In March 2023, Silicon Valley Bank (SVB), the 16th largest US bank, was forced to close and declared bankruptcy after it was unable to stem a spike in deposit outflows and obtain new funding.

About six months earlier, UK liability driven investment (LDI) funds were severely stressed after the government’s “mini-budget” was followed by sharp price movements that forced the funds to sell assets at substantial losses to obtain funding in response to margin calls (Breeden 2022). In March 2020, as Covid-19 morphed into a global pandemic, financial institutions around the world struggled to obtain liquidity and funding—with the subsequent “dash for cash” even causing stress in the US Treasury market (Ivashina and Breckenfelder 2021, Vissing-Jorgenson 2021, FSB 2020a). Each of these episodes was a stark reminder of the vulnerability of financial institutions to any shock that disrupts liquidity and access to funding.

Each of these episodes also raised questions about the impact of the extensive post-2008 regulatory reforms. Had these reforms meaningfully bolstered the resilience of the broader financial system to most shocks? Had stricter regulations on banks shifted vulnerabilities to other financial institutions in ways that created new systemic risks? Even if large banks were stronger and better capitalised, did interconnections with other financial intermediaries generate new vulnerabilities (e.g. Aramonte et al. 2022, FSB 2020a, 2020b)?

In a recent paper (Forbes et al. 2023), we use the price dynamics of credit default swaps (CDS) during March 2020 to better understand how the risks from different funding exposures have evolved after a decade of regulatory reforms. We test whether the different funding choices of banks and corporates – including the source, instrument, currency, and geographical location of the counterparty – amplified or mitigated the impact of this severe risk-off shock on financial stress. We also test which policy interventions were most effective at reducing the financial stress in 2020 around these different funding vulnerabilities.

The results suggest that although the post-2008 regulatory reforms strengthened the resilience of banking systems overall, meaningful vulnerabilities still exist through exposures related to nonbank financial institutions (NBFIs) and dollar funding. Policy interventions targeting these specific vulnerabilities during periods of financial stress, however, could significantly mitigate these fragilities (e.g., policies supporting the NBFI sector and US dollar swap lines).

An extensive body of literature has previously explored a range of vulnerabilities around funding characteristics and exposures. For example, Forbes (2021) surveys the literature showing how tighter regulations on banks shifted financial intermediation to NBFIs,

or ‘shadow banks’, generating new risks to financial stability. Ahnert et al. (2021) highlights how stricter regulations on banks’ foreign exchange (FX) exposures caused changes in funding strategies (such as increased US dollar bond issuance by non-US companies) that increased corporate vulnerability to exchange rate fluctuations (Vij and Acharya 2021).

Our paper builds on this literature in several ways. We simultaneously test for the importance of these different types of funding vulnerabilities across sectors – a broader perspective that is important as macroprudential reforms may have bolstered certain segments of the economy (such as banks) while simultaneously increasing the vulnerability of others. By focusing on high-frequency CDS spreads, our analysis is also able to capture short-lived periods of financial stress for each sector that arise for different reasons. The extreme risk-off period in March 2020 is a useful natural experiment as it was an exogenous shock (i.e. not caused by prior funding decisions) and is the first opportunity to evaluate how the widespread macroprudential reforms and corresponding changes in funding structures over the previous decade affected the resilience of financial systems.

A cross-country and cross-sector approach to understand funding vulnerabilities

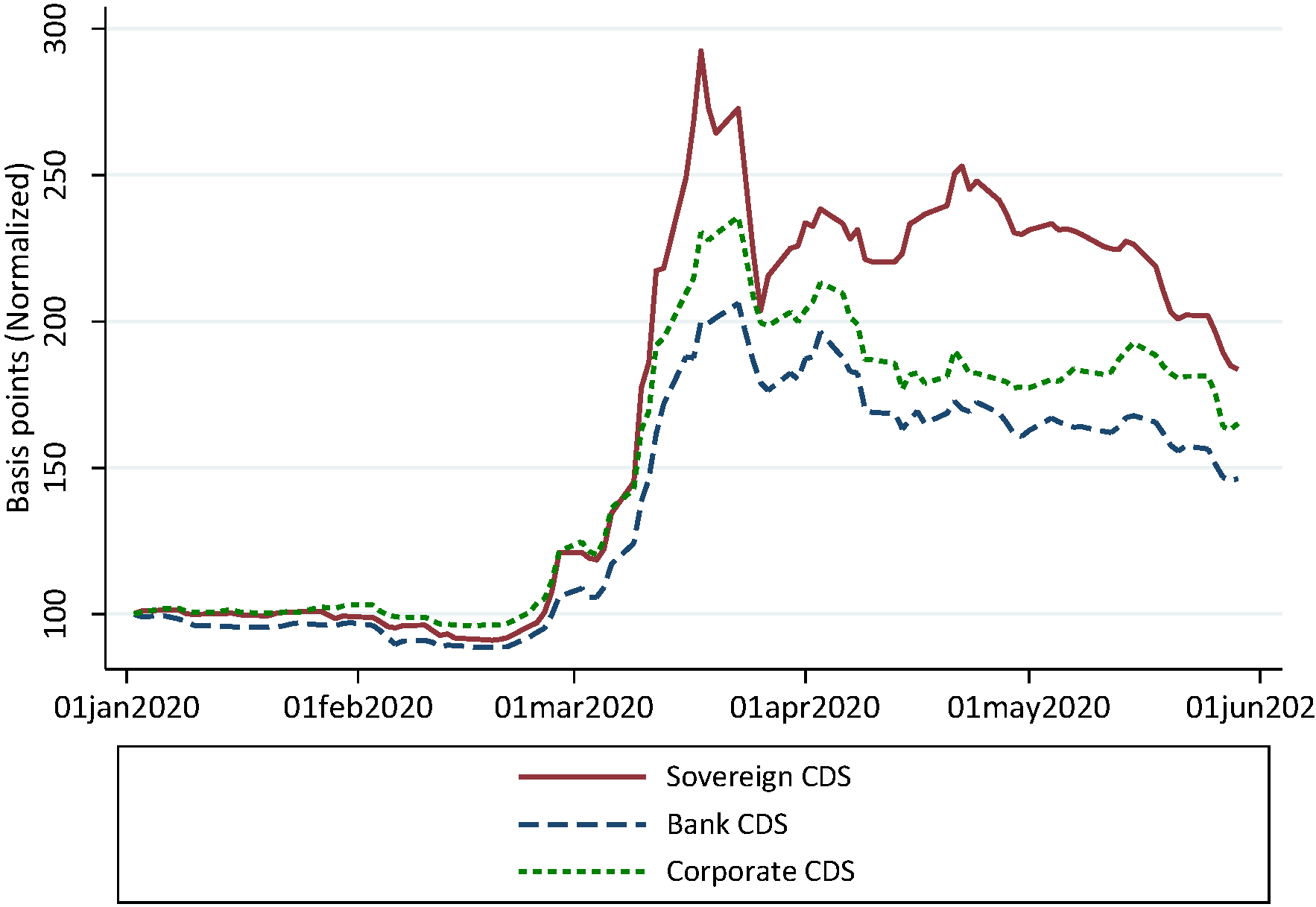

Figure 1 shows the evolution of average CDS spreads for sovereigns, banks and corporates in a cross-section of countries in the first half of 2020. These series are based on a newly created database with information on 2,532 CDS series covering 68 countries. On average, CDS spreads increased sharply as Covid-19 evolved into a global pandemic, but the CDS for banks increased less than for corporates and sovereigns, consistent with arguments that macroprudential reforms over the last decade meaningfully improved the resilience of banking systems. CDS spreads declined as governments and central banks announced a series of policy responses, albeit remaining substantially elevated compared to their pre-crisis levels. The individual CDS spreads underlying these averages show, however, substantial variation across countries and sectors. This variation is useful in the empirical analysis identifying the role of different funding structures.

Figure 1 CDS spreads across countries

Notes: Figure shows the mean CDS spreads across countries, with each series normalized to 100 in Jan 1, 2020. The sample for “All Countries” is all countries with CDS data for each of the three sectors (Sovereign, Bank and Corporate). Underlying data on individual CDS is from Refinitiv, compiled and collapsed as described in Section 3 and Online Appendix A of Forbes et al. (2023).

Next, we combine these data with detailed information on the funding structures of banks and corporates from the Bank for International Settlements (BIS) to build two datasets. One is a panel with country-sector information (for banks and corporates, with the sovereign as the benchmark), and the other incorporates daily information to utilise the time-series dimension. Both data sets cover the period from 1 January 2020 through 23 March 2020 (when most measures of financial stress peaked) for a sample of 25 (mainly advanced) economies.

Our main analysis regresses financial stress (measured by percent changes in CDS spreads for sovereigns, banks and corporates) on pre-Covid funding exposures. We focus on four types of funding exposures: the source of funding (from household deposits, corporate deposits, banks or NBFIs), the instrument of funding (from loans versus debt/equity markets), the currency of funding (US dollar versus other currencies), and the geographical location of the funding counterparty (domestic or cross-border). We include country fixed effects (to control for any country-wide factors) as well as interactions between each sector and the number of reported Covid cases.

Our results suggest that banking systems which were more reliant on funding from NBFIs experienced significantly more stress during the spring of 2020. To put this in context, banks with a 10 percentage points higher share of funding from NBFIs had a 30 percentage point larger increase in CDS spreads. Banking systems also experienced significantly more stress if they were more reliant on US dollar funding. Corporate sectors that were more exposed to NBFI and US dollar funding were also more vulnerable, although the estimates were less consistently significant.

Also noteworthy, although the source and currency of funding significantly affected financial stress, the form and the geography of funding was usually insignificant for both sectors. More specifically, whether banks or corporates relied more on loans (instead of debt markets) or on cross-border counterparties (instead of domestic) did not significantly increase their resilience during March 2020

Policy implications

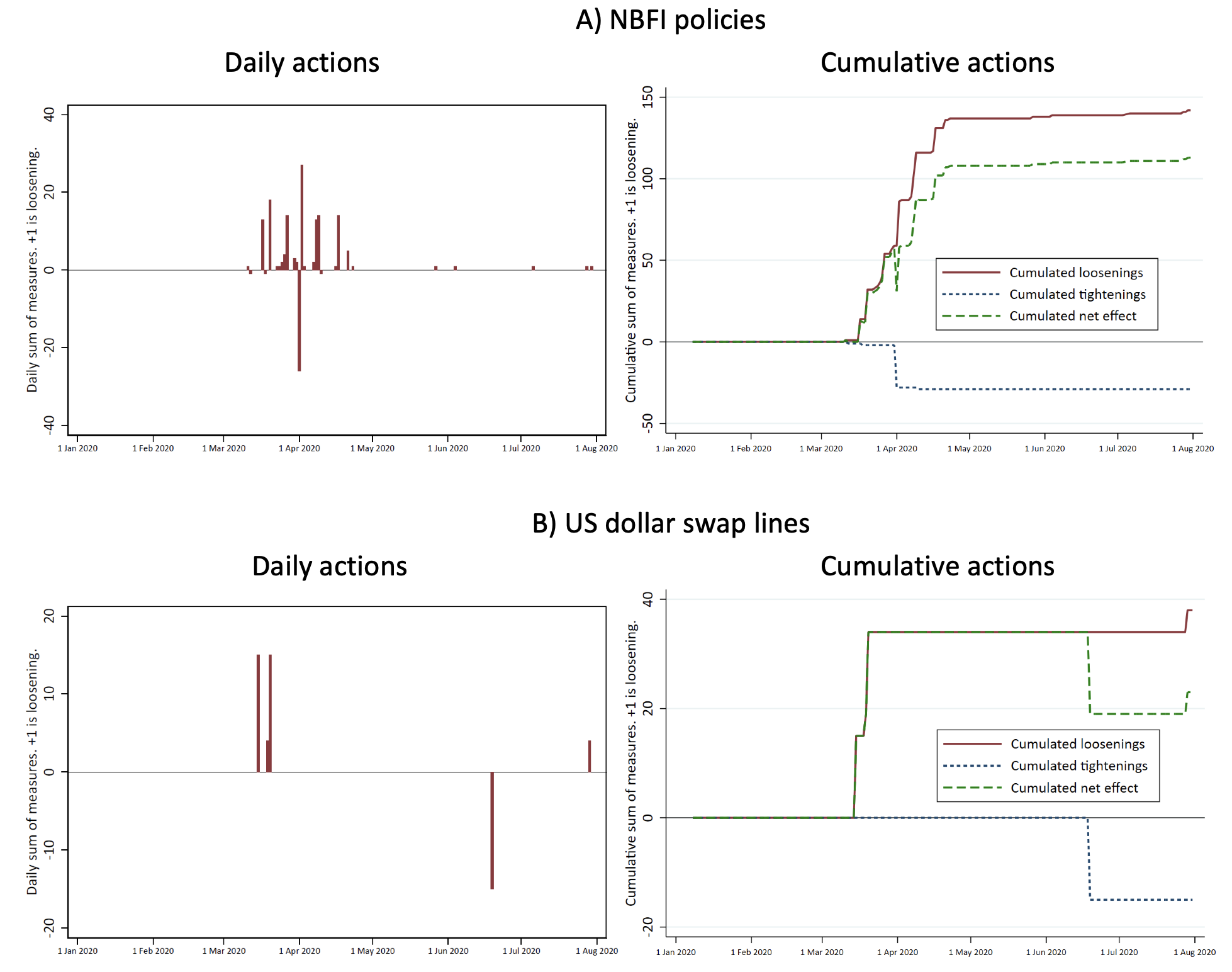

Figure 1 shows that financial stress fell significantly after March 2020. To assess which policy responses were most effective at reducing financial stress, we incorporate the impact of a wide range of policy responses (all taken from Kirti et al. 2022). We assess the impact of: ‘economy-wide policies’ (lower interest rates, quantitative easing, liquidity support and fiscal stimulus), ‘bank-focused policies’ (changes in prudential regulations and macroprudential buffers), and ‘structure-specific policies’ (which target vulnerabilities related to funding from market-based sources, NBFIs, and US dollars). Figure 2 shows the number of countries adopting the last two of these interventions.

Figure 2 Policy interventions: Two examples

Note: The panels above show the use of NBFI policies and US dollar swap lines during Covid-19. The left-hand side of each set shows the policy actions on a daily basis. The right-hand side shows the cumulative policy actions over time. An increase corresponds to a policy loosening and a decrease to a tightening. The sample ranges from 1 January 2020 to 31 July 2020 and includes 24 countries.

The results suggest that policy responses targeting specific structural vulnerabilities – such as measures supporting the NBFI sector and providing FX swap lines – were successful at reducing financial stress. These policies had significant effects, even after controlling for broader, ‘economy-wide’ macroeconomic responses. These highly targeted policies were also more successful at mitigating the stress related to NBFI or US dollar funding than easing more generalised banking regulations. These results suggest that during the next period of market fragility or financial stress, policymakers should consider whether any funding pressures could be addressed with targeted policies focused on specific vulnerabilities rather than a general easing of banking regulation or with broader macroeconomic policies.

This evidence also helps set priorities for the next phase of financial regulations. The results highlight the importance of focusing on regulations related to vulnerabilities from NBFIs and US dollar exposures. This could include strengthening NBFI regulations (as suggested in Carstens 2021 and FSB 2020a) and reviewing liquidity regulations corresponding to specific FX funding currencies. The results also suggest that macroprudential FX regulations (which focus on the currency of the borrowing) would be more effective at reducing vulnerabilities than capital controls (which focus on nationality).

Most important, the results from this analysis combined with the recent funding vulnerabilities exposed in SVB and the UK LDI funds over the last year are potent reminders of the risks that remain in financial systems. Even though the post-2008 regulatory reforms have increased the resilience of banking systems, there is still more work to be done.

References

Ahnert, T, K Forbes, C Friedrich, and D Reinhardt (2021), “Macroprudential FX Regulations: Shifting the Snowbanks of FX Vulnerability?”, Journal of Financial Economics 140: 145-174.

Aramonte, S, A Schrimpf, and H S Shin (2022), “Non-bank Financial Intermediaries and Financial Stability,” CEPR Discussion Paper 16962.

Breeden, S (2022), “Risks from leverage: how did a small corner of the pensions industry threaten financial stability?,” speech at ISDA and AIMA, 7 November.

Carstens, A (2021), “Non-bank Financial Sector: Systemic Regulation Needed,” BIS Quarterly Review, December: 1-6.

FSB – Financial Stability Board (2020a), Holistic Review of the March Market Turmoil, November.

FSB (2020b), Global Monitoring Report on Non-Bank Financial Intermediation, December.

Forbes, K (2021), “The International Aspects of Macroprudential Policy,” Annual Review of Economics 13: 203-228.

Forbes, K, C Friedrich and D Reinhardt (2023), “Stress Relief? Funding Structures and Resilience to the Covid Shock,” Journal of Monetary Economics, forthcoming.

Ivashina, V and J Breckenfelder (2021), “Bank leverage constraints and bond market illiquidity during the COVID-19 crisis,” VoxEU.org, 27 November.

Kirti, D, Y Liu, S Martinez Peria, P Mishra and J Strasky (2022), “Tracking Economic and Financial Policies during COVID-19: An Announcement-Level Database,” IMF Working Paper 22/114.

Vij, S, and V Acharya (2021), “Foreign currency corporate borrowing: Risks and policy responses,” VoxEU.org, 29 April.

Vissing-Jorgensen, A (2021), “The Treasury market in spring 2020 and the response of the Federal Reserve”, Journal of Monetary Economics 241: 19-47.

Weder di Mauro, B (2023), "Announcing a new Vox debate: Lessons from recent stress in the financial system", VoxEU.org, 21 April.