First posted on:

Finance: Research, Policy and Anecdotes, 12 February 2018.

Early February saw the first two stops of our road show of the Ordoliberalism: A German oddity? eBook, edited by Hans-Helmut Kotz and me. The first one was scheduled on Monday in Washington DC at the Peterson Institute. Courtesy of snowy weather in Toronto, I missed the presentation, but contributor Jeromin Zettelmeyer did an excellent job in introducing ordoliberalism to a mostly American audience. For anyone who wants to read a ‘personalized’ introduction into ordoliberalism, I recommend reading his chapter.

On Friday 9 February, an event at the Austrian National Bank, with Governor Nowotny and the chief economist, Doris Ritzberger-Grünwald. Hans-Helmut and I both did a general introduction on the difference between the German rule-based approach and Anglo-Latin pragmatism, and then narrowed in onto one specific policy area – bank regulation and banking union.

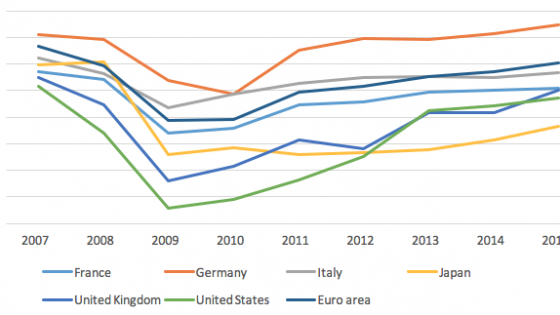

The lack of any bank resolution framework nationally and at the euro area level was clearly the weak link in the euro area in 2007/8. This area has also been one where notable progress has been made over the past years. Bank resolution shows very clearly the conflict between the ex-ante optimal solution of no-bailout (to avoid moral hazard and aggressive risk taking), and the ex-post optimal solution of bailout (to minimize negative effects of bank failure on the financial system and real sector). All national authorities in Europe decided for bailouts in 2008, especially for large and systemically important financial institutions, including the German government, certainly in violation of any ordoliberal principles.

The banking union, with its bail-in principles and stricter regulatory and supervisory frameworks, was designed to avoid such violations in the future, and to minimise both moral hazard and negative effects for the remaining financial system and the real economy. While the case of Banco Popular (sold to Santander over a weekend with no costs for taxpayers) was certainly an example of how the banking union can work effectively, two other examples show that we are still far from an ideal world. The limited bail-in of senior bondholders in the case of Veneto Banca and Banca Popolare di Vicenza and support with taxpayer money might not have violated the letter but certainly the spirit of the banking union.

Behind this failed resolution, however, hides the ugly truth that the new regulatory regime was put in place before the legacy problems were resolved. Applying rules where they do not make sense is certainly not a useful economic policy approach. Even worse, when Deutsche Bank was rumoured to be in trouble a few months ago, there was little public discussion on how to resolve such a large, fragile bank in line with the new rules, but focused rather on how the German government would bail out its national champion. Teutonomics trumps ordoliberalism again!

Not all economists in Germany are ordoliberals, as Adalbert Winkler made very clear in his discussion of German angst on loose monetary policy and quantitative easing, resulting in persistent predictions of imminent hyperinflation, warnings of uncontrollable asset bubbles, and a focus on the rules of monetary policy (e.g. purchase of government and corporate bond papers) rather than the outcome (currently sub-target level of inflation). This has also resulted in a clear reputation loss for the ECB in the largest euro area economy, which can only be damaging for future monetary policy conduct. In my opinion, there is a clear contradiction in the German view on this – after all it was they (together with other national governments) who refused the use of any other policy tools to address the euro area crisis (such as fiscal policy, more aggressive bank restructuring at the euro area level), which in turn imposed a bigger burden on the ECB as the only functioning euro area-wide policy authority.

If there was one surprising insight for me from the meeting in Vienna, then it is that most people in the room seemed to agree with us. We were clearly missing a staunch supporter of the current teutonomic/ordoliberal approach. We hope to get this at our next discussion round in Berlin, in March!