China has embarked on an ambitious campaign to close income gaps, address regional inequality and unfair social welfare provision, and make solid progress towards common prosperity by 2035. This marks a shift in focus from overall growth to promoting equitable and balanced growth. To evaluate the growing inequality during China’s recent period of rapid expansion, a number of papers have documented the evolution of income inequality, especially in urban China, since the beginning of the economic reforms and opening up (Khan and Riskin 1998, Meng 2004, Meng et al. 2005, Ravallion and Chen 2007, Benjamin et al. 2008). Others also study the change in consumption inequality alongside income inequality (Cai et al. 2010, Ding and He 2018). Most recently, Santaeulàlia-Llopis and Zheng (2018) investigate the joint evolution of income and consumption inequality using a long household-level panel of income and consumption and establish that in both urban and rural areas of China, there was considerable deterioration in households’ ability to insure consumption against unanticipated changes in income over the growth period of 1989 to 2009. Our recent research (Attanasio et al. 2021) zooms in on rural China and asks, in particular, how much of this erosion of insurance was due to a decline in risk sharing within a village, as an insurance network, versus across villages, and what mechanisms were at play.

The changing economic landscape of villages in China

Using the China Health and Nutrition Survey (CHNS), a household-level panel of income and consumption from about 150 rural villages in China from 1989 to 2009, we first confirm the main economic trends widely understood about rural China in our sample. We document that rural households in our sample experienced rapid income and consumption growth during this period, with the average household income tripling and consumption doubling. Moreover, we show three broad trends in sectoral composition, industrial ownership composition, and central-local fiscal relationships.

Trend 1. There was a gradual but steady shift out of the agricultural sector into the industrial sector

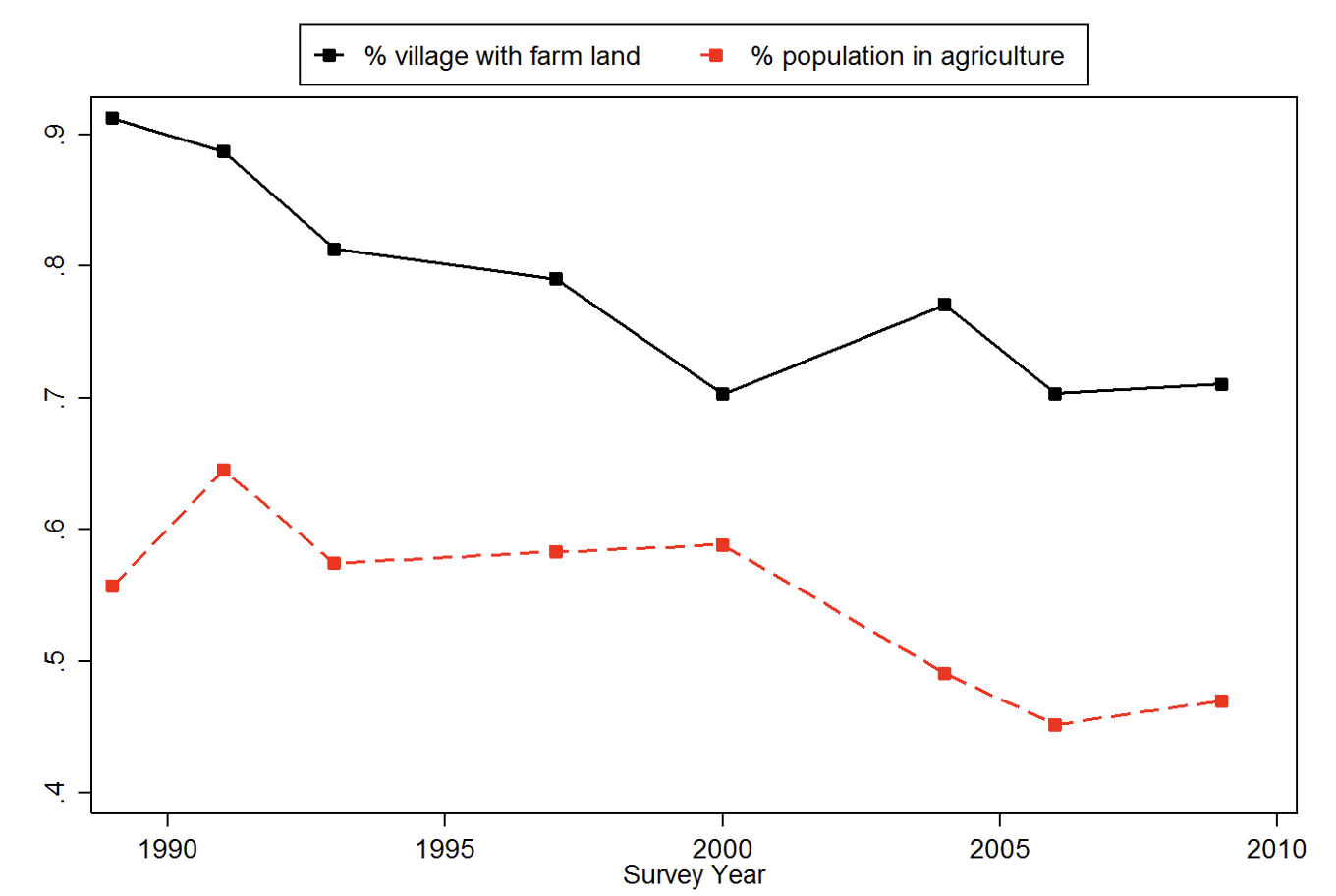

This process of industrialisation is reflected in our sample, in that 90% of our villages had farmland and 55% of the working age population worked on a farm in 1989, while in 2009 only 70% of the villages had farmland and 45% of the working age population worked on a farm (Figure 1, panel a).

Trend 2. The dominance of township and village enterprises rose and fell during the economic transition

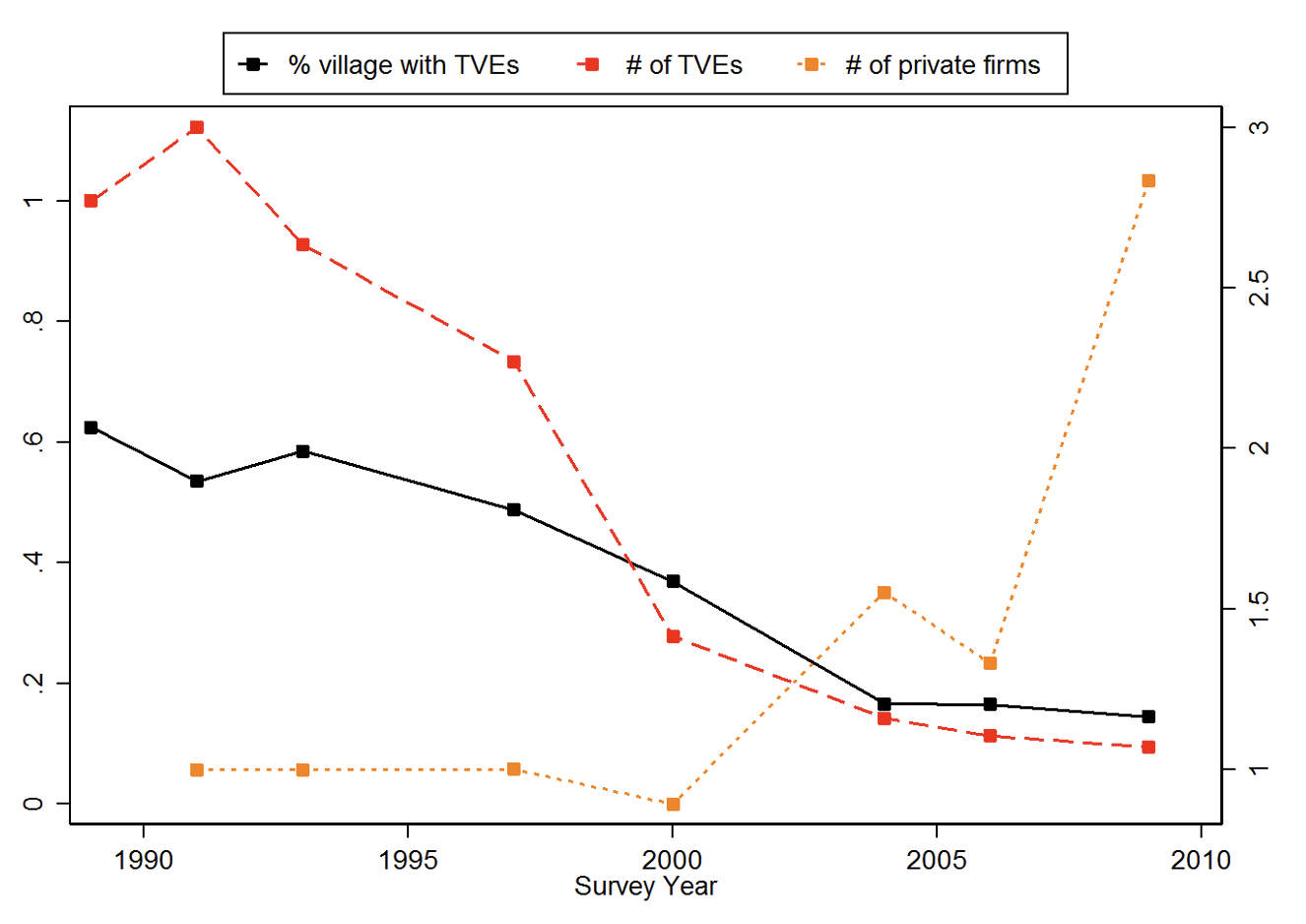

Rural industrialisation was first pioneered by township and village enterprises (TVEs), which were enterprises owned by local township and village governments and yet allowed to respond to market forces that were gradually introduced. However, they soon lost out to private firms that were newly allowed in the market. In our sample, we observe a clear decreasing time trend in the number of TVEs per village, and a contrasting increasing time trend in the number of private firms per village, especially in the 2000s (Figure 1, panel b).

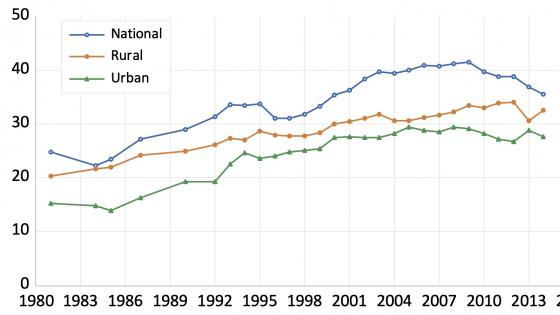

Trend 3. The changing central-local fiscal relation led to increasing disparity in fiscal resources across local governments

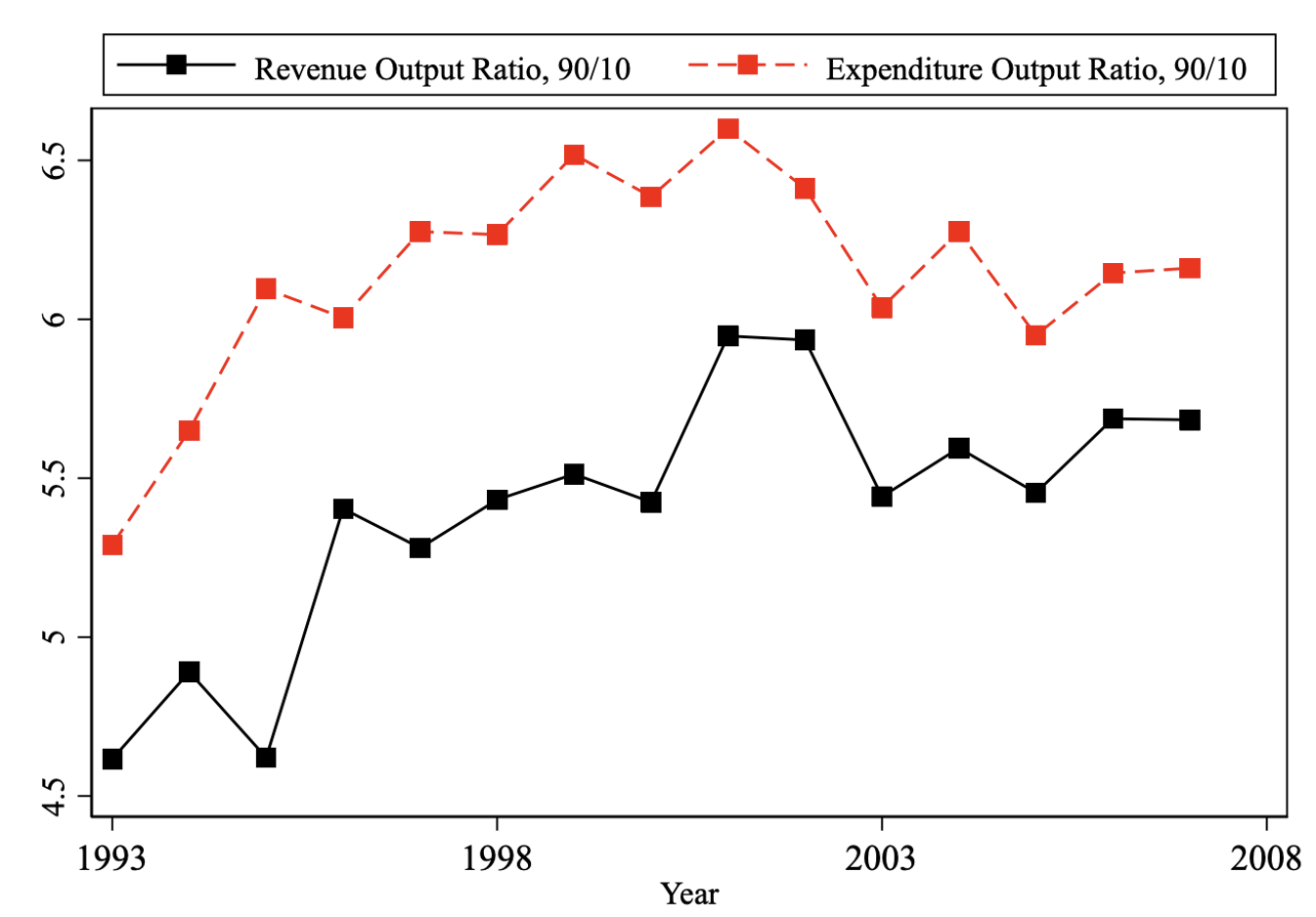

With the 1994 Tax Reform, which centralised tax revenues from local governments but also left fiscal responsibilities to local governments, local governments became increasingly self-reliant in financing public expenditures. Given the highly unbalanced regional economic development across China, disparities in local fiscal revenues and expenditures between richer and poorer counties increased. This is illustrated in the increasing time trend, especially in the 1990s and early 2000s, in the 90-10 ratio of county-level revenue-to-output and expenditure-to-output ratios (Figure 1, panel c).

These broad trends suggest important implications for risk sharing within and across villages: the decline of agriculture and the demise of TVEs suggest a deterioration of transfers within villages, while the breakdown of the central-local fiscal relationship suggests a deterioration of transfers across counties, the lowest level of government for which we observe fiscal conditions, which is likely passed down to villages across the country.

Figure 1 Changes in agriculture, industrial, and public sectors in rural China

Panel (a)

Panel (b)

Panel (c)

Note: Panels (a) and (b) are based on the CHNS sample and panel (c) is based on the county-level fiscal balance sheet sample from the EPS China database. In panel (b), the number of TVEs per village is normalized to one in 1989 and the number of private enterprises per village is normalizsed to one in 1991 (right axis), the first wave in which this information is collected. Panel (c) shows, by year, the 90-10 ratio of county-level fiscal revenue to output ratio and of county-level local fiscal expenditure to output ratio.

The evolution of consumption insurance in rural China

We start by testing whether rural households in our sample achieved perfect risk sharing within a village, based on the pioneering work of Townsend (1994). The idea is that if a social planner could pool all incomes in a village and distribute consumption to each household according to agreed-upon weights, then controlling for village-level total income, household consumption should not vary with its own income. Our data firmly reject perfect risk sharing within villages, and the correlation between household consumption and own income increases significantly from the 1990s to the 2000s. When we extend this logic to risk sharing across villages within a province, we obtain similar results. In sum, these exercises suggest that risk sharing decreased both within and across villages.

While the aforementioned tests suggest the presence of incomplete insurance, they do not distinguish between shocks of different durations and sources. To complement these results, we apply the methodology developed in Attanasio et al. (2018) to decompose income shocks along two dimensions: permanent versus transitory shocks and village-aggregate versus idiosyncratic shocks. This allows us to estimate how shocks of different nature affect consumption. For example, one would expect households to have more means, private or public, to insure their consumption against idiosyncratic shocks than against village-aggregate shocks since within village insurance mechanisms (such as informal transfers between households) could help with the former shock but not the latter.

We find that there is large scope for within-village risk sharing: close to 60% of permanent income shocks and 90% of transitory income shocks are idiosyncratic and thus insurable within a village. We also find that all types of income shocks were well insured in the early years of our sample period, but that this insurance deteriorated by the end of our sample period, particularly for aggregate shocks. Specifically, compared to the near-perfect insurance achieved in the 1990s, as much as 60% of village-aggregate permanent income shocks and around 20% of idiosyncratic transitory shocks were passed onto consumption in the 2000s. Consumption equivalent calculations imply that the welfare cost of these changes was on the order of 0.5% to 1.5% of consumption. Moreover, this welfare cost is almost entirely driven by the erosion of insurance as opposed to an increase in income risk, and most of this insurance effect is due to changes in insurance against village-aggregate permanent shocks.

Potential mechanisms behind the decline in insurance

To interpret these results against the backdrop of the drastic changes that rural villages experienced during those twenty years, we further investigate the characteristics of villages that correlate with the deterioration in consumption insurance. Notably, in regions where (i) the agriculture sector was weaker, (ii) migration rates were higher, and (iii) there were fewer publicly owned TVEs, the deterioration of consumption insurance was more pronounced. These attributes, which characterise the economic transformation of rural China in the 1990s and 2000s, all weaken insurance within the village, as villages have less ability to provide social insurance from TVE revenue and household migration can weaken inter-household bonds.

To explore the decline of across-village insurance, we investigate the changing role of the central government by directly measuring intergovernmental transfers using data from county fiscal balance sheets from 1993 to 2007. We find that county government tax revenue and spending increasingly co-vary with output over time, while transfer programs, which were set up for insurance and redistribution purposes, become less negatively correlated over time. These findings suggest that the intergovernmental fiscal transfer programs put in place after the 1994 Tax Reform became less progressive over the course of economic transition and led to a decrease in insurance provision against shocks that impact local communities. With rising regional inequality, local governments were left to themselves for insurance, which made village aggregate income risk increasingly difficult to insure.

Conclusion

The case of rural China offers valuable lessons to other transition economies. Our analysis confirms that the amount of risk-sharing depends on the economic and policy environment. In developed countries, strong private insurance contracts and public insurance systems (e.g. unemployment insurance programs) play a prominent role in insuring income risk and partially protecting people in a volatile world. In less developed countries with little access to formal insurance, informal risk sharing plays a larger role, typically within smaller groups such as villages. Therefore, the level of risk sharing that occurs in agrarian or collective economies may no longer be effective or sustainable when pro-growth market incentives are introduced. The story of rural China is a portrait of such transition and reveals important challenges along the path to industrialization. For China, how to better integrate rural areas into social insurance and social welfare institutions remains a key policy question in the quest for common prosperity.

Editors’ note: This column first appeared on VoxChina. Reproduced with permission.

References

Attanasio, O, C Meghir, and C Mommaerts (2018), “Insurance in Extended Family Networks”, Cowles Foundation discussion paper no. 1996R.

Attanasio, O, C Meghir, C Mommaerts, and Y Zheng (2021), “Growing Apart: Declining Within- and Across-Locality Insurance in Rural China”, CEPR Discussion Paper 16654.

Benjamin, D, L Brandt, J Giles, and S Wang (2008), “Income Inequality During China’s Economic Transition”, in L Brandt and T G Rawski (eds), China’s Great Economic Transformation, Cambridge University Press.

Cai, H, Y Chen, and L-A Zhou (2010), “Income and Consumption Inequality in Urban China: 1992–2003”, Economic Development and Cultural Change 58(3).

Ding, H and H He (2018), “A Tale of Transition: An Empirical Analysis of Economic Inequality in Urban China, 1986–2009”, Review of Economic Dynamics 29: 106–37.

Khan, A R and C Riskin (1998), “Income and Inequality in China: Composition, Distribution, and Growth of Household Income, 1988 to 1995”, China Quarterly 154: 221–53.

Meng, X (2004), “Economic Restructuring and Income Inequality in Urban China”, Review of Income and Wealth 50(3): 357–79.

Meng, X, R Gregory, and Y Wang (2005), “Poverty, Inequality, and Growth in Urban China, 1986– 2000”, Journal of Comparative Economics 33(4): 710–29.

Ravallion, M, and S Chen (2007), “China’s (Uneven) Progress Against Poverty”, Journal of Development Economics 82: 1–42.

Santaeulàlia-Llopis, R and Y Zheng (2018), “The Price of Growth: Consumption Insurance in China 1989–2009”, American Economic Journal: Macroeconomics 10(4): 1–36.

Townsend, R M (1994), “Risk and Insurance in Village India”, Econometrica 62(3): 539–91.