Following the huge fiscal expansions implemented by governments around the world in the aftermath of the Covid-19 crisis, fiscal dominance has gained centre stage in economic debates (Mengus et al. 2021). While many studies have been devoted to the impact of fiscal dominance on the internal value of money, i.e. on inflation (Saito and Hooley 2021), much less attention has been dedicated to its impact on the external value of money, i.e. its exchange rate (Aizenman et al. 2019). This distinction is of fundamental importance as these two channels do not perfectly coincide and have quite different distributional implications.

It is a matter of fact that, taking a relatively longer-time perspective, the last decade witnessed the largest, fastest, and most broad-based increase in debt levels around the world (Kose et al. 2021), as most countries significantly increased their public-sector borrowing as a share of GDP.

Overall, this growing public debt might influence monetary policy actions, inducing central banks to accommodate the costs of servicing public debt, eventually leading to higher risks of both inflation and currency depreciation. These considerations outline the relevance of studying the transmission channel between fiscal deficits, monetary policy, and exchange rates.

Defining fiscal dominance

This line of research has a long history. As economic policy thought evolved over the last four decades, a consensual view has progressively emerged concerning how the institutional design of central bank rules can shape policymakers’ incentives. Its key intuition can be summarised as follows: in general, governments would use monetary policy tools with a short-sighted perspective, aiming to smooth fiscal imbalances (Sargent and Wallace 1981, Barro 1983). The term 'fiscal dominance' has become commonplace to describe an institutional framework in which monetary policy is driven by fiscal policy. On the one hand, the term has been employed to describe an institutional setting in which, as explained by the political economy literature (Rogoff 1985, Grilli et al. 1991), the central bank is not independent enough to oppose government deficit monetisation. On the other hand, the term has been employed to describe a macroeconomic setting – also defined as a 'non-Ricardian regime' (Sargent 1982, Aiyagari and Gertler 1985) – in which instead of providing full backing for its debt by using a stream of future taxes, the fiscal authority finances its fiscal deficits with money creation.

The literature on fiscal dominance has extensively explored the inflation channel (for a recent survey, see Cevik and Miryugin 2023). By contrast, the depreciation channel has been relatively overlooked. Nonetheless, several contributions have indeed analysed empirically how fiscal dominance, debt, and exchange rate movements can be associated (Blanchard 2004, Ahmed et al. 2021, Alberola et al. 2021). One of the messages of this literature is that while in Ricardian regimes fiscal expansions are associated with an appreciation of the domestic currency, in non-Ricardian regimes they are rather associated with its depreciation (Alberola et al. 2021).

Fiscal monetisation experiments in early modern Venice

In a recent paper (Masciandaro et al. 2023), we investigate the relationship between fiscal dominance and exchange rates in the context of a unique early experiment with fully floating state-issued money in 17th century Venice. It is well known that since the late Middle Ages, Italian city-states achieved a remarkably high level of financial sophistication (Fratianni and Spinelli 2006). Venice was a top international financial centre in late medieval and early modern times, and was run for centuries by a stable constitutional regime controlled by its mercantile oligarchy. The historical literature has largely documented the modernity of the Venetian fiscal and monetary systems.

On the one hand, Venice developed remarkable fiscal capacity: the Republic’s ability to farm taxes from the population (through a strongly regressive tax system) was high by international standards, as it could borrow large amounts on financial markets at comparatively low interest rates. Historical research on the Venetian fiscal policy has documented that while in troubled times the Republic was able to borrow largely from financial markets, in tranquil times it was equally able to generate substantial fiscal surpluses to decrease the outstanding amount of its public debt – so that in the long run, its public finances were kept on a sustainable path (Pezzolo 2018, Alfani and Di Tullio 2019).

On the other hand, Venice was also a pioneer in the development of modern banking, being among the very first places to create public banks which can be legitimately considered as proto-central banks (Roberds and Velde 2016, Ugolini 2017, Bindseil 2019). Recent studies have rediscovered the unique modernity of the ‘monetary experiment’ implemented by the Republic between 1619 and 1666. During this period, the Banco del Giro (a public bank with no formal separation from the government) issued fiat money which was inconvertible on demand into specie: the value of this State money was therefore purely managed by the government itself through the implementation of open market operations.

Such an experiment, however, was not meant to put the domestic economy on an inflationary path. The ‘moneyed interests’ who stably ran the Republic had a strong anti-inflationary bias, and the Banco’s mission was rather to preserve the stability of the money it issued. This notwithstanding, in this very period Venice endured large real shocks which obliged the government to resort to active monetisation of fiscal deficits through this public bank (Ugolini 2020, Goodhart et al. 2021a, 2021b).

When credibility is not enough

We uncovered a previously unused archival source and built a new hand-collected database of high-frequency exchange rate data between Venice and 32 other cities or exchange fairs between 1627 and 1684 (Masciandaro et al. 2023). Based on these new data, we are able to show that in spite of the Venetian government’s reputation for fiscal prudence, the external value of the ducat was highly sensitive, and increasingly so, to episodes of automatic government deficit monetisation through the Banco del Giro during the macroeconomic shocks of 1630 (outbreak of the bubonic plague) and 1648-50 (escalation of the Cretan War).

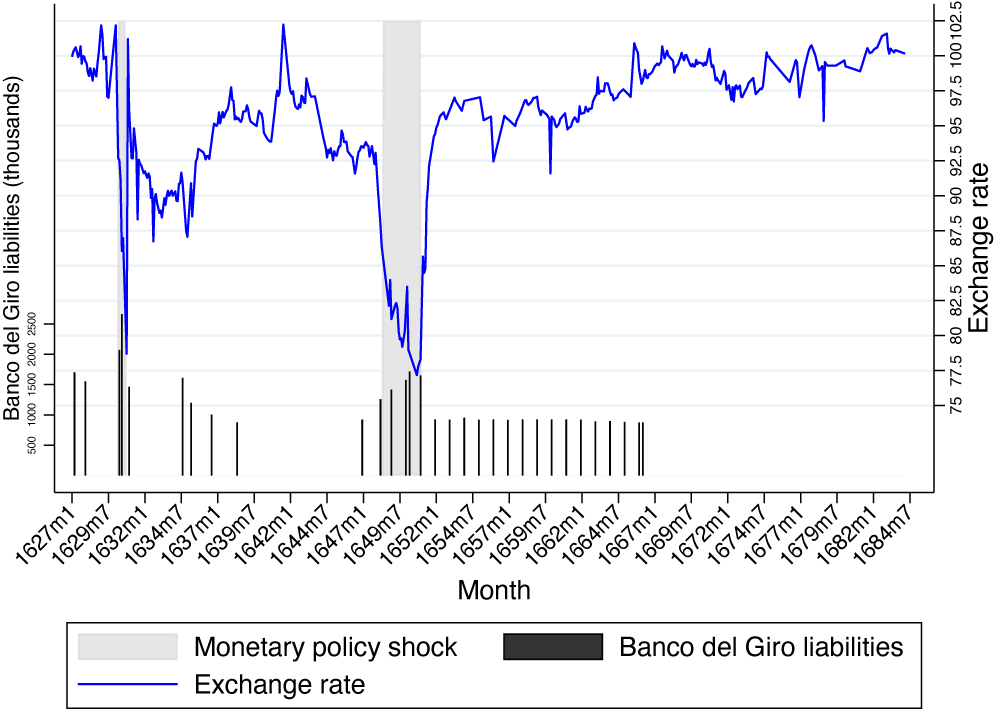

Figure 1 below shows the evolution of the average exchange rate between a sample of 16 currencies and the Venetian Banco ducat together with the evolution of the Banco del Giro’s liabilities, highlighting the fiscal monetisation shocks. The figure provides a visual sense overview of the association between exchange rate depreciations and the implementation of government deficit monetisation in the Venetian Republic, implemented via the expansion of the Banco del Giro’s liabilities. Indeed, despite the limited data on the Banco del Giro’s liabilities, it is possible to notice how their increase by around 30% between April and June 1630 was associated with a sharp depreciation of the Venetian ducat. This sharp decline in 1630 had almost reverted by 1630, following a drop in the Banco’s liabilities of around 45% between June 1630 and December 1630. Similarly, the increase in the Banco del Giro liabilities between March 1648 and December 1650 is associated with a large depreciation of the ducat value, followed by an appreciation following the contraction of these liabilities.

Figure 1 Exchange rate evolution and fiscal monetisation shocks

Based on the new data series as well as on other available quantitative and qualitative historical evidence, we implemented an event study analysis to test the impact of government deficit monetisation on exchange rates throughout this period. Our results document a high sensitivity of the external value of the Venetian Banco ducat to fiscal deficit monetisation, despite the Venetian government’s strong reputation for fiscal prudence in the long run.

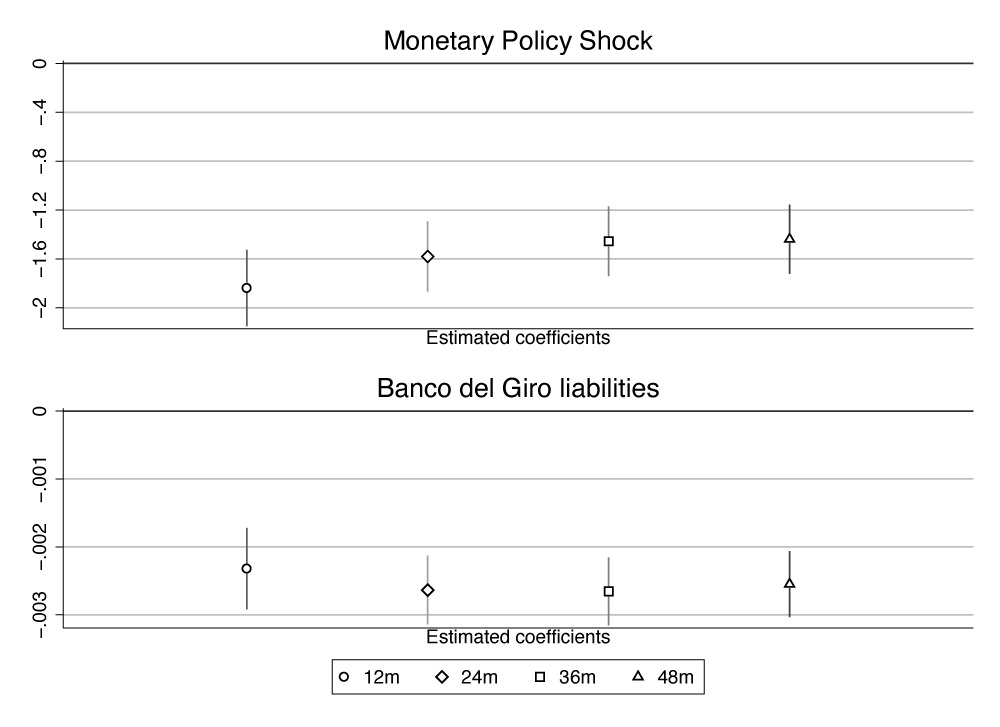

Figure 2 summarises the results obtained when focusing our analysis on the 12, 24, 26, and 48 months around a monetary policy expansion episode for both a monetary policy shock dummy (Panel A) and the Banco del Giro’s liabilities (Panel B). These results provide evidence that periods of monetary policy expansion are associated with the depreciation of the Venetian ducat.

Figure 2 Exchange rate variation and monetary policy shocks around monetary policy expansions

Note: The figures show the estimated coefficient of our monetary policy shock measures. The dependent variable is the change in the exchange rate in the 12, 24, 36 and 48 months around the monetary policy shocks. The upper figure (Panel A) shows the estimates using a dummy for monetary policy shocks, while the lower one (Panel B) those obtained using the level of the Banco del Giro liabilities. City fixed effects are included. 90% confidence intervals are presented.

Conclusions: Institutional design matters

To sum up, the historical literature suggests that the vicissitudes of the Banco del Giro between 1619 and 1666 provide an ideal case study to investigate the relationship between government deficit monetisation and currency depreciation under a flexible exchange rate regime. On the one hand, the institutional setting in Venice resembled the prototypical ‘fiscal dominance’ setting – the monetary authority being a mere division of the fiscal authority, and no formal obstacle prevented the government from automatically monetising its deficits. On the other hand, though, the government had a strong reputation for fiscal soundness and consistently showed Ricardian behaviour in the long run.

Overall, the Venetian experiment of 1619-66 suggests that, in an institutional fiscal dominance setting with freely floating exchange rates, the external value of the domestic currency is particularly sensitive to changes in the fiscal stance – and this is the case even if the government has a solid reputation for maintaining a Ricardian behaviour in the long run. This finding vindicates the importance of the institutional design in determining the international credibility of a currency.

References

Aiyagari, S and M Gertler (1985), “The Backing of Government Bonds and Monetarism”, Journal of Monetary Economics 16(1): 64-83.

Aizenman, J, Y Jinjarak and R Ahmed (2019), “Inflation and Exchange Rate Targeting Challenges Under Fiscal Dominance since the Global Crisis”, VoxEU.org, 28 June.

Ahmed, R, J Aizenman and Y Jinjarak (2021), “Inflation and Exchange Rate Targeting Challenges Under Fiscal Dominance”, Journal of Macroeconomics 67, 103281.

Alberola, E, C Cantù, P Cavallino and N Mirkov (2021), “Fiscal Regimes and the Exchange Rate”, Bank for International Settlements Working Papers n.950.

Alfani, G and M Di Tullio (2019), The Lion’s Share: Inequality and the Rise of the Fiscal State in Preindustrial Europe, Cambridge University Press.

Barro, R T (1983), “Inflationary Finance under Discretion and Rules”, Canadian Journal of Economics 16(1): 1-16.

Bindseil, U (2019), Central Banking before 1800: A Rehabilitation, Oxford University Press.

Blanchard, O (2004), “Fiscal Dominance and Inflation Targeting: Lessons from Brazil”, NBER Working Paper Series n.10389.

Cevik, S and F Miryugin (2023), “It’s Never Different: Fiscal Policy Shocks and Inflation”, IMF Working Papers Series 23/98.

Fratianni, M and F Spinelli (2006), “Italian City-States and Financial Evolution”, European Review of Economic History 10: 257-278.

Goodhart, C, D Masciandaro and S Ugolini (2021a), “Helicopter Money in Another Pandemic Recession: Venice, 1630”, VoxEU.org, 4 February.

Goodhart, C, D Masciandaro and S Ugolini (2021b), “Pandemic Recession and Helicopter Money: Venice 1629-1631”, Financial History Review 28(3): 300-318.

Grilli, V, D Masciandaro and G Tabellini (1991), “Political and Monetary Institutions and Public Financial Policies in the Industrial Countries”, Economic Policy 13: 342-392.

Kose, M A, P Nagle, F Ohnsorge and N Sugawara (2021), Global Waves of Debt: Causes and Consequences, World Bank.

Masciandaro, D, D Romelli and S Ugolini (2023), “Fiscal Dominance, Monetary Policy and Exchange Rates: Lessons from Early-Modern Venice”, Bocconi University Working Paper Series 202.

Mengus, E, G Plantin and J Barthèlemy (2021), “Large Public Debts Need Not Imply Fiscal Dominance”, VoxEU.org, 13 November.

Pezzolo, L (2018), “Public Banks and State Finance in Florence and Venice”, In L Costabile and L Neal (eds.), Financial Innovation and Resilience: A Comparative Perspective on the Public Banks of Naples (1462-1808), Palgrave Macmillan, 147-164.

Roberds, W and F R Velde (2016), “Early Public Banks I: Ledger-Money Banks”, In D Fox and W Ernst (eds.), Money in the Western Legal Tradition: Middle Ages to Bretton Woods, Oxford University Press, 321-355.

Rogoff, K (1985), “The Optimal Degree of Commitment to an Intermediate Monetary Target”, Quarterly Journal of Economics 100(4): 1169-1189.

Saito, M and J Hooley (2021), “Inflation and ‘Fiscal Dominance’: Evidence from Sub-Saharan Africa”, VoxEU.org, 6 December.

Sargent, T J (1982), “The Ends of Four Big Inflations”, In R Hall (ed.), Inflation: Causes and Effects, University of Chicago Press, Chicago and London, 41-98.

Sargent, T J and N Wallace (1981), “Some Unpleasant Monetarist Arithmetic”, Federal Reserve Bank of Minneapolis Quarterly Review, Fall, 1-17.

Ugolini, S (2017), The Evolution of Central Banking: Theory and History, Palgrave Macmillan.

Ugolini, S (2020), “The Historical Evolution of Central Banking”, In S Battilossi, Y Cassis and K Yago (eds.), Handbook of the History of Money and Currency, Springer, 835-856.