Expectations play a central role in economic fluctuations. The Federal Reserve’s recent hiking cycle is largely aimed at cooling aggregate demand by increasing the cost of external finance in the form of higher borrowing rates (D’Acunto et al. 2022b).

Business surveys are a standard tool used to understand how firms plan to change their investment, but the difficulty in reaching actual decision makers in a representative sample of firms makes surveys prohibitively costly. In this column, we argue that academics and policymakers alike can elicit firms’ beliefs and plans by using recent developments in AI, and in particular ChatGPT, on corporate disclosures and calls with analysts.

Policymakers must understand corporate policies to make informed decisions. Investment policies, in particular, are key to corporate growth and aggregate fluctuations, with aggregate investment being the most volatile component of GDP. Neoclassical q-theory suggests that Tobin’s q can serve as a sufficient statistic to describe firms’ investment opportunities and policies (Hayashi 1982). Yet, due to information and capital market frictions, variables other than q, such as private information of managers, might have predictive power for future investment.

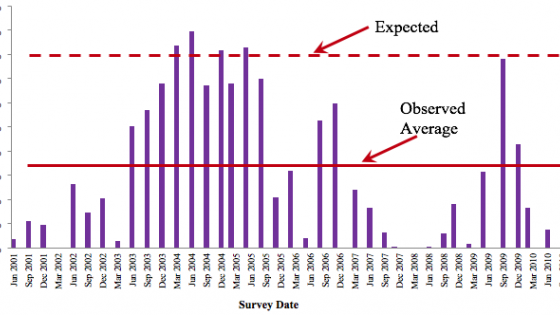

Unfortunately, managerial information is typically not available for all firms, despite the availability and usefulness of information for a subset of firms provided through various surveys, such as the Duke University/Federal Reserve CFO Surveys and the Conference Board CEO Surveys.

To address this issue, in a recent paper (Jha et al. 2023) we harness the power of ChatGPT, an advanced AI model developed by OpenAI capable of processing long and complex questions and providing detailed, expert-level responses. Using ChatGPT, we extract firm-level corporate expectations of future investment policies and answer the following questions: Can ChatGPT help understand corporate policies? Does the ChatGPT-extracted investment policy provide incremental information for future investment beyond existing measures like Tobin’s q or cash flows? How does this information impact asset prices and returns?

Our sample comprises 74,586 conference call transcripts from 3,878 unique companies between 2006 and 2020. These transcripts contain valuable information including corporate managers’ beliefs and expectations about their firms’ future capital expenditures. Using ChatGPT, we extract quantitative assessments of future increases and decreases in investment and construct a firm-level ChatGPT investment score.

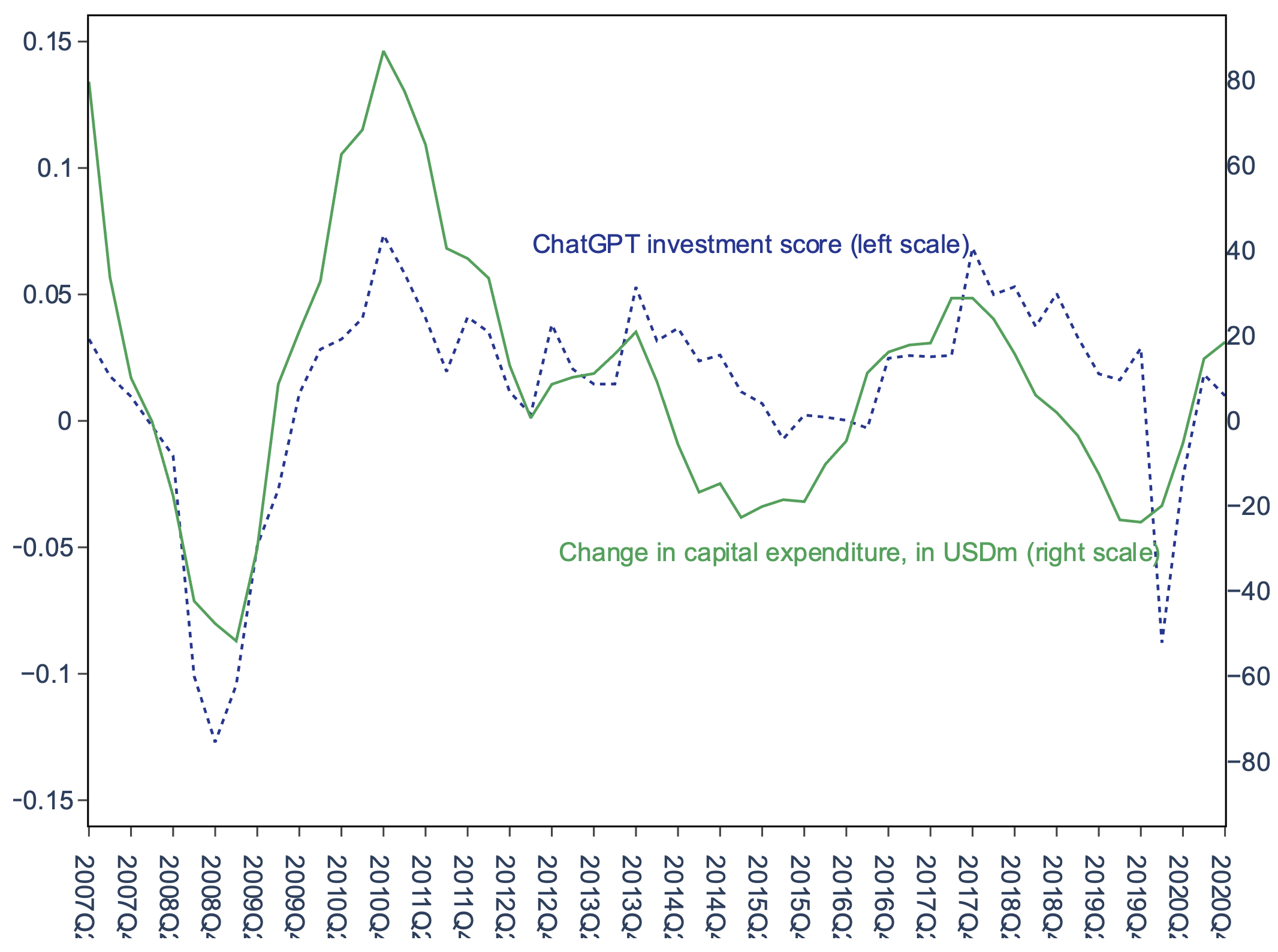

We validate this measure in several ways. First, we compare our investment score with responses from the Duke CFO surveys, which directly elicit a firm’s expected capital expenditure for a subset of our sample. Firms with a high ChatGPT investment score also report in the surveys their intent to increase investment over the next 12 months. Second, we observe similar trends between the average investment score in our sample and future changes in capital expenditure over time (Figure 1).

Figure 1 ChatGPT investment score vs realised investment

Notes: This figure plots the time series of average quarterly ChatGPT investment score and average future four-quarter change in capital expenditure.

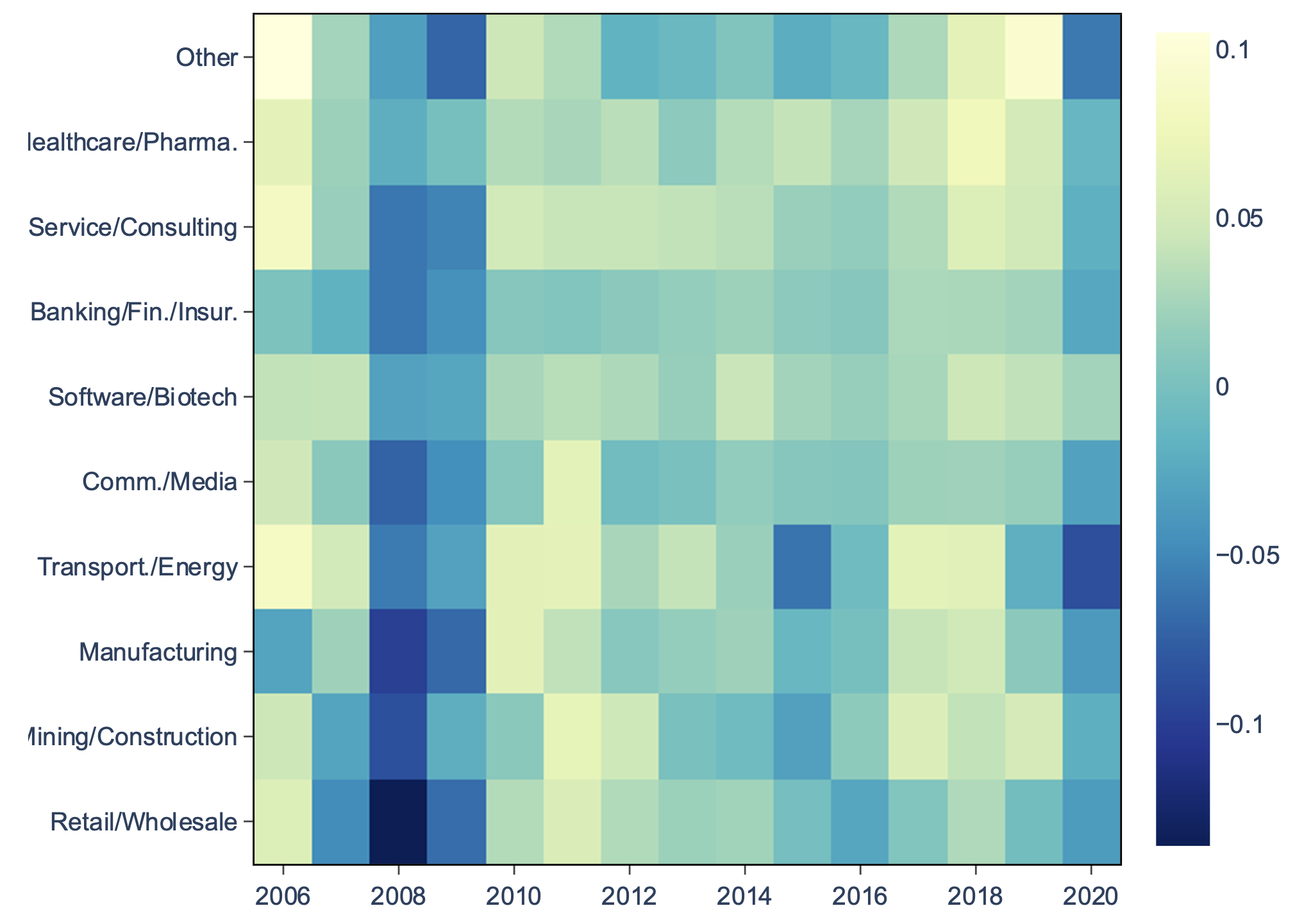

Third, the industry-level average investment scores exhibit patterns consistent with major changes in the economy. For example, firms in the software/biotech industries expect increased investment during the COVID-19 pandemic, whereas many other industries expect decreases (Figure 2).

Figure 2 ChatGPT investment score across industries

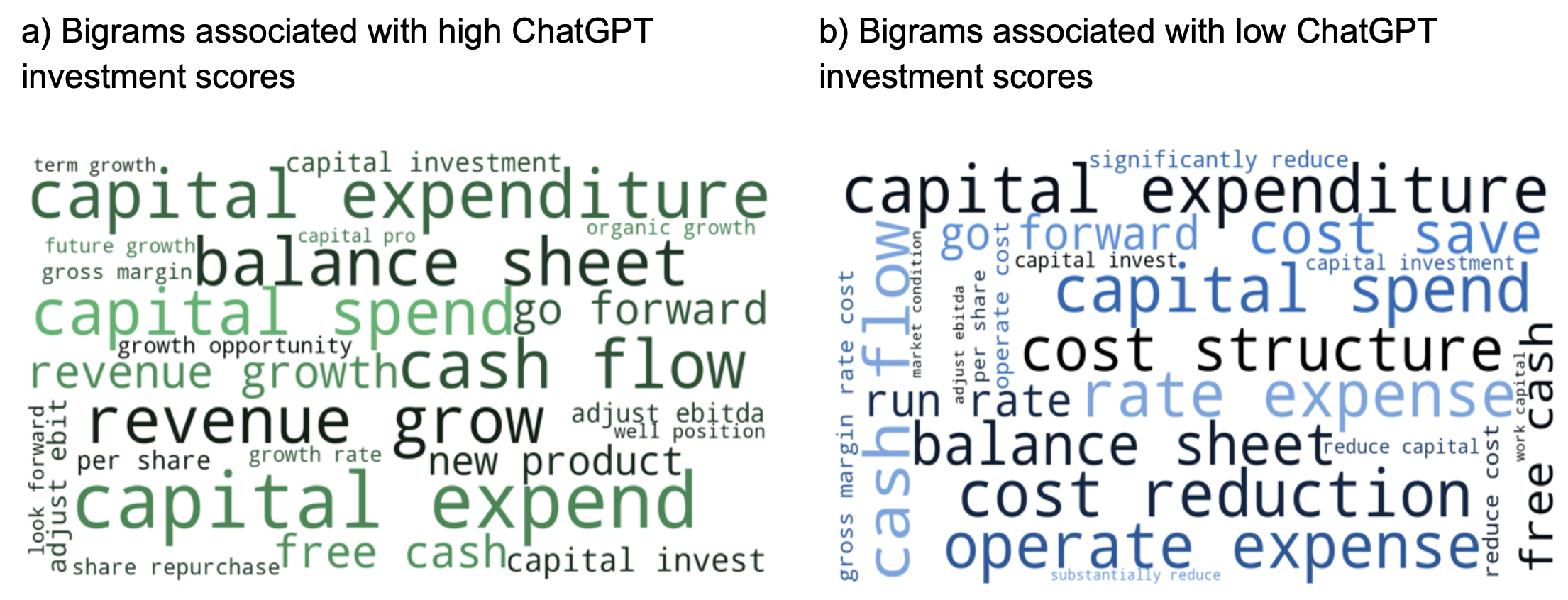

Finally, we ask ChatGPT to provide excerpts from conference call transcripts that support its assignment of investment scores, revealing interpretable phrases and sentences. For example, Figure 3 shows that the most frequent bigrams associated with high and low investment scores are consistent with managerial plans to increase or decrease investments.

Figure 3 Interpreting the ChatGPT investment score

We then study the predictive power of our novel AI-based investment score for future realised investment at the firm level. We find that the ChatGPT investment score provides incremental predictive power for future investment when we control for Tobin’s q and other firm-level predictors of investment.

A one-standard-deviation increase in the inestment score is associated with a 0.034 standard-deviation increase in capital expenditure in the quarter after the conference call, about two-thirds of the corresponding sensitivity of capital expenditure to total q, which is an extended measure of Tobin’s q that incorporates intangible capital (Peters and Taylor 2017). This relationship is a robust feature of the data and also holds after we keep constant lagged capital expenditure and add firm and time fixed effects, suggesting that the investment score contains new, incremental information derived from managerial private information and expectations.

The significant predictive power of the investment score persists for up to nine quarters, emphasising the long-term nature of managers’ expectations. Moreover, the ChatGPT investment score not only predicts future physical investment but also forecasts other forms of investment, including intangible investment, research and development, and total investment in both the short and long run.

Furthermore, we explore the relationship between the ChatGPT investment score and expected stock returns. Investment-based asset pricing theory (Liu et al. 2009) predicts that firms with lower expected returns invest more, because they apply a lower hurdle rate, resulting in more investment projects with a positive net present value. Therefore, we expect high expected investment stocks to experience lower future stock returns. Our tests confirm this hypothesis: the ChatGPT investment score is significantly and negatively associated with raw returns and factor-adjusted abnormal returns in the subsequent quarter. Similar to investment, the return predictability also persists for up to nine quarters.

In addition to investment policies, we investigate whether our methodology can be applied to other corporate policies, such as dividend payment and employment policies. We find strong correlations between the ChatGPT-based expected corporate policies and the expected policies obtained from the Duke CFO Survey responses (Graham and Harvey 2001, Graham et al. 2016) for the same set of firms, suggesting that our approach can be applied to a wide range of corporate policies.

Overall, our paper makes several key contributions. First, our paper is related to the literature on the investment-q relation. Despite theories that establish strong links between Tobin’s q and investment (Hayashi 1982), their empirical relationship had been weak. Our AI-based investment score provides new information for firms’ future investment opportunities that complements Tobin’s q and total q, which can help researchers and regulators to better understand corporate investment and its consequences for the economy.

Second, our paper pertains to the feedback literature, according to which managers learn to make investments and other corporate decisions (Chen et al. 2007). Our findings suggest that the other direction of the link is also important: the market can also learn from managers.

Third, our study relates to the survey and expectations literature. Surveys are a powerful tool for researchers to access information that is not available in standard datasets (D’Acunto et al. 2022b, Coibion et al. 2022). Our approach can complement existing surveys and generate measures based on executives’ plans and discussions for a large sample of firms and provide a new set of tools and data for researchers.

Finally, our approach provides a step forward for textual analysis. Researchers have utilised textual analysis to analyse unstructured text information such as the levels and extent of sentiment (Hanley and Hoberg 2010, Loughran and McDonald 2011). Very recently, researchers have started to use ChatGPT (Lopez-Lira and Tang 2023, Kim et al. 2023). We show that ChatGPT can help extract information about complex concepts such as future corporate policies. Furthermore, such information is interpretable, as humans can read and understand the arguments given by ChatGPT when making decisions.

In conclusion, our paper demonstrates the value of using advanced AI models like ChatGPT to extract firms’ beliefs and plans for future corporate policies, particularly investment decisions. The ChatGPT investment score provides insights beyond traditional measures, offering incremental predictive power for future investment and its impact on asset prices and returns. This approach can be extended to other corporate policies, providing a versatile tool for researchers and policymakers. As AI technology continues to advance, its integration with economic research holds promise for deeper insights and better decision-making processes.

References

Chen, Q, I Goldstein, and W Jiang (2007), “Price informativeness and investment sensitivity to stock price”, Review of Financial Studies 20: 619–50.

Coibion, O, Y Gorodnichenko, and M Weber (2022), “Monetary policy communications and their effects on household inflation expectations”, Journal of Political Economy 130: 1537–84.

D’Acunto, F, D Hoang, and M Weber (2022a), “Managing households’ expectations with unconventional policies”, Review of Financial Studies 35: 1597–642.

D’Acunto, F, U Malmendier, and M Weber (2022b), “What do the data tell us about inflation expectations?”, CEPR Discussion Paper 17094.

Graham, J R, and C R Harvey (2001), “The theory and practice of corporate finance: Evidence from the field”, Journal of Financial Economics 60: 187–243.

Graham J, C Harvey, and I Ben-David (2016), “Managers are miscalibrated”, VoxEU.org, 20 August.

Hanley, K W, and G Hoberg (2010), “The information content of ipo prospectuses”, Review of Financial Studies 23: 2821–64.

Hayashi, F (1982), “Tobin’s marginal q and average q: A neoclassical interpretation”, Econometrica 50: 213–24.

Jha, M, J Qian, M Weber, and B Yang (2023), “ChatGPT and corporate policies”, working paper.

Kim, A G, M Muhn, and V V Nikolaev (2023), “Bloated disclosures: Can ChatGPT help investors process information?”, working paper.

Liu, L X, T M Whited, and L Zhang (2009), “Investment-based expected stock returns”, Journal of Political Economy 117: 1105–39.

Lopez-Lira, A, and Y Tang (2023), “Can ChatGPT forecast stock price movements? Return predictability and large language models”, working paper.

Loughran, T, and B McDonald (2011), “When is a liability not a liability? Textual analysis, dictionaries, and 10-ks”, Journal of Finance 66: 35–65.

Peters, R H, and L A Taylor (2017), “Intangible capital and the investment-q relation”, Journal of Financial Economics 123: 251–72.