During the global COVID-19 crisis, fiscal deficits have widened, and government debts have spiked in advanced and developing economies almost across the board. Moreover, those countries with the fewest resources at their disposal have fared the worst on many fronts, including the perception of sovereign risk. While 15% of advanced economies have had their credit ratings cut since the start of 2020, the comparable share of downgrades for emerging markets and developing economies (EMDEs) is almost 40% (Andritzky and Schumacher 2021).1 Concerns about the sustainability of sovereign debt in many EMDEs were already on the rise prior to the pandemic.

In this column, we review some of the features of past episodes of default and restructuring of sovereign external debts, with a focus on the 1980s and the 1930s. These two memorable sovereign default waves are of interest as they came on the heels of a deep, broad-based, and synchronous contraction in economic activity spanning scores of countries.

Default spells and restructuring deals

As in Reinhart and Rogoff (2009), the start of a ‘default spell’ is marked by a credit event while its end is dated by the debt restructuring or other agreement that cures the default for at least 24 months (Farah-Yacoub et al. 2021).2 These ‘spell-ending’ restructuring deals are also referred to as ‘decisive’, as in Reinhart and Trebesch (2016). Decisive debt restructurings are usually followed by renewed capital market access and improved macroeconomic performance, at least for a time.

The extensive catalogue of debt restructuring deals analysed here integrates the data from Cruces and Trebesch (2013) and Meyer et al. (2019). The debt restructurings come in two varieties: decisive restructurings that bring the debt crisis to an end; and interim restructurings that fall short of placing debt on a sustainable path, so that the country ends up relapsing within two years. Of course, it is comparatively easy to classify restructurings into these two buckets with the benefit of hindsight. Discerning, ex ante, which restructuring deals are doomed to fail is far more complicated, as will be discussed. A default spell may include multiple or serial interim restructuring deals.

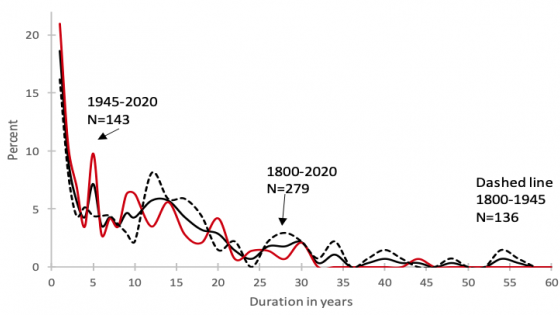

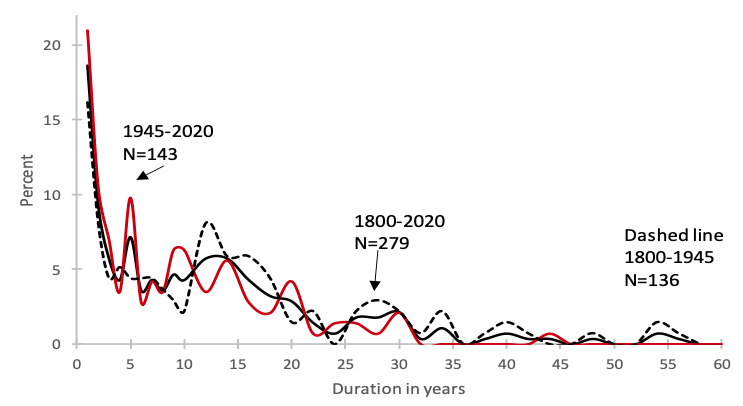

Figure 1 presents the marginal and cumulative frequency distributions of the duration (in years) of 279 external default spells (excluding repudiation cases) in 113 countries over 1800–2020. The average default spell for the full sample lasted ten years, while the median is seven years. A significant share of the longest multi-decade episodes involved wars or internal civil conflict and predate the 21st century.3 As shown, since the end of WWII, default spells have become shorter, lasting on average 7.9 years, with a median duration of five years.

Notwithstanding the post-WWII decline in duration, during the synchronous default crises of the 1930s and 1980s, the average default duration was 13.9 and 11 years, respectively. In the 1930s, about half of the default spells lasted more than a decade. During the ‘lost decade’ of the 1980s, over one third of all default spells lasted more than ten years and three-quarters were five years or longer.

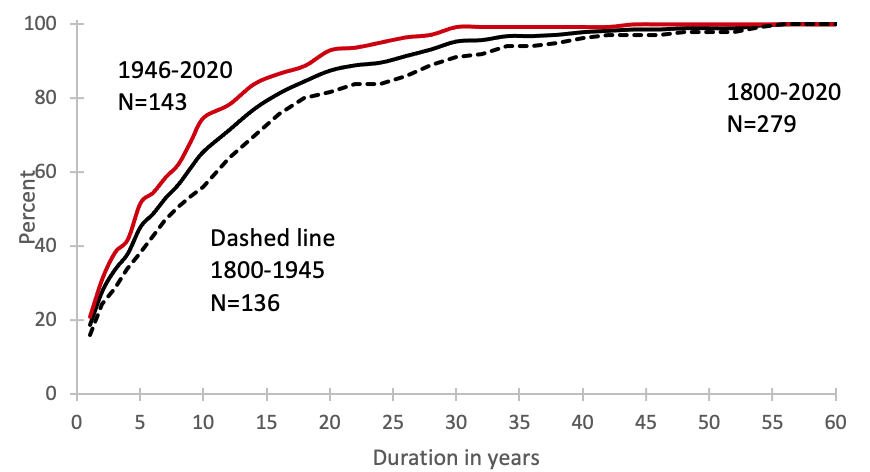

Delay and replay: Interim serial restructuring

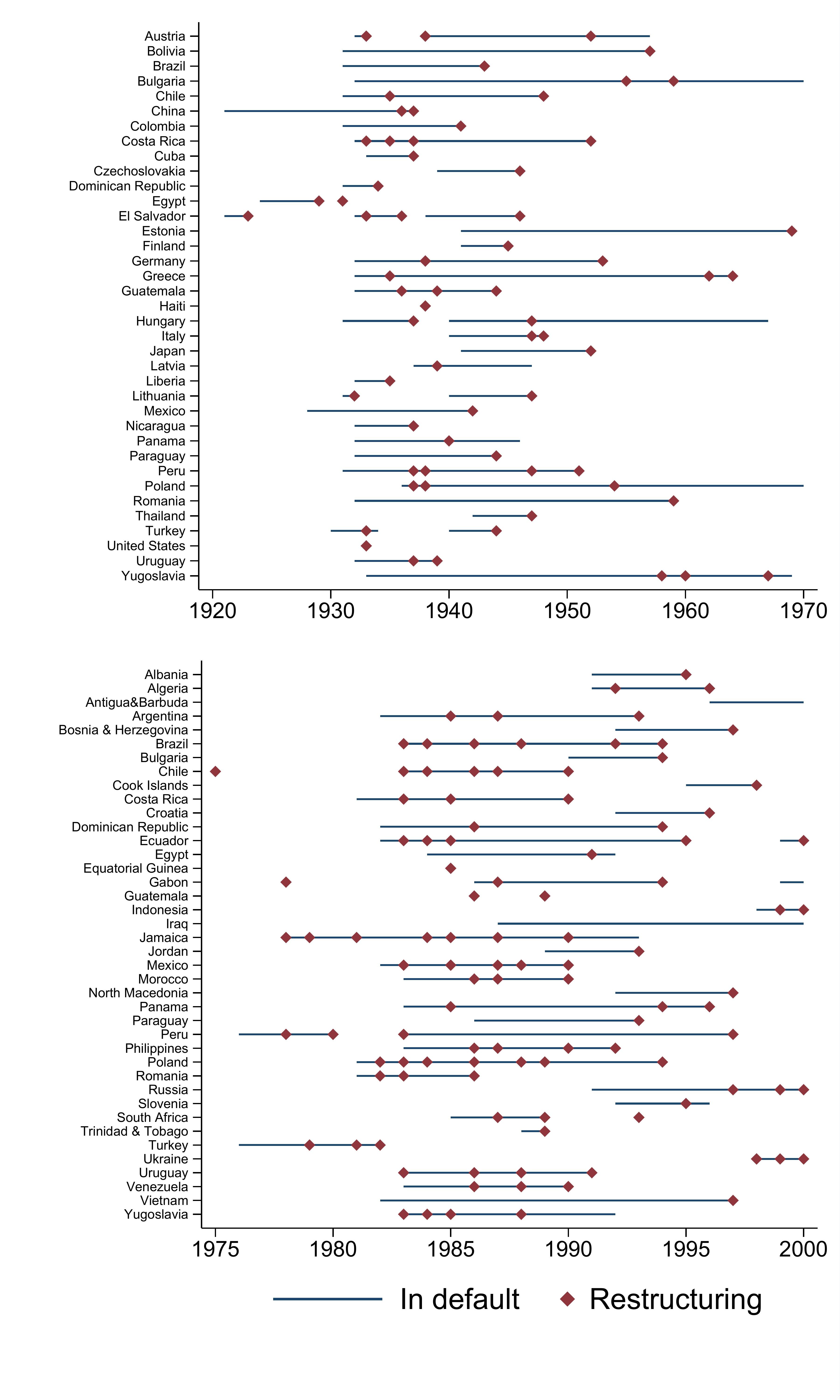

While serial default, a term coined by Reinhart et al. (2003), refers to countries with a track record of more than two default spells or episodes, interim serial restructuring, as noted, refers to restructuring within a default spell that do not bring the debt crisis to closure. Figure 2 shows the frequency distribution for two subperiods (1920–1969 and 1970–2020). On average, it took two restructurings before a sovereign default was settled ‘sustainably’. It bears mentioning that these data underestimate the number of debt-restructuring deals. This is because we are not including restructurings that were intended to be temporary by design. The G20’s DSSI in response to the pandemic is a very special example of a temporary measures.4

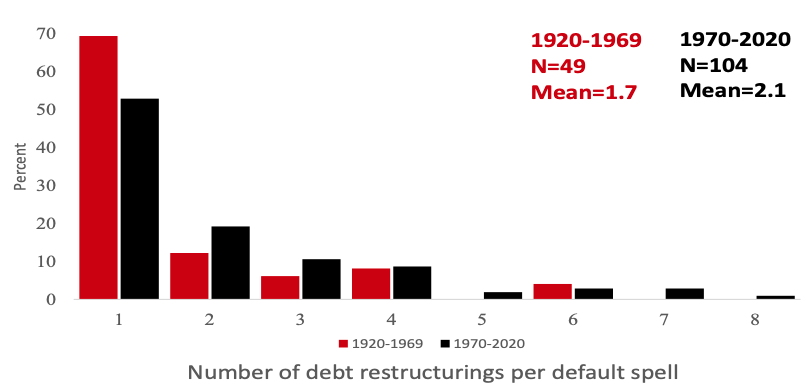

On serial interim restructurings, Poland holds the record, with eight debt restructurings during its 1981–1994 debt crisis (seven of these interim). Democratic Republic of Congo, Jamaica, and Nigeria follow closely with seven restructurings each. The longer default spells of the 1930s and the 1980s were particularly prone to serial restructuring, which is illustrated in Figure 3 for a subsample of the countries in our group. Now, Chad is seeking its third restructuring since 2014, highlighting that serial restructurings are not a relic of the past.

Figure 1 The duration of defaults, 1800–2020

a) Marginal frequency distribution

b) Cumulative frequency distribution

Source: Farah-Yacoub et al. (2021).

Figure 2 Number of debt-restructuring deals per default episode, 1920–2020

Sources: Cruces and Source: Trebesch (2013), Asonuma and Trebesch (2016) and Meyer et al. (2019).

Figure 3 Restructurings and default spell duration: 1930s (top) and 1980s (bottom)*

Note: *Excludes countries covered by the International Development Association (IDA) and the Heavily Indebted Poor Countries (HIPC) initiative.

Sources: Cruces and Trebesch (2013), Reinhart and Rogoff (2009), Meyer et al. (2019), Farah Yacoub et al. (2021).

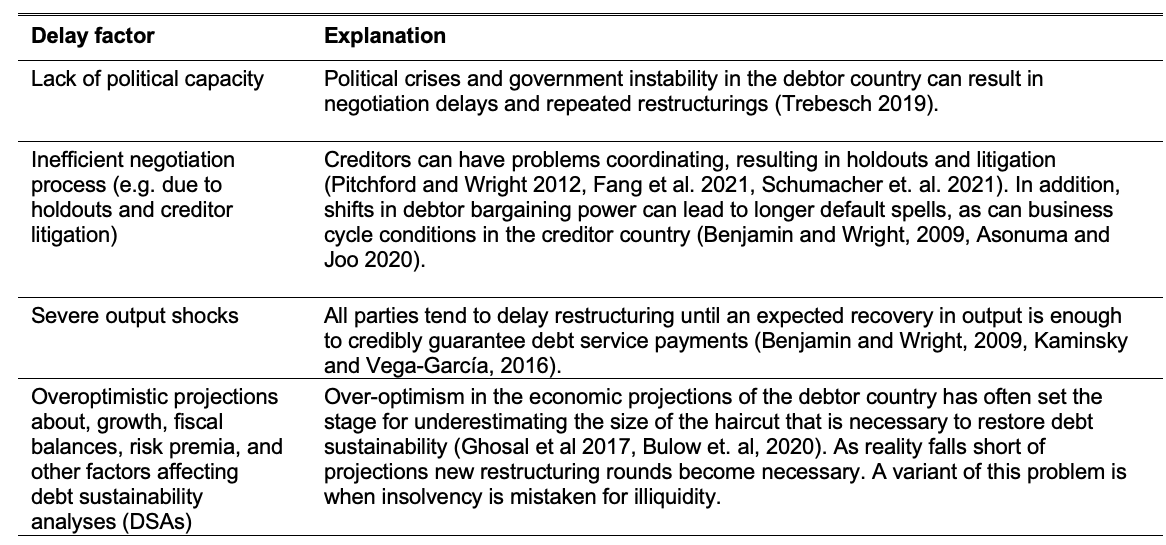

Factors that delay and derail debt crisis resolution

In this section, we present some of the arguments that have been offered to explain why debt crises often take so long to resolve. The first explanation has been around since time immemorial. Creditors – governments, commercial banks, and bondholders alike – have usually been reluctant to offer significant debt relief quickly. No one likes losses. Beyond this, Table 1 sketches other reasons. While the explanations vary, the common outcome (for whatever reason) is that the initial restructuring terms (‘haircut’) fall short of what is necessary to achieve debt sustainability. The 1985 Baker Plan is an example. The scheme relied on cash flow relief and avoided face-value haircuts; an approach that proved insufficient to end the 1980s crisis. There are comparable examples in the 1920s and 1930s. This is in line with the literature that finds that more extensive initial restructurings reduce the probability of additional restructurings (e.g. Reinhart and Trebesch 2016, Ghosal and Miller 2017).

Table 1 Factors that prolong default crises

What’s next for debt restructuring?

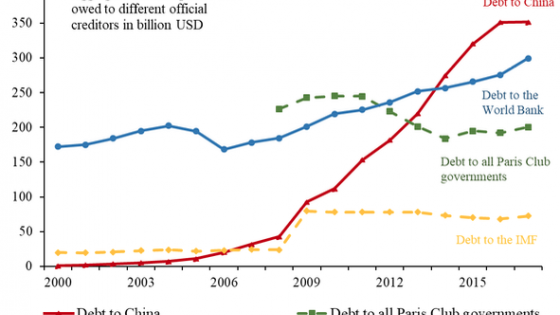

During the period of high commodity prices and solid growth that lasted until around 2014, many EMDEs accumulated significant ‘hidden debts’ to non-Paris Club creditors, importantly including China (Horn et al. 2019). A substantial share of these debts went unrecorded in major databases and was not on the radar screen of credit rating agencies. External borrowing by state-owned enterprises, which have much more uneven reporting standards also escalated. Several low-income countries began to issue Eurobonds, as investors underpriced risk in countries with opaque debt structures, contributing to the debt build-up. Domestic debt (which was a minor issue in the 1980s debt crisis) has grown steadily and data availability is sketchy. The upshot of these developments is that many of the developing countries that may need their debts restructured now face a more complex and varied group of creditors than the Paris Club and commercial banks of the 1980s. This is bound to complicate a coordinated response.

Transparency cannot overcome many of the challenges summarised here, but it can go a long way to increase trust among creditor groups, which at present is rather low. The Common Framework (CF), endorsed by the G20 late last year to address unsustainable debt, seeks comparable treatment from all official bilateral creditors, both Paris Club and non-Paris Club, and private creditors. Without transparency and disclosure, individual creditors may be unwilling to take that first step towards debt restructuring and protracted default spells punctuated by unsuccessful restructuring negotiations may once again become the norm.

References

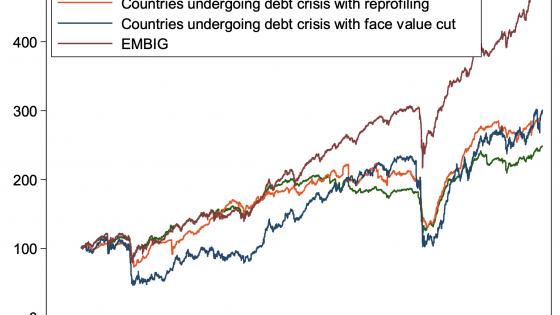

Andritzky, J and J Schumacher (2018) “Bond returns in sovereign debt crises: The investors’ perspective,” VoxEU.org, January 18.

Asonuma, T and H Joo (2020), “Sovereign Debt Restructurings: Delays in Renegotiations and Risk Averse Creditors”, Journal of the European Economic Association 18(5): 2394–2440.

Benjamin, D and M Wright (2009). “Recovery Before Redemption: A Theory of Delays in Sovereign Debt Renegotiations”, April.

Bulow, J, C Reinhart, K Rogoff and C Trebesch (2020), “The Debt Pandemic”, Finance and Development, September: 13-16.

Cruces J and C Trebesch (2013), “Sovereign defaults: The price of haircuts”, American Economic Journal: Macroeconomics 5(3): 85–117.

Fang, C, J Schumacher and C Trebesch (2021). Restructuring Sovereign Bonds: Holdouts, Haircuts and the Effectiveness of CACs”, IMF Economic Review, forthcoming

Farah-Yacoub, J, C Graf von Luckner and C Reinhart (2021), “Sovereign Debt Crises Database”.

Horn, S, C Reinhart and C Trebesch (2020). “China’s overseas lending and the looming developing country debt crisis”, VoxEU.org, 4 May.

Ghosal, S and M Miller (2017), “A new bargaining perspective on sovereign debt restructuring”, VoxEU.org, 17 April.

Kaminsky, G L and P Vega-García (2016), “Systemic and idiosyncratic sovereign debt crises”, Journal of the European Economic Association 14(1): 80-114.

Meyer, J, C M Reinhart and C Trebesch (2019), “Sovereign Bonds Since Waterloo”, NBER Working Paper 25543.

Pitchford, R and M Wright (2012), “Holdouts in Sovereign Debt Restructuring: A Theory of Negotiation in a Weak Contractual Environment”, The Review of Economic Studies 79(2): 812-837.

Reinhart, C M and K Rogoff (2009), This Time is Different: Eight Centuries of Financial Folly, Princeton University Press.

Reinhart, C M, K Rogoff and M Savastano (2003), “Debt Intolerance,” Brookings Papers for Economic Activity Vol. 1, Spring: 1-74.

Reinhart, C and C Trebesch (2016), “Sovereign Debt Relief and t’s Aftermath”, Journal of the European Economic Association 14(1): 215-251.

Schumacher, J, C Trebesch and H Enderlein (2021), “Sovereign Defaults in Court”, Journal of International Economics, forthcoming

Trebesch, C (2019). “Resolving Sovereign Debt Crises: The Role of Political Risk”, Oxford Economic Papers 71(2): 421–444.

Endnotes

1 The number of advanced and EMDE rated sovereigns is 39 and 108, respectively.

2 Any violation of the original debt contract (suspension or partial payments) or changes the terms of the debt contract that are less favorable to the creditor (maturity extension, interest rate reduction, nominal face value reduction) is considered a credit event. As far as credit ratings are concerned credit events are defaults.

3 Bulgaria’s 56-year spell (1932 – 1987) stretched through the post-WWII Soviet era.

4 For a discussion of some of these temporary deals see Cruces and Trebesch (2013).