Editors' note: This column is a lead commentary in the VoxEU debate on euro area reform.

The European fiscal rules have been temporarily suspended since March 2020 to enable member states to take emergency measures against the Covid crisis. This should be taken as an opportunity for an ambitious reform of a now clearly outdated fiscal framework. The reactivation of the rules, now foreseen in 2023, should be made contingent on a political agreement on reforming the fiscal framework.

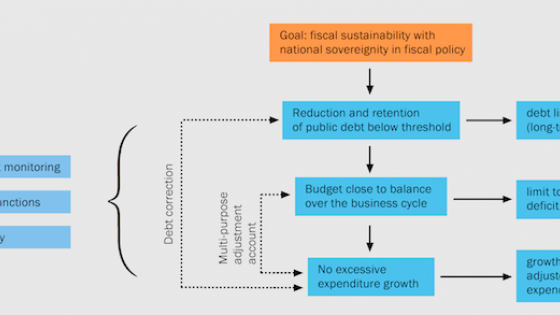

We propose a comprehensive reform in which the new European fiscal framework would prioritise externalities arising from debt sustainability risks and demand spillovers. Fiscal targets should be differentiated depending on country vulnerabilities and implemented in a more decentralised way. We provide a detailed economic and institutional roadmap for this reform.

We are no longer in the world of Maastricht

Since the Maastricht Treaty, the European fiscal rules have been constantly revised (without significant Treaty changes) but overall, the underlying framework has remained the same. Even before the Covid-19 crisis, many economists and officials were calling for its reform (e.g. Bénassy-Quéré et al. 2018, Darvas et al. 2018, Feld et al. 2018, Thygesen et al. 2018).

The post-Covid context results in a disconnect between these rules and four new facts: higher public debts, very low or even negative interest rates, limited effectiveness of monetary policy in the vicinity of the effective lower bound, and common debt issuance with the adoption of the European recovery plan in 2020. In this context, the role of fiscal policy in reducing both temporary and persistent demand deficits must be reassessed.

This has strong implications for the euro area, where this role has been codified on a premise that now appears to be obsolete. Echoing Mario Draghi’s 2014 call for a “greater role” for fiscal policy alongside monetary policy (Draghi 2014), ECB Executive Board member Isabel Schnabel recently advocated rethinking the relationship between monetary and fiscal policy when interest rates can no longer be reduced, saying that “effective macroeconomic stabilisation in the vicinity of the lower bound requires both unconventional monetary and fiscal policies” (Schnabel 2021).

The case for a comprehensive overhaul of the fiscal rules

In a recent French Council of Economic Analysis paper (Martin et al. 2021), we argue that to be effective, an overhaul of the rules should address two main fiscal externalities.

The first, which was at the heart of the euro area crisis, is the risk to the area’s financial and monetary stability posed by sovereign insolvency and, even more so, by the possible exit that could follow. The rules should tackle the insolvency risk resulting from excessive debt, not the threats resulting from self-fulfilling expectations, which are and should remained addressed by the ECB (Farhi and Martin 2018).

The second externality, which was largely neglected in the design of the EMU, pertains to aggregate demand. As long as fiscal support to aggregate demand is called for and no central budget exists to take on this role, the impact of national fiscal policies on partner countries must be considered. This externality was long considered secondary because of opposite spillover effects through the goods and capital markets, yet it is significant when the central bank's policy rate can no longer be reduced due to the effective lower bound.

While the need for reform is increasingly recognised, its nature remains fiercely debated. Blanchard et al. (2021) call for replacing budgetary rules by qualitative standards. They propose to get rid of all numerical criteria, to replace them with the sole principle that member states "ensure that their public debts remain sustainable with a high probability" and (in the most streamlined version of their proposal) to replace the mechanism of gradual sanctions by the standard EU procedure of action by the Commission before the Court of Justice.

We agree on the focus on sustainability and on removing the multiple numerical criteria that have accumulated in the European fiscal framework. However, we consider a complete break with the Pact as unrealistic.

Country-specific debt targets

We do not propose to rewrite the central provisions of the Treaty on the Functioning of the European Union (TFEU). This applies first of all to Article 126 (“Member States shall avoid excessive government deficits”), including the gradual pressure its procedures entail and the possibility – never used – of financial penalties. We regard a gradual peer pressure mechanism as appropriate in a context where excessive public debt may have adverse effects on partner countries.

Similarly, we do not propose to eliminate the central provision of Article 121 (“Member States shall regard their economic policies as a matter of common concern and shall coordinate them within the Council”) on which the preventive arm of the Stability Pact was built. Neither the spirit nor the letter of this article prejudges the nature of externalities or the desirable direction of national policies.

However, we believe it is essential to at least de facto (and in time de jure) remove the uniform numerical thresholds for the debt (60% of GDP) and the deficit (3% of GDP) indicated in the Protocol 12 annexed to the TFEU. The debt threshold sets a target that is too far removed from reality and lacks analytical foundations.

Uniform numerical criteria are misplaced because debt sustainability depends fundamentally on the differential between the interest rate and the growth rate and on a state’s capacity to maintain a sufficient primary surplus. These determinants of debt sustainability are all very much country-specific.

We therefore propose that each government sets a medium-term debt target, the appropriateness of which would be first assessed by the domestic independent fiscal institution (IFI) on the basis of a common methodology, monitored by the EFB, and second endorsed (or rejected) by the EU. This target should be explicitly based on estimates of the maximum primary balance and the risks to the interest rate–growth rate differential.

Once debt targets have been set, they should serve as anchors for expenditure rules. The path for primary nominal expenditure net of new discretionary tax measures (and excluding automatic stabilisers on the expenditure side) would be determined accordingly.

Our proposal would change the hierarchy of objectives. So far, the deficit criterion has in most cases been given priority over the debt criterion. We would instead give priority to a country-specific debt target and de-emphasise the primacy of the deficit criterion.

Legally speaking, the reference value for public debt mentioned in Article 126 would need to be interpreted as country-specific rather than uniform. Ultimately, this would require amending Protocol 12, which can be done by unanimous agreement.

We do not favour introducing a golden rule that would treat investment expenditures differently from other public expenditures, as the distinction between investment expenditures and other growth-enhancing expenditures would raise endless discussions. Nevertheless, it will be the role of the IFIs and of the EU to take into account the impact on potential output of public investment in a broad sense. The assessment of public finance sustainability should also consider the time profile of climate investments in order to ensure they are not postponed.

Space for discretionary policy

Because discretionary fiscal policy has an important role to play in a regime of low interest rates and as long as the sustainability objective is not at risk, the fiscal framework should leave room for active demand management. A possibility would be to apply a common flexibility factor to national expenditure rules. However, this would not prevent member states from running excessively tight fiscal policies in a slump.

The Recovery and Resilience Facility (RRF), introduced in 2021 to respond to the pandemic shock, could serve as a template for a new European fiscal instrument. It would not be a budget, and the stabilisation of business cycles would continue to rely on monetary policy and on the member states’ fiscal policies. Nevertheless, the experience with the RRF could serve as a basis for taking joint fiscal initiatives in response to crises leading to prolonged demand shortfalls or to a structural lack in public investment. This could take the form of a European instrument to finance specific public investment programmes by means of mutualised debt.

A new institutional framework

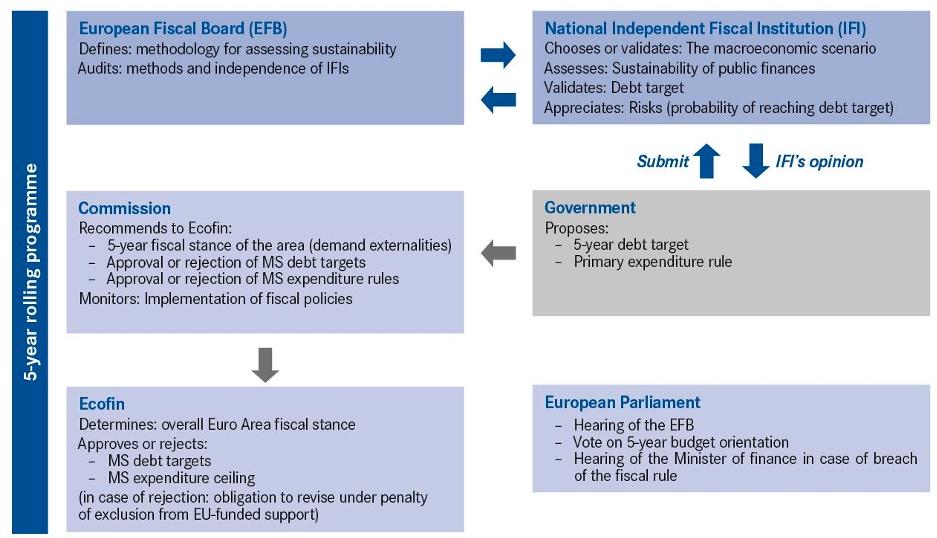

We propose a redefinition of responsibilities of both the IFIs and of the European Fiscal Board (EFB). We recommend strengthening the resources, independence and surveillance capacities of the national IFIs, in order to further anchor the culture of fiscal responsibility in domestic institutions. We propose that:

- the EFB defines a common methodology to assess national fiscal sustainability, and controls its implementation by the IFIs;

- each government sets a debt target and expenditure rule over a five-year horizon;

- the IFI assesses whether the government's debt target is compatible with the EU sustainability standards, and its detailed assessment is made public;

- the Commission recommends to the Council whether or not to endorse the national debt target and expenditure rule;

- the Council (in euro format) endorses or rejects the member state’s fiscal targets; and

- the Commission monitors the implementation of the country-specific fiscal rule.

A detailed map of the institutional geography is given in Figure 1.

Figure 1

Enforcement

To remain effective, a more adaptable oversight system must rely on credible sanctions for violation of the sustainability requirement. On top of the approval of the debt target and the expenditure rule by the Council, we propose the excessive deficit procedure be triggered by a manifest violation of the country-specific expenditure rule. Moreover, if the Commission assesses that the budget for the following year risks materially violating the expenditure rule, it should refer it to the Eurogroup, which would make its opinion public. Finally, an adjustment account should be introduced that would keep the memory of past spending slippages (or past under-spending) and contain or permit future spending overruns. On top of being legally powerful, analyses and pronouncements by the IFIs, the Commission and the Council will carry weight because these informed judgements on potential risks to debt sustainability would have financial consequences through impacting borrowing costs.

For the management of demand externalities, we propose that the Commission make a recommendation to the Council on the overall fiscal stance of the euro area, both at a one-year and five-year horizon, and that it recommend the reorientation of a fiscal policy (be it too restrictive or too expansionary) of a member state that would aggravate current account imbalances within the zone. The Commission should also be entrusted with the responsibility of proposing the activation of exceptional support through the to-be-constructed common fiscal instrument.

Conclusion

The reforms we propose are substantial but compatible with the essential provisions of the European Treaties. They aim to avoid policies that would endanger the stability of the euro area, whether through excessive debt or lack of fiscal support. We believe that the European economic policy system must learn all the lessons of the new economic and financial environment. The reforms of the fiscal framework that we are proposing aim to make states both more autonomous in their fiscal choices, and more responsible.

References

Bénassy-Quéré A, M Brunnermeier, H Enderlein, E Farhi, C Fuest, P O Gourinchas, P Martin, J Pisani-Ferry, H Rey, I Schnabel and N Véron (2018), "Reconciling Risk Sharing with Market Discipline: A Constructive Approach to Euro Area Reform", CEPR Policy Insight No. 91.

Blanchard O J, Á Leandro and J Zettelmeyer (2021): "Redesigning EU Fiscal Rules: From Rules to Standards", PIIE Working Paper No. 21/1.

Darvas Z, P Martin and X Ragot (2018): "Reforming European Budgetary Rules: Simplification, Stabilization and Sustainability", Notes du CAE, no 47, September

Draghi, M (2014), “Unemployment in the Euro Area”, speech at the Annual Central Bank Symposium in Jackson Hole, 22 August.

Farhi, E and P Martin (2018), “The role of the ECB in the reform proposals in CEPR Policy Insight 91”, VoxEU.org, 19 April.

Feld, L, C Schmidt, I Schnabel and V Wieland (2018), "Refocusing the European Fiscal Framework", VoxEU.org, 12 September.

Martin, P, J Pisani-Ferry and X Ragot (2021), "Reforming the European Fiscal Framework", Les notes du conseil d’analyse économique, no 63.

Schnabel, I (2021), “Unconventional Fiscal and Monetary Policy at the Zero Lower Bound”, Speech at the Third Annual Conference organised by the European Fiscal Board.

Thygesen, N, R Beetsma, M Bordignon, S Duchêne and M Szczurek (2018), Second Annual Report of the European Fiscal Board, European Budget Committee.