Public pensions are among the largest social insurance schemes. In 2019, expenditures on such programmes in OECD countries amounted to 7.7% of GDP. These programmes aim to help people – especially those who might not save adequately for retirement – smooth consumption from working life into retirement by providing old-age benefits to retirees. Yet due to factors like population aging, many pension programmes face budgetary pressures, and governments around the world are enacting or considering reforms to their social security systems.

One common reform involves increasing official retirement ages, which determine when people become eligible for early or full retirement benefits. Indeed, the full retirement ages are rising in more than half of OECD countries (OECD 2023). While the details of such reforms vary across contexts, recent research from different countries indicates that people claim pension benefits later and work longer when policymakers increase retirement ages, especially the early retirement age (Cribb et al. 2016, Lalive et al. 2017, Magesan et al. 2021, Geyer and Welteke 2021, Haller 2019, Deshpande et al. 2021, Seibold 2021, Nakazawa 2022). Moreover, research indicates that the spouses of people affected by these reforms also delay their retirements (Lalive and Parrotta 2017, Johnsen et al. 2022, García-Miralles and Leganza 2024a). The goals of such reforms are often to encourage people to work longer, so this research-based evidence on labour supply is crucial for policy.

Yet we know less about how these reforms affect savings, even though a key motivation for social security in general is to help people finance consumption in retirement. To have a more complete understanding of how increasing retirement ages impacts people, and in particular how these policies impact income security, we need to understand how such reforms impact savings.

The effects of increasing retirement ages

In our paper (García-Miralles and Leganza 2024b), we provide evidence on how savings responded to a reform in Denmark that increased the early retirement ages. (The reform also increased the standard retirement age, but our analysis focused on the early retirement programme.) Before the reform, people could claim early retirement benefits at 60, while there were some incentives in place to encourage retirements at 62. The reform increased these two critical ages to 60.5 and 62.5.

Importantly, the reform only applied to people born on or after 1 January 1954. This setup thus allowed us to tease out causality by comparing outcomes of people born just after this ‘cut-off date’, who were affected by the reform, to those born just before, who were not.

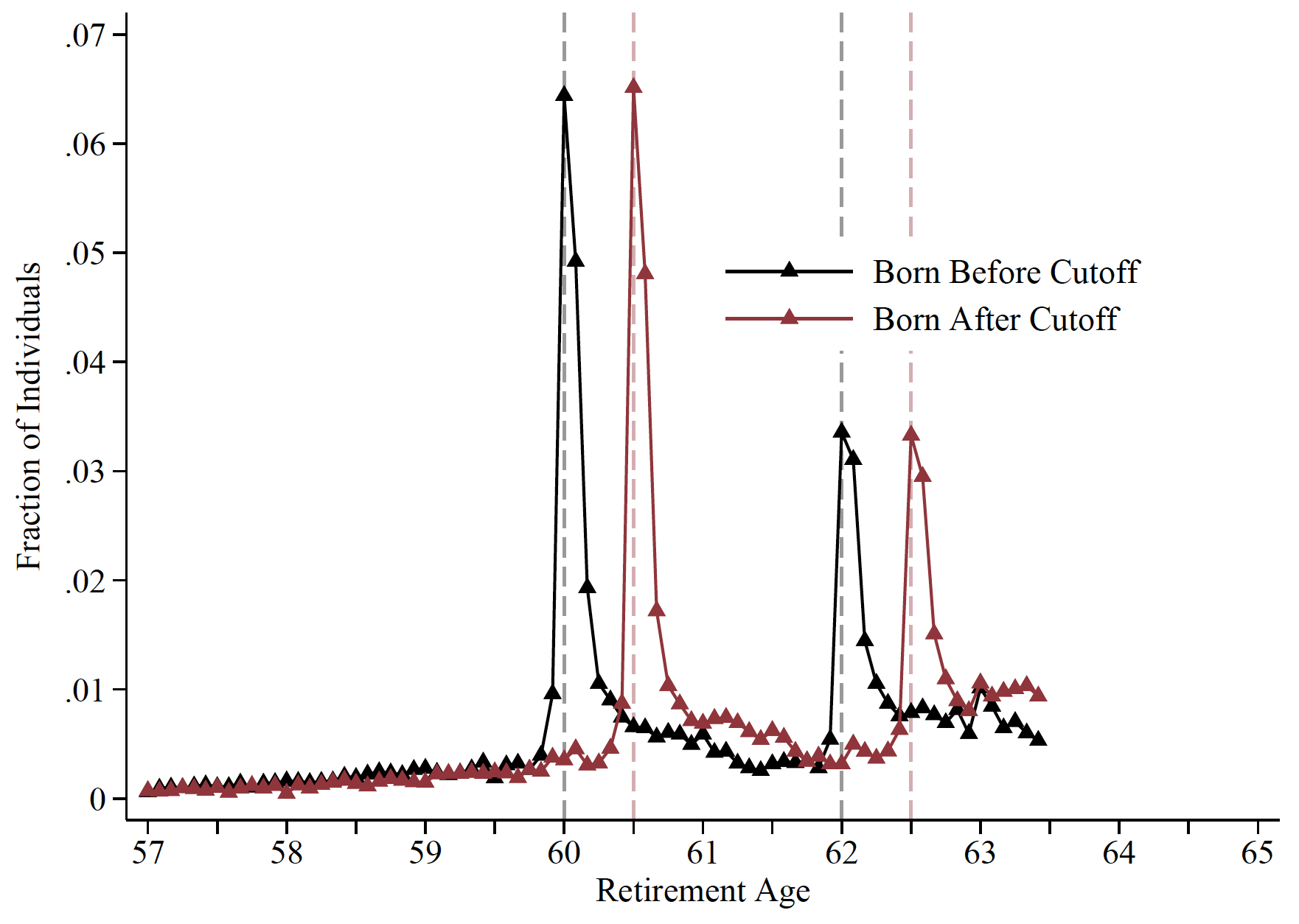

We first looked at how the reform impacted retirement and benefit claiming. Figure 1 shows the fraction of people who retired at different ages. There are large spikes in retirement at the old retirement ages for people unaffected by the reform. Strikingly, for people affected by the reform, these large spikes in retirement shift to the new official retirement ages in lockstep. A similar pattern emerges for benefit claiming. In response to the six-month increase in retirement ages, many people claimed benefits six months later and continued to work for six more months. This evidence is consistent with previous research, and it indicates that policymakers can achieve their goals of encouraging more years of work by increasing retirement ages.

Figure 1 Distributions of retirement ages, for people affected and unaffected by the reform

We next looked at the effects on savings. The reform was announced in 2011, when the people affected were 57 years old, and our data allowed us to track people from 57 to 64. Over these eight years, we estimated that, on average, cumulative contributions to retirement savings accounts increased by over $3,000, or about 10%.

This increase was mostly driven by contributions to employer-sponsored retirement accounts, but we also found that people increased contributions to personal retirement accounts not provided by employers. In contrast, we found no evidence that the reform impacted other types of savings, like savings in bank accounts or stock market investments outside of retirement accounts.

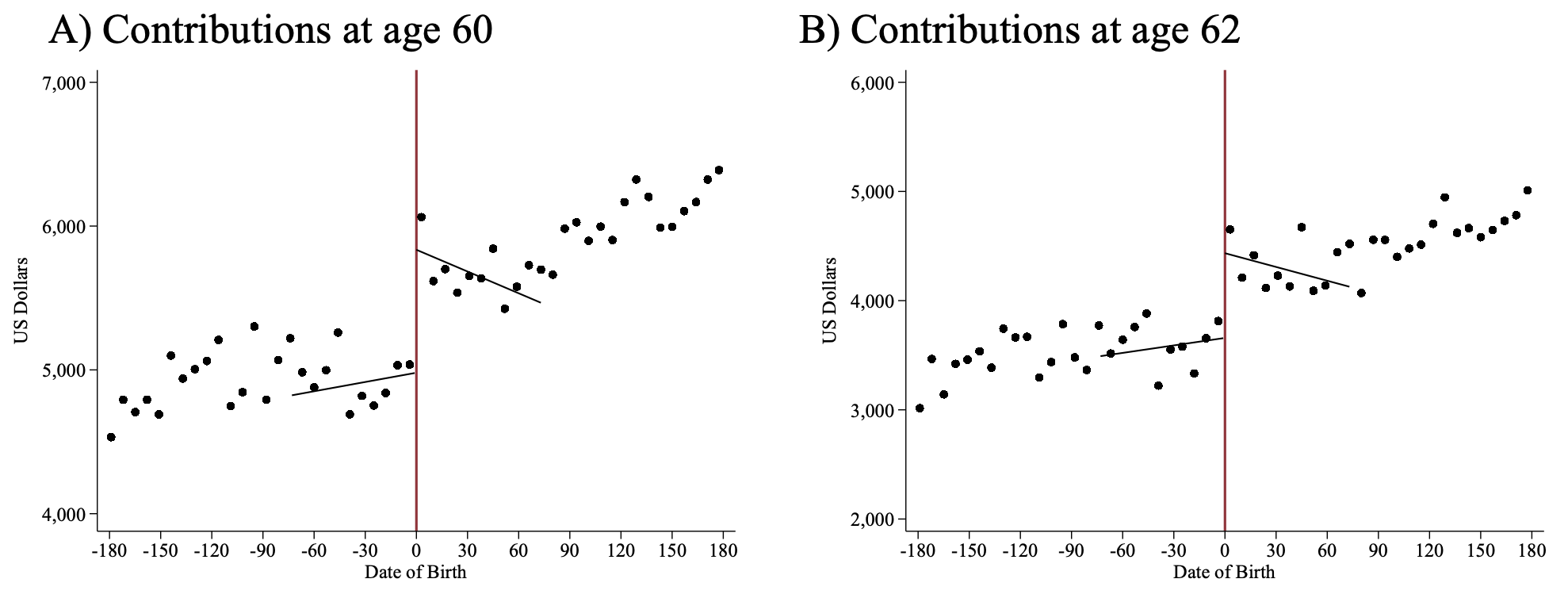

Moreover, we estimated that the bulk of this increase in savings came during two key years: when people reached the early retirement ages of 60 and 62. For example, Figure 2 illustrates how contributions to employer retirement accounts were greater for people affected by the reform during these two years when they were induced to work longer. Each dot in the graphs corresponds to the average contributions to employer retirement accounts for people born within one week of each other. The dots to the left of the vertical lines are for people unaffected by the reform (those born before 1 January 1954), and the dots to the right are for people affected by the reform (those born after). The dots to the right are higher than the dots to the left, indicating that the reform caused people to save more on average.

Figure 2 Contributions to employer retirement accounts at key ages

Alternatively, we found that savings responses at other ages were muted. Notably, we did not find any evidence that people adjusted savings after the reform was announced but before they aged into the early retirement programme.

In sum, people worked longer to retire at the new retirement ages and experienced increases in earnings and retirement savings during this period of extended employment.

What explains the increase in retirement savings?

We argued that a likely explanation for these findings is inertia, the continuation of previous savings behaviours. The six-month increase in retirement ages caused many people to work six more months, and it seems that they continued saving for retirement during these six months as they were previously doing.

In support of this explanation, we showed that the increase in contributions to personal retirement accounts was mostly explained by frequent contributors continuing to contribute, as opposed to infrequent contributors starting to save more regularly. Moreover, we showed that the increase in contributions to employer retirement accounts was mostly explained by people continuing to save at firm-set default contribution rates. In Denmark, many people are covered by quasi-mandatory employer-provided retirement savings schemes. It is common for mandatory (minimum) contribution rates to be set by employers, with contributions made by employers directly or employees via payroll deductions. This feature of the policy environment is thought to be a key driver of high savings rates in Denmark (Mann et al. 2022). We showed that this feature is important for our study and estimated that continuing to contribute at firm-set contribution rates could explain about 70% of the increased savings in employer retirement accounts that we observed.

Implications for policy

Both economics research and the policy debate around increasing retirement ages often (and understandably) focus on how these reforms impact labour supply. But when weighing the pros and cons of such reforms, it is important to have as complete of an understanding of the impacts as possible. Understanding how these reforms affect savings is crucial for assessing how they impact retirement readiness and financial security.

We showed that an increase in retirement ages in Denmark led to delayed retirements and the continued accumulation of retirement savings. Our results are thus consistent with other influential research in the Danish context that showed that many people are passive savers (Chetty et al. 2014). In a setting where people tend to accumulate savings passively, we found that savings responses to social security occur through changes in employment.

On average, people affected by the reform thus ended up with more earnings and more retirement savings set aside for a shorter retirement. On the one hand, in this sense the reform seems to have improved retirement income security. On the other hand, this improvement came at the cost of working longer. Our analysis did not investigate the heterogeneous effects of the reform or any potential implications for inequality, but that is an important area for future research and the focus of an emerging line of the literature (Spinnewijn et al. 2022, Morris 2022, Kolsrud et al. 2024, Sæverud 2024). The cost of working longer is likely different for people in different types of jobs, for instance.

More broadly, our findings underscore an important connection between saving and employment that policymakers should keep in mind. In many modern economies, a dominant form of saving involves contributing to employer retirement accounts. Previous research shows that firm policies influence how much people save in these accounts (e.g. Madrian and Shea 2001, Beshears et al. 2009, and Choi 2015), and our analysis highlights how these firm policies can dictate how people’s savings ultimately respond to social security reforms.

Finally, we emphasise that this type of interaction between public policies and firm policies could be important outside the context of social security as well. Often, employment involves a compensation bundle. When people work longer, they experience increases in earnings but also increases in access to other benefits tied to work (e.g. employer retirement plans like in our context and others, health insurance in the US context). Public policies that increase labour supply are also therefore likely to increase access to these other benefits provided by firms that are tightly linked to employment.

References

Beshears, J, J J Choi, D Laibson and B C Madrian (2009), “The importance of default options for retirement saving outcomes”, Social Security Policy in a Changing Environment: 167-195.

Chetty, R, J N Friedman, S Leth-Petersen, T H Nielsen and T Olsen (2014), “Active vs. passive decisions and crowd-out in retirement savings accounts: Evidence from Denmark”, Quarterly Journal of Economics 129(3): 1141-1219.

Choi, J J (2015), “Contributions to defined contribution pension plans”, Annual Review of Financial Economics 7: 161-178.

Cribb, J, C Emmerson and G Tetlow (2016), “Signals matter? Large retirement responses to limited financial incentives”, Labour Economics 42: 203-212.

Deshpande, M, I Fadlon and C Gray (2024), “How Sticky Is Retirement Behavior in the United States?”, Review of Economics and Statistics: 1-14.

García-Miralles, E and J M Leganza (2024a), “Joint retirement of couples: Evidence from discontinuities in Denmark”, Journal of Public Economics 230, 105036.

García-Miralles, E and J M Leganza (2024b), “Public pensions and private savings”, American Economic Journal: Economic Policy 16(2): 266-405.

Geyer, J and C Welteke (2021), “Closing routes to retirement for women: How do they respond?”, Journal of Human Resources 56(1): 311-341.

Haller, A (2019), “Welfare Effects of Pension Reforms”, Working Paper.

Johnsen, J, K Vaage and A Willén (2022), “Interactions in public policies: spousal responses and program spillovers of welfare reforms”, The Economic Journal 132(642): 834– 864.

Kolsrud, J, C Landais, D Reck and J Spinnewijn (2024), “Retirement consumption and pension design”, American Economic Review 114(1): 89-133.

Lalive, R, A Magesan and S Staubli (2017), “Raising the full retirement age: Defaults vs incentives”, NBER Working Paper orrc17–12.

Lalive, R and P Parrotta (2017), “How does pension eligibility affect labor supply in couples?”, Labour Economics 46: 177–188.

Madrian, B C and D F Shea (2001), “The power of suggestion: Inertia in 401 (k) participation and savings behavior”, Quarterly Journal of Economics 116(4): 1149-1187.

Magesan, A, S Staubli and R Lalive (2021), “The impact of social security on pension claiming and retirement”, VoxEU.org, 12 January.

Mann, K, J Bhattacharya, A Grodecka-Messi and T M Andersen (2022), “Pension systems matter for wealth accumulation and distribution”, VoxEU.org, 5 May.

Morris, T (2022), “The unequal burden of retirement reform: Evidence from Australia”, Economic Inquiry 60(2): 592-619.

Nakazawa, N (2022), “The effects of increasing the eligibility age for public pension on individual labor supply: Evidence from Japan”, Journal of Human Resources.

OECD (2023), “Key facts and figures (Infographic)”, in Pensions at a Glance 2023: OECD and G20 Indicators, OECD Publishing, Paris.

Sæverud, J (2024), “The Impact of Social Security Eligibility and Pension Wealth on Retirement”, Working Paper.

Seibold, A (2021), “Reference points for retirement behavior: Evidence from German pension discontinuities”, American Economic Review 111(4): 1126-1165.

Spinnewijn, J, C Landais, D Reck and J Kolsrud (2022), “The hidden costs of incentivizing later retirement”, VoxEU.org, 22 March.