A recent Communication of the European Commission observes that “the most notable success of the RRF [Recovery and Resilience Facility] so far is the coherent sequencing between reforms and investments and a results-based approach that is pivotal to the program’s effectiveness”. The results-based approach, organised into milestones and targets, incentivises methodical planning and facilitates more efficient implementation, since milestones and targets represent concrete steps towards the implementation of each measure.

Reforms are the main benefit from the RRF. Investments – the other component of the RRF – can raise output growth in the short run but cannot cure Europe’s growth malaise; this requires reforms, something especially true in the case of Italy, the largest recipient of RRF funds.

Were Italy to fail in implementation of these reforms, the argument for repeating the use of EU common debt – for areas such as EU defence (as suggested by President Macron and others), the Green Transition, or the reconstruction of Ukraine – would run into insuperable opposition. For this reason, evidence of Italy’s progress in adopting the reforms, agreed as part of the RRF, is important.

The RRF has not had good press. In an article in the Financial Times on 11 May 2024, Tony Barber expressed considerable doubts about the ability of the RRF to improve on the unimpressive record of earlier EU initiatives, such as the Lisbon Agenda, which have been unable to reverse a pattern of “excessive regulation, not enough competition, insufficient incentives to innovate and invest”. Similarly, Boeri and Perotti (2023), based on scant evidence, argue that the Italian programme is a historic failure: no reforms and a waste of resources. Italy is investing, thanks to the RRF, an amount close to 12% of the country’s 2020 GDP. It is by far the largest portion of the RRF programme. If Boeri and Perotti were right, their evidence (recently echoed by Luis Garicano) would provide a decisive argument against repeating the RRF.

In CEPR Policy Insight No. 130 (Giavazzi and Goretti 2024), we document the disruptive role that the RRF can play, and is playing, in kick-starting long-delayed reforms in Italy.

Judiciary

The RRF reform of Italy’s judicial system targets all levels of judgement, from the lower courts to the Supreme Court of Cassation, and all types of courts, from civil to criminal to administrative. As of December 2023, two years into the RRF, there was a significant reduction in the backlog: the outstanding backlog of cases was down by 50% for Tribunals and 43% for Courts of Appeal, compared to the 90% reduction expected at the end of the plan (June 2026).

For criminal justice the results are striking. The reduction is observable in all phases of judgement: 27.0% in the courts, 22.3% in the courts of appeal and 33.8% in the court of cassation, with an average reduction of 25%. Two and a half years ahead of the set date, the final target has already been achieved. A similar reduction is registered for the disposition time of civil justice (17.4% in Dec 2023), almost halfway towards the achievement of the final target of a 40% reduction.

In conclusion, the civil justice intermediate target for December 2024 is already very close to being fully achieved. As for the final targets, with two and a half years left to complete the programme (out of a total of four and a half years), the civil justice system is halfway towards reaching its final targets and the criminal justice system has already reached them.

Public procurement

The reform of public procurement is another key RFF reform aimed at a sector in which Italy performs poorly compared with other European countries. The main objectives of this reform are to simplify public procurement rules, increase legal certainty for businesses, and accelerate the award of public contracts, while maintaining procedural guarantees in terms of transparency and equal treatment, thus reducing the margin for corruption.

Current available figures describe a system where the benefits from professional, centralised purchases were not a concern. The new qualification system for procurement stations, which came into force on 1 July 2023, produced a reduction of stations to around 4,800, a fraction of the number of stations operating in previous years. Beyond changing Italy’s procurement, the new system has also started a process of aggregation. The 533 central purchasing bodies (for works and supplies) represent 8,630 affiliated administrations. On average, each central purchasing body has 16 affiliates, but the distribution is strongly concentrated in the largest central purchasing bodies (>12 affiliates), which cover 75% of the affiliated administrations.

The reform provides for continuing evaluation of the selected stations, along two criteria: competence in the conduct of tenders and in the execution of contracts; and their ability to effectively satisfy the needs of those who have not qualified. For this to be possible, a profound administrative reorganisation must be encouraged, with human and financial resources reallocated to centralised structures. Furthermore, innovative contractual instruments must be fully exploited, such as the Accordi Quadro, which tested very positively within RRF tenders.

The integrated water services reform

The aim of the reform of water services is to reduce fragmentation of the sector, where excessive fragmentation hinders an efficient use of water resources and has never allowed an adequate level of investment. In some parts of the country, water services are often still managed directly by municipalities, even relatively small ones, which are usually without adequate resources or professional skills to perform this function.

In 2021, as the RRF came into effect, four particularly problematic regions – Campania, Calabria, Molise, and Sicily – signed a memorandum of understanding which sets objectives in terms of creating local water management authorities, reducing the number of operators, and achieving economies of scale in view of the definition of unique operators. The new legislation, adopted in 2022 to implement the reform, sets deadlines for the choice of a single operator and strengthens the substitutive powers against non-compliant administrations, i.e. the transfer of decision-making power to the president of the region, and were this not to work, to the Office of the Prime Minister.

As underlined in the European Commission’s preliminary assessment for the disbursement of the third RRF tranche, at the end of 2022, award of water services to a single operator had already occurred in all Optimal Territorial Zones (Ambio Territoriale Ottimale, or ATOs) except six (Irpino, Napoli Nord, and Sannita in the Capania region; and Messina, Siracusa, and Trapani in Sicily). In those cases, substitutive powers have been triggered.

Calabria, the most striking example, has created a single operator (ARRICAL) which will absorb (with limited exclusions, consistent with the law) the services of the municipalities that still have direct management. According to the Bluebook 2023, published by Utilitatis, 96% of Calabrian municipalities managed water services directly, covering 89% of the regional population.

The RRF started a process that had been on hold for years and which today has a good chance of being completed, permanently modifying the structure of the water sector in those parts of the country that record serious deficiencies in terms of quality and efficiency of the service. Completing the process, however, still requires additional political support, as the last remaining non-compliant ATOs are often the most difficult ones to bring into line.

Phasing out regulated prices in the electricity sector

The 2022 competition law – an RRF milestone – includes the liberalisation of the gas and electricity sectors by gradually phasing out the regime of regulated tariffs for micro-enterprises and households, thus aligning these sectors with other enterprises which have already been moved to the free market. The end of the regime of regulated tariffs had been legislated for in Italy in 2017 but was never fully implemented.

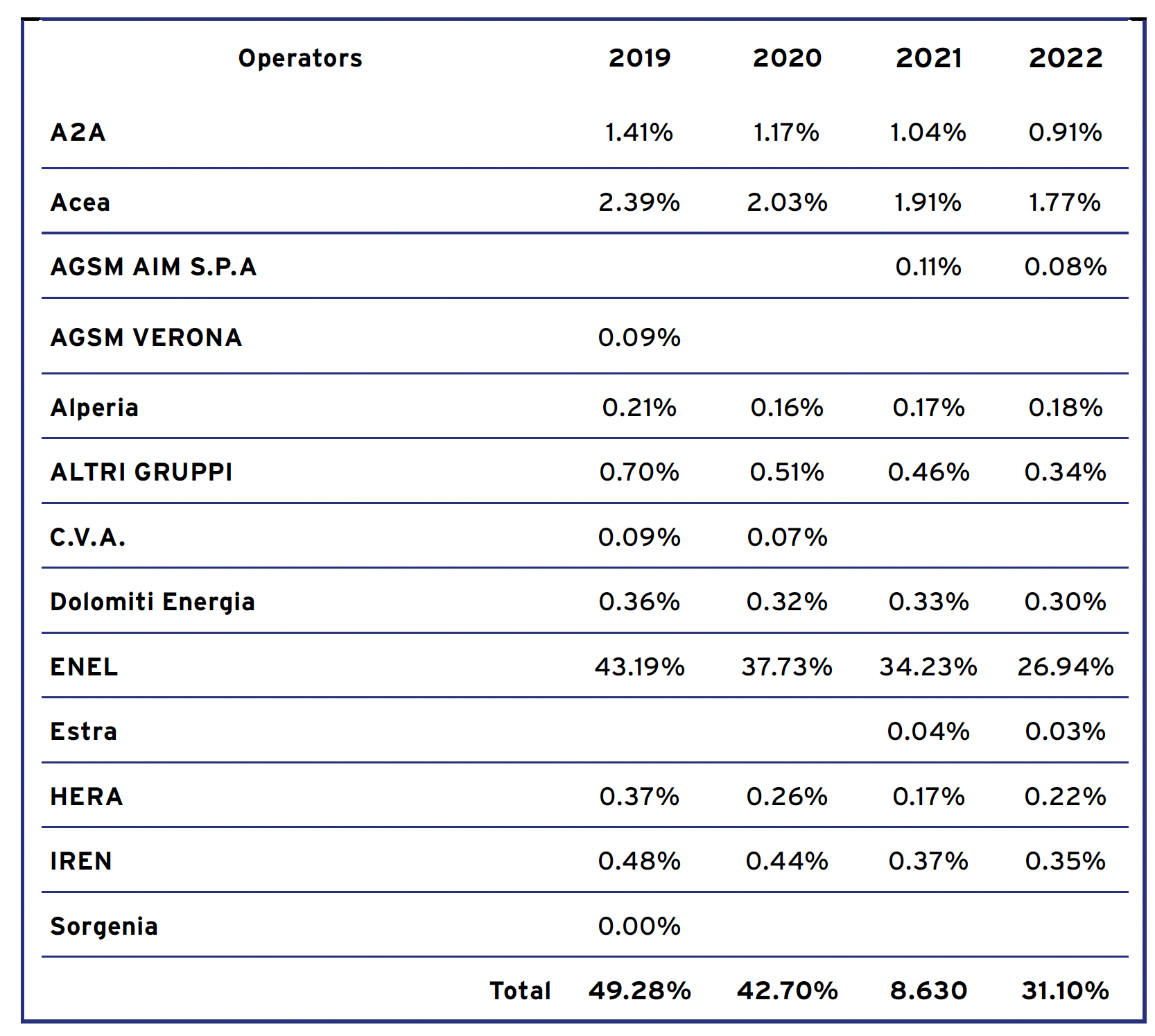

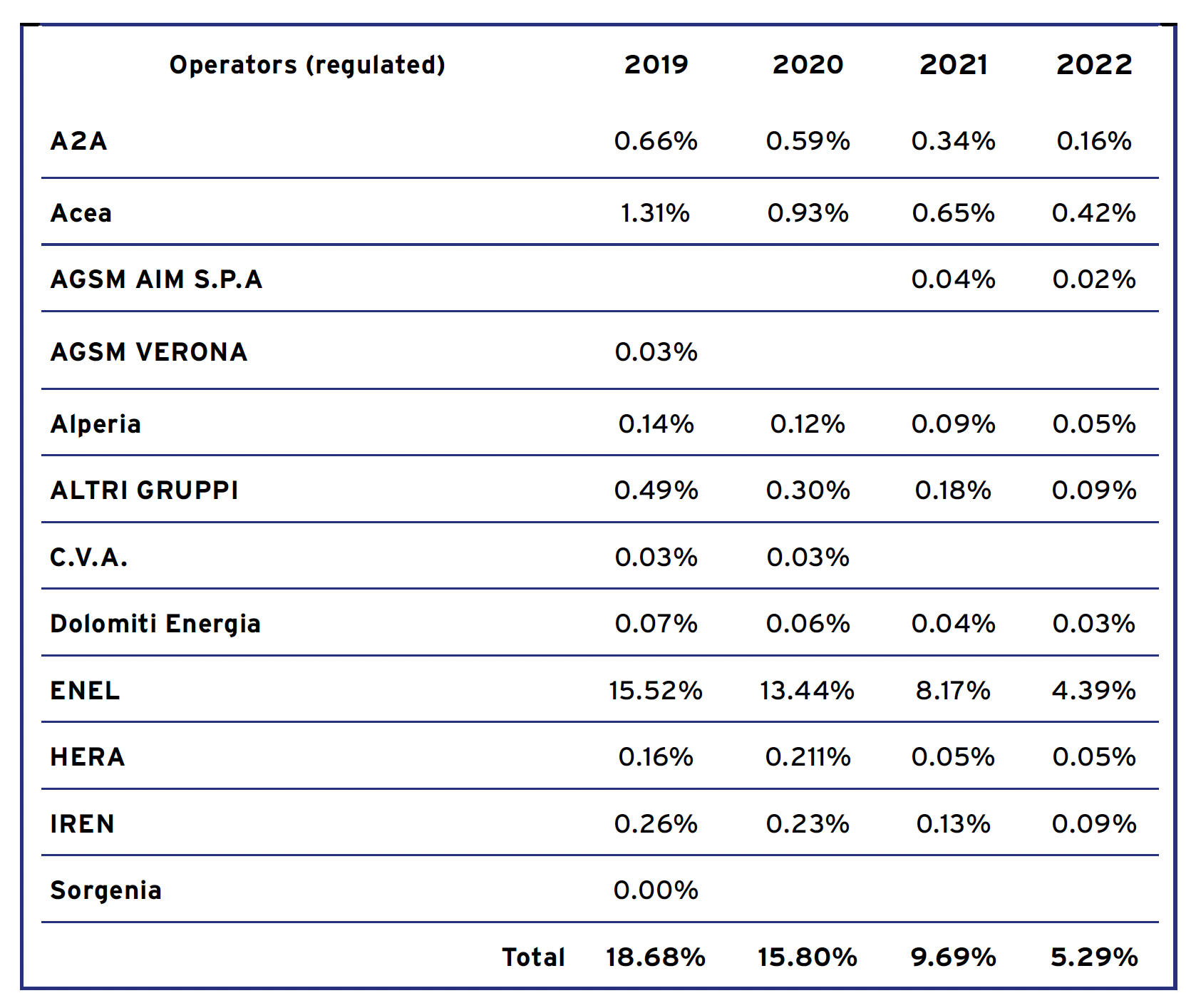

Since the introduction of the legislation, the size of the regulated market has shrunk over the years (from 49% to 31% for households; from 19% to 5% for BT and other uses), with ENEL in a clearly dominant position (Tables 1a and 1b).

Table 1a Electricity operators’ market share: regulated market household

Table 1b Electricity operators’ market share: regulated market BT and other uses

Under the 2022 reform, Arera, the sector regulator, will allocate (under contracts lasting for three years) customers who have not yet chosen a supplier in the free market to operators selected on the basis of competitive procedures. In this way, the regulated system will be substituted by a gradual protection regime, and, in a given timeframe, all users will move to free markets. To guarantee competition during the transition, a ceiling has been legislated for the auctions, setting a maximum market share that each supplier can win (35% for micro enterprises, 30% for households).

Arera carried out the tenders in November 2022 (for microenterprises) and January 2024 (for consumers). Now consumers, through a dedicated search engine, can compare and choose offers within the electricity and natural gas retail markets in a transparent way.

Within the electricity market, the tender procedures in the auctions for household supply, aimed at phasing out regulated prices, concluded with all areas assigned to seven operators. The transition from the regulated prices to the gradual protection regime – which will happen on 1 July 2024 – will, under current conditions, lead to an overall saving for each access point of approximately €130 per year, in relation to the marketing component, with a saving that would be worth more than 20% of the total bill.

The January 2024 Arera monitoring report (published at the end of February) highlighted how simulations based on the offers for electricity in the free market, available on the ARERA portal, show that 10% of free market contracts lead to a lower cost than the regulated price, both for households and enterprises.

Moreover, the outcomes of the competitive procedures have partly redesigned the map of suppliers for domestic electricity customers in the country. Due to limits imposed in the auctions, Enel, the former state monopoly company, has reduced its share of domestic customers served throughout the retail electricity market (both protected and free) to a market share of 48% (compared to the pre-auction market share of 56.7%). Hera, having almost tripled the number of domestic customers served, has become the third market operator by number of PODs, with a market share very close to Eni Plenitude.

As mentioned above, the transition to a free market for electricity had been legislated for since 2017, but the process was repeatedly slowed down, mostly because of the reluctance of vested interests. The table above documents a significant success for the RRF in mitigating such interests.

Summing up

In conclusion, the RRF started a process that had been on hold for years and which today has a good chance of being completed, permanently modifying the structure of the water sector in those parts of Italy that record serious deficiencies in terms of quality and efficiency of the service.

Completing the process, however, still requires additional political support, as the last remaining non-complaint ATOs are often the most difficult ones to bring into line.

Authors’ note: The views in this column are those of the author and do not represent the position of the Senate of the Italian Republic.

References

Boeri, T and R Perotti (2023), La Grande Abbuffata, Feltrinelli.

Giavazzi, F and C Goretti (2024), “Is Italy’s RRF plan working, or it is just another waste of money?”, CEPR Policy Insight 130.