First posted on:

The Trade Post, World Bank, 19 July 2018

Much has been written on the escalation of the trade dispute. What hasn’t been discussed is what will be the impact on developing nations who rely on trade as an engine of economic growth for ending poverty.

As tariffs are beginning to be imposed, we analysed the impact of these new tariffs and the potential for tariff escalation in developing countries in a new World Bank note. We found that the new trade tariffs will depress bilateral trade, disrupt global supply chains, and increase demand for substitutes from developing countries.

Our analysis shows that tariff escalation, coupled with a shock to investor confidence, could reduce global exports by up to 3% ($674 billion) and global income by up to 1.7% ($1.4 trillion) with losses across all regions. A major concern is that firms will delay investments because of uncertainty over market access, reversing the ongoing recovery in global trade and investment.

Looking at the possible impacts of tariff escalations on developing countries, we see thatthird-party countries can benefit from increased preference margins in the US and Chinese markets when the two trading partners impose tariff surcharges. But, when investor confidence is shaken, these gains are more than offset for all regions by negative income effects. In this scenario, income losses range between 0.9% for South Asia and 1.7% for Europe and Central Asia.

Our analysis also looks at the economic impact on the world’s biggest economies to better understand the impact on developing countries. China and the US could lose up to 3.5% ($426 billion) and 1.6% ($313 billion), respectively. The sectors most affected include: agriculture, chemicals and transport equipment in the US; and electronic equipment, machinery and other manufacturing in China.

In the current uncertain global business environment, all countries need to act to retain investor confidence and avoid the disruption of trade flows and global supply chains. Countries can improve the credibility of future policies by deepening their commitments in multilateral fora such as the WTO and regional trade agreements. The timely and clear communication of all future changes in trade policy are important to minimize policy uncertainty.

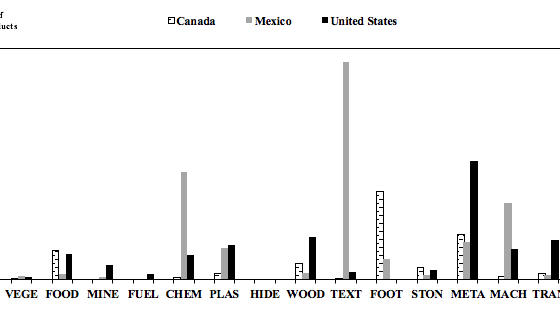

As global income growth is being driven by trade and investment, understanding the impacts of trade disputes is key. If investor confidence is shaken, the recovery could be derailed, as seen in this graph from the 2018 Global Economic Prospects report.

Source: Global Economic Prospects 2018, World Bank

A worldwide escalation of tariffs up to the limits permitted under existing international trade rules could lead to cumulative trade losses equivalent to those experienced during the global financial crisis in 2008-09, with particularly severe consequences for developing countries.