In recent years, rising geopolitical tensions have led to a surge in restrictions on trade and capital flows. Import restrictions and export controls based around national security concerns are on the rise (Hoekman et al. 2023), increasing the risk of geo-economic fragmentation (Aiyar et al. 2023).

Against this backdrop, most advanced economies have adopted or tightened their existing investment screening mechanisms (ISMs), which empower national authorities to review, and potentially condition or prohibit, transactions that may threaten domestic interests, including national security and public order.

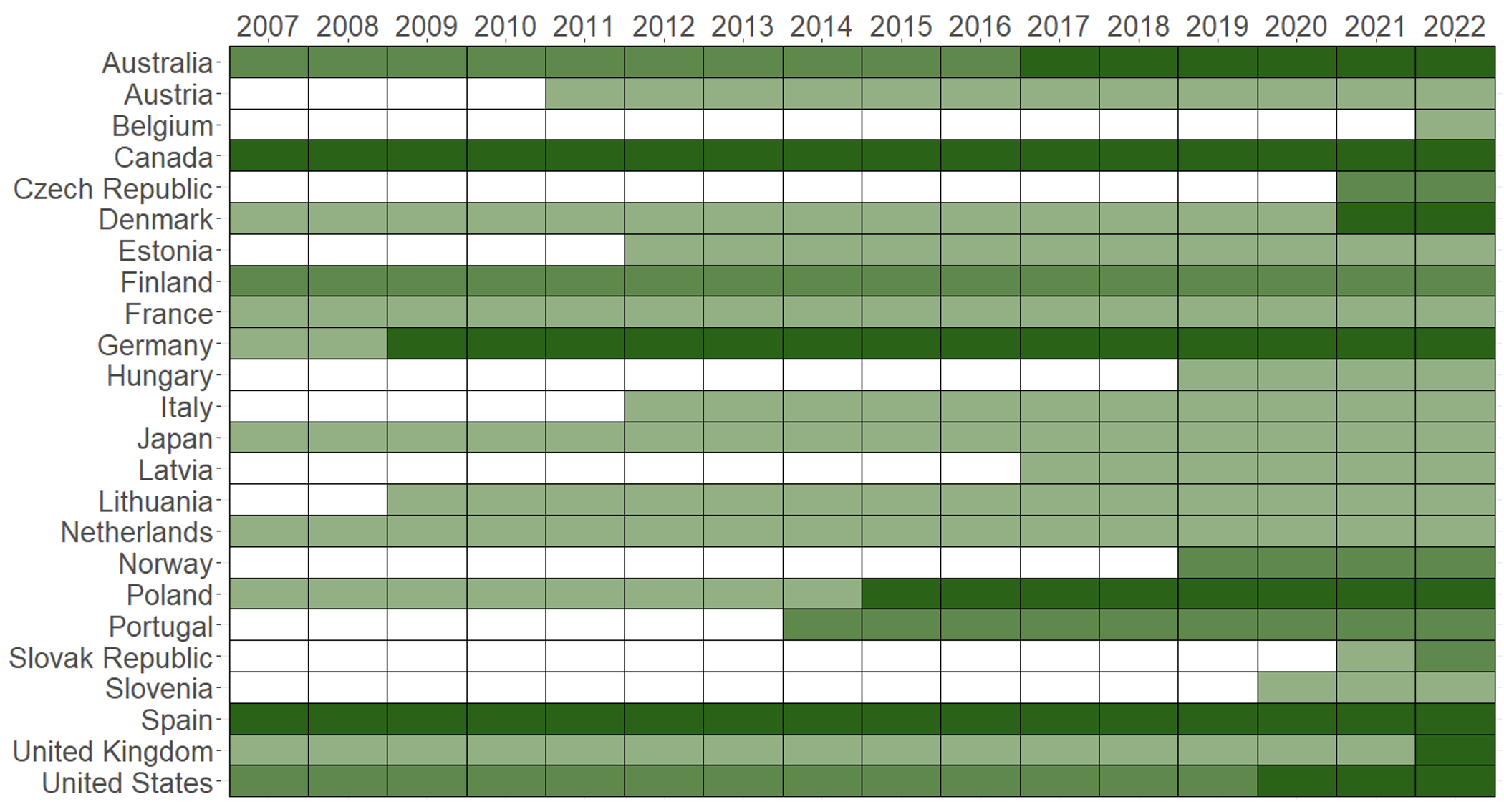

Figure 1 shows that a number of advanced economies, which have traditionally been open to foreign investments, implemented stricter scrutiny of foreign transactions from the late 2010s onward. Alongside these national developments, in 2019 the EU adopted a framework to ensure Union-wide coordination and cooperation on the screening of foreign direct investment (FDI).

At the same time, the notion of national security has expanded beyond the defence industry to assets previously not deemed strategic. The scope of most FDI screening regimes now encompasses transactions relating to critical infrastructure (whether physical or virtual, including data processing and storage and financial infrastructure), communication networks, or advanced technologies (AI, robotics, bio-technologies, etc.).

Although most national investment screening mechanisms do not overtly single out any particular country, the existing literature focuses on these mechanisms as a response to the rise of Chinese outward investment (Eichenauer et al. 2021). National security threats from Russia have also played a role in the rise of investment screening mechanisms in Central and Eastern European countries (Bauerle Danzman and Meunier 2023a). More recently, the Covid-19 pandemic strengthened governments’ commitment to preventing the sale of strategic domestic assets to foreign investors (Evenett 2021).

Figure 1 The rise of investment screening mechanisms in advanced economies

Note: Most countries that did not have an investment screening mechanism (white tiles) have adopted such mechanisms over the past decade (green). A number of countries have shifted from sectoral mechanisms (where the government has the authority to review a list of sectors, shown in light green) to a cross-sectoral (green) or mixed mechanism (dark green), where the government can review investments in any sector and subject a specific list of sectors to stricter review requirements.

Source: PRISM database; Bauerle Danzman and Meunier (2023b).

EU countries do not systematically have the strictest regimes compared to other advanced economies

In a recent paper (Bencivelli et al. 2023), we analyse whether investment screening mechanisms strike a balance between the need to maintain an open and attractive investment environment and a desire to ensure enhanced scrutiny of potentially hostile foreign takeovers.

We make several contributions to the literature:

- First, we have built a comprehensive database mapping the main features of FDI screening regimes in major advanced economies.

- Second, we provide a composite index measuring the restrictiveness of screening regimes. To the best of our knowledge, this is the first attempt to propose an indicator suitable for cross-country comparisons of FDI screening regimes.

The identification of potentially threatening transactions relies on combinations of several criteria and parameters, which contributes to challenges in comparing different mechanisms and their scope of application (Pohl and Rosselot 2020).

The index covers five dimensions:

- Investor-related parameters (eg. origin of investors subject to review or enhanced scrutiny for investors controlled by foreign governments) and territorial scope of the investment screening mechanism (eg. extraterritorial scope of national legislation)

- Sectoral scope and coverage of greenfield investments

- Transactions subject to review and thresholds triggering a review

- Screening procedure

- Enforcement and sanctions for non-compliance

The investment screening mechanism restrictiveness index ranges from zero (relatively less restrictive) to one (relatively more restrictive). It highlights two main findings:

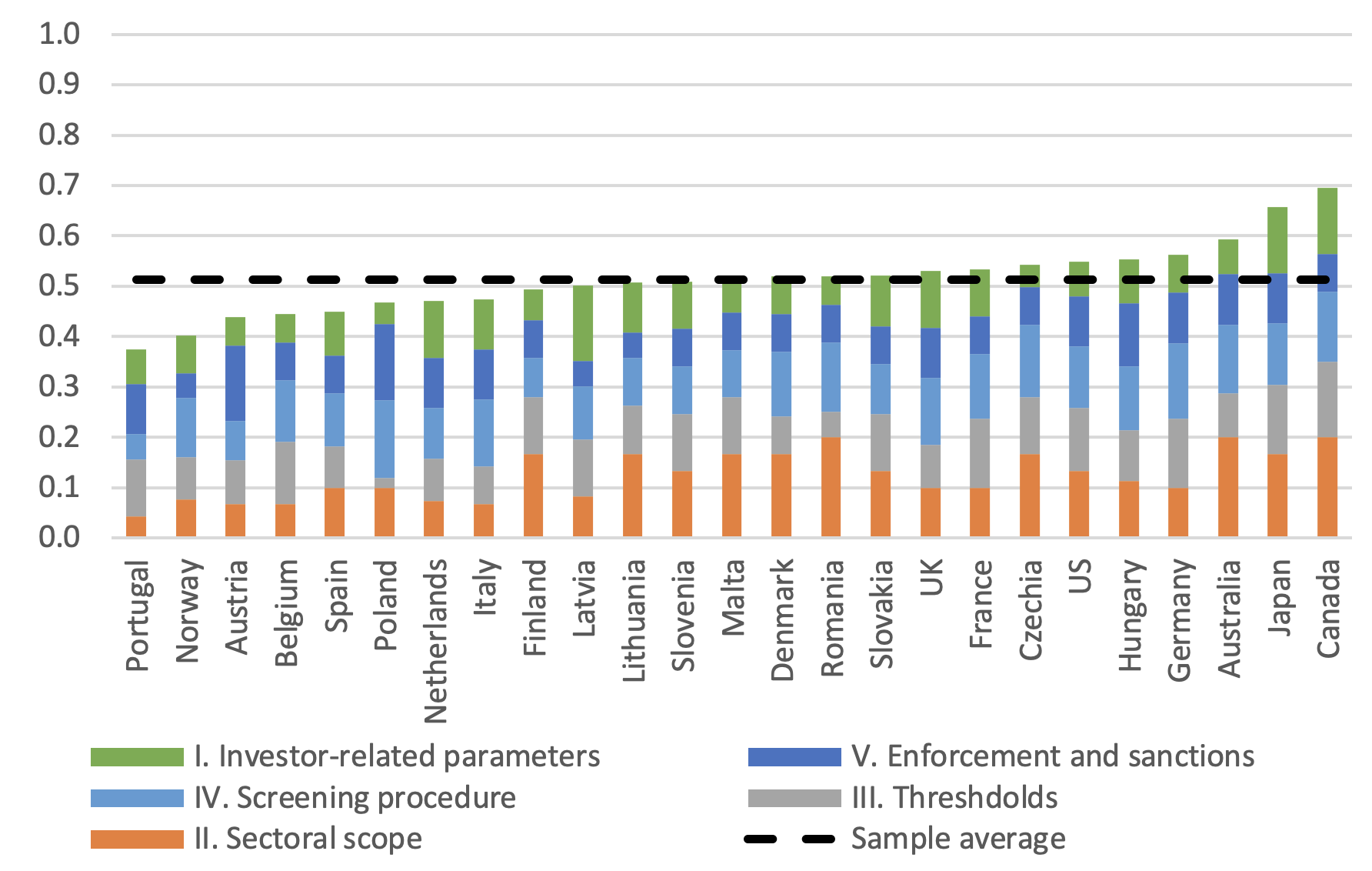

- First, the most restrictive mechanisms are found in Australia, Japan, and Canada, which have been filtering investments for a long time. Hence, EU countries do not systematically have the strictest regimes (see Figure 2).

- Second, the index is helpful for tracking the pace of legislative convergence within the EU.

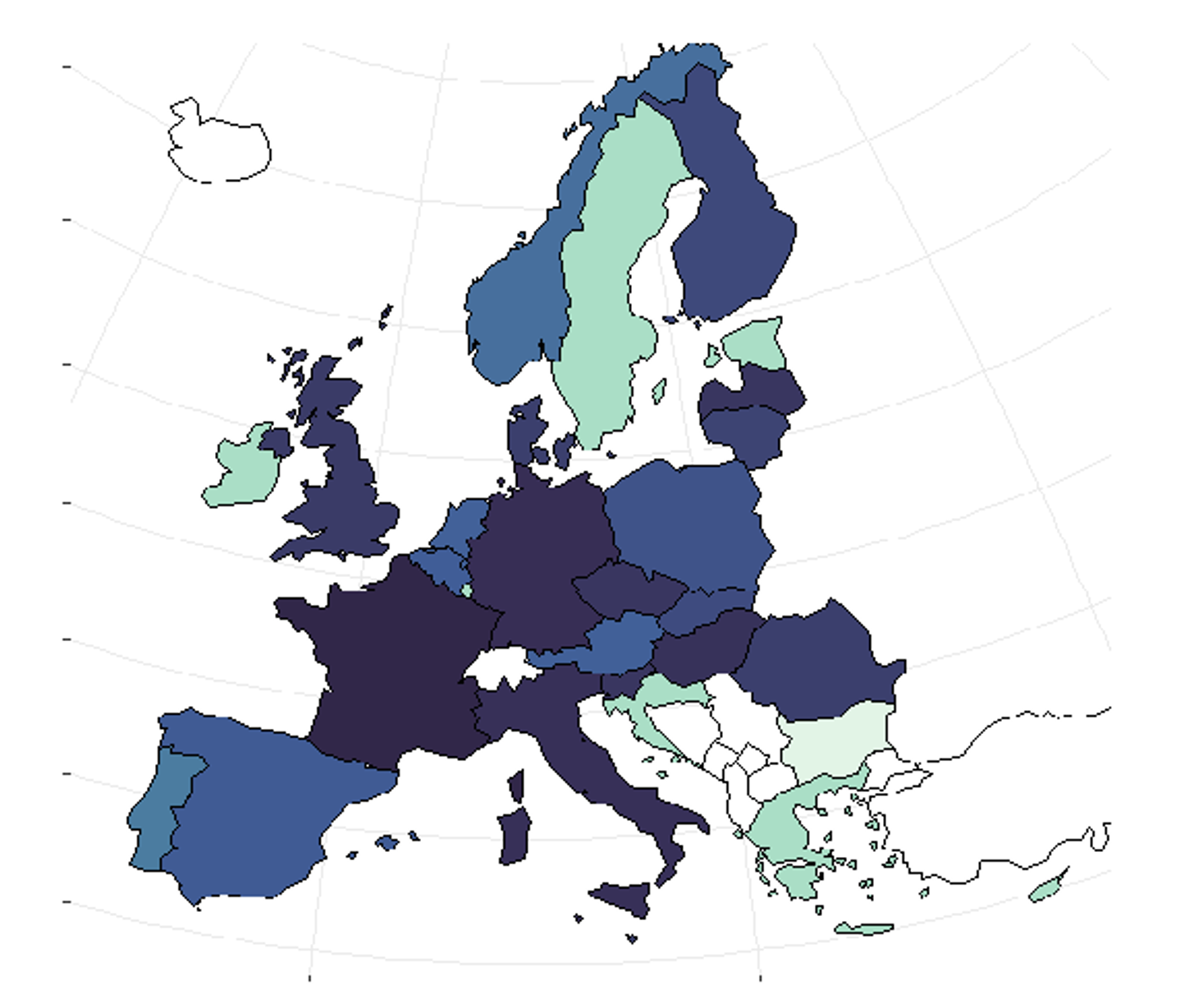

While the EU regulation aims to facilitate convergence in national screening regimes,

the index outlines their heterogeneity (see Figure 3). Few restrictions apply in Portugal, Austria, and the Netherlands, whereas screening regimes are stricter and have been amended more recently in France and Germany. The latter two countries already had screening regimes in place in the early 2000s and were the earliest proponents of the EU framework for screening inward investment (Chan and Meunier 2022).

Figure 2 Restrictiveness and heterogeneity of national investment screening mechanisms in advanced economies

Note: the index ranges from 0 (relatively less restrictive investment screening mechanism) to 1 (relatively more restrictive investment screening mechanism). The highest score for any dimension is capped at 1 (full range of restrictions on FDI on national security grounds) and the lowest is 0 (no restrictions on foreign investments). Scores are scaled down when restrictions only apply to a subset of investors or transactions. Each dimension consists of several items, the scores of which are averaged to obtain the dimension score.

Figure 3 Restrictiveness and heterogeneity of national investment screening mechanisms in Europe

Note: Dark (light) blue: relatively more (less) restrictive investment screening mechanism. Green: consultative or legislative process expected to result in the adoption of a new mechanism. Light green: no legislative initiative.

Macroeconomic and geopolitical factors shape the restrictiveness of investment screening mechanisms

We show how country-specific characteristics and geopolitical factors shape the restrictiveness of national investment screening mechanisms. We focus on three factors that may result in more restrictive regimes.

- First, we check whether the restrictiveness of national investment screening mechanisms correlates with variables reflecting commercial links and exposure to Chinese investors. Overall, advanced economies that are highly exposed to investments from China tend to be more restrictive.

- Second, we focus on natural resources and technological specialisation. Technology transfer associated with foreign acquisitions might be a greater concern in economies with a larger share of R&D in sectors related to critical technology. Resources-rich countries might also be more likely to scrutinise foreign takeovers in the mining industry. We show that the restrictiveness of national investment screening mechanisms correlates with the number of patents per capita.

- Third, geopolitical factors might be another driver of FDI screening. We check whether the restrictiveness of national investment screening mechanisms correlates with geopolitical distance from either the US, China, or Russia, based on voting patterns at the United Nations General Assembly (Bailey et al. 2017).

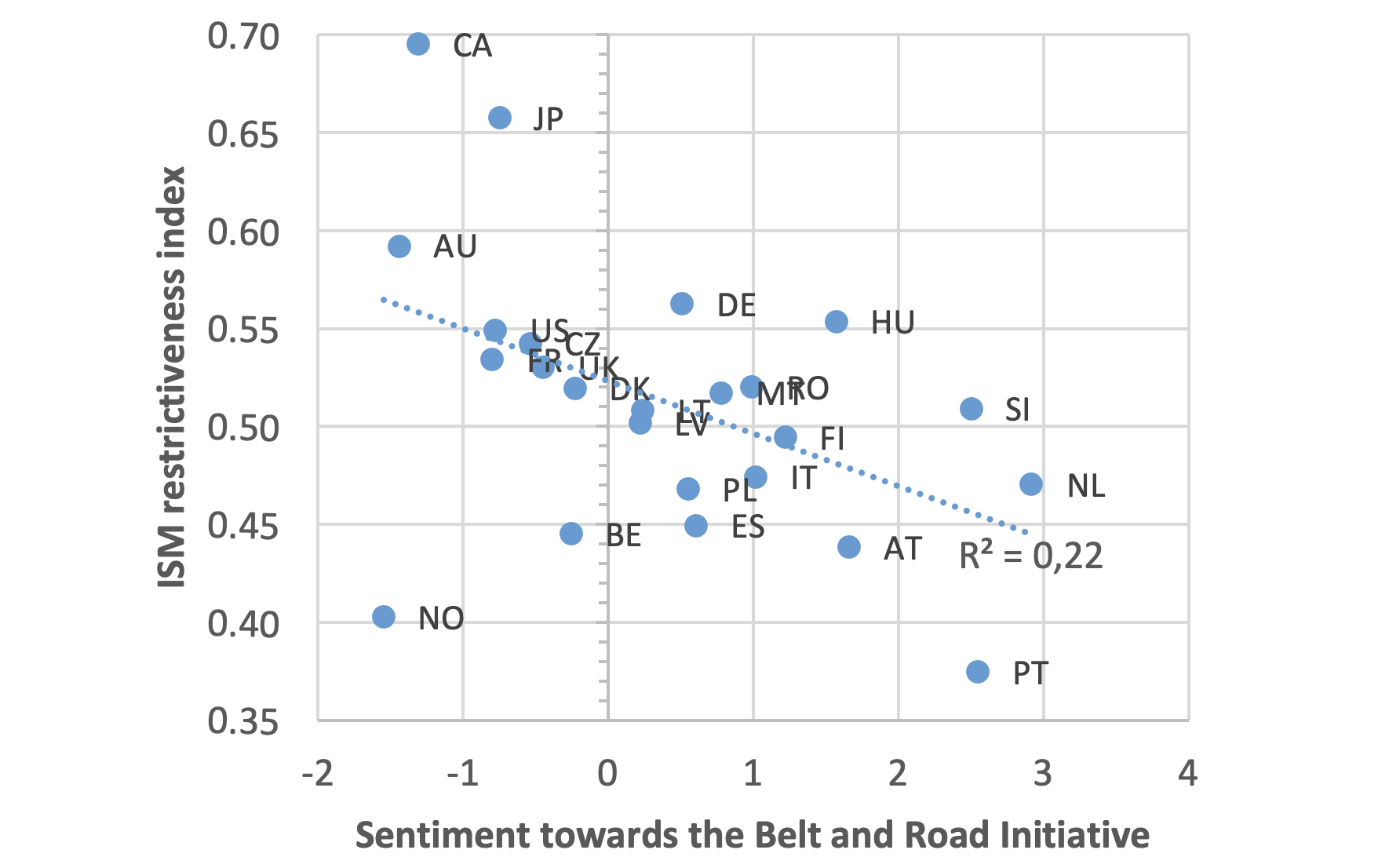

Countries that are geopolitically aligned with the USA tend to have stricter investment screening mechanisms, while negative sentiment towards the Chinese Belt and Road Initiative correlates with more restrictive investment screening mechanisms (see Figure 4).

Figure 4 Investment screening mechanism restrictiveness index and public sentiment towards the Belt and Road Initiative

Note: The chart shows the relationship between the investment screening mechanism restrictiveness index and sentiment towards the Belt and Road Initiative. A positive sentiment means that public media in the country favours the Belt and Road Initiative (BRI), whereas a negative tone indicates a negative sentiment. The correlation between the ISM restrictiveness index and sentiment towards the Belt and Road Initiative is negative, suggesting that countries that feel most negatively about the Belt and Road Initiative implement stricter ISMs.

Sources: Garcia-Herrero and Schindowski (2023), and Bencivelli et al. (2023).

Restrictive investment screening mechanisms can coexist alongside an otherwise liberal investment environment

Investment screening can coexist alongside an otherwise liberal investment regime. Indeed, there is no systematic correlation between the restrictiveness of national investment screening mechanisms and attractiveness to foreign investors, as reflected by foreign investment inflows.

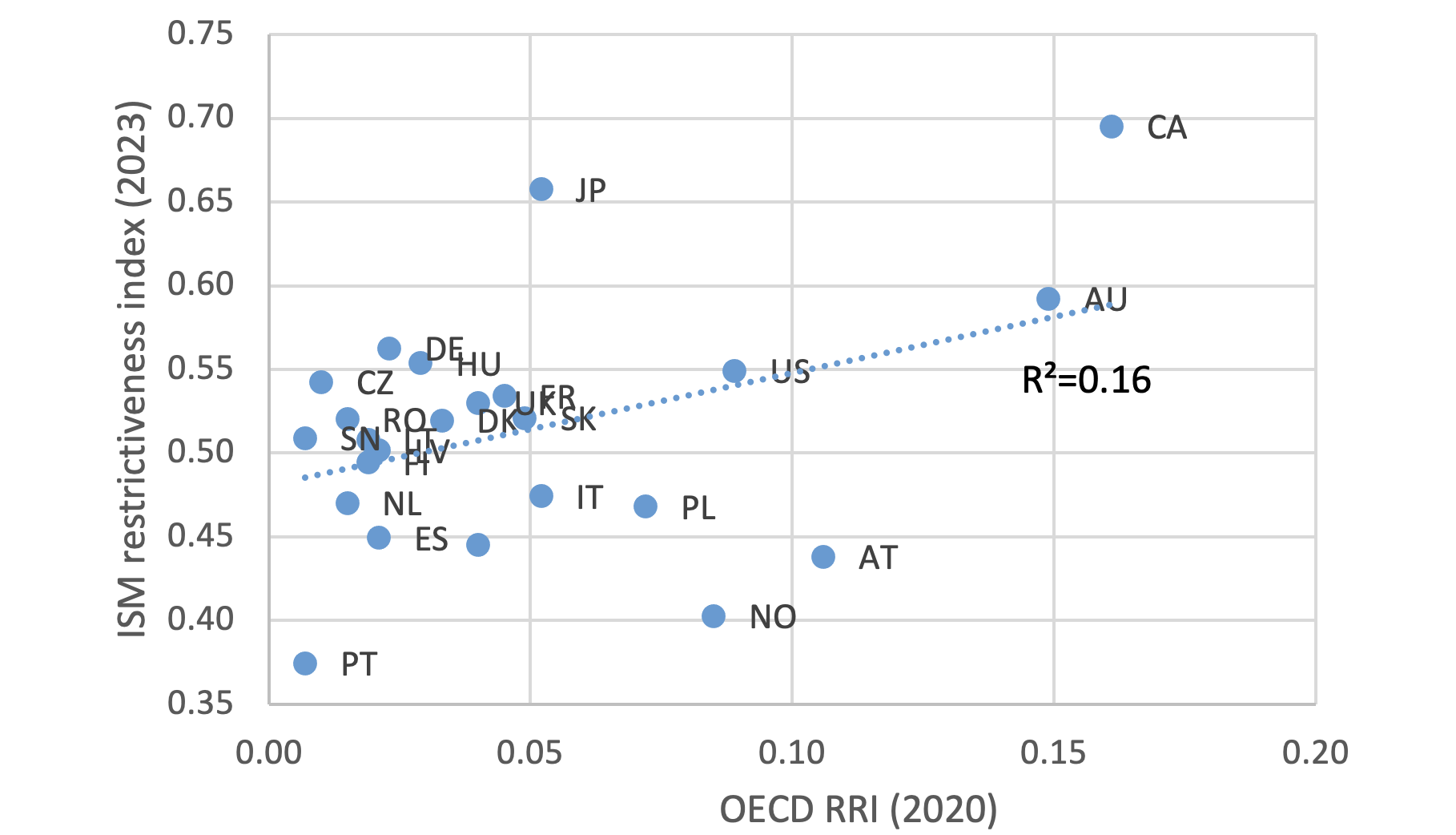

The investment screening mechanism restrictiveness index usefully complements existing indicators of FDI restrictiveness, which focus on distinct mechanisms for controlling inward investment. Figure 5 shows the low, albeit positive, correlation between the ISM restrictiveness index and the OECD’s Regulatory Restrictiveness Index (RRI), which excludes screening on national interest or national security grounds.

Figure 5 Correlation between the investment screening mechanism restrictiveness index and the OECD’s Regulatory Restrictiveness Index (RRI)

Note: Both the Regulatory Restrictiveness Index and investment screening mechanisms restrictiveness index range from 0 (relatively open regime) to 1 (relatively restrictive). The correlation between the ISM restrictiveness index and the RRI is positive: in both cases, the higher the index, the stricter the regime. The OECD’s FDI Regulatory Restrictiveness Index (RRI) measures statutory restrictions on FDI. Measures taken for reasons of public order and essential security interests are not scored. By contrast, the ISM restrictiveness index focuses on investment screening on grounds of national security or public order.

Sources: OECD, Bencivelli et al. (2023) and author’s calculations.

Conclusions

Overall, the recent tightening of national investment screening mechanisms has not coincided with investors’ reappraisal of the most attractive destinations.

Although a large number of transactions are subject to review, the number of blocked transactions is limited, suggesting that investment screening mechanisms strike a balance between openness to FDI and the protection of national interests. However, the limited number of blocked transactions could also reflect the deterrent effect of investment screening mechanisms.

Determining whether the recent tightening of investment screening mechanisms has affected foreign investment flows is challenging. Indeed, foreign investment screening is one of many factors that could influence FDI inflows. The literature suggests that the key determinants of FDI flows are sound macroeconomic conditions (investment returns, access to markets, etc.), together with institutional factors (good governance, low sovereign risk, and a stable legal system). In this respect, transparent foreign investment screening regulations might improve the perceived transparency of government regulations.

Authors’ note: The views expressed are those of the authors and do not necessarily reflect those of the Banque de France or the Banca d’Italia.

References

Aiyar, S and A Ilyina (2023), “Geo-economic fragmentation: What it means for multilateralism”, VoxEU.org, 29 March.

Bailey, M, A Strezhnev and E Voeten (2017), “Estimating dynamic state preferences from United nations voting data”, Journal of Conflict Resolution 61(2): 430–456.

Bauerle Danzman, S and S Meunier (2023a), “Naïve no more: Foreign Direct Investment screening in the European Union”, Global Policy (00):1-14.

Bauerle Danzman, S and S Meunier (2023b), “Mapping the Characteristics of Foreign Investment Screening Mechanisms: the New PRISM Dataset”, International Studies Quarterly 67(2).

Bencivelli, L, V Faubert, F Le Gallo and P Négrin (2023), “Who’s afraid of foreign investment screening”, Banque de France Working Paper No. 2023/927.

Chan, Z and S Meunier (2022), “Behind the Screen: Understanding National Support for a Foreign Investment Screening Mechanism in the European Union”, The Review of International Organizations 17(3): 309-322.

Eichenauer, V, M Dorsc and F Wang (2021), “Investment Screening Mechanisms: the Trend to Control Inward Foreign Investment”, EconPol Policy Reports 34(5).

European Commission (2022), “Screening of FDI into the Union and its Member States”, Commission Staff Working Document, SWD(2022)219.

Evenett, S J (2021), “What caused the resurgence in FDI screening”, SUERF Policy Note 240: 1–20.

Garcia-Herrero, A and R Schindowski (2023), “Global trends in countries’ perceptions of the belt and road initiative”, technical report, Bruegel Working Paper.

Hoekman, B, C Petrocs, D Mavroidis and R Nelson (2023), “Non-economic objectives, globalisation, and multilateral trade cooperation”, VoxEU.org, 11 September.

Kalinova, B, A Palerm and S Thomsen (2010), “OECD’s FDI Restrictiveness Index: 2010 Update”, OECD Working Papers on International Investment 2010/3, OECD Publishing.

Pohl, J and N Rosselot (2020), “Acquisition- and ownership-related policies to safeguard essential security interests – current and emerging trends, observed designs, and policy practice in 62 economies”, technical report, OECD.