The unprecedented period of work from home experimentation during the pandemic led many workers and firms to invest in remote work skills, establishing an employment practice that is expected to last far beyond the pandemic (Bartik et al. 2020, Barrero et al. 2021). The implications of this shift to remote work for commercial office space – the site of former office jobs – remain a matter of considerable debate.

If workers are set to come back to the office – whether fully in-person or in a hybrid system with sufficient in-person requirements – then firms may not cut back very much on office space. By contrast, if fully remote or hybrid and sufficiently flexible work arrangements enable firms to change their office demand, the implications for property owners and urban governments, which are heavily reliant on commercial office space for tax revenue, may be substantially greater.

In Gupta et al. (2022), we seek to quantify the impact of remote work trends on the valuation of commercial office buildings. This is a challenging problem given the illiquidity and opacity of the commercial real estate asset class. We make progress by combining comprehensive leasing data with a novel asset pricing model, and find striking implications for current and future office real estate values.

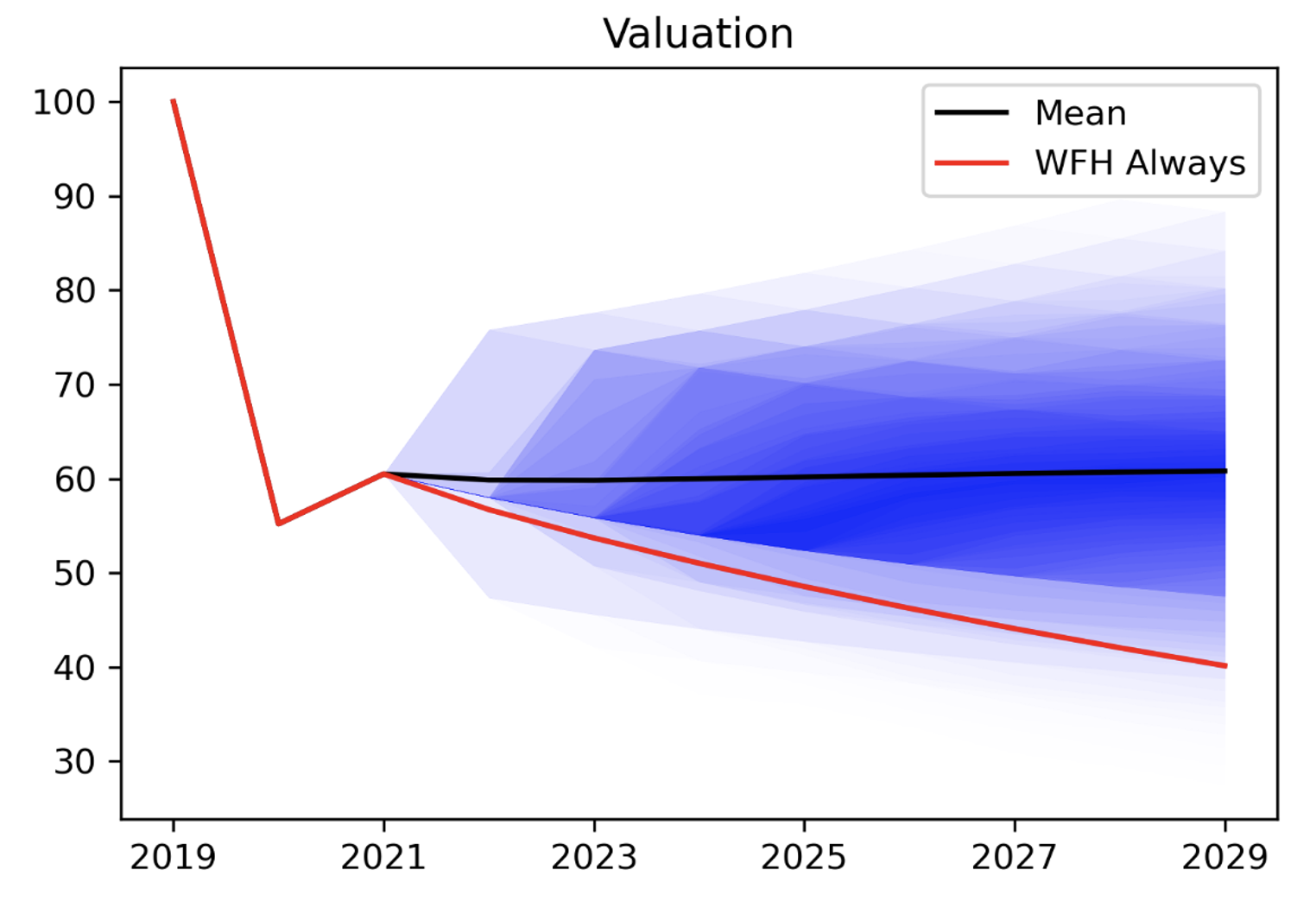

We estimate that commercial office buildings at the end of 2029 will be worth about 40% less than their value in 2019. This value decrease reflects a slight increase over their value in 2020, in the depths of the pandemic, when work from home (WFH) practices combined with a recession to generate the perfect storm for office buildings. Looking forward, we anticipate that WFH practices will generate a persistent drag on office values well into the future. Equal in importance to the baseline estimate we quantify is the uncertainty around this baseline value, which reflects the fundamental uncertainty around back-to-office plans.

To demonstrate this large shock, we first document changes in office leasing activity over the pandemic using CompStak data, a proptech data provider that offers substantial coverage of office leases across 105 markets in the US.

Office leasing quantities have fallen substantially, from 253 million square feet of new leases signed annually in 2019, to just 59 million in May 2022. Since more long-term leases expired than new leases were signed, office vacancy rates have risen, often to multi-decade highs. Rents on newly signed leases declined substantially in real terms across the country at the onset of the pandemic and remain depressed in cities like New York. Total leasing revenue on all in-force leases has fallen by 17.5% in real terms nationwide. Many tenants signed long-term lease commitments before the pandemic, while others signed short-term leases during the pandemic. The large share of tenants that has yet to make active lease renewal decisions will create substantial uncertainty around office demand for years to come.

We also find evidence for a flight-to-quality effect: the youngest buildings, and those with the highest rent levels, appear to have held up better than lower class office spaces (class B or C office space). New leasing volume fell by a smaller amount for higher quality buildings, and rents for the youngest buildings even increased between the end of 2019 and mid-2022. Deep-pocketed employers may be trying to lure employees back to the office by offering higher quality office space.

These shifts in office demand can be associated with remote working practices. Firms that have announced fully remote or even hybrid working plans have cut back on office space by more than firms that are expecting to be back fully in person.

To calibrate the impact of these shifts in office demand on valuation requires us to carefully account for shifting cash flow and risk profiles. We construct a novel asset pricing model for commercial offices, in which we value buildings as portfolios of leases. Lease renewal probabilities, the growth rate of market rents, and the growth rate of new office supply all depend on the state of the economy. The latter can take on four values in our model: non-WFH expansion, non-WFH recession, WFH expansion, and WFH recession. Prior to 2020, the economy was in the non-WFH state; in 2020, it transitions to mass adoption of remote work.

A key parameter in the model is the persistence of the WFH state. We pin down this parameter by matching the observed return of commercial office REITs in 2020. Since prices are forward-looking, the more commercial REIT prices fall, the more persistent is the market’s expectation of remote work. The REIT data imply an annual persistence parameter of 0.82. This implies a 20% probability that the economy will remain in the WFH state until 2029.

Combining cash flows across states and state transition probabilities gives us estimates of future cash flows on commercial office buildings. To convert these cash flows into valuations, we also need a discount rate. A first component of our stochastic discount factor model is standard, and matches risk-free interest rates and the equity risk premium across expansions and recessions (Melino and Yang 2003). A second component is novel, and captures how investors discount a future $1 payoff in the WFH state versus in the non-WFH state. To measure that component, we match the return on an equity portfolio which goes long on stocks that benefit from remote work (like Zoom) and short on stocks that do better when activities are in-person (like Carnival Cruises). Office REITs have a negative exposure to this novel risk factor.

We calibrate the model to New York City, the country’s largest office market, making use of the CompStak leasing data and matching the observed vacancy rate, which rises to 21.5% in 2022.Q2. Combining cash flows and discount rates delivers our headline estimates – a 45% decline in office values in 2020, followed by a minor rebound in 2021 as the economy exits the recession state. Simulating many future paths, we find a 39% average decline in NYC office value in 2029 relative to 2019 values (black line in Figure 1). There is considerable uncertainty around this average path, as indicated by the blue shaded areas in the graph. On sample paths where workers go back to the office, there is a recovery in office values. The decline is much larger than average on sample paths where the economy remains in the WFH state (such as the red line in the graph, wherein the economy remains in the WFH state until at least 2029).

Figure 1

Using a separate cash-flow calibration for A+ buildings in NYC, we obtain shocks to valuations of around 20%, half as much as for the stock of all buildings. Aggregating our estimates to the nation, we find that the value of office stock has lost about $450 billion in value.

These results have large implications for market participants and policymakers. Perhaps most directly, they suggest that office real estate – especially low-quality office real estate – is at risk of becoming a ‘stranded asset’ in the wake of the disruptions from remote working practices. The rising cost of protection against commercial office debt default suggests possible long run implications for financial stability. Conversion of offices into other uses, like multifamily apartments, is a possibility for some buildings, but remains a logistical and regulatory challenge. While we focus on the US, remote work is likely to reshape markets in many other countries as well (Bergeaud et al. 2022, Aksoy et al. 2022).

Our results also have implications for urban governments, which rely heavily on property and rent tax revenue on commercial buildings directly, as well as indirectly via consumption taxes and transit revenue earned from commuters. While cities can respond to these shortfalls by raising other taxes or cutting spending on public goods, such responses may discourage residents from staying in the city. This dynamic raises concerns of an ‘urban doom loop’ of the kind that affected cities like Detroit in the wake of deindustrialisation, or New York City in the 1970s and 80s.

Commercial office space is ground zero for the impact of remote work, and its future needs to be observed carefully.

References

Aksoy, C, J Barrero, N Bloom, S Davis, M Dolls and P Zarate (2022), “Working from home around the world”, VoxEU.org, 17 January.

Barrero, J, N Bloom and S Davis (2020), “COVID-19 and labour reallocation: Evidence from the US”, VoxEU.org, 8 October.

Bartik, A, Z Cullen, E Glaeser, M Luca and C Stanton (2020), “How the COVID-19 crisis is reshaping remote working”, VoxEU.org, 19 July.

Bergeaud, A, J Eymeoud, T Garcia and D Henricot (2022), “Working from home and corporate real estate”, VoxEU.org, 17 January.

Gupta, A, V Mittal and S Van Nieuwerburgh (2022), “Work From Home and the Office Real Estate Apocalypse”, NBER Working Paper No. w30526.

Melino A and A Yang (2003), “State-dependent preferences can explain the equity premium puzzle”, Review of Economic Dynamics 6(4), 806–830.