We have no consensus on the purpose served by bitcoin and other cryptocurrencies. Is it the replacement of fiat money or protection against corrupt and incompetent governments? Perhaps the most persistent pro-crypto argument is that it is a macro hedge, providing a store of value that protects against large economic shocks, government corruption and mismanagement: a 21st century version of gold. We certainly need a macro hedge. With recession looming, stock markets crashing, and inflation exceeding 10% – while central banks seem paralysed and governments are intent on monetising increased expenditure – a useful macro hedge would be welcomed.

So why would bitcoin be a good macro hedge? In common with fiat currencies, it doesn’t have any intrinsic value. Fiat money retains value because we trust the central bank to manage it sensibly. If it does not, the result is inflation or hyperinflation, as in Venezuela today. Bitcoin replaces trust in the government with trust in technology. In the narrative of crypto advocates, technology is pure. Unlike corrupt governments, it cannot abuse its money-printing privilege, and that limit on money creation promises to make bitcoin a macro hedge. Does that argument stand up to scrutiny?

What sort of asset is bitcoin?

The evidence is mixed, as noted by Feyen et al. (2022). The events of the past two and a half years give us an excellent chance to investigate what sort of asset bitcoin is. We had the Covid market turmoil in early 2020, the post-Covid economic and market boom, high inflation, and Russia’s invasion of Ukraine. A macro hedge should have predictable properties through all these scenarios.

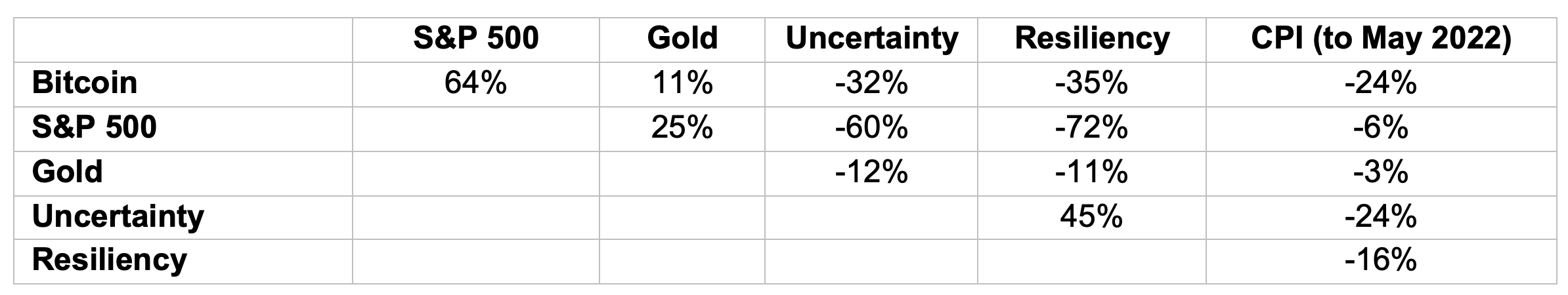

To examine what actually happened, we took monthly observations of six economic variables from the start of 2020 to the present. The variables were returns on bitcoin and gold, the S&P 500 index, and US inflation, as well as percentage changes to the monthly macroeconomic uncertainty index (Bloom and Davies 2022), and a resiliency index constructed by capturing the chance of a 90% drop in the S&P 500 over the next 10 years (Bevilacqua et al. 2021).We took 30 observations for each variable, except the Consumer Price Index (CPI), where we took 29.

Table 1 shows the correlation between these variables. For a sample size of 30, a 35% correlation is significantly different from zero at 5% significance.

Table 1

There is nothing in these results to suggest that bitcoin is a useful macro hedge. It is significantly and positively correlated with the stock market, and negatively correlated with resiliency, macro uncertainty, and inflation. If it were a macro hedge, those negative correlations would be significant and positive. Furthermore, as both the stock market and bitcoin are negatively correlated with resiliency, these numbers suggest that speculation rather than fundamentals drives both markets. These results make it abundantly clear that bitcoin cannot be a good hedge against macro fears that resemble those that we have seen over the past two and a half years.

The inflation correlation is particularly interesting. A macro hedge, and especially bitcoin, should be positively correlated with inflation. As central banks massively expand the money supply, an asset with a fixed supply such as bitcoin should increase along with inflation, not move in the opposite direction.

Gold and bitcoin, the internet, and electricity

When considering bitcoin as a macro hedge, the most helpful analogy – and the one usually made by crypto advocates – is gold. Gold has been a macro hedge throughout the world for millennia. The myth of King Midas extolled its virtues three millennia ago, and it was revered long before. Gold has good properties for a macro hedge. It doesn’t rust, nor does it depend on technology. It is among the heaviest of metals, and therefore it is easy to verify whether a coin or bar actually contains gold. Most importantly, it has provenance. It has been trusted as a macro hedge for millennia, which gives us comfort that it will continue to serve that function. Stories about families hiding their gold in times of war, only to recover it years or decades later once things calm down, abound. It is the essence of a good macro hedge. And because we have price data on gold over many centuries, it is easy to verify how its price relates to historic key economic variables and alternative investment choices, making it a straightforward task to ascertain how gold performs as a macro hedge.

Bitcoin is none of these things. It is 13 years old, and the only real experience of how it behaves in times of stress has come from the past two and a half years, as the previous years of its existence were relatively calm. Will a family facing civil war and desiring to hide their assets be confident that the bitcoin they buy today will be accessible in 50 years? Will bitcoin exchanges still exist, or will they have become a faded memory of the craziness of the century’s second decade?

We don’t need such an extreme scenario. One needs access to electricity and the Internet to use bitcoin. Civil war and governments have a way of disrupting both. Gold does not depend on the Internet or electricity. Even relatively temporary disruption to global Internet access could cause the bitcoin blockchain to split into two or more competing branches. This would result in considerable disruption to users of bitcoin – even losses. While the cryptography of the bitcoin blockchain easily resists attacks using today’s technology, there is no such reassurance for the future. Technologies such as quantum computing could facilitate the theft of tokens on the blockchain.

Finally, it is worth remembering that the bitcoin blockchain is publicly visible. This may not be entirely attractive to those who consider expropriation by the authorities to be a substantial threat.

Bitcoin and the stock market

While bitcoin does not seem to be much of a macro hedge, it is 64% correlated with the stock market. Throughout its history, bitcoin has vastly outperformed the stock market, but it is also 2.6 times riskier than equities.1 Therefore, the price of bitcoin resembles a leveraged bet on the stock market. Its price increases rapidly when the stock market performs well, and similarly falls along with the stock market.

This is not surprising, as the vast majority of crypto investors are buying it simply because they have seen its price go up. This means that the overall sentiment in the financial markets drives the prices of crypto, not a desire to hedge against macroeconomic uncertainty. Because the price of crypto is driven by speculation, not fundamentals or politics, it is not much of a macro hedge.

Conclusion

Crypto advocates argue that bitcoin and other cryptocurrencies are the future of money partly because they are a macro hedge that protects against incompetent and corrupt institutions and governments. A series of stress events since 2020 – Covid, inflation, and war – have allowed us to test whether this is true. If bitcoin were a true macro hedge, it would be positively correlated with macroeconomic uncertainty. But it is not. Instead, the price of bitcoin and other cryptocurrencies resembles that of a high-risk speculative asset.

Bitcoin does not live up to the promises of its promoters, and it is a lousy macro hedge. That might be its ultimate weakness.

References

Bevilacqua, M, L Brandl-Cheng, J Danielsson and J-P Zigrand (2021), “Moral hazard, the fear of the markets, and how central banks responded to Covid-19”, VoxEU.org, 28 January.

Bloom, N, S Davis and S Baker (2022), Economic Policy Uncertainty Index.

Feyen, E, Y Kawashima and R Mittal (2022), “The ascent of crypto assets: Evolution and macro-financial drivers”, VoxEU.org, 19 March.

Gandal, N (2021), “The microeconomics of cryptocurrencies”, Vox Talk, 15 January.

Endnotes

1 See http://extremerisk.org and Gandal (2021)