly different behaviours. But they are, at present, incapable of capturing the kinds of announcement effects that we know are characteristic of real world data. In the real world, an announced future tax increase will bite immediately. In the current generation of ABMs it will not.

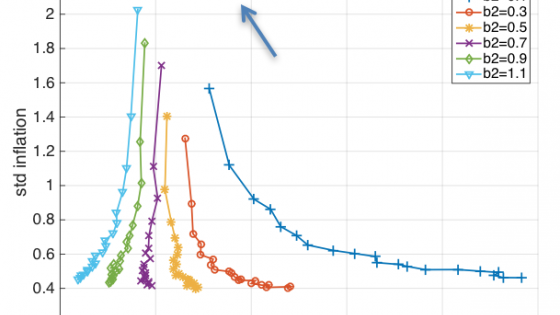

Is it possible to construct a macroeconomic theory that allows for more sophisticated individual behaviours but does not preserve the constraints of the representative agent approach? I believe so and the mainstream is already moving in that direction by incorporating heterogeneous agents into simple DSGE models. What the mainstream is missing, is that the future behaviour of prices and quantities may not be governed by stationary probability laws, even if the fundamentals of the economy are governed by such laws.

Some have argued that the social world, like the weather, is obviously governed by chaotic processes: the so-called butterfly effect. What I have learned in my discussions with the applied mathematicians and physicists who attended our meeting, is that the natural world is far less predictable than that. It is not just the variables themselves that evolve in non-linear chaotic ways; it is the probabilities that govern this evolution.

So where do we go from here? First, there is a convergence already happening between DSGE models with heterogeneous agents and ABM modelers. These people need to talk more to each other. Second, a theme that emerges in my own work is that heterogeneous agent models are replete with multiple equilibria. In multiple equilibrium environments, there is not much to be gained from a more sophisticated view of what we mean by ‘rational’ beliefs about the future. Subjective beliefs are themselves fundamentals.

Finally, what I have learned from talking with smart people from many fields is that words mean different things to different groups. We all must take some time to learn each other’s language and to be a little humbler in our perceptions that our own tribe is the unique repository of all useful knowledge.