Gone are the days when investors’ sole request to asset managers was to make them rich. In today’s world, driven by mounting concerns over climate change, growing social consciousness, and a stronger emphasis on ethical practices, investors seek sustainable investment options. Responding to this demand, the asset management industry has swiftly capitalised on the opportunity. According to Diab and Adams (2021), responsible firms are on track to manage a staggering $53 trillion in assets by the conclusion of 2025.

While certain investors hold the belief that sustainability is a panacea, delivering both superior returns for themselves and a better world for all, academic research has consistently cautioned that there is no free lunch. Scholars have emphasised time and again that ex-ante, a fund cannot be inherently responsible and simultaneously deliver consistently superior performance (Gantchev et al. 2022, Ceccarelli et al. 2023). While responsible investing can align with ethical values and promote positive societal impacts, it forces fund managers to shun high-performing yet controversial assets, such as those issued by polluting firms or by businesses operating in ‘sin industries’ (Hong and Kacperczyk 2009, Kacperczyk and Bolton 2021).

Yet, sustainability used to be in the eye of the beholder. Is Tesla sustainable? While Tesla cars do not pollute, Tesla’s record on workplace practices and occupational safety is unimpressive. It is easy enough for asset managers to make an argument in favour of Tesla stock if they wanted to buy it, or against it if they did not want to. This changed in 2016, when Morningstar became the first company to start assigning ratings to funds based on how sustainable their disclosed portfolios were. In its most popular version of such ratings, Morningstar ranks funds from one globe (the least sustainable funds in their category) to five globes (for the most sustainable funds). These objective and easy-to-interpret metrics have been a game-changer for a segment of the industry still lacking regulation and transparency.

The ratings also changed managers’ incentives: it doesn’t look good if you run an environmental, social, and governance (ESG) fund and you are ranked poor in sustainability. Despite the positive impact on the industry, sustainability ratings have one limitation: they rely on portfolios disclosed by the funds themselves. In the US, funds are legally required to disclose their portfolios four times a year (at the end of each fiscal quarter), with some voluntarily disclosing more frequently, up to 12 times per year. In most European countries, disclosure is obligatory at least twice a year. Although this provides some transparency, it still means that investors only know with certainty the assets held by their funds on four days per year in the US and two days per year in Europe.

What assets do ESG funds hold during the rest of the time? The infrequent disclosure of portfolios poses a challenge as it opens the possibility for a fund to strategically purchase ESG stocks just before disclosure, thereby earning a high sustainability rating, and subsequently shifting to higher-yielding yet less responsible assets when detection is unlikely. In Parise and Rubin (2023), we explore this trading practice, which we refer to as ‘green window dressing’. Due to the lack of daily observations of fund holdings, we infer them from fund returns, as returns are reported daily. The intuition behind our approach is as follows: if a fund primarily invests in ESG stocks, its performance should closely correlate with the main ESG indexes. When ESG stocks perform well, the fund should also excel, and vice versa. However, we demonstrate that the correlation with ESG indexes drops significantly right after mandated disclosure, while a sudden increase in correlation appears with stocks of high CO2 emitters. This behaviour indicates that some funds engage in green window dressing with benefits for their performance and ability to attract investors.

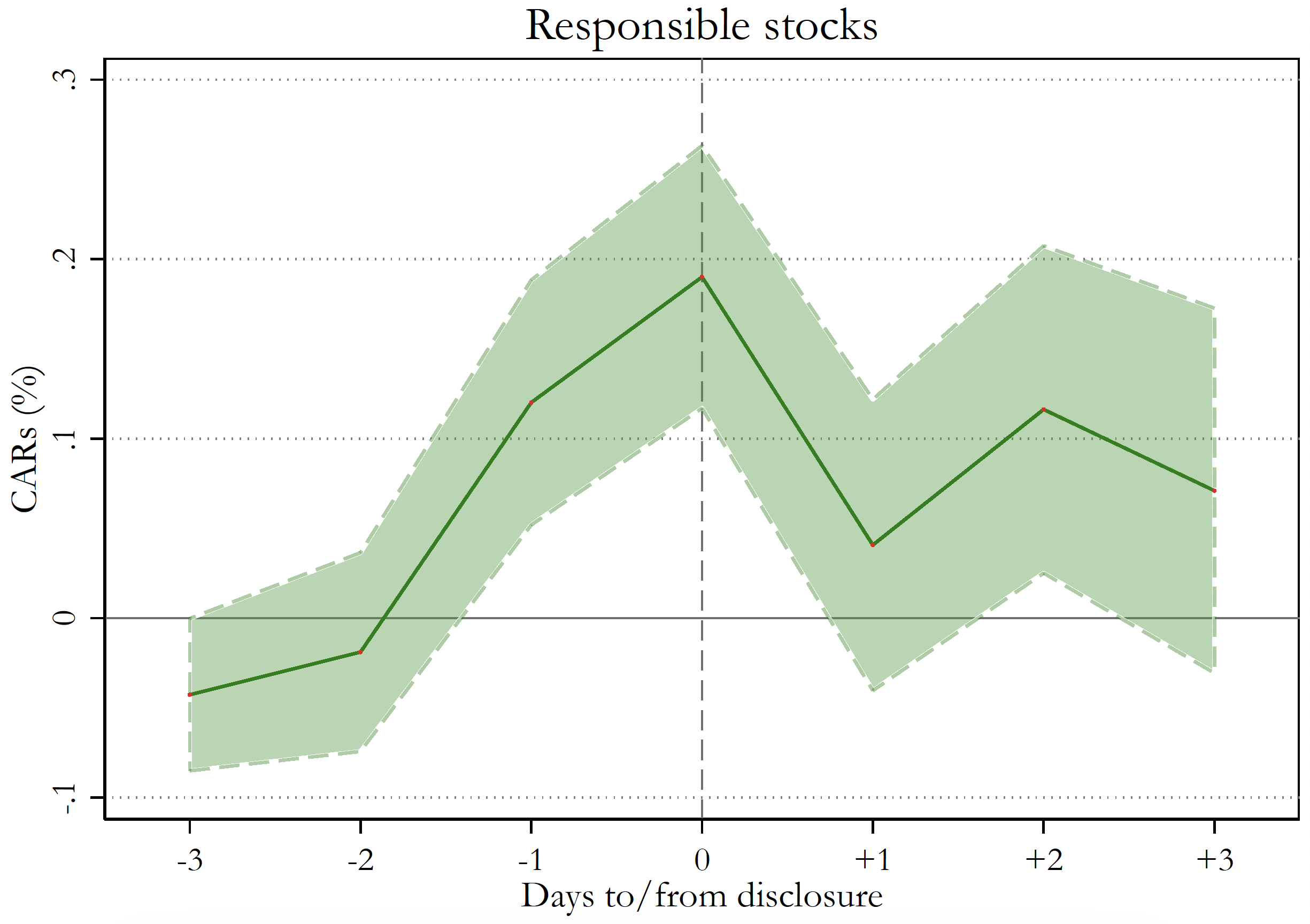

We also document substantial but short-lived asset pricing implications. Figure 1 shows that high-ESG stocks deliver positive cumulative abnormal returns (CARs) in the days leading up to fund disclosure, consistent with the notion that fund managers bid up their prices when attempting to greenwash their portfolios. Yet, the sudden surge in prices swiftly reverts after disclosure, suggesting that fund managers either cease to purchase high-ESG assets or divest from them altogether.

Figure 1

Note: This figure illustrates average cumulative abnormal returns (CARs) for stocks in the top 20% of MSCI ESG ratings in the [-3,+3]-day interval around fund disclosure.

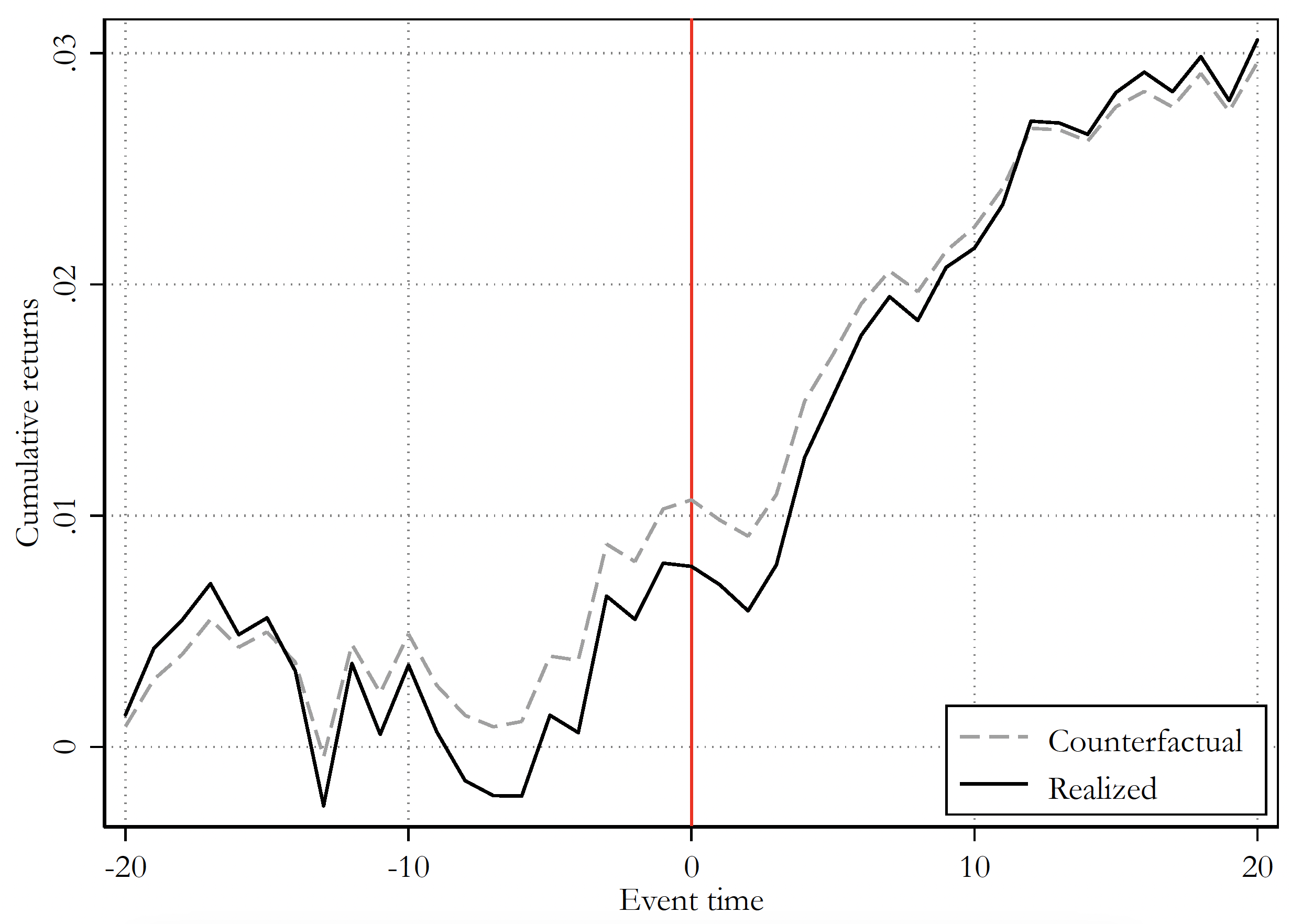

As a final piece of evidence, we calculate the hypothetical returns a fund would earn based on the disclosed portfolio and compare them to its realised returns. In Figure 2, we observe that in the ten days leading up to disclosure, funds tend to underperform the portfolio they are about to disclose. This observation is consistent with the idea that, during this period, they incur meaningful transaction costs as they adjust their portfolio to include more environmentally friendly and sustainable assets. However, following the disclosure event, we notice a shift in performance dynamics. Funds begin to outperform the portfolio that they have just disclosed, indicating that they are now holding higher-paying assets than the ones they have recently made public. This trend is in line with the hypothesis that after the disclosure event, funds might replace some ESG assets with higher-yielding but less sustainable assets.

Figure 2

Note: This figure illustrates average realized vs hypothetical daily fund returns in the [-20,+20]-day interval around fund disclosure. Hypothetical returns are based on portfolio stock holdings disclosed at event time 0.

Our analysis does not paint a picture that is entirely bleak. While our statistical findings indicate that a significant number of funds engage in green window dressing, it is essential to acknowledge that an almost equal number does not. In conclusion, a clear message emerges from our analysis: those who viewed responsible investing as the definitive solution to address sustainability issues in the corporate world may need to reconsider. While responsible investing has clear merits and can lead to positive impacts, our research highlights the importance of scrutiny and regulation to disentangle true sustainability from greenwashing.

References

Ceccarelli, M, S Ramelli and A F Wagner (2023), “Low-carbon mutual funds”, Review of Finance, forthcoming.

Diab, A and G M Adams (2021), “ESG assets may hit $53 trillion by 2025, a third of global AUM”, Bloomberg Intelligence.

Gantchev, N, M Giannetti and R Li (2022), “Sustainability or performance? Ratings and fund managers’ incentives”, Swedish House of Finance Research Paper.

Hong, H and M Kacperczyk (2009), “The price of sin: The effects of social norms on markets”, Journal of Financial Economics 93(1): 15-36.

Kacperczyk, M and P Bolton (2021), “Global pricing of carbon-transition risk”, VoxEU.org, 24 March.

Parise, G and M Rubin (2023), “Green Window Dressing”, CEPR Discussion Paper 187270.