While in the run-up to the Economic and Monetary Union (EMU) significant progress was made in terms of nominal convergence as required by the Maastricht criteria, some of the gains in real (income) convergence made in the first ten years of EMU were lost after the Global Crisis and the sovereign debt crisis in the euro area. The main reasons were related to the underlying structural divergences that had resulted in a build-up of imbalances and required costly adjustments (Frenkel et al. 2018, Buti and Turrini 2015, European Commission 2008). Indeed, structural differences in key features of economies can result in important differences in their resilience to shocks and their ability to recover from them, thus resulting in different macroeconomic outcomes.

Assessing the developments of the German and French economies in the perspective of this typology of nominal, real, and structural convergence within EMU is particularly relevant, as together they account for almost half of the euro area GDP and have strong spillovers between them and with other member states in the euro area and the EU. They are – to varying degrees – both highly complex, diversified, technologically advanced and integrated in global value chains, whilst at the same time having distinctly different ‘business models’ as regards, for example, the openness of the economy or the importance of the public sector.

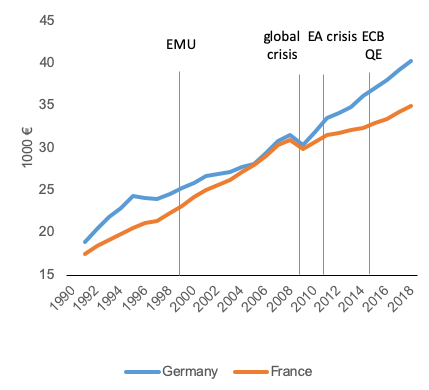

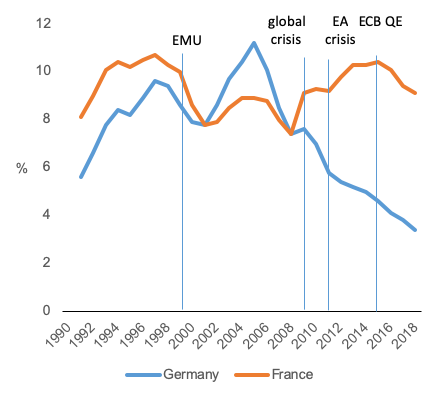

A number of studies have compared the German and the French economies from a variety of perspectives (Praet 2018, Lallement 2017, Piketty 2017, Enderlein/Pisany-Ferry 2014). A recent paper by European Commission staff analysed the reasons behind the latest episode of income divergence between Germany and France (Cléaud et al. 2019). Since the Global Crisis, income and labour market developments have been markedly more favourable in Germany than in France. After an initial fall following the crisis, the German economy recovered much faster, which enabled a difference in GDP per capita to emerge, increasing from about €180 in 2005 to almost €5,400 per year in 2018 (see Figure 1). While the unemployment rate stood at 7.8% in both countries in 2008, it was at around 3.5% in Germany compared to 9% in France in 2018 (see Figure 2).

Figure 1 Income rose faster in Germany after the crisis…

(GDP per capita in current prices, 1991-2018)

Note: 1991-1998 in ECU. The timelines refer to the creation of the Economic and Monetary Union in 1999; the peak of the global financial crisis in 2009; the euro area crisis in 2011; and the quantitative easing that the ECB launched in 2015.

Source: Ameco, European Commission.

Figure 2 …with faster growth also enabling a stronger labour-market performance

(unemployment rate, 1991-2018)

Source: Ameco, European Commission.

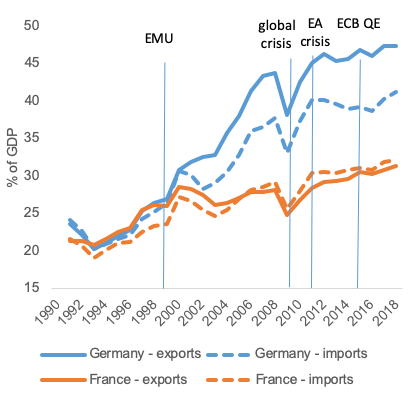

What was the driving force behind these diverging trends? Cléaud et al. (2019) suggest that it was, in particular, differences in the labour market institutions that mattered. While distinct labour market policies also played a role in both countries, it has been the application of collective bargaining by social partners at the firm level in particular that allowed for a greater flexibility in Germany. Moreover, collective bargaining had a different influence on wage developments and working time arrangements. Specifically, when responding to adverse cyclical developments, firms were able to reduce working hours to a larger extent in Germany through working-time accounts and part-time work instead of the larger job-shedding observed in France. The German business model, with a large(r) export sector, has also put a sustained downward pressure on wage growth in manufacturing to maintain its competitiveness (see Figure 5 for exports as a share of GDP). It must be noted, though, that the higher resilience and flexibility of the German labour market has come at the price of more jobs at lower wages compared to France, resulting in higher market-income inequality and poverty, with implications for domestic demand.

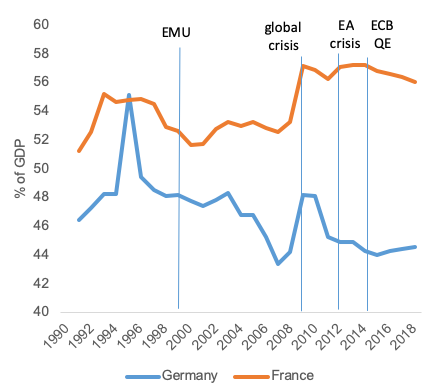

There are also differences in their economic structure that contribute to explaining the income divergences that emerged since the crisis. A larger public sector in France has undoubtedly helped support domestic demand and smoothen economic cycles. Nevertheless, the higher public expenditure-to-GDP ratio has implied higher public deficits and debt as well as a significantly higher tax burden that, ceteris paribus, weighs on growth (see Figure 3). The much more important role of state-owned enterprises in France may also come with some efficiency losses. That said, when looking at the efficiency of public expenditure, a more nuanced picture emerges where France performs better in some areas such as health care and mitigating income inequality and poverty.

Figure 3 The public sector plays a much larger role in France

(public expenditure relative to GDP, 1991-2018)

Note: The 1995 spike for Germany was related to the absorption of Treuhandanstalt debt following reunification.

Source: Ameco, European Commission.

Although there are differences also in the structure and performance of their respective private sectors, labour productivity levels are gradually converging. While Germany had higher labour productivity in manufacturing and, in particular, in the car-manufacturing sector (where its performance used to be noteworthy also in a global comparison), France had higher labour productivity level in the services sector. The business environment appears slightly more favourable in Germany overall, even if the detailed picture is less conclusive. The very different size, structure and role of the banking sectors in the two countries is unlikely to explain the differences in growth performance in view of the lower borrowing costs in France. While this could be the result of the different cyclical positions of the two economies and the efficiency in the two banking systems in transmitting monetary policy impulses, it cannot be excluded that structural features of the respective banking sector will play a more significant role going forward.

A reversal of fortunes?

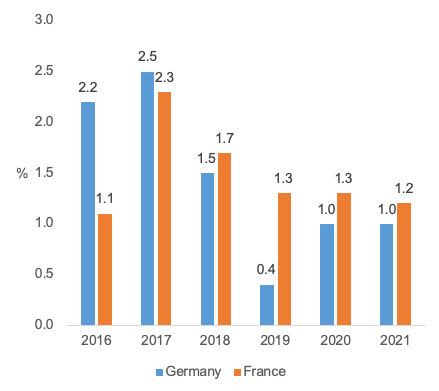

More recently, the picture for growth performance appears to have changed, as the German economy is slowing down sharply while the French economy maintains a path of more stable growth (see Figure 4). Some commentators have already identified 2019 as a turning point, relating the recent slump in the German economy to structural factors rather than to cyclical ones.1 The stagnation of global trade since the start of 2019 has been particularly felt in Germany, where a (technical) recession was narrowly avoided (European Commission 2019). This should not come as a surprise, given that German exports (as a share of GDP) are significantly larger than in France (see Figure 5). This reflects the escalating trade tensions and disruptions in manufacturing, particularly in the car industry that is central to the German manufacturing sector. In contrast, France has so far weathered the current global downturn better, as it continues to rely more on domestic demand. The Commission’s Autumn 2019 Forecast therefore predicts a continued positive outlook for the French economy above the one for the German economy. Indeed, these recent developments confirm the longer-term picture where the French growth model generates a relatively stable (albeit on average lower) growth path, while income growth has been significantly more volatile in Germany.

Figure 4 Sharper slowdown in Germany in 2019

(real GDP growth in Germany and France, 2016-2020)

Note: Figures for 2018 are provisional, for 2019 and 2020 forecast

Source: European Commission Autumn 2019 Forecast.

Figure 5 The stronger importance of trade in Germany compared to France

(exports and imports of goods and services, 1991-2018)

Source: Ameco, European Commission.

Looking further ahead, a number of structural developments are raising concerns about the medium-term growth prospects for both economies. The German export sector’s product and geographical specialisation could prove challenging in coming years as demand in emerging markets such as China is gradually shifting from capital to consumption goods. Also affecting the German economy in particular, globalisation and an increasing need to combat climate change are likely to exert pressures for rapid structural changes in some industrial sectors (in the car industry, for example, which accounts for about one-fifth of German manufacturing).

Population ageing will cause a significant decrease in the share of the working-age population in both countries, although this trend is set to be less severe in France due to its higher birth rate. At the same time, even if the French economy may generate a more stable growth path, it is also more regulated, and the larger state implies a higher tax burden and/or the need to service a larger debt. This can reduce the country’s future capacity to stabilise further the economy by using public funds. The impact of sustained high unemployment on human capital in the longer term is a further unknown. On current trends and assuming unchanged policies, the Commission’s medium-term projection beyond the forecast horizon, i.e. from 2022-2024, points to potential growth of 1.2% in Germany and 1% in France, on average.

Implications of these structural divergences for adjustment and stabilisation within the euro area

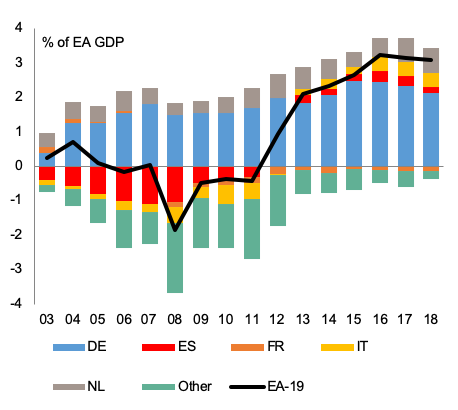

Beyond being particularly exposed to the global cycle, Germany’s export-based growth model, resulting in a high current-account surplus and coupled with moderate growth and low inflation, has complicated the process of adjustment within the euro area (European Commission 2018: 18ff.). The current accounts in countries previously widely in deficit returned closer to balance while the large surpluses in Germany (together with those in the Netherlands) persisted. As a result, the euro area surplus increased visibly after the 2008 crisis and has stabilised at around 3% of GDP since 2015 (see Figure 6). Notwithstanding plans for a slightly expansionary fiscal stance in Germany and the Netherlands, the adjustment of macroeconomic imbalances within the euro area is in that respect still incomplete and asymmetric. Countries with a past of large deficits remain characterised by sizeable negative net international investment positions coupled with large stocks of private or government debt that represent vulnerabilities.

Figure 6 Sustained current-account surpluses in a few countries driving the euro-area balance

(euro area current account evolution: Breakdown by country)

Source: Eurostat, Balance of payments figures.

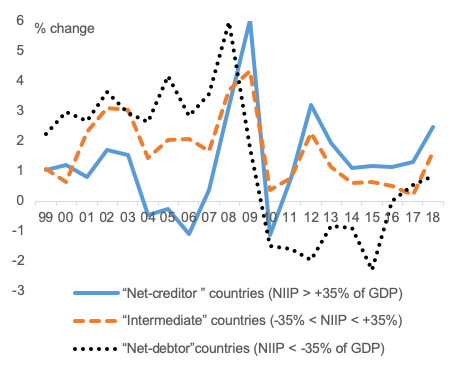

Figure 7 Rebalancing across the euro area

(unit labour costs growth)

Source: AMECO, European Commission.

A more symmetric rebalancing – not only of countries with current account deficits but further adjustment also of those with surpluses – would help ensure macroeconomic stability in the euro area going forward. In net-debtor countries, bringing down the large stocks of foreign and domestic debt to avoid the need for pro-cyclical tightening in bad times requires maintaining prudent current-account balances and raising the growth potential (e.g. via appropriate investment and reforms). Their relative competitiveness gains through internal devaluation to support the rebalancing that started in 2012 have been narrowing, also due to the low inflation in other parts of the euro area (see Figure 7).2 Conversely, policies to foster investment and overcome low inflation from wage inertia would help address persistent large surpluses in net-creditor countries while contributing to supporting growth and making it less dependent on foreign demand.

At the current juncture, there are specific challenges for euro area economic policy coordination in response to the ongoing economic slowdown amidst external risks. As monetary policy is at the zero lower bound and quantitative easing is reaching its limits, fiscal policy needs to assume more responsibility. However, fiscal space varies across member states and is subject to debt-sustainability considerations as codified in the Stability and Growth Pact (SGP) and national fiscal rules. In highly indebted countries, debt-sustainability concerns will only allow very limited stabilisation efforts in the event of an economic downturn. In addition, the built-in asymmetry of the SGP, which is stronger on restricting than on recommending fiscal expansion, results in a tendency of pro-cyclicality for the euro area as a whole. Finally, wage policies remain decentralised across and within member states, being ultimately an adequate reflection of significant national, regional, and sectoral differences in levels and growth of labour productivity.

These considerations are a particular concern as EMU’s architecture remains to be completed to strengthen the resilience of the euro area and to reinforce adjustment mechanisms that allow a smoother response to shocks. There is, in particular, still insufficient private-sector risk diversification through financial markets due to the varied progress on the Banking Union and the Capital Markets Union as well as the absence of a euro area safe asset. Moreover, fiscal stabilisation in the euro area is hampered by the absence of a euro-area fiscal capacity of any significant size. This could allow for a better-targeted euro-area fiscal stance that is not merely the sum of the budgetary policies of its members.

Policies to support more balanced, inclusive, and sustainable growth in Germany and France

The transformation of the European economy, which is central to delivering on Europe’s model of more balanced, inclusive and sustainable growth, will have to come from policies at both the EU and member-state level. Indeed, policy choices can make a difference to facilitate this transformation. It was not too long ago, in the early 2000s, that Germany was dubbed the ‘sick man of Europe’ but managed to turn its performance around with a number of comprehensive reforms coupled with a – with hindsight, perhaps excessively – prudent behaviour of social partners. France has recently embarked on a process of reforms of its economy that are delivering some first results, although not without political and social difficulties. When considering policy options with a view to structural convergence, the main objective is to make euro area economies more similar in their resilience to shocks, enhance their adaptability, and in this way support their nominal and real convergence.

Several priorities for policy reforms in Germany and France have been identified that would provide benefits simultaneously for each of the two countries and for the euro area as a whole.3 In Germany, the main objective should be to strengthen domestic demand in a way that also fosters potential growth. This would help to reduce its dependency from global growth by reducing net exports and a large current account surplus while, at the same time, contributing to euro area rebalancing and countering the ongoing economic slowdown.

First, fiscal and structural policies could be used to support private and public investment in a number of areas such as education, research and innovation, digitalisation, thereby underpinning productivity in general, the transformation of the transport and energy networks more specifically, as well as affordable housing. More competition – notably in network industries, business services, and regulated professions – would also contribute to these objectives.

Second, policies could support higher wage growth by influencing the reservation wage. In addition, Germany should act to support the inclusiveness of its labour market by, in particular, shifting taxes away from labour to other sources more supportive to growth, reducing disincentives to work more hours, in particular for low-wage and second earners, and improving educational outcomes and skills levels of disadvantaged groups.

In France, the main challenge is to enhance potential growth and regain fiscal space. This requires improving the efficiency and sustainability of the public sector, notably to reduce the general government debt ratio. Expenditure savings and efficiency gains across all sub-sectors of the government are the way forward, as well as reforming the pension system’s fairness and sustainability. The tax system could be further simplified, in particular by limiting the use of tax expenditures, further removing inefficient taxes and reducing taxes on production. Economic policies to support investment should focus on research and innovation, energy, and digital infrastructure, whilst taking into account territorial disparities. Moreover, the French economy could become more dynamic by reducing regulatory restrictions, in particular in the services sector, and by implementing measures to foster the growth of firms. France could also do more to improve the functioning, resilience and inclusiveness of its labour market. To foster labour market integration for all those seeking a job, a particular focus should be on vulnerable groups, including people with a migrant background, and on addressing skills shortages and mismatches.

Implementing these policies would not only help Germany and France converge in nominal, real, and structural terms but also support the correction of imbalances in the euro area. Finally, it should be recalled that Germany and France are also key players for finding agreements to make progress on deepening EMU and improving economic policy coordination in the euro area. Better progress in addressing their respective challenges could also make a substantial difference in moving away from the unhelpful framework of risk reduction versus risk sharing in which these discussions are held.

Authors’ note: The authors are writing in their personal capacity and their opinions should not be attributed to the European Commission.

References

Buti, M and A Turrini (2015), “Three waves of convergence – Can Eurozone countries start growing together again?”, VoxEU.org, 17 April.

Cléaud, G, F de Castro Fernández, J Durán Laguna, L Granelli, M Hallet, A Jaubertie, C Maravall Rodriguez, D Ognyanova, B Palvolgyi, T Tsalinski, K-Y Weißschädel and J Ziemendorff (2019), “Cruising at different speeds: Similarities and divergences between the German and the French economies”, ECFIN Discussion Paper No. 103.

Enderlein, H and J Pisani-Ferry (2014), Reforms, Investment and Growth - An agenda for France, Germany and Europe, Report to the French Minister for the Economy, Industry and Digital Affairs and to the German Federal Minister for Economic Affairs and Energy.

European Commission (2008), EMU@10 - successes and challenges after 10 years of Economic and Monetary Union, Brussels.

European Commission (2018), Alert Mechanism Report 2019, Brussels, COM(2018) 758 final of 21.11.2018.

European Commission (2019), Autumn 2019 Economic Forecast, a challenging road ahead, Brussels.

Franks, J, B Barkbu, R Blavy, W Oman, and H Schoelermann (2018), “Economic Convergence in the Euro Area: Coming Together or Drifting Apart?”, IMF Working Paper WP/18/10.

Lallement, R (2017), “Les mutations socioéconomiques en Allemagne: bilan et perspectives”, France Stratégie working document no. 2017-04.

Piketty, T (2017), “Of productivity in France and in Germany”, blog, 9 January.

Praet, P (2018), “Improving the functioning of Economic and Monetary Union: lessons and challenges for economic policies”, Speech at the NABE Symposium, Madrid, 16 April.

Endnotes

[1] See, for example, the following newspaper articles: “Avantgarde statt Tristesse”, Handelsblatt, 27 September 2019; “Frankreich, Du hast es besser – oder doch nicht?”, Franfurter Allgemeine Zeitung, 14 August 2019; La France résiste mieux que l”Allemagne au ralentissement économique”, Le Monde, 28 August 2019; “Face au ralentisssement européen, l’économie française resiste”, La Tribune, 4 October 2019; “Franc is Europe’s New Economic Growth Engine”, Bloomberg News 6 November 2019.

[2] ‘Net-creditor’ countries are DE, LU, NL, BE, MT. Countries with a net international investment position (NIIP) between 35% and -35% of GDP are FI, EE, IT, LT, FR, SI, AT. Remaining euro area countries are in the NIIP<-35% of GDP group. The country split is based on NIIP average values in the 2016-2018 period. Net-creditor countries generally recorded a current account surplus over the same period average. Further explanations and analysis can be found in the forthcoming Alert Mechanism Report of the European Commission.

[3] See also the country-specific recommendations addressed in July 2019 by the EU to Germany (http://data.consilium.europa.eu/doc/document/ST-10158-2019-INIT/en/pdf) and France (http://data.consilium.europa.eu/doc/document/ST-10163-2019-INIT/en/pdf).