In early 2020, as COVID-19 morphed into a global pandemic, countries faced multifaceted challenges: a health crisis from a poorly understood disease, a financial crisis as investors ‘dashed for cash’ and liquidity dried up, and an economic crisis as governments announced lockdowns and mobility restrictions. How did policymakers respond to these overlapping challenges? What policy tools were available? Understanding when policy is constrained and what responses to shocks could further undermine stability is critically important. If the UK government had better understood these constraints, it might have been more cautious in the design of its October 2022 fiscal programme, a programme that sparked financial turmoil and led to the collapse of the new government.

As COVID-19 spread, many economists argued that fiscal policy should be a central part of the response in order to bolster health systems and provide immediate support to households and businesses (e.g. Hoang et al. 2020, Furman 2020). Many countries already had record debt ratios, however, and previous literature suggested that this lack of ‘fiscal space’ traditionally constrained a country’s ability to use fiscal policy to respond to crises and shocks (Romer and Romer 2018, 2019, Jordà et al. 2016). Other tools – such as monetary policy – were also believed to be constrained; in advanced economies interest rates were already near (or at) lower bounds, and in emerging economies a reduction in interest rates could aggravate capital outflows and currency depreciations. The COVID-19 period is a unique case study to understand these constraints on policy responses as it resulted from an external shock that did not reflect domestic policies or imbalances. In addition, the severity and global nature of the shock also led to the creation of several new and extremely detailed cross-country data sets tracking these responses almost in real time (IMF 2021a, 2021b, Fratto et al. 2021, Adler et al. 2021).

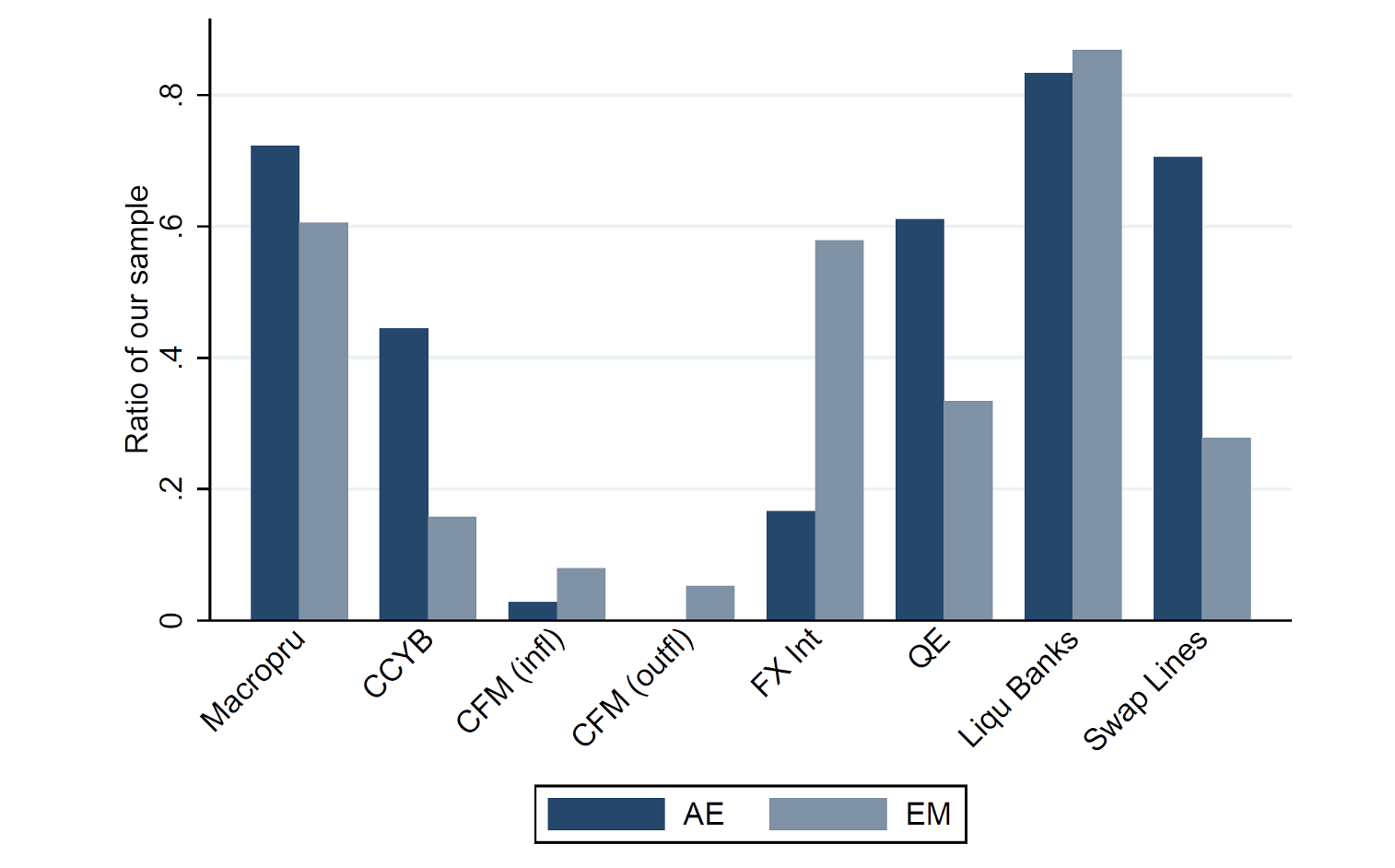

Our new paper (Bergant and Forbes 2022) uses these new data sets to better understand the choice of economic policies to respond to the initial phase of the COVID-19 pandemic. Almost all countries enacted a large fiscal stimulus (averaging about 11% of GDP) and provided monetary stimulus through a range of tools – including not only lowering their policy interest rates (by 1.7 percentage points on average), but also through asset purchase programmes, liquidity support programmes, and swap lines. Figure 1 shows the share of advanced and emerging countries adopting different forms of monetary policy, macroprudential policy, foreign exchange (FX) intervention and capital controls, during the first half of 2020. Each of these policies was widely used, except for adjustments to capital controls.

Figure 1 Changes in macroprudential policy, foreign exchange intervention, capital controls and unconventional monetary policy in response to COVID-19

Notes: Figure 3 of Bergant and Forbes (2022). Share of advanced economies (AEs) and emerging markets (EMs) that used each policy during 2021q1-2020q2. “Macropru” and “CCyB” report any easing in macroprudential regulations and the CCyB, respectively. “CFM (inf)” and “CFM (outfl)” report any easing of inflow controls or tightening of outflow controls. “FX Int” reports any use of FX reserves for exchange rate intervention. “QE”, “Liqu Banks”, and “Swap Lines” report any use of unconventional monetary policy in the form of asset purchases, liquidity provision to banks, or swap lines, respectively.

Source: Based on scraped data from the IMF’s Policy Tracker. See Bergant and Forbes (2022) for more details.

A closer analysis of these different policy responses, however, shows a striking result – the substantial variation in how different countries used each tool. For example, for fiscal policy, the size of the stimulus ranged from 1% to 37% of GDP, with some countries doing all of the stimulus using above-the-line measures (i.e. on-budget increases in spending and foregone revenue), and some doing almost all using below-the-line measures (i.e. loans, equity infusions and credit guarantees). For monetary policy, most countries lowered their policy interest rates, but the average reduction of 166bp includes one country that lowered its rate by 2277bp and another that raised by 25bp. Of the emerging markets that used FX reserves to intervene in currency markets, some used large amounts of reserves to mitigate depreciation pressures (with the largest loss equal to 8.3% of GDP), while others accumulated reserves (with the largest gain reaching 3.6% of GDP).

What explains this variation in policy responses to the COVID-19 pandemic? The most important and consistently significant determinant of the use, form, and magnitude of most policy tools was the extent of ‘policy space’ for the given tool. More specifically, countries with a higher policy interest rate before the pandemic lowered this policy rate by more and relied less on other forms of monetary stimulus (such as asset purchases and liquidity provision to banks). Countries with more FX reserves (relative to GDP) were more likely to use FX intervention (in either direction). Countries with tighter macroprudential regulations before the pandemic eased regulations more in response.

While it might seem logical that only countries with tighter policy stances ex ante can loosen these policies or regulations more in response to a shock, it is noteworthy that policy space appeared to be even more important than the extent of financial stress, economic damage, and COVID-19 cases in determining country responses.

While countries used a range of tools to respond to COVID-19, we find limited evidence that the use of these tools was coordinated, despite recent arguments and economic models suggesting that the ability to use other tools should factor into policy choice (Basu et al. 2020). For example, countries with less space to lower interest rates did not use fiscal policy more forcefully, and countries with higher debt levels did not use any form of monetary policy more forcefully. This suggests that countries are not following the predictions of standard economic models suggesting that they should rely more on fiscal stimulus when monetary policy is constrained, and that they should rely more on monetary stimulus when debt levels are high (Aizenman et al. 2019, Auerbach and Gorodnichenko 2017, Bartsch et al. 2020). Similarly, the loosening of macroprudential tools only depended on how high countries set their buffers before the pandemic, but not on the monetary stance. This series of results suggests that countries are not making optimal use of their tools as substitutes or complements, and not considering their policy tools in an integrated framework.

While policy space was a critical determinant for the use of most policy tools during the early stages of COVID-19, the one exception was for the amount of fiscal stimulus in advanced economies. Although there is some evidence emerging markets with higher debt levels were somewhat constrained in their fiscal response to COVID-19, advanced economies with less fiscal policy space (as measured by debt-to-GDP ratios or other standard metrics) were not constrained in their ability to use fiscal stimulus in the first half of 2020, especially in their use of below-the-line fiscal policy.

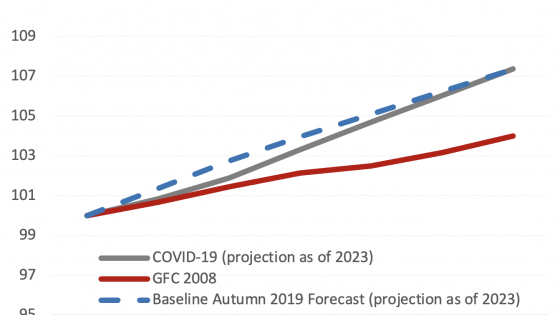

Has something changed relative to the historic experience? Are countries less constrained by existing debt levels in their ability to use fiscal stimulus to respond to shocks? This is an important topic for future work, but it is worth briefly considering several possible hypotheses. First, the exogenous nature of the COVID-19 pandemic may have reduced concerns about a country’s ability (or willingness) to repay additional debt, as it did not reflect prior policy mistakes or domestic imbalances. Second, market participants may have expected that most of the negative impact of the pandemic would be short-lived – which is the standard situation when a large and temporary stimulus to smooth incomes is the optimal policy response to reduce scarring (IMF 2020a, Blondeau 2021). Third, the low interest rate environment in 2020 would have increased countries’ debt capacity through the decrease in expected debt service costs. Fourth, the nature of the health shock, for which fiscal policy was the most effective tool to save lives, address the inequities from the pandemic, and help economies recover, may have reduced concerns about large stimulus packages.

Understanding which of these factors reduced the constraints on the fiscal responses to the pandemic is important in evaluating how much governments should prioritise building fiscal space in order to be able to use fiscal policy in the future. The experience of the UK in October may be a poignant warning. Debt levels may be more of a constraint on fiscal policy in the future – especially against a backdrop of higher borrowing costs and if the shock is caused by domestic policy. For other policies, the lesson from COVID-19 is even more clear-cut. In order to be able to use this range of tools to respond to shocks in the future, policymakers should prioritise creating space through raising interest rates, tightening regulations, and building FX reserves when appropriate and as their economies recover.

References

Adler, G, K S Chang, R Mano and Y Shao (2021), “Foreign Exchange Intervention: A Dataset of Public Data and Proxies”, IMF Working Paper.

Aizenman, J, Y Jinjarak, H T K Nguyen and D Park (2019), “Fiscal Space and Government Spending and Tax-Rate Cyclicality Patterns: A Cross-Country Comparison, 1960-2016”, Journal of Macroeconomics 60: 229-252.

Auerbach, A and Y Gorodnichenko (2017), “Fiscal Stimulus and Fiscal Sustainability”, in Fostering a Dynamic Global Economy, Proceedings of the Kansas City Federal Reserve Banks, Jackson Hole, Wyoming.

Bartsch, E, A Bénassy-Quéré, G Corsetti and X Debrun (2020), It's All in the Mix: How Monetary and Fiscal Policies Can Work or Fail Together, Geneva Reports on the World Economy 23, ICMB and CEPR.

Basu, S, E Boz, G Gopinath, F Roch and F Unsal (2020), “A Conceptual Model for the Integrated Policy Framework”, IMF Working Paper.

Bergant, K and K J Forbes (2021), “Macroprudential Policy During COVID-19: The Role of Policy Space”, CEPR Discussion Paper No. 16607.

Bergant, K and K J Forbes (2022), “Policy Packages and Policy Space: Lessons from COVID-19”, CEPR Discussion Paper No. 17699.

Blondeau, F, K McMorrow, A Thum-Thysen, C Maier, A Hristov, B Döhring and F D’Auria (2021), “Output gaps, potential output and the COVID-19 crisis: Policymaking under uncertainty”, VoxEU.org, 10 December.

Fratto, C, B Vannier, B Mircheva and H Ward (2021), “Unconventional Monetary Policies in Emerging Markets and Frontier Countries”, IMF Working Paper.

Furman, J (2020), “Protecting people now, helping the economy rebound later”, VoxEU.org, 31 May.

Hoang, D, M Weber and F D’Acunto (2020), “Unconventional fiscal policy to exit the COVID-19 crisis”, VoxEU.org, 8 June.

International Monetary Fund (2020a), Fiscal Monitor October 2020: Policies for the Recovery.

International Monetary Fund (2021a), “Policy Tracker”.

International Monetary Fund. (2021b). “Fiscal Monitor Database of Country Fiscal Measures in Response to the COVID-19 Pandemic”.

Jordà, O, M Schularick and A Taylor (2016), “Sovereigns versus Banks: Credit, Crises, and Consequences”, Journal of the European Economic Association 14(1): 45–79.

Romer, C and D Romer (2019), “Fiscal Space and the Aftermath of Financial Crises: How it Matters and Why”, Brookings Papers on Economic Activity.

Romer, C and D Romer (2018), “Why Some Times Are Different: Macroeconomic Policy and the Aftermath of Financial Crises”, Economica 85 (337): 1–40.