In response to population ageing, a growing number of industrialised countries are shifting from pay-as-you-go pension schemes towards funded pension arrangements (Boulhol and Geppert 2018). This transition often relies on the introduction of pension funds that invest individual savings in financial assets, including domestic equity. As a result, pension funds are becoming key investors, often acquiring large stakes in both listed and non-listed firms (Boeri and Bovenberg 2007).

Given their rising importance, funded pensions have attracted the attention of policymakers and researchers alike. For example, the G20 has identified pension funds as a key source of long-term capital to finance growth and development. The availability of long-term capital is especially relevant in a context where there is a high demand for large investments in digitalisation and the transition from fossil energy towards clean energy. Pension funds, together with other long-term financiers such as insurance companies, can play a substantial role in supporting individual firms in the adoption of expensive technologies that make them more productive and sustainable. In theory, the size of pension funds and their long-term liabilities should make them a good match for large, long-term projects.

Against this backdrop, a natural question that arises is whether and how pension funds affect the companies they invest in, and consequently how pension funds contribute to national output. The existing literature has, to date, focused mostly on the relationship between the amount of pension savings in an economy and domestic GDP growth or capital market development, largely disregarding how these savings are invested. These studies have provided mixed conclusions about the effect of pension funding on economic growth (Altiparmakov and Nedeljkovic 2018, Bijlsma et al. 2018). Furthermore, the growing literature on the effects of ownership composition on corporate outcomes has not yet explicitly investigated the role of pension funds and has mainly focused on samples of publicly listed companies.

Pension fund investments and firms’ productivity

In a recent paper (Beetsma et al. 2022), we try to fill this gap in the literature by providing empirical evidence on the effects of domestic pension funds' equity investments on firms’ productivity with high-quality data for Denmark, which offer three main advantages. First, they are based on a large and comprehensive sample of firms drawn from administrative records. Second, they cover detailed information on the ownership relationships between all limited liability companies in Denmark, which allows us to include both publicly listed and unlisted companies. Third, they carefully identify domestic pension funds' equity investments by Danish pension funds in Danish firms, and therefore are a rare source of pension fund investment data at the firm level.

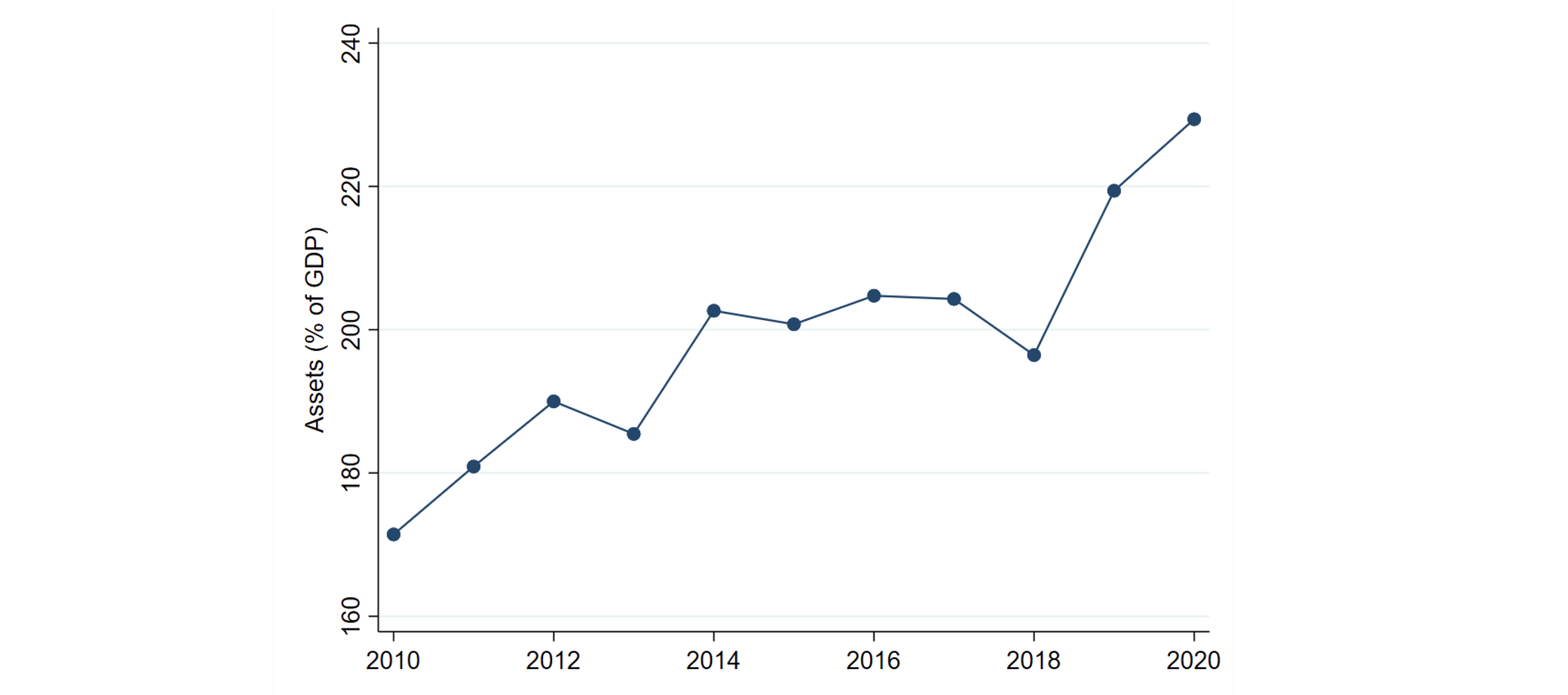

Denmark is a fitting setting for this type of analysis for two main reasons. First, the unique features of the Danish data allow us to link pension funds' investments to both listed and unlisted firms' characteristics. Second, Danish pension funds play an important role in the domestic economy. At the end of 2020, assets in retirement savings plans in Denmark were the largest as a share of GDP among the OECD countries, standing at almost 230% (OECD 2021) – see Figure 1.

Figure 1 Total assets in retirement savings plans in Denmark (% of GDP)

Source: OECD (2021).

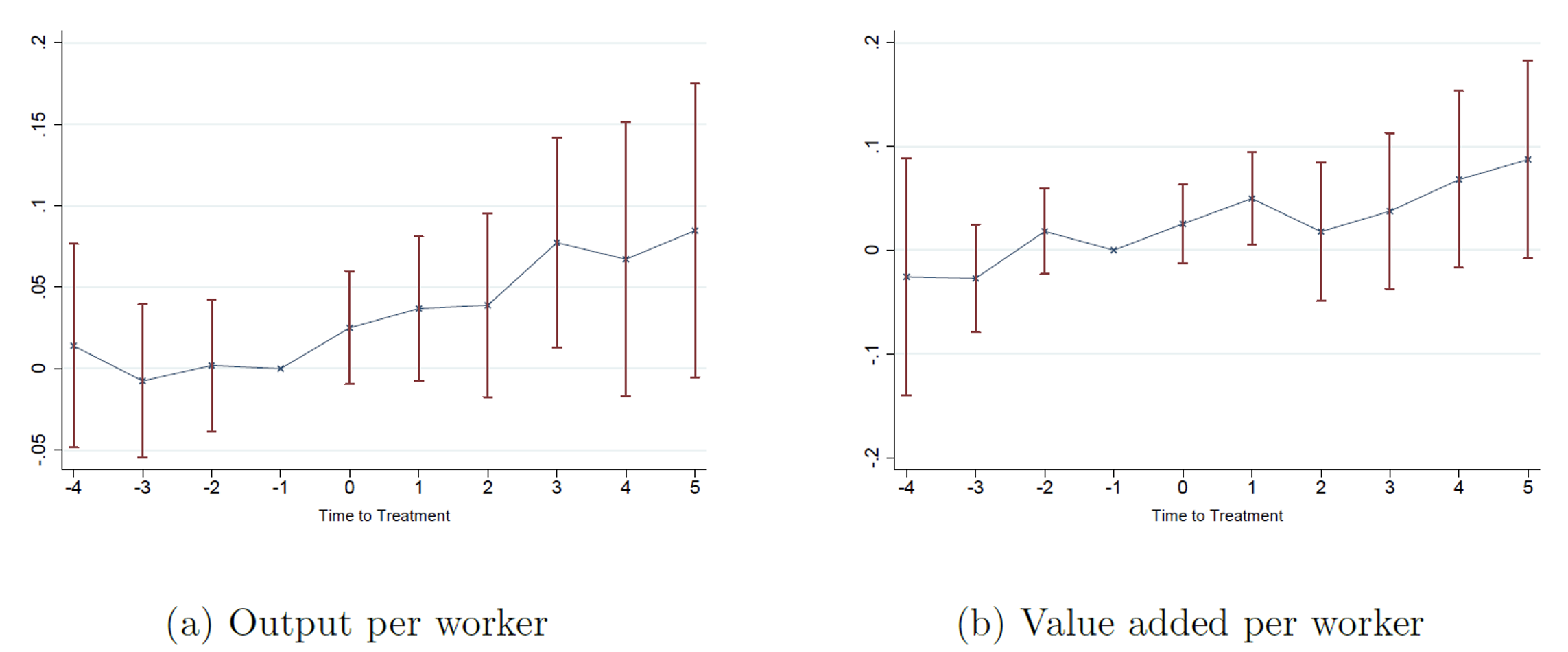

A major challenge in investigating the effect of investors on the firms that they invest in is that investors may carefully select the latter. We deal with this selection issue in two ways. First, we show in Figure 2 that companies that receive a pension fund's investment have almost the same development in productivity up to the investment event as otherwise similar firms. The same event study analysis reports a positive relationship between a pension fund's investment and firms’ output and value-added per worker in the period after the investment event. We argue that this positive trend is consistent with a whole host of benefits that pension funds may bring to the table, such as an improvement in corporate governance, an increase in capital availability, long-term financing commitment, and a reduction in the cost of external financing.

Figure 2 Pension fund investments and firms’ productivity

Notes: These figures present point estimates and 90% confidence intervals of an event study specification using the estimator proposed by de Chaisemartin and D'Haultfoeuille (2020).

Second, we estimate the impact of a pension fund investment with an econometric approach that allows us to control for past productivity and therefore selection (Bøler et al. 2015, De Loecker 2013, and Doraszelski and Jaumandreu 2013). Similarly to the event study, we find that a pension fund investment positively affects firm productivity. Specifically, receiving a pension fund investment in the previous year is associated with an increase in a firms’ productivity ranging from 3.5% to 4.9%, depending on the econometric specification. Furthermore, the concern that the estimated effects are merely driven by selection is also dismissed by our refinement analyses. For example, we find suggestive evidence that investments of longer duration tend to provide larger benefits in terms of productivity. This result is consistent with the hypothesis that pension funds offer a stable and long-term financing commitment that allows firms to invest in projects that are less liquid but yield a higher long-term return. Indeed, other studies have shown that pension funds tend to commit their investments for longer periods than other investors (Artiga Gonzalez et al. 2020, Cremers and Pareek 2016). Our findings resonate with previous evidence that the investors' time horizon matters for corporate outcomes, such as the quality of corporate governance (Garel 2017).

Pension fund investments and firms’ innovation

The fact that pension funds tend to provide beneficial effects to companies is also confirmed by additional analyses, in which we include firms’ patenting activities as outcomes (Pinkus et al. 2022). Specifically, pension funds might theoretically help firms to become more innovative in two ways. First, compared to other institutional investors, which typically move rapidly in and out of companies' stocks depending on earnings and other short-term factors, pension funds have a tendency to stay committed in a firm for the long-term and therefore provide the type of finance required to support innovative projects. Second, by concentrating ownership, pension funds represent an effective instrument to stem managers' propensity to support inefficient and short-sighted strategies.

Our empirical analysis reveals that firms where pension funds invest experience on average a two percentage points increase in the probability of having at least one patent application and a 15% increase in the quality-adjusted number of patent applications, after controlling for a large and extensive set of confounding factors. Interestingly, pension funds' investments are also shown to be correlated with firms' innovation in green technologies: firms where pension funds invest experience on average a 1.2 percentage point increase in the probability of having at least one green patent application. This last result suggests that pension funds could be a formidable force in getting companies to embrace environmental, social, and governance values such as combating climate change.

Conclusions and policy implications

Over the last two decades, funded pension savings have increased significantly across the globe, and countries with high levels of pension savings relative to GDP typically top the international ranking of pension systems. Denmark has one of the best-rated pension systems in the world and at the same time has the highest pension assets to GDP ratio among OECD countries (OECD 2021). However, while pension funds are potential financiers of firms, it has been so far unclear whether and to what extent pension fund investments affect firms' performance. In this column, we highlight several possible channels for a positive effect of a pension fund investment on firms' productivity and innovation. By channelling savings toward firms, pension funds can raise the supply of capital, thereby reducing its cost and hence stimulating investment by firms. Additionally, pension funds are long-term investors, which could give firms the assurance they need when undertaking innovative projects and investments that raise productivity in the long run rather than focusing on short-term gains.

Policies aimed at increasing pension savings and investment can have the unintended, but beneficial, consequence of supporting domestic productivity and innovation. Such policies could rely on tax incentives by, for example, allowing pension contributions to be deducted from taxable income or raising the limit on the maximum deduction. Another measure could consist of making the tax rate on capital gain a declining function of the length of the holding period of equities. Our findings may also have consequences for the supervision of institutional investors, particularly pension funds. Typically, supervision focuses on the protection of savings held by individual institutions. However, an ‘excessive’ quest for safety at the level of individual institutions may have adverse macroeconomic implications, as it could result in an undersupply of funds to invest in risky projects with a high expected return. Such an approach could thus undermine available long-term financing for firms and the real economy more broadly. Further, our finding that the productivity-enhancing effect of pension fund investment is larger for unlisted than for listed firms would argue in favour of supporting more pension fund investment into unlisted assets. Obviously, it is important that regulation strikes a careful balance between the risks for pension savers and the macroeconomic benefits of more pension investment in firms.

References

Altiparmakov, N and M Nedeljkovic (2018), “Does pension privatization increase economic growth? Evidence from Latin America and Eastern Europe”, Journal of Pension Economics and Finance 17(1): 46–84.

Artiga Gonzalez, T, I van Lelyveld and K Lucivjanska (2020), “Pension fund equity performance: Patience, activity or both?”, Journal of Banking & Finance 115.

Beetsma, R, S E Hougaard Jensen, D Pinkus and D Pozzoli (2022), “Do Pension Fund Investments Make a Difference? Effects on Firm Productivity”, Mimeo, Copenhagen Business School and University of Amsterdam.

Bijlsma, M, J Bonekamp, C van Ewijk and F Haaijen (2018), “Funded Pensions and Economic Growth”, De Economist 166(3): 337–362.

Boeri, T and L Bovenberg (2007), “Pension Funds as Investors”, VoxEU.org, 16 May.

Boulhol, H and C Geppert (2018), “Population ageing: Pension policies alone will not prevent the decline in the relative size of the labour force”, VoxEU.org, 4 June.

Bøler, E A, A Moxnes and K H Ulltveit-Moe (2015), “R&D, international sourcing, and the joint impact on firm performance”, American Economic Review 105(12): 3704-3739.

Cremers, M and A Pareek (2016), “Patient capital outperformance: The investment skill of high active share managers who trade infrequently”, Journal of Financial Economics 122(2): 288-306.

de Chaisemartin, C and X D'Haultfoeuille (2020), “Difference-in-Differences Estimators of Intertemporal Treatment Effects”, SSRN Electronic Journal.

De Loecker, J (2013), “Detecting Learning by Exporting”, American Economic Journal: Microeconomics 5(3): 1-21.

Doraszelski, U and J Jaumandreu (2013), “R&D and Productivity: Estimating Endogenous Productivity”, The Review of Economic Studies 80(4): 1338-1383.

Garel, A (2017), “When Ownership Structure Matters: a Review of the Effects of Investor Horizon on Corporate Policies”, Journal of Economic Surveys 31(4): 1062-1094.

OECD (2021), Pension Markets in Focus 2021, Technical Report.

Pinkus, D, D Pozzoli and C Schneider (2022), “Pension Fund Investments and Firms’ Innovation”, Mimeo, Copenhagen Business School.