Climate risk is often characterised as a problem of the future – involving a slow buildup of vulnerabilities unfolding over decades, primarily consisting of long-dated costs. But in reality, climate-related shocks have already been growing in voracity in recent years,

with uneven financial sector impacts amid a growing scrutiny of financial markets.

As climate risk becomes more salient, it could give rise to larger expectation shocks in forward-looking financial markets, with an associated prospect of financial stability risk along the transition. Our recent work in a joint ECB/ESRB project team (ECB/ESRB 2022) has investigated the scope for financial instability resulting from climate change, including not only in the long but also in the near term, and the basis for climate-oriented macroprudential policies to tackle associated risks.

A potential for climate risk concentrations to spread through the financial system

Climate-related financial risk in the EU has been shown to be concentrated in two key ways (see ECB/ESRB 2021). The first is physical risk at the level of regions, amid a noteworthy insurance protection gap. And the second is transition risk at the level of economic sectors (albeit with strong heterogeneity across firms).

Such risk concentrations have changed little over recent years. The loan-weighted emission intensity of exposure to the mining, manufacturing, and electricity sectors, for instance, still represents around 60% of total euro area banking sector exposures. At the same time, a combination of climate-related and more traditional financial vulnerabilities might leave firms in a broader set of economic sectors (including agriculture, construction, and transport) at particular risk.

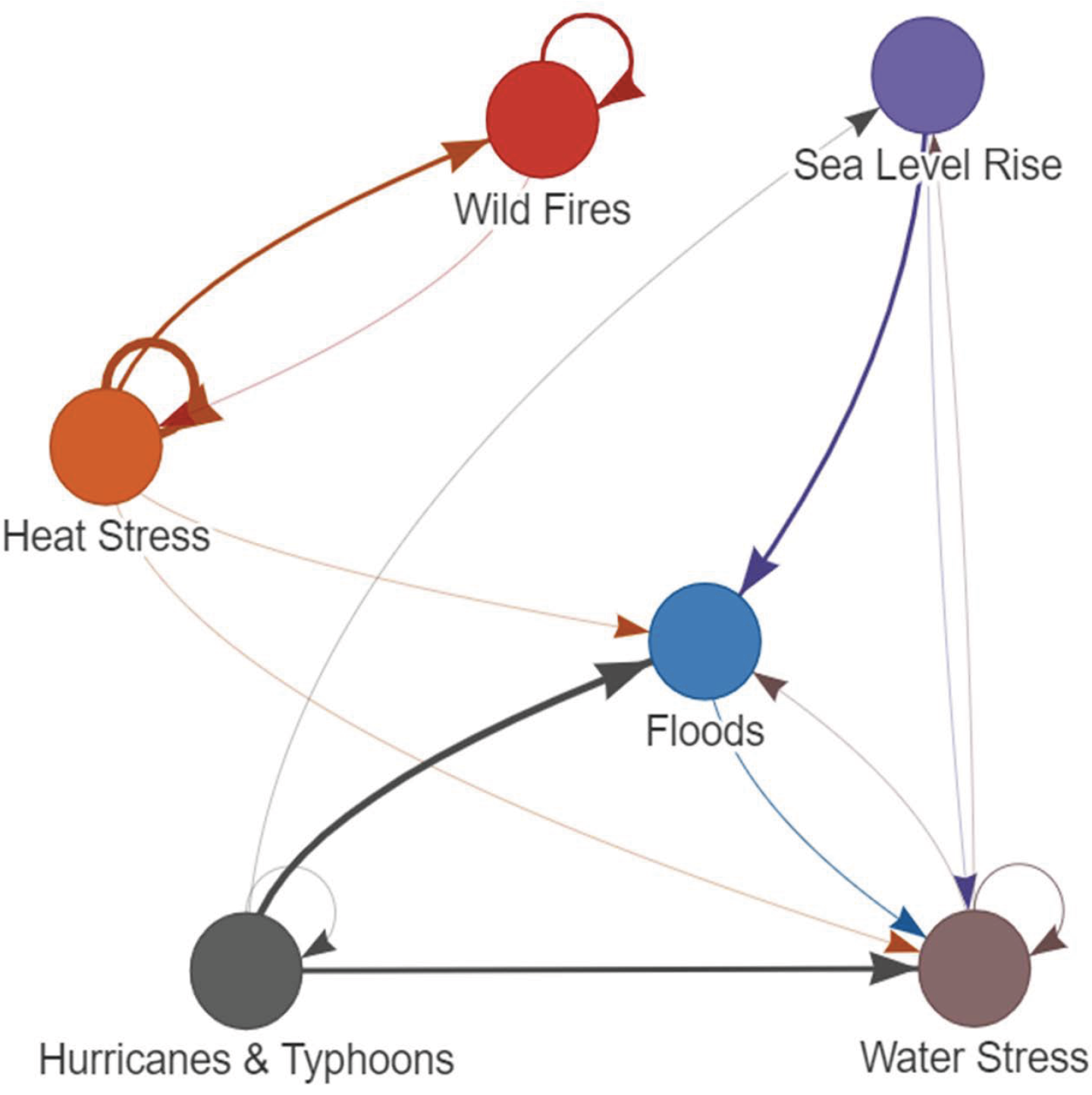

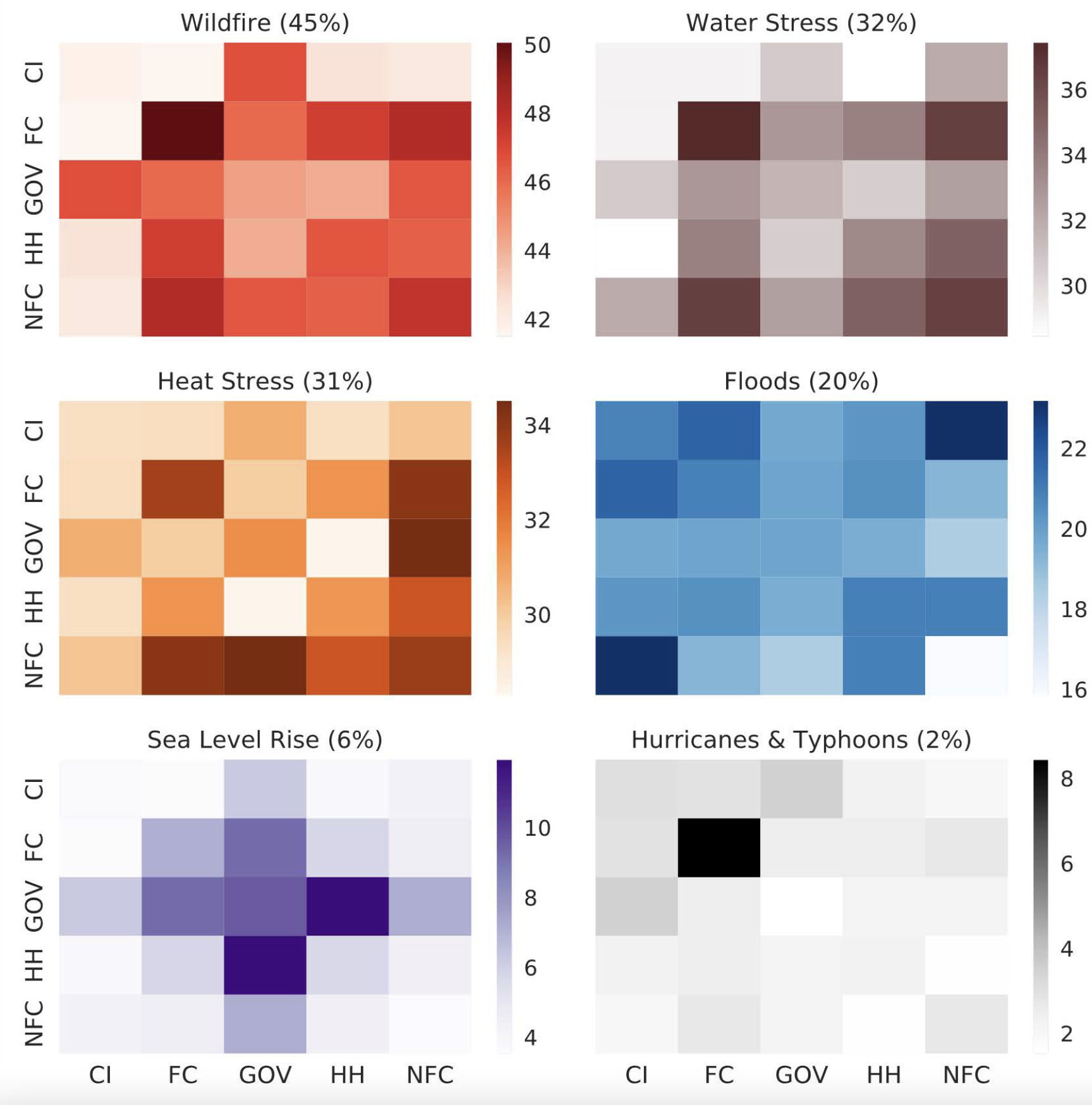

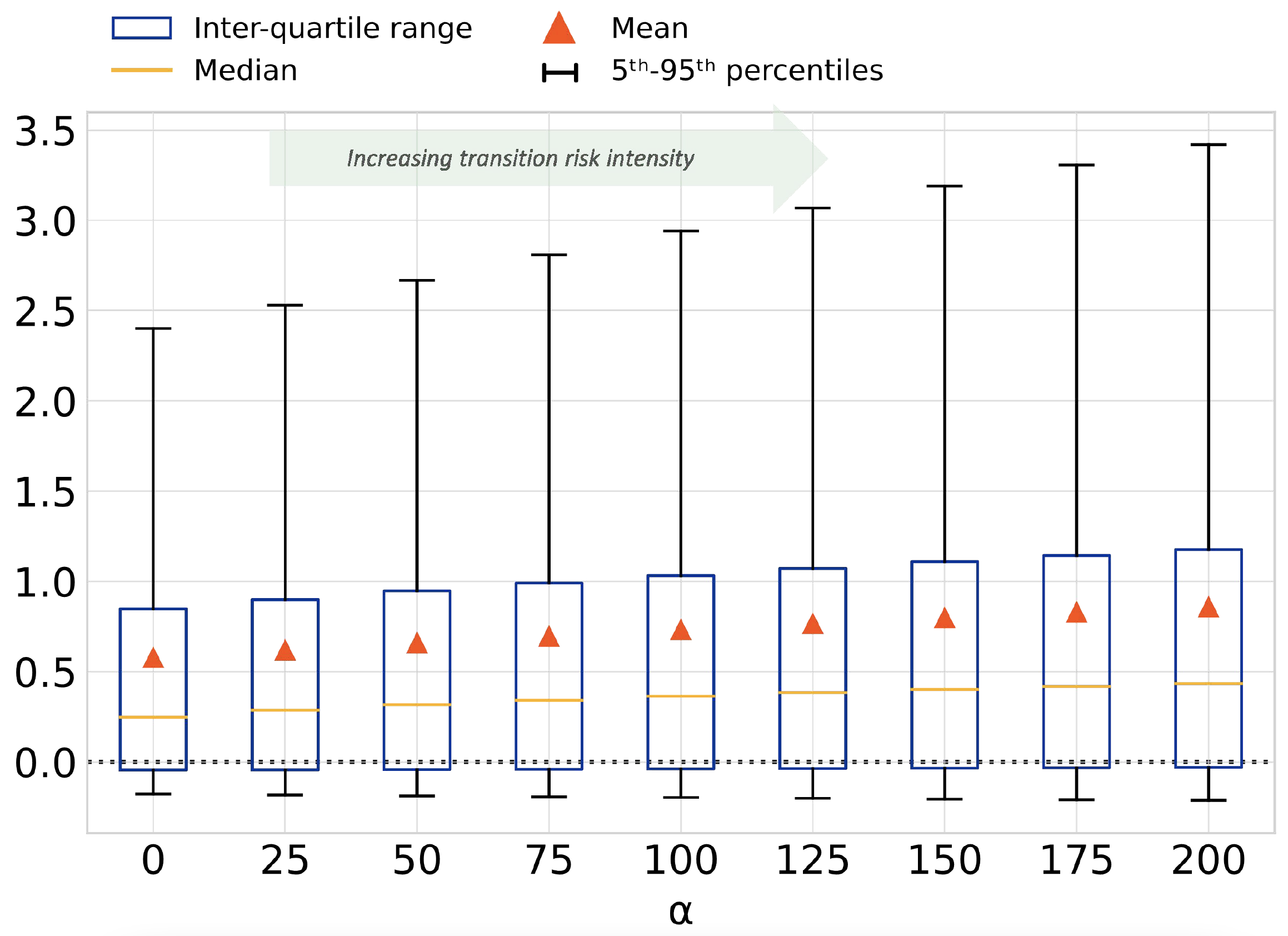

There are several channels through which climate risk concentrations could spread across the financial system. A first is the interconnected nature of climate shocks. While climate hazards are often analysed separately, they are rather likely both self-reinforcing and correlated across categories (Figure 1, Panel a). Such shocks, in turn, might be aggravated by financial market forces, notably by overlapping portfolios when taking a financial system-wide perspective (Figure 1, Panel b). Alongside these physical risk channels, transition risk may percolate through counterparty risk and default cascades. Simulations show that financial contagion resulting from a disorderly tightening of transition risk would not only impact high-emitting firms, but could also engulf firms that were previously only weakly correlated through financial linkages. This is suggested by an average near doubling in default correlations for disorderly transition intensities, and a positive skew suggesting an even stronger increase for emissions-intensive counterparties (Figure 1, Panel c).

Figure 1 Amplification channels

a) Interdependencies of natural hazards

(Arrows based on hazards’ correlations and causal relations)

Sources: Data from Gill and Malamud, “Reviewing and visualizing the interactions of natural hazards” (2014) and ECB calculations.

Notes: Links refer to both correlations as well as causal links. Arrows’ thickness is proportional to a score capturing either increased probability or causal trigger of hazards, in terms of both spatial overlaps as well as temporal likelihood.

b) Physical-risk-weighted overlapping portfolios

Share of common asset holdings (mean as % in parenthesis)

Sources: Security Holding Statistics, 427, and ECB.

Notes: Overlapping portfolios weighted by physical hazard scores as share of common asset holdings by aggregate sectors.

c) Pairwise default correlations and transition risk intensity (%)

Source: ECB.

Note: Based on a multi-firm Merton model (A Grassi and L Mingarelli) and 500k bootstrapped Monte Carlo simulations on the full EA Moody’s Credit Edge sample. The transition risk intensity parameter 𝛼=(1−𝛽)𝑇incorporates both the transition risk shock 𝑇 as well as a pass-through factor 𝛽 capturing the degree to which firms can pass the cost of a transition risk shock to consumers.

Scenario analysis for the financial system suggests systemic losses will not only be path dependent, but also bumpy

Scenario analysis illustrates how the buildup of physical climate risks can be minimised with timely and orderly action to reduce carbon emissions (ECB/ESRB 2021, Alogoskoufis et al. 2021). The distribution of losses across both firms and financial institutions might not, however, be evenly distributed.

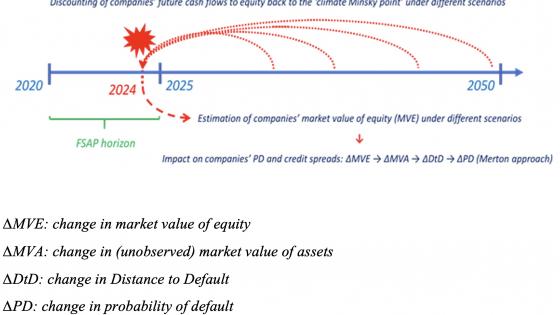

The evolution of market and credit risk is key to understanding how climate risk might unfold across different parts of the financial system. In particular, expectations in an orderly, disorderly, or insufficient climate transition will be key in determining the materialisation of risk (ECB/ESRB 2022). Forward-looking investors will seek to price the likely evolution of future shocks to financial securities. Such asset valuation shocks, in turn, could presage eventual firm defaults.

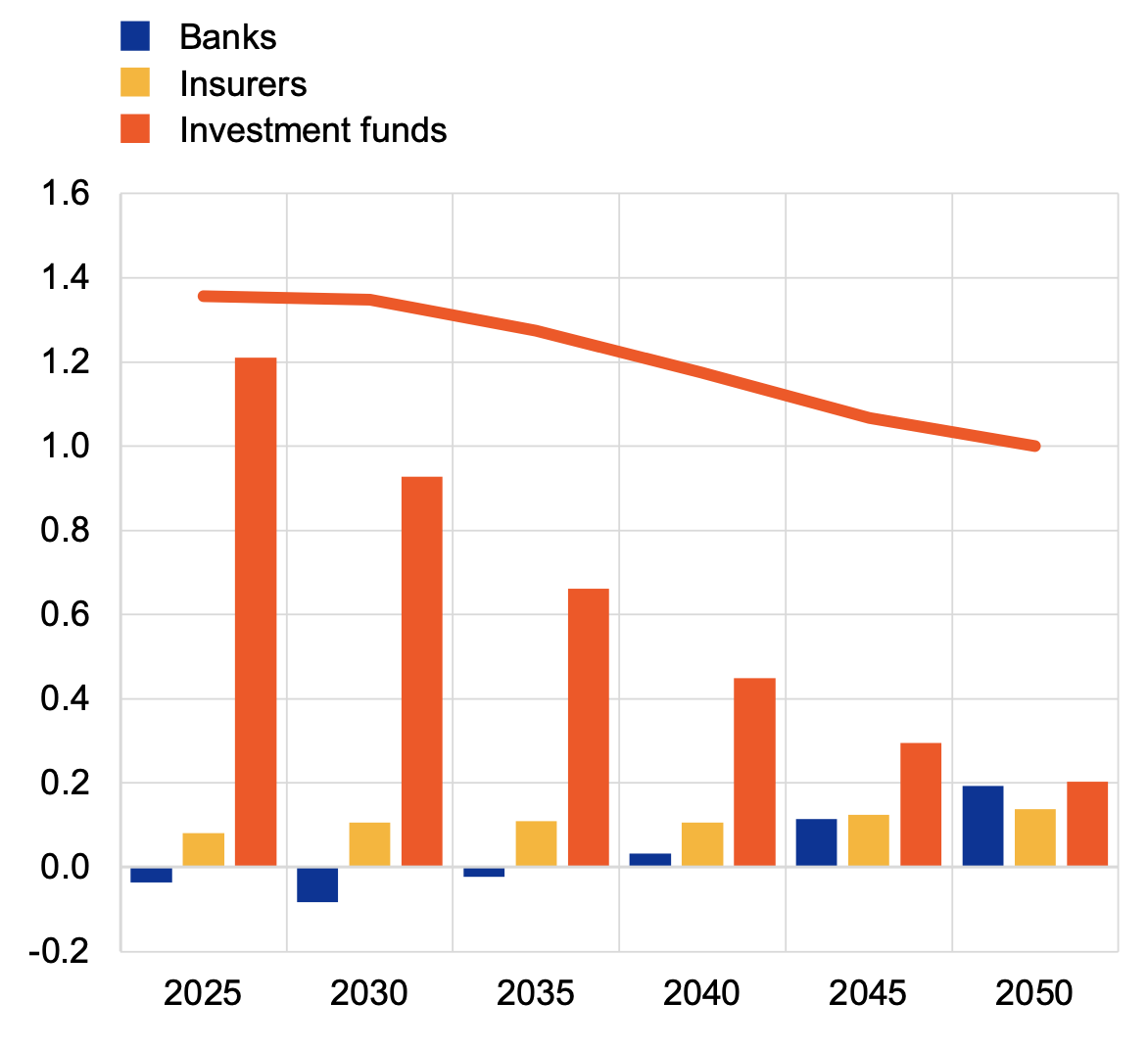

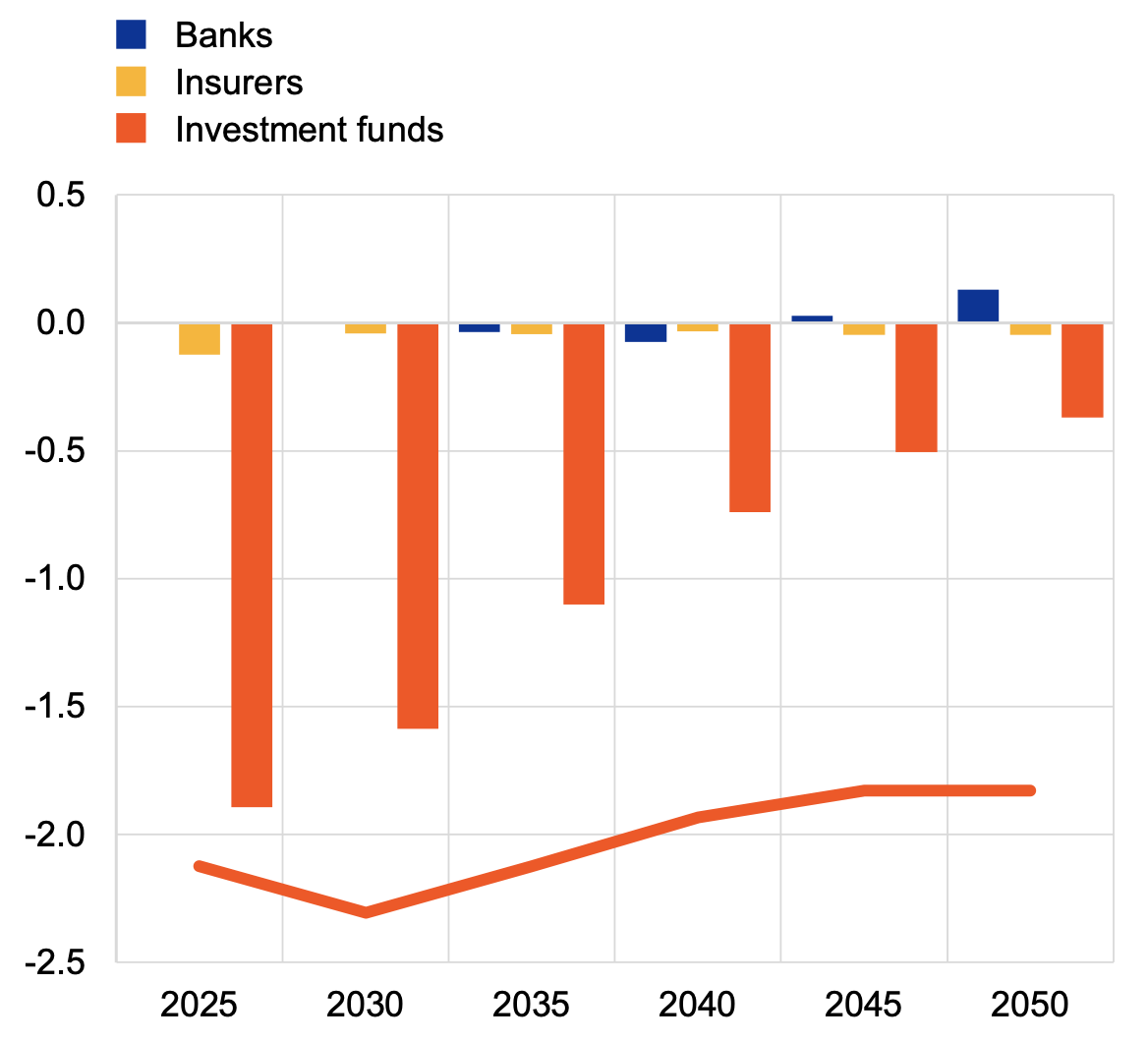

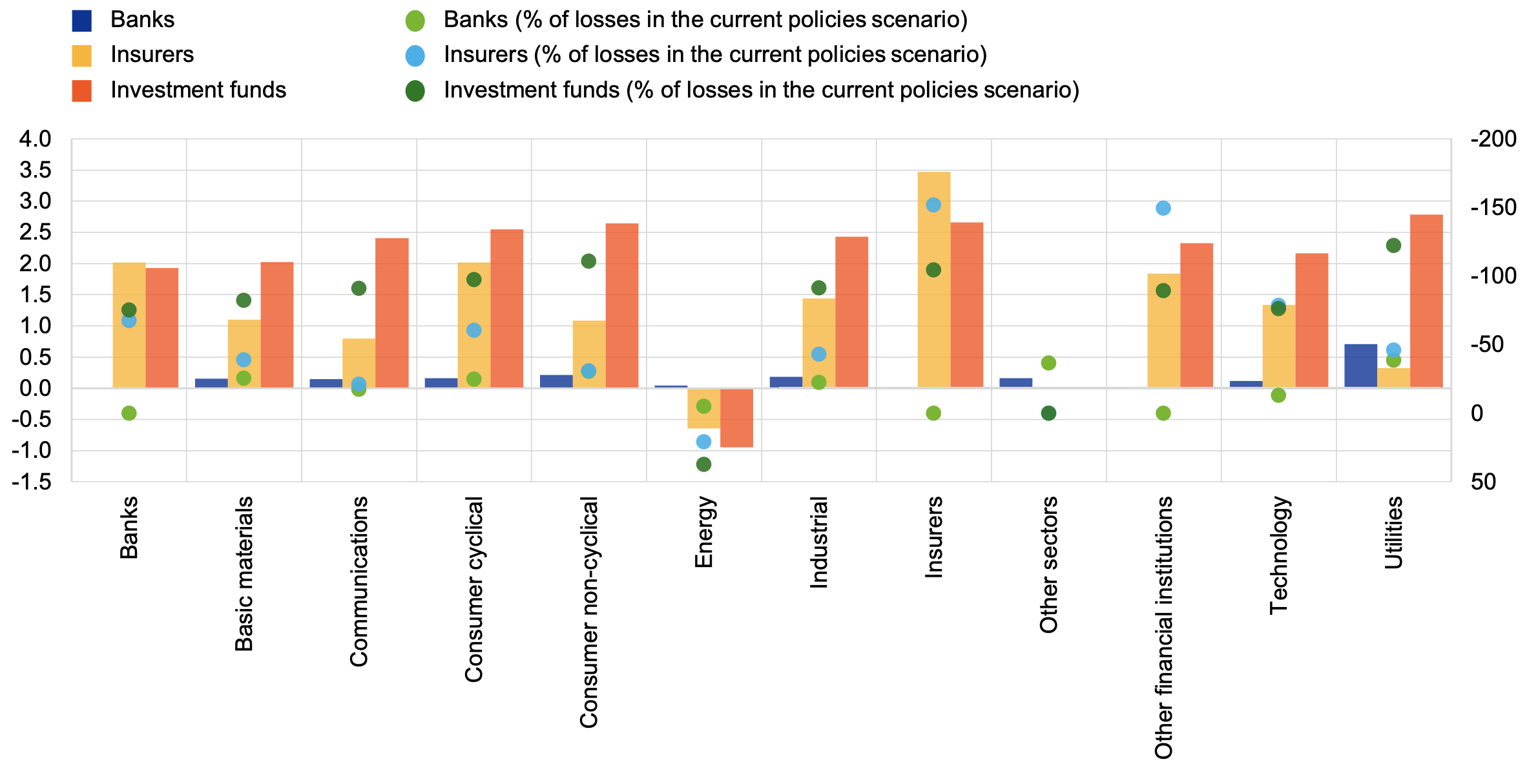

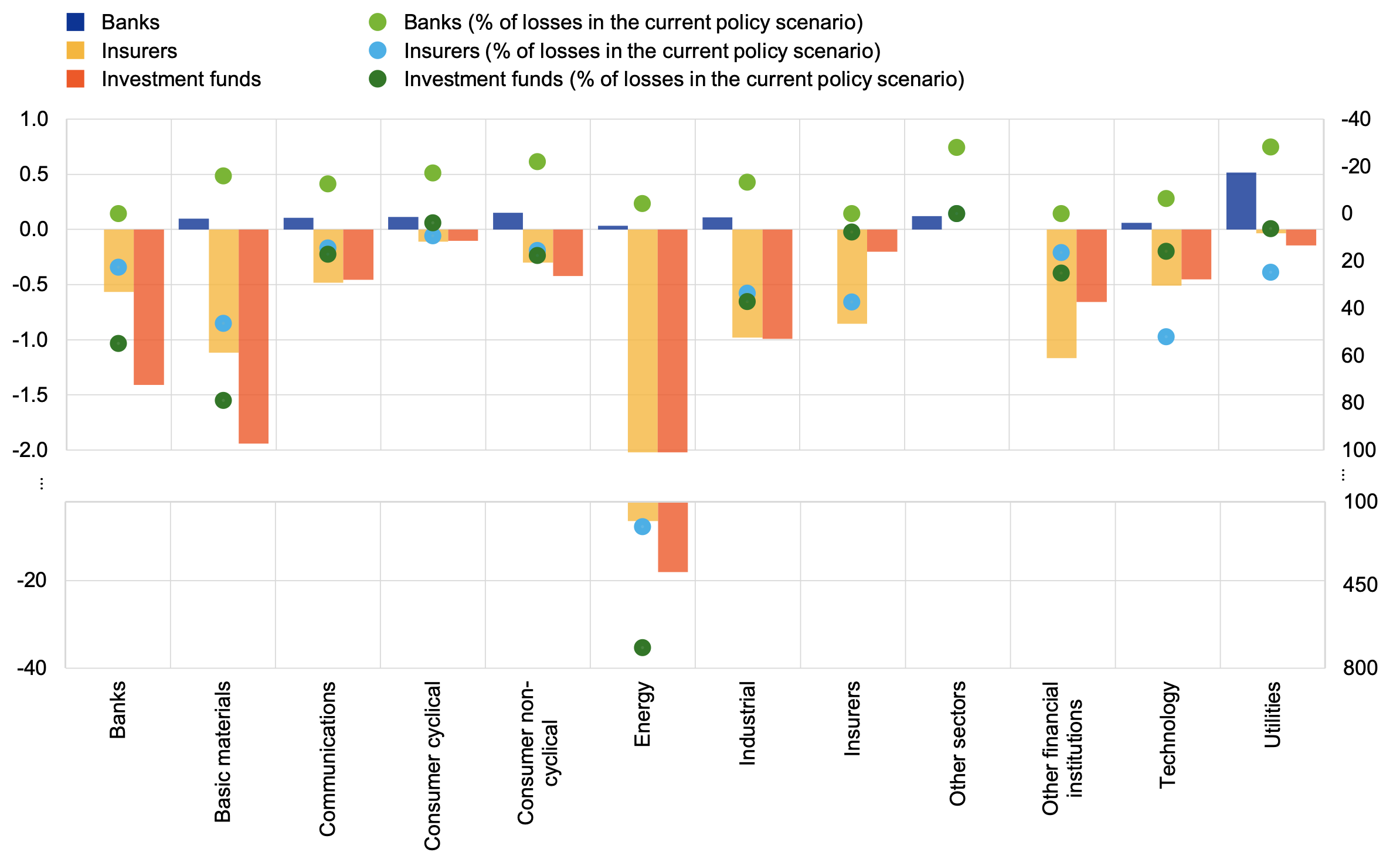

The above mechanisms are illustrated in a simulated evolution of an orderly versus a disorderly transition. On aggregate, investment funds with considerable equity exposures would see the largest market valuation shocks – swinging from gains in an orderly transition to losses in a disorderly one, relative to status quo policies (Figure 2, panels a and b). Insurers would see a similar, albeit more muted loss profile, with a relatively higher exposure to bonds. Banks, in contrast, would see an intertemporal tradeoff with a J curve type shaped impact, with marked shifts at the level of economic sectors contributing to initial credit losses, giving way to growing net gains with time (Figure 2, panels c and d).

Figure 2 Scenario analysis

Y-axis: percentage difference of stress-tested assets compared with the current policies scenario of the same year (with the red line representing losses of investment funds accounting for dynamic changes in equity values over time in percentage of equities measured in the reference period); secondary y-axis: percentage losses in the current policies scenario of the same year.

a. Orderly transition (time dynamics)

b. Delayed transition (time dynamics)

c. Orderly transition (sectoral losses, by 2050)

d. Delayed transition (sectoral losses, by 2050)

Sources: ECB, EIOPA, ESMA.

Note: For insurers and investment funds the bars represent the analogous relative differences in market risk losses in percentage of initial asset values (equities and bonds for insurers, and equities for investment funds). The red line represents the cumulative losses of investment funds accounting for dynamic changes in equity values over time in percentage of equities measured in the reference period. Note that there are marked differences in methodologies – see Table 8 in ECB/ESRB 2022 for more detail.

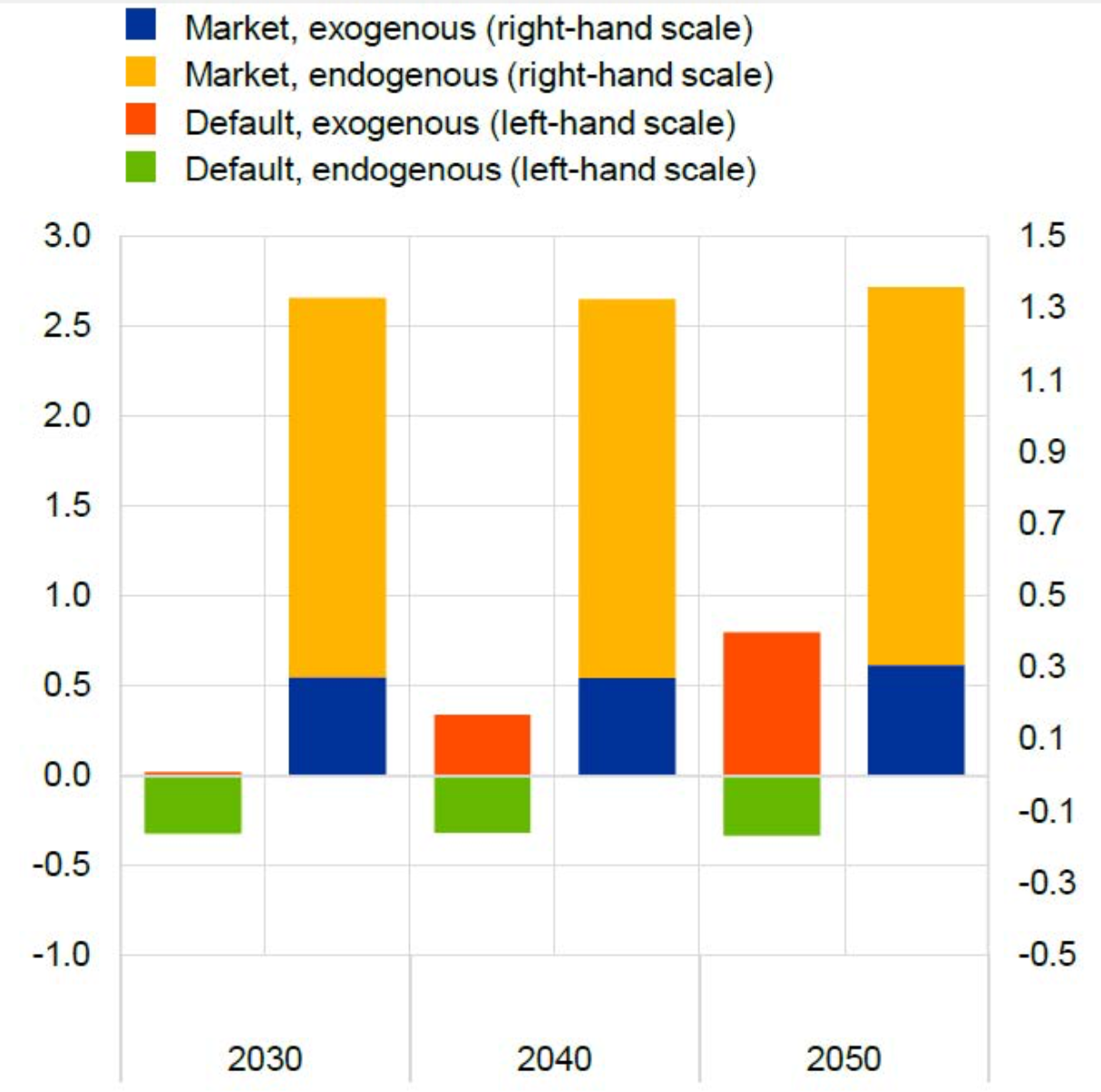

Relatively contained aggregate losses under static balance sheets might be amplified by dynamic financial interactions. These include not only remedial actions, which will surely be taken by individual banks, insurers, and investment funds, but also interactions across various parts of the financial sector. A simulation model building on both within and across sector contagion suggests that system-wide interactions could amplify the reduction in market losses by up to three times in an orderly transition (Figure 3 panel a).

Figure 3 System-wide interactions, and the case for macroprudential policy

Primary axis: losses (-) / gains (+) in an orderly transition expressed in terms of total assets in the system, % mille (left-hand scale). Secondary axis: %

Source: ESRB/ECB (2022).

Notes: “Default, first-round” refers to NFC defaults. “Market, first-round” refers to exogenous market losses both due to the market scenario and due to the price drop of exogenously defaulting NFCs issuing securities. “Second-round” losses are model-driven. The left-hand axes are expressed in pcm (% mille) and the right-hand axes in %.

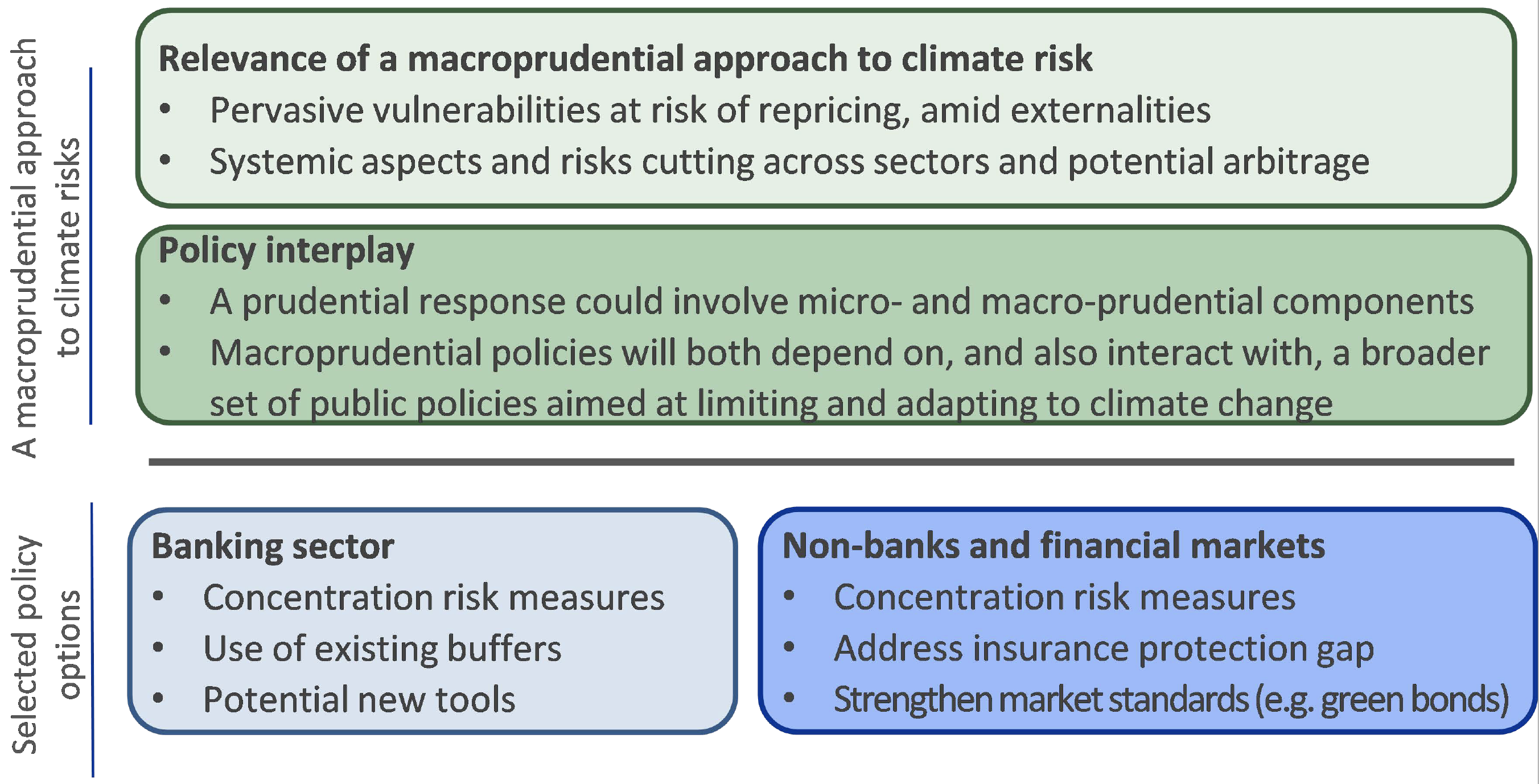

Macroprudential considerations, and illustrative policy options

Source: ESRB/ECB (2022).

Note: This figure is for illustration purposes and not meant to be comprehensive.

Macroprudential policies have a role to play in addressing systemic risk associated with climate change, as part of a broader policy response

Addressing climate change requires a broad policy response, with a carbon framework tackling root causes at its core.

Prudential policies would in this respect play a complementary role, focusing on tackling related climate-related financial risk. Complementing microprudential policies that contain risk for individual institutions, macroprudential policies would contain both time-series and cross-sectional risk for the financial system. Two externalities would be key in the latter respect – those in a corrective phase (additional interconnectedness and spillovers that climate-related financial risk brings to the financial system), and those in a build-up phase (risk for the macroeconomy from the collective financing of projects inconsistent with a net zero transition).

Several policy options follow (Figure 3, panel b). These include measures to limit and manage risk concentrations, address insurance protection gaps, and improve the quantity and quality of disclosures. Last but not least, a macroprudential approach to climate change requires close international cooperation to limit the prospect of clear spillovers amid high interdependencies between jurisdictions.

References

Alogoskoufis, S, N Dunz, T Emambakhsh, T Hennig, M Kaijser, C Kouratzoglou, M A Muñoz, L Parisi and C Salleo (2021), “ECB economy-wide climate stress test – Methodology and results”, ECB Occasional Paper Series No 281.

Borio C, S Claessens and N Tarashev (2022), “Finance and climate change risk: Managing expectations”, VoxEU.org, 7 June.

ECB/ESRB (2022), “The macroprudential challenge of climate change”, Joint European Systemic Risk Board and European Central Bank study.

ECB/ESRB (2021), “Climate-related risk and financial stability”, Joint European Systemic Risk Board and European Central Bank study.

ECB/ESRB (2020), “Positively green: Measuring climate change risks to financial stability”, Joint European Systemic Risk Board and European Central Bank study.

Hiebert (2021), “Climate change will unevenly impact the European financial system”, VoxEU.org, 13 July.

IMF (2022), “Financial stability at the ‘climate Minsky point’”, VoxEU.org, 7 June.

IPCC (2021), “Summary for Policymakers”, in V Masson-Delmotte et al. (eds), Climate Change 2021: The Physical Science Basis. Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change, Cambridge University Press, Cambridge.

Kotlikoff L, F Kübler, A Polbin and S Scheidegger (2021), “Economists have needlessly produced a climate war”, VoxEU.org, 27 October.