First posted on:

modelsandrisk.org

Two widely used indicators of financial risk (riskometers), the VIX index and the ECB’s CISS, are at a historical low. The (financial) world must be really safe. However, that doesn’t square with all the newspaper headlines screaming political uncertainty. What gives?

Perhaps the best known indicator of financial risk is the VIX index, often known as the markets’ fear index. It even has a popular thriller written about it. On 2 October 2017, the VIX was at 9.45, the fourth- lowest daily value in its 27 year history.

Another indicator, one used by European policymakers, is the ECB’s systemic stress indicator, the CISS, indicating the level of systemic stress in European financial markets. According to its last measurement, it is at 0.047, also one of the lowest values in its 20-year history.

The two measures can be seen in the following figure:

They behave quite similarly and are 71% correlated.

What is a bit surprising is that at the same time they signal very low risk, there seems to be a lot of political uncertainty. Most recent are the Catalan referendum and the German election, but more longer-term disruptions include Brexit, Trump, Ukraine, the South China Sea, Qatar and North Korea, just to name some of the most important.

We have seen the same puzzling differences between the financial market and the political system many times before. The years with the lowest stock market volatility in the US were 1962 to 1964, exactly the time we were closer to a nuclear war than ever before or since.

But this isn’t all that puzzling. Take the VIX. It is the thirty-day volatility of options on the S&P 500 index, the Q measure and hence risk aversion is low. There is plenty of cash in the system, no liquidity constraints apparent. Financial markets are at record highs. QE is still happening and won’t be unwound in the near future.

High volatility is not a measurement of high risk, it is an indication we are switching from a low risk to a high-risk environment or vice versa.

So long as one does not expect anything bad to happen over the next month, the VIX remains very low. It and the CISS measure short-term risk in the financial system, not tail risk or political risk or systemic risk.

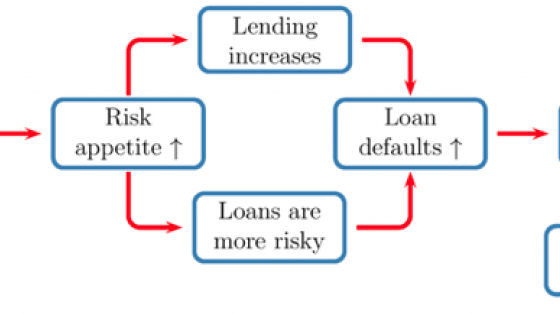

Both the VIX and CISS are riskometers and so can only capture perceived risk not actual risk, the dragons that cause crises. This is an example of endogenous risk.

Furthermore, in order to interpret VIX as volatility we must assume the normality of returns. CISS is similarly volatility, and hence normal distribution dependent. For extreme risk, fat tails matter, not volatility. Disregarding that, it's just an invitation to be eaten by the dragon.

Risk is hard to measure, and so the riskometers focus on the visible and the easily measured, what can be quantified and represented as a number. Brexit or Trump may increase systemic risk (or not), but regardless, it can’t be quantified. There is no number for systemic risk arising from political uncertainty.

So there is no puzzle. Provided we only worry about the immediate future, and then only care to measure the easily visible, our favourite risk indicators will tell us everything is fine, even if the longer term political uncertainty appears high. And maybe that’s misleading and political uncertainty is just typical.

The VIX and the CISS are indicators of short-term market risk, not tail risk and not systemic risk, even if the CISS pretends to do so. If there is a problem, it arises when using those riskometers for making decisions sensitive to tail risk or systemic risk.

Instead of using volatility as a measure of extreme risk, much better to use extreme value theoryand even better, go beyond statistics and look at the fundamentals.