In 2018, a shift in US trade policy upended decades of market openness. At the heart of it was a growing concern regarding the US economy’s dependence on China. When President Trump “ordered” US firms to immediately start looking for an alternative to China at the height of the US-China trade conflict (Oprysko 2019), it sparked a vigorous discussion among policymakers and international businesses on `nearshoring', ‘friendshoring’, and whether Mexico can be that alternative (Yellen 2022, Goodman 2023, Stott and Murray 2022, Drenik 2023, Sonenshine 2023, Alfaro and Chor 2023).

Mexico was long the most important economic and trade partner of the US from the emerging world as a neighbouring country, integrated by important trade agreements until it was outcompeted by China shortly after China’s entry into the WTO. Traditional labour-intensive industries in which Mexico had a comparative advantage over the US, such as textiles and clothing, were washed away by Chinese competition in the US market (Utar and Ruiz 2013). Are the tides now turning in favour of Mexico?

In a recent paper (Utar et al. 2023), we use administrative data on the universe of firms with international trade transactions in Mexico to show that, indeed, the change in US trade policy has led to nearshoring.

One distinctive feature of our study is that we are able to identify firms participating in global value chains based on the official registry of Mexico’s IMMEX programme, which is instrumental in integrating Mexico's manufacturing sector into global value chains (GVCs).

Identifying IMMEX firms in customs transactions allows us to estimate the possible differential response of Mexican exporters based on their GVC participation. We find that the US-China trade conflict had an economically (and statistically) significant positive impact on Mexican firms’ exports, that occurred exclusively through exporters that participate in the IMMEX programme (‘GVC exporters’).

Mexico's IMMEX programme as a primary creator of US-China trade war spillovers

Our findings that tap into the comprehensive firm-level longitudinal data reveal a significant response of Mexican exporters to the change in the US tariffs on Chinese goods. We show that an average Mexican firm’s exports to the US increase in response to an increased tariff burden on a Chinese exporter with an identical pre-shock export product portfolio. When we distinguish responses of Mexican exporters based on their GVC status, our findings reveal the pivotal role of Mexico’s IMMEX in the positive effect of the US protectionist trade policy towards China.

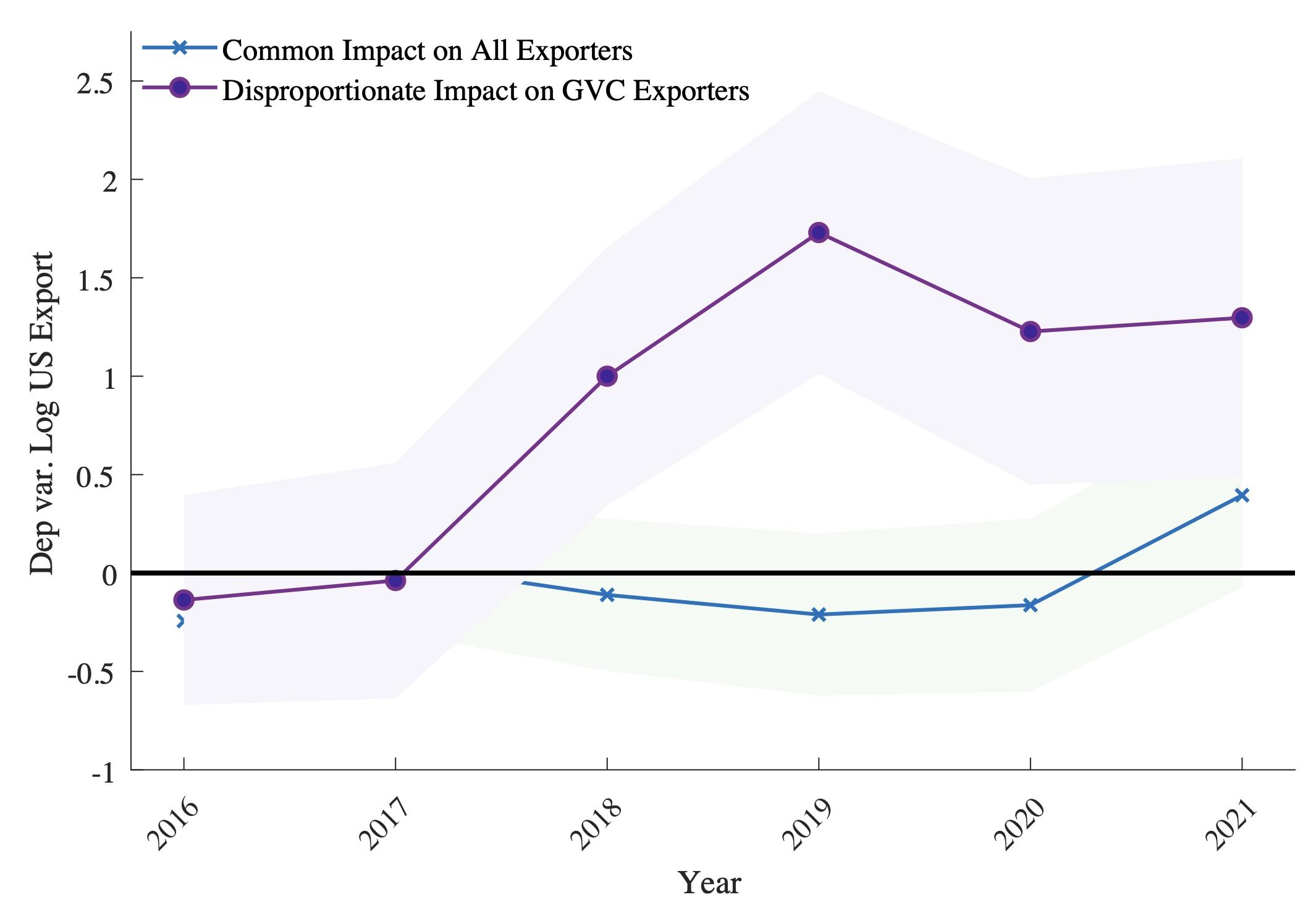

Figure 1 shows the yearly export response of firms to the increased US tariffs on Chinese goods, after controlling for other possible factors affecting firms’ exporting. The blue line represents the causal effect of the increased US tariffs on Chinese goods on the US exports of the Mexican firms that do not participate in GVCs, along with its 95% confidence interval. The purple line shows the same results but for those firms that do participate in GVCs. Thus, it is the response of GVC firms that drives the positive export response at the aggregate level, as we show in Utar et al. (2023).

Figure 1 US tariffs increase Mexican firms’ exports to the US, but only among GVC firms

Notes: The figure shows how the effects of the increased US tariffs on Chinese imports on Mexican exporters differ depending on their GVC status. The blue line shows the effect on non-GVC exporters’ US exports, while the purple line shows the disproportionate impact on GVC exporters’ US exports, as obtained from a triple difference-in-differences analysis. The shaded area indicates the confidence interval at the 95% level. See Utar et al. (2023) for details.

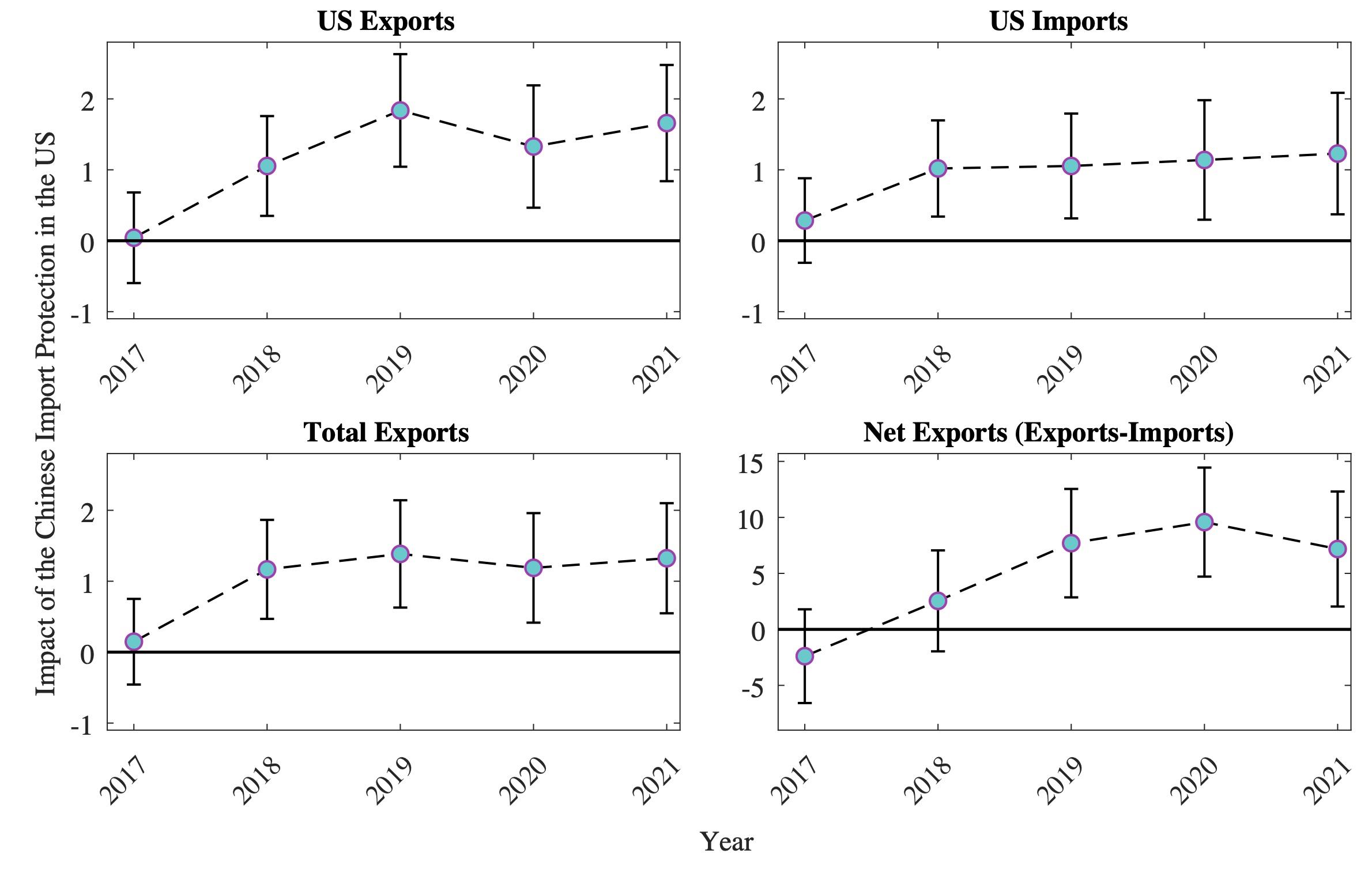

Much of the discussion on GVC relocation in response to the US-China trade war was centred on manufacturing in particular. Figure 2 shows the yearly effect of the US tariffs on manufacturing GVC firms in Mexico. It shows the positive effect on firms’ exports to the US, imports from the US, total exports and the total exports net of imports. Comparing two firms, one located at the 25th and the other located at the 75th percentile of exposure to the US tariffs on China (based on their pre-trade-war product portfolio), the results show a notable 20% uptick in exports from manufacturing GVC firms to the US in 2019. Despite a slight decline in 2020 coinciding with the COVID-19 shock, the positive effect was sustained by 2021. Our findings on increased net exports suggest increased domestic activities in Mexico.

Figure 2 Heightened Chinese import protection in the US and manufacturing GVC firms’ response in Mexico

Notes: The figure shows the causal effect of the increased US tariffs on Chinese imports on Mexico’s manufacturing GVC firms’ exports to the US (in natural logarithm), imports from the US (in natural logarithm), total exports (in natural logarithm), and total net exports (in inverse hyperbolic sine), respectively. Difference-in-differences coefficient estimates with 95% confidence intervals are shown. See Utar et al. (2023) for details.

Selective expansion

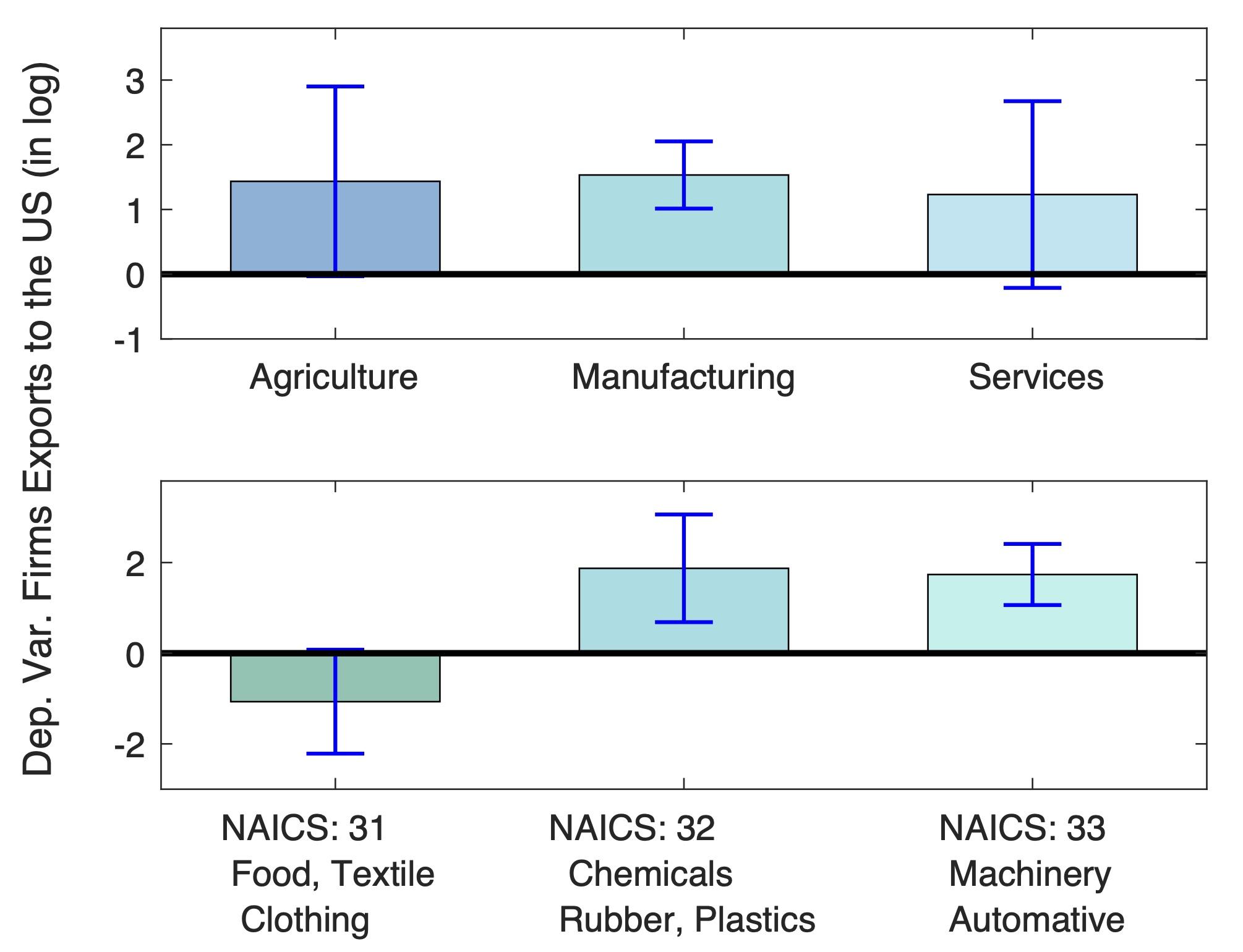

Our research shows that the positive effect of the US tariffs is more pronounced in the manufacturing sector. Within manufacturing, though, not all GVCs benefited from the US tariffs. In particular, rather than traditionally labour-intensive industries such as textile, apparel, and footwear, more skill and technology-intensive industries such as chemicals, computers, aircraft, and automotive (North American Industry Classification (NAICS) 32 & 33) industries capitalised on the opportunity, stepping into the void left by Chinese competitors now facing hefty tariffs.

Figure 3 shows the effect of the 2018/19 US tariffs on China depending on GVC firms’ sectors. It depicts the average effect on firms' exports to the US over the period 2018-2021, estimated separately among IMMEX firms operating within each sector and within manufacturing across industries.

Figure 3 How the 2018/19 US tariffs on China affect Mexico’s GVCs across different industries

Notes: The figure shows how the average effect of the increased US tariffs on Chinese imports on Mexico’s GVC firms’ exports to the US differs across industries. Error bars indicate 95% confidence intervals. See Utar et al. (2023) for details.

We also document that GVC firms are not just expanding their exports within existing products but bringing new product lines in response to the US tariffs. At the same time, our study shows that these new product lines moving to Mexico are concentrated in final goods markets, suggesting that more production stages closer to the final consumer are now being performed in Mexico.

The tale of Mexican GVC firms is not solely one of expansion based on domestic capabilities. The narrative is also about the adaptations of multinationals on a global scale. Our findings show that GVC firms have increased their imports from the US, but most notably from Asian markets – namely China, Japan, Korea, Thailand, Taiwan, Vietnam, and India – in response to the shift in the US trade policy. We also show that GVC firms in Mexico increasingly use duty-free permits in sourcing from Asian markets, indicative of long-term value chain relocations. Our results point to the role of supply chains linked to Asia in Mexico’s positive response and indicate that the shift in US trade policy intended to reduce American reliance on Chinese imports, somewhat ironically, also increased the dependence of Mexico on Chinese imports.

The US-China trade war: A mixed bag of opportunities and challenges

The concept of nearshoring gained traction as US firms sought alternatives to Chinese partnerships. Mexico, with its proximity and established trade agreements, emerged as a frontrunner. However, this transition isn't free from setbacks. In particular, China’s retaliatory tariffs had a negative, albeit more transitory effect on firms’ exports, particularly affecting export service GVCs. We also find evidence of a robust negative effect on GVC firms whose inputs are concentrated on targeted Chinese goods. These counterbalancing negative effects underscore the importance of firm-level analysis in highlighting the nuanced nature of the adjustment taking place.

Our research suggests that the adaptability of Mexico’s GVC firms to the 2018/19 US-China trade conflict, buoyed by IMMEX, has been notable, with a discernible spillover into the broader Mexican economy and highlight the role of multinational corporations in shaping the third-country response.

Author's note: The views in this paper are those of the authors and do not necessarily reflect the views of Banco de Mexico or its Board of Governors or of the Federal Reserve Bank of Dallas or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

References

Alfaro, L, and D Chor (2023) “A perspective on the great reallocation of global supply chains”, VoxEU.org, 28 September

Drenik, G (2023), “Why Nearshoring Is Closer Than Ever: How Mexico Is Becoming The Next Big Thing In Global Markets”, Forbes, 23 March.

Goodman, P (2023), “‘OK, Mexico, Save Me’: After China, This Is Where Globalization May Lead”, The New York Times, 1 January.

Oprysko, C (2019), “Trump orders US companies to find an alternative to China”, PoliticoPro, 23 August.

Sonenshine, T (2023), “Not “Made in America”, but close”, The Hill, 4 January.

Stott, M and C Murray (2022), “Why Mexico is missing its chance to profit from US-China decoupling”, Financial Times, 2 July.

Utar, H and L B Torres-Ruiz (2013), “International Competition and Industrial Evolution: Evidence from the Impact of Chinese Competition on Mexican Maquiladoras”, Journal of Development Economics 105(11): 267-287.

Utar, H, A C Zurita and L B Torres-Ruiz (2023), “The US-China Trade War and the Relocation of Global Value Chains to Mexico”, CESifo Working Paper No. 10638.

Yellen, J (2022), “Remarks by Secretary of the Treasury Janet L. Yellen on Way Forward for the Global Economy” delivered to the Atlantic Council, 13 April.