In the aftermath of the global financial crisis, and in light of rising inequality in many countries of the world, concerns about top earners and super-rich individuals relocating for tax reasons have grown. Many countries are worried about losing significant fractions of their tax base to low tax regions, and tax havens have come under scrutiny.

Over the past years, economic research has made important contributions, showing that top earners indeed relocate across borders for tax reasons. This has been found to be the case in particular for professionals facing a global labour market like football players (Kleven et al. 2011, 2013), star scientists (Akcigit et al. 2015, 2016), or internationally mobile high-skilled professionals (Kleven et al. 2013, 2014).

But tax havens are not only a phenomenon in the international landscape; they often also exist within countries that have a fiscally decentralised structure. And as relocating within a country is typically less costly than moving across national borders, top earners tend to be even more sensitive to tax differences, as for example Moretti and Wilson (2017, 2022) show for the US, or Schmidheiny and Slotwinski (2018) for Switzerland (see Kleven et al. 2019 for a summary of the literature).

Yet while ample evidence exists that lowering taxes is an effective means to attract top earners, it is not always clear how and whether this pays off for the jurisdictions that lower their tax rates.

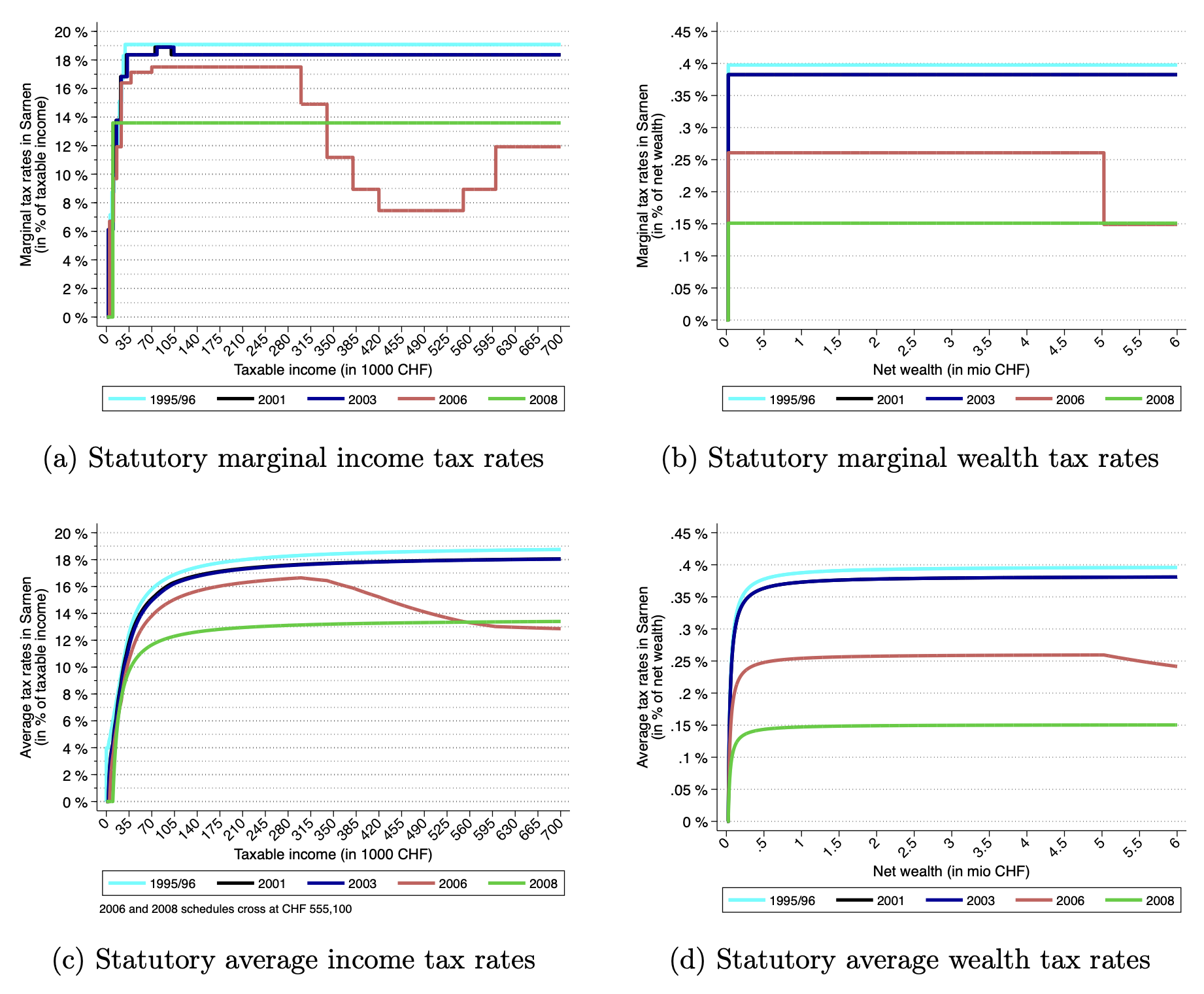

In recent work (Martínez 2022), I study a tax cut by the small Swiss canton of Obwalden, located in central Switzerland. The goal explicitly was to attract high-income taxpayers, and this was to be achieved through the introduction of a regressive income and wealth tax schedule. In 2006, Obwalden changed its tax code and introduced falling marginal tax rates for incomes beyond 300,000 Swiss francs (CHF). This corresponded roughly to the income threshold of the top 1% of Swiss taxpayers. The introduction of the regressive scheme implied that for a single taxpayer with taxable income of 500,000 CHF (approx. 512,000 CHF gross income), the statutory average cantonal income tax rate fell from 17.9% to 14% after the reform. For an otherwise identical taxpayer with taxable income of 300,000 CHF (approx. 312,000 CHF gross income), the average tax rate in contrast only fell from 17.6% to 16.6%, as illustrated in Figure 1. (Note that the total tax load would further include the federal income tax, which, however, is uniform across the canton and does not affect moving decisions.) Due to its regressive nature, the reform was repelled by the Federal Court. In response to the court ruling, in 2008 the canton introduced a flat rate tax, which lowered the tax load for top earners even further.

Figure 1 Statutory income and wealth tax rates after different cantonal tax reforms

Since in Switzerland income and taxation is residence based, it was sufficient for taxpayers to move to Obwalden to take advantage of the low tax rates. Furthermore, the Swiss tax system does not distinguish between income from labour or capital. As I shown in the paper, this reform therefore introduced a sharp, sizable, and very salient decrease in marginal and average tax rates. I therefore exploit variation over time, across cantons, and across different groups of taxpayers to identify the pull effect of this pro-rich tax policy in Obwalden.

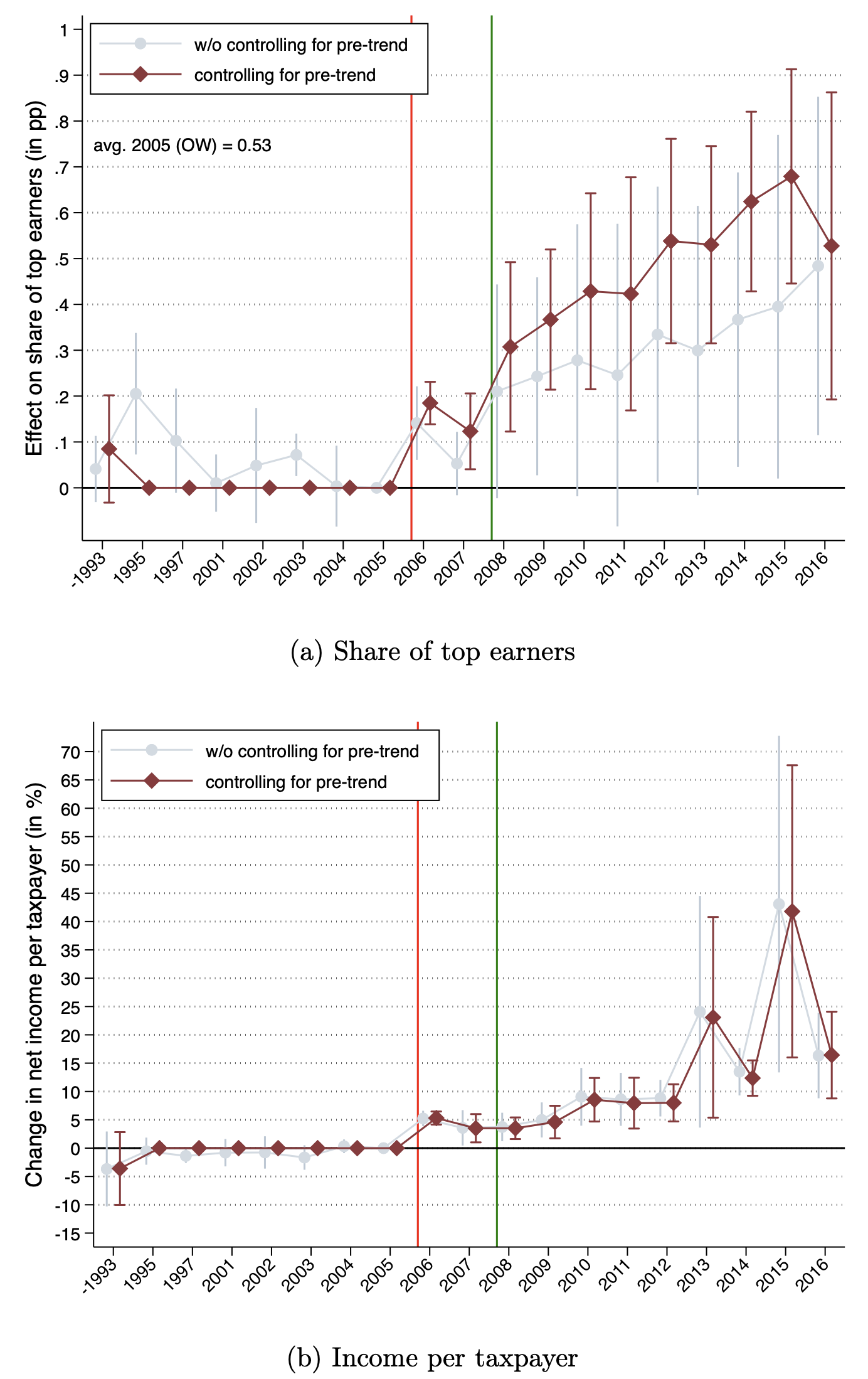

Using federal income tax data, I first analyse (i) the population share of high-income taxpayers living in a canton, and (ii) net income per taxpayer in Obwalden in comparison to other cantons in a difference-in-differences setting. Results from the corresponding event studies (shown in Figure 2) indicate that the reform had the intended effect: by 2016, the share of high-income taxpayers in Obwalden had grown by 0.53 percentage points relative to other cantons. This is an increase of 100% compared to Obwalden’s initial share of top earners. Net income per taxpayer had risen by 17%.

Figure 2 Event study estimates of the effect on Obwalden’s tax base

To obtain a comparable measure of the effects of tax rate changes, economists typically compute the elasticity with respect to the net-of-average-tax rate (i.e., one minus the average tax rate). This rate indicates the percentage of pay that a taxpayer takes home after paying taxes.

I find a large elasticity of in-migration in the five years after the reform. A 1% increase in the net-of-average-tax rate increased the inflow of top earners by up to 7.2%. These moving responses were immediate and flattened out somewhat over time. The more precisely identified elasticity of the stock of high-income taxpayers living in the canton (which also accounts for residents who stayed but would otherwise have moved elsewhere), lies in the range of 1.5–2. In that respect, the reform was a success.

The critical reader may be sceptical about such large behavioural responses to taxation. However, these elasticities must be understood within the institutional context (Kleven et al. 2019). Four factors help to explain the large responses:

1. Elasticities are larger in settings without restrictions with respect to profession, income source, nationality, or origin to take advantage of lower taxes in another jurisdiction. In this regard, Switzerland comes close to a Tiebout (1956) model world, where people vote with their feet.

2. The highly debated tax changes were large and salient, making it more likely that people actually considered moving for tax reasons.

3. Switzerland is a small country at the heart of Europe. Moving distances and hence the costs of moving are low.

4. The canton of Obwalden started out from a situation with very few top earners moving to or living in the canton. The relative changes were therefore large for such a small jurisdiction. This is also why theory, in fact, predicts that small jurisdictions will on average benefit from engaging in tax competition while large jurisdictions will lose.

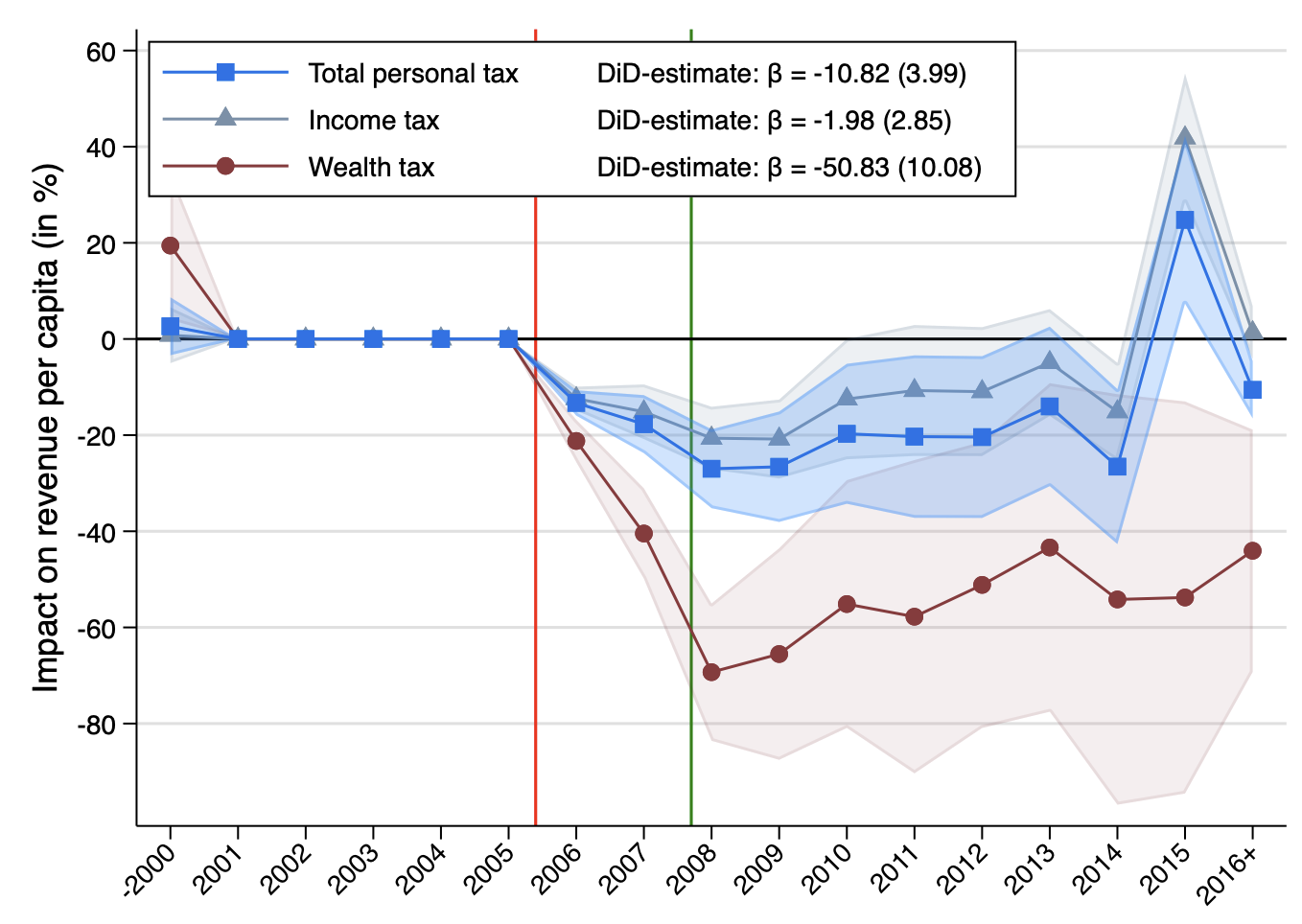

But besides having more high-income earners living in the canton, how much did Obwalden really gain? Event study estimates comparing the cantonal tax revenue in Obwalden with the revenue in other cantons (Figure 3) show that the reform did not increase revenue. (This is even despite the fact that the other cantons serving as a control group in this quasi-experimental setting were slightly negatively treated, since Obwalden attracted taxpayers from them thanks to its aggressive tax strategy.) True, Obwalden’s total tax revenue rose over time, but personal tax revenue in other cantons rose even more in comparison.1 This is therefore also a tale about what the right counterfactual is when evaluating a policy. In a similar vein, Agrawal and Foremny (2019) find that while tax differentials in Spain did lead to migratory responses, they were not enough to compensate the mechanical revenue losses that arise from lowering the tax rates.

Figure 3 Difference-in-difference estimates of cantonal tax revenue

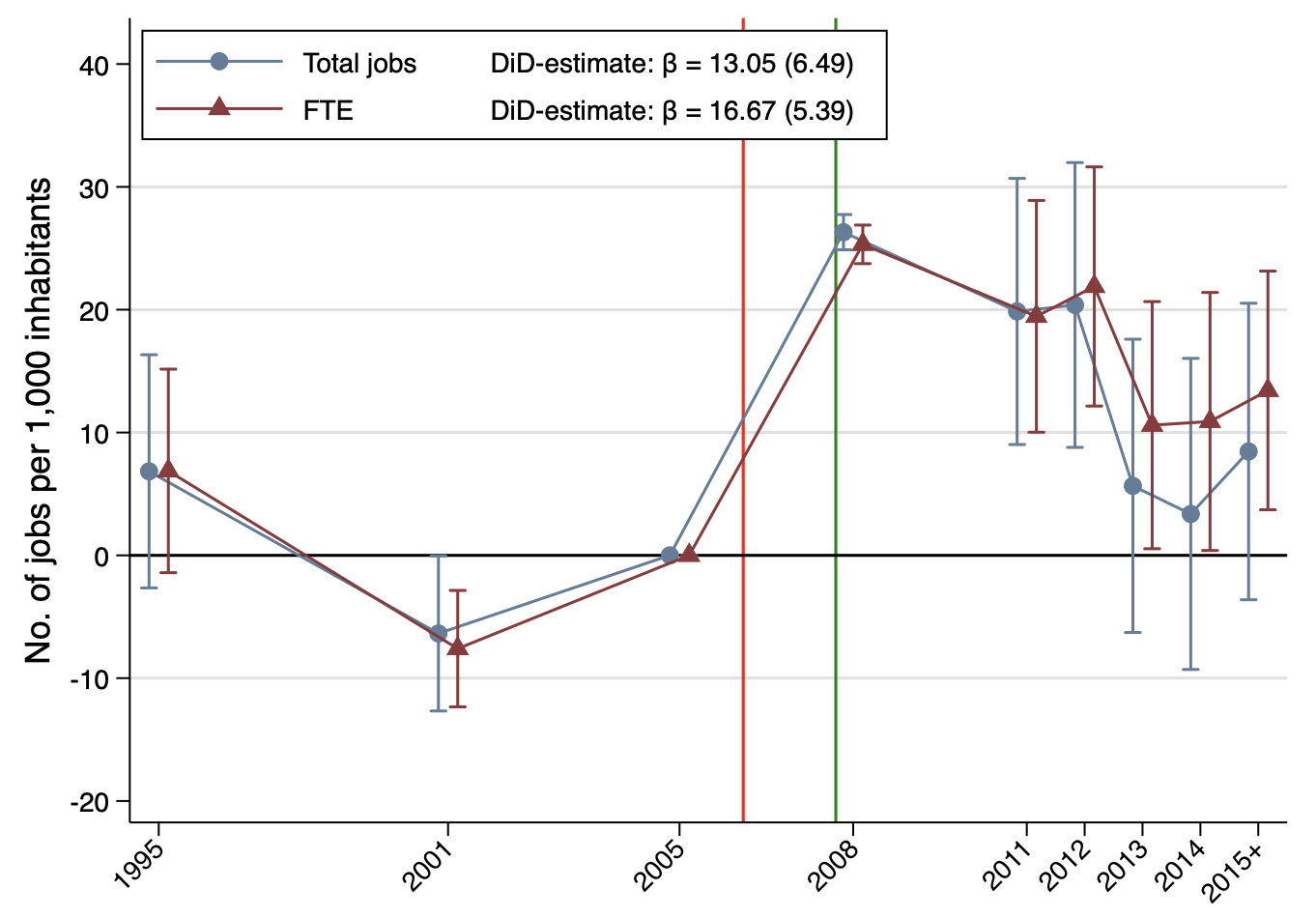

Where does this leave us? Attracting high-skilled top earners might have positive spillovers to the local economy. But this is the case when tax policy is targeted and combined with industry policies. Moretti and Wilson (2017) find that lower top marginal tax rates attract star scientists to US states – in combination with attractive corporate income taxes and investment tax credits, which are especially relevant for industries with high R&D expenses. In the case of Obwalden, I find that local employment increased: between 2005 and 2008, the number of full-time equivalent (FTE) jobs rose by 11%, compared to a 4.3% increase in all Switzerland over the same period. This is even more remarkable as the total number of FTE jobs had been constant in Obwalden between 1995 and 2005. Difference-in-difference estimates imply an increase in the number of jobs per capita of 2.3%, and of 4% for the number of FTE jobs per capita. The corresponding event studies are shown in Figure 4. However, these increases may not be solely due to the personal income tax reform: in 2006, Obwalden also substantially reduced its corporate tax rates to a uniform rate of 6.6%, the lowest in the country at the time. It is unfortunately not possible to disentangle the effects of the two reforms. Yet again, this suggests that lowering personal income tax rates alone may not be sufficient to take home substantial gains from the tax competition game.

Figure 4 Event study of total jobs and full-time equivalent jobs per capita in Obwalden

References

Agrawal, D R and D Foremny (2019), “Relocation of the Rich: Migration in Response to Top Tax Rate Changes from Spanish Reforms”, Review of Economics and Statistics 101(2): 214-232.

Akcigit, U, S Baslandze and S Stantcheva (2015), “The effects of top tax rates on superstar inventors”, VoxEU.org, 26 April.

Akcigit, U, S Baslandze and S Stantcheva (2016), “Taxation and the international mobility of inventors”, American Economic Review 106(10): 2930-2981.

Kleven, H, C Landais, M Munoz and S Stantcheva (2019), “Taxation and migration: Evidence and policy implications”, Journal of Economic Perspectives 34(2): 119-142.

Kleven, H J, C Landais and E Saez (2011), “Taxation and international migration of superstars: Evidence from the European football market”, VoxEU.org, 6 January.

Kleven, H J, C Landais and E Saez (2013), “Taxation and international migration of superstars: Evidence from the european football market”, American Economic Review 103(5): 1892-1924.

Kleven, H J, C Landais, E Saez and E A Schultz (2013), “Migration and wage effects of taxing top earners: Evidence from the foreigners' tax scheme in Denmark”, VoxEU.org, 17 September.

Kleven, H J, C Landais, E Saez and E A Schultz (2014), “Migration and wage effects of taxing top earners: evidence from the foreigner tax scheme in Denmark”, Quarterly Journal of Economics 129(1): 333-378.

Martínez, I Z (2022), “Mobility responses to the establishment of a residential tax haven: Evidence from Switzerland”, Journal of Urban Economics 129(103441).

Moretti, E and D J Wilson (2017), “The effect of state taxes on the geographical location of top earners: Evidence from star scientists”, American Economic Review 107(7): 1858-1903.

Moretti, E and D J Wilson (2022), “Taxing billionaires: Estate taxes and the geographical location of the ultra-wealthy”, American Economic Journal: Economic Policy, forthcoming.

Schmidheiny, K and M Slotwinski (2018), “Tax-induced mobility: Evidence from a foreigners’ tax scheme in Switzerland”, Journal of Public Economics 167: 293-324

Tiebout, C M (1956), “A pure theory of local expenditures”, Journal of Political Economy 64(5): 416-424.

Endnotes

1 To make things worse, over time Obwalden further lost revenue from the national fiscal equalisation scheme, which redistributes revenue from rich cantons with a large tax base to poor cantons with a small tax base in per capita terms. Thanks to its success in increasing its tax base, Obwalden has moved from a net beneficiary to a net contributor to the equalisation scheme.