Sustainable finance refers to a growing field in the financial services industry that incorporates environmental, social, and governance (ESG) considerations into investment decisions (European Commission 2020). Regulatory requirements targeting climate risks and aiming at the transition to a low-carbon economy as well as an increase in environmental and sustainability awareness of companies and investors have led to the emergence of green and sustainable debt instruments (Abiry et al. 2022, Beyene et al. 2021, Ehlers et al. 2020, Löyttyniemi 2021). Although the green bond market is so far the most popular and relatively mature market, green lending instruments, i.e. ‘green loans’ and sustainability-linked loans, henceforth ‘sustainable loans’, have recently become globally recognised. Green loans are project-based debt instruments similar to green bonds that their proceeds should be entirely used to finance green projects. The Green Loan Principles provide guidelines on which projects are eligible to be classified as ‘green’ to accomplish an efficient contribution to environmental sustainability (Loan Market Association 2018).

Sustainable loans, on the other hand, do not have any limitations on the use of proceeds. The characterising feature of this type of loan is that the terms of the loan are determined by the borrower’s performance against some predefined ESG criteria, which usually impact the loan’s pricing (Loan Market Association 2019). This implies that borrowers are granted a pricing reduction if they improve their ESG performance, whereas a pricing increase is applied as a punishment if ESG performance deteriorates. This contingency aims to incentivise borrowers to improve their sustainability profile. The Sustainability Linked Loan Principles outline the sustainability performance targets that allow the assessment of a borrower’s sustainability profile. Some examples are improving the company’s ESG score, achieving predefined corporate social responsibility targets, increasing the female proportion in management positions, or reducing the incident and sick rates at the workplace. Hence, sustainable loans are available to a broader scope of companies that are willing to integrate their corporate sustainability targets into their financing decisions.

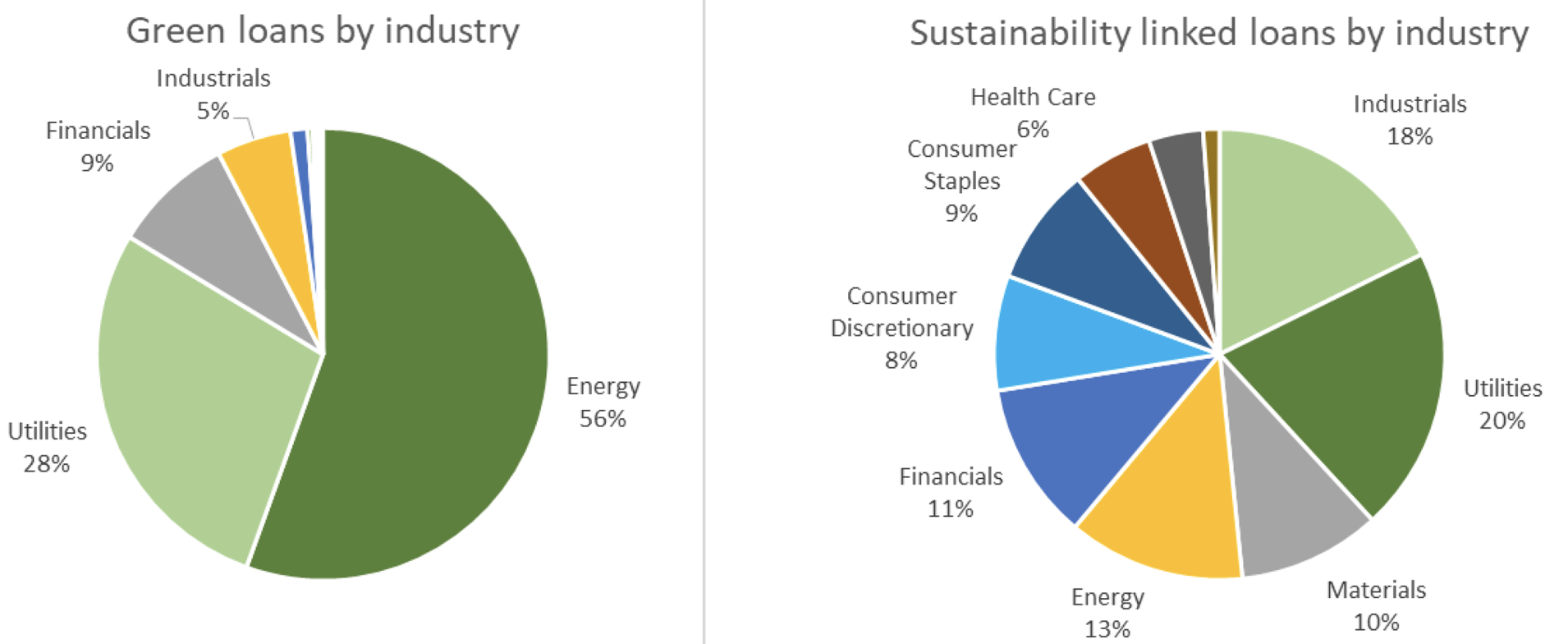

As shown in Figure 1, the majority of green loans are utilised in industries that have green projects by nature or have broadly accepted definitions of green, such as the energy or utilities sector. Similar to green bonds, they are most popular in the industries where environment is central for firms’ businesses (Flammer 2021). In contrast, the industries raising sustainable loans are more dispersed. These loans do not require a green project to be financed but instead allow companies to improve their sustainability performance by linking it to the terms of the loan. As a result of its design, it attracts borrowers from a broad set of industries that lack green projects such as transportation and logistics (industrials sector), the food and beverage industry (consumer staples sector), or the financials industry.

Figure 1 Volume of green and sustainable loans by industry

Although the Green Loan Principles and the Sustainability Linked Loan Principles have been implemented to provide the best practice for the green and sustainable loan market, there is still a risk of ‘greenwashing’ and, in the case of sustainable loans, ‘sustainability washing’ (Kim et al. 2022). In our recent study, we examine the effectiveness of green and sustainable loans in terms of their impact on firms’ sustainability profile by analysing the development of a firm’s ESG performance following the issuance of these types of loans (Dursun-de Neef et al. 2022). This allows us to investigate whether green and sustainable loans achieve their objectives, which is crucial for the success of the regulatory initiatives aiming at stimulating sustainable economic activity.

We analyse the complete sample of green and sustainable loans issued by European firms in the period between 2014 and 2019. According to our results, firms’ ESG performance evolves differently after a green loan issuance compared to a sustainable loan issuance. We find that firms issuing more green loans shrink their environmental emissions in the long term, which increases their environmental performance. However, there is a possible negative externality: Firms’ social performance deteriorates following the issuance of green loans in the long term. Firms experience a significant decrease in their social score, which comes from a significant decrease in the scores of the following subcategories: Community score, product responsibility score, and human rights score. These findings indicate that green loan issuers prioritise their environmental goals, while they neglect their commitment towards their customers and the society. As a result, their overall ESG performance does not improve following the issuance of green loans. This suggests that the successful delivery of green projects might not necessarily imply that firms effectively improve their ESG performance in the rest of their business activities.

Our results on sustainable loans, on the other hand, suggest that the incentive mechanism of this type of loans is more effective. Following the issuance of sustainable loans, firms improve their overall ESG performance in the long term by increasing their environmental and governance scores. The increase in environmental performance is driven by an increase in firms’ resource use score, whereas the increase in their governance performance is driven by an increase in the corporate social responsibility (CSR) strategy score. These findings imply that, following the issuance of a sustainable loan, firms tend to implement eco-friendly solutions and consider environmental and social factors in their business activities.

Overall, the issuance of a sustainable loan appears to precede (and may potentially signal) subsequent improvements in the firms’ ESG performance consistent with the signaling theory discussed in Flammer (2021). This suggests that sustainable loans might be a more efficient instrument to enhance firms’ overall ESG performance. However, issuing green loans cannot be interpreted as a clear signal on firms’ ESG outlook. This could be attributed to the specific design of each debt instrument. While green loans aim to increase investments in environmentally beneficial projects, sustainable loans do not target specific projects and instead focus on the overall sustainability profile. As a result, following the issuance of green loans, firms focus on their green projects and improve their environmental performance, while they neglect their social performance. On the other hand, issuing sustainable loans increases the overall ESG performance.

References

Abiry, R, M Ferdinandusse, A Ludwig and C Nerlich (2022), “Green QE and carbon pricing: Looking at potential tools to fight climate change”, VoxEU.org, 7 October.

Beyene, W, M Delis, K De Greiff and S Ongena (2021), “Too-big-to-strand? Bond versus bank financing in the transition to a low-carbon economy”, VoxEU.org, 4 December.

Dursun-de Neef, H Ö, S Ongena and G Tsonkova (2022), “Green versus sustainable loans: The impact on firms’ ESG performance”, Swiss Finance Institute Research Paper, (22-42).

Ehlers, T, B Mojon, F Packer and L A Pereira da Silva (2020), “Green bonds and carbon emissions: Exploring the case for a rating system at the firm level”, VoxEU.org, 12 December.

European Commission (2020), Overview of sustainable finance.

Flammer, C (2021), “Corporate green bonds”, Journal of Financial Economics 142(2): 499-516.

Kim, S, N Kumar, J Lee and J Oh (2022), “ESG lending”, In Proceedings of Paris December 2021 Finance Meeting EUROFIDAI-ESSEC, March.

Loan Market Association (2018), “Green loan principles”, December.

Loan Market Association (2019), “Sustainability linked loan principles”, March.

Löyttyniemi, T (2021), “Integrating climate change into the financial stability framework”, VoxEU.org, 8 July.