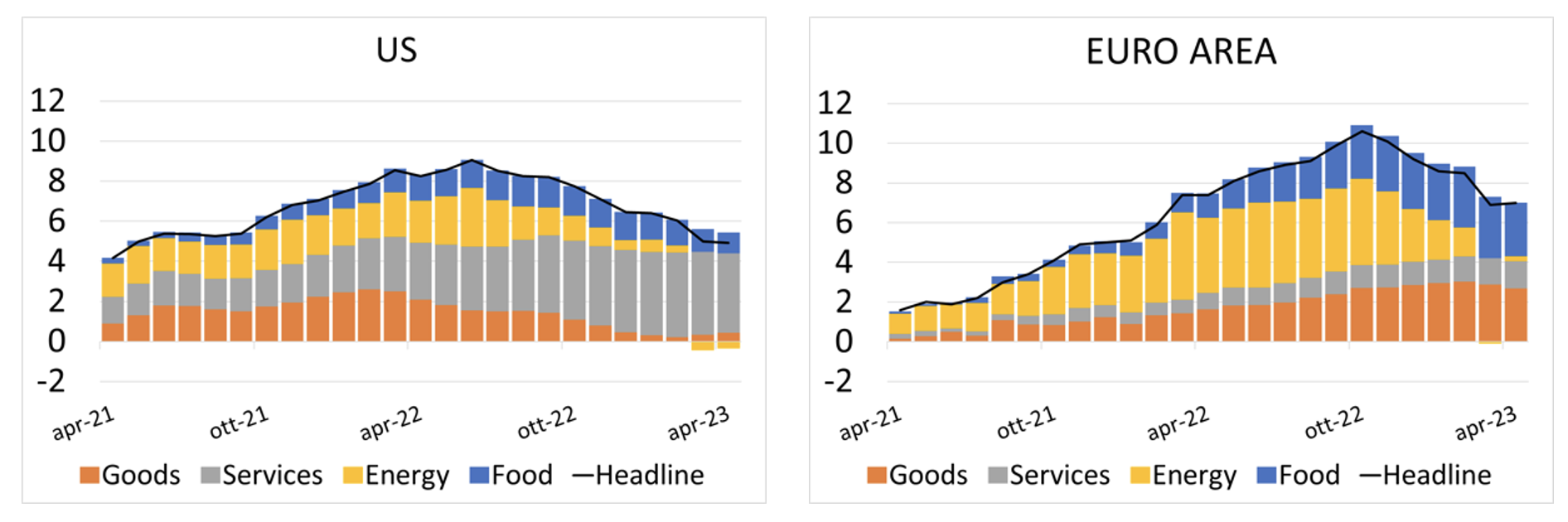

Inflation in the US and in the euro area has fallen since mid-2022, as the downward pressure from lower energy prices and the easing of supply bottlenecks was only partially offset by the acceleration of some core items, such as non-energy industrial goods and services (see Figure 1). The fall of inflation, however, has been slower than expected. Despite the steep drop in en

ergy prices, which was sharper than implied by futures prices one year ago, inflation forecasts from major forecasters have been constantly revised upwards, especially in the euro area. Stronger than expected developments in core inflation were the main driver of upward inflation surprises (Ilzetzki and Jain 2023).

Figure 1 Headline inflation and contribution from main components (year-on-year percentage changes and percentage points)

Source: Refinitiv, Eurostat, Office for National Statistics, Bureau of Labor Statistics.

Against this backdrop of falling energy prices and stubborn core inflation, an important policy question emerges: to what extent are current elevated levels of core inflation the result of the delayed pass-through of past energy prices? Our analysis shows that the role played by energy prices in explaining high core inflation in 2023 is negligible for the US but substantial for the euro area.

Energy prices and core inflation before and after the 2021-22 shock

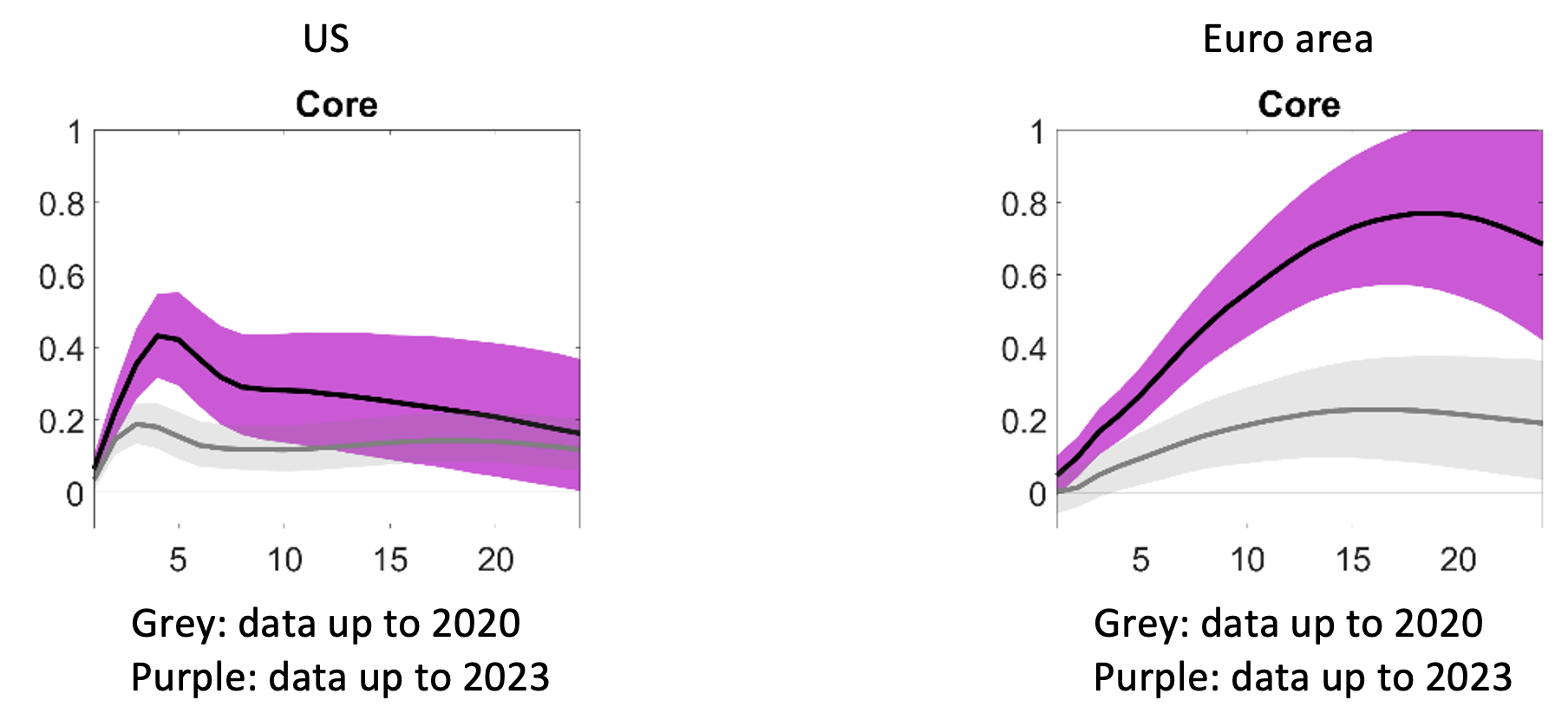

Until 2020, the pass-through of energy price shocks to core inflation was small and similar in the US and in the euro area. The speed and magnitude of this pass-through are measured by the impulse response functions (IRFs) of a vector autoregression (VAR) model. The baseline specification includes consumer energy inflation, food inflation, core inflation,

the unemployment rate, and negotiated wage growth.

When models are estimated with data up to 2020 (i.e. before the 2021-22 energy price shock), a 10% consumer energy price shock raises core inflation in the US and in the euro area by between 0.1% and 0.2% (Figure 2, grey areas). When extending the analysis to 2023, and therefore including the 2021-2022 energy price shock, the response of core inflation to energy prices appears to be much stronger, especially in the euro area (Figure 2, purple areas), suggesting that the surge in energy prices induced a break in the relationship between core prices and energy input costs. Figure 5 reports the IRFs obtained when extending the analysis to 2023, therefore including the large energy price shock that occurred in 2021/2022. For the sake of comparison, they are overlapped with those estimated on the sample ending in 2020. Following a 10% energy price shock, the peak response of core inflation to an energy price shock estimated on the full sample for the euro area is now much larger at 0.8% – a fourfold increase (Figure 2, right-hand side). This larger impact is also coupled with rising dispersion in euro area inflation rates (Goujard and Beynet 2022). In the US, there is also a non-negligible increase, but the overall impact is more contained at 0.4% (Figure 2, left-hand side).

Figure 2 Impulse response functions following a shock to energy prices

A more granular analysis (not shown for brevity) reveals that the sharp increase in the sensitivity of euro area core inflation to energy prices is mostly explained by the stronger sensitivity of core inflation to gas and electricity price shocks, a result that chimes with the analysis by Boeck and Zoerner (2023) on the effects of gas price shocks on US and euro area core inflation.

Our conjecture is that the exceptional size of the shock to these costs induced a non-linear adjustment of final prices, especially in the euro area. De Guindos (2023) similarly argues that “the pass-through from the recent supply shocks to underlying prices has been faster and more widespread than before the pandemic. This likely reflects both the unprecedented size and duration of the shocks”. The shock to energy prices in the euro area was indeed of historical proportions. For example, between the beginning of January 2021 and their peak in the summer of 2022, spot gas prices rose by roughly a factor of 17 in the euro area (based on TTF prices), compared to a factor of 3.8 in the US (based on Henry Hub prices). A shock of these proportions is likely to have triggered some non-linearity along the transmission chain in the euro area.

This explanation would be consistent, for instance, with pricing models in which firms face a fixed cost of price adjustment. Cavallo et al. (2023) show that in general models with menu costs, “large shocks travel fast”. Faced with a shock to their production costs, firms need to decide whether to optimally reset their price and pay the menu cost, or leave prices unchanged at the cost of lower profits. The latter alternative becomes less and less appealing the larger the shock is, and therefore the more distant the actual price from the profit-maximising one price is (Nakamura and Steinsson 2008, Vavra 2014).

Implication for current and future US and euro area core inflation dynamics

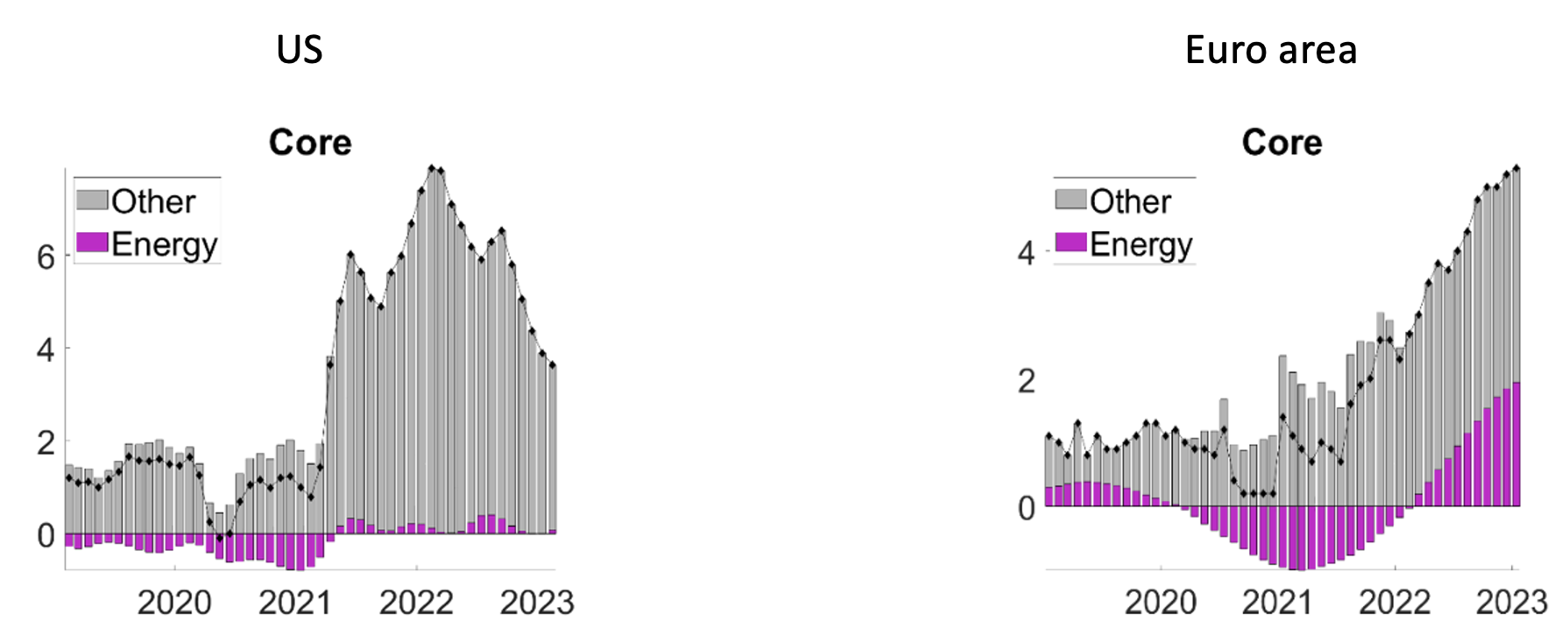

Consistently with the above analysis, the contribution of past energy shocks to current core inflation is very small in the US, whereas it is significant in the euro area. Figure 3 highlights the contribution of current and past energy price shocks to core inflation according to the baseline VAR model that includes data up to 2023.

The effect of past energy shocks on US core inflation is negligible, consistent with the results in Kilian and Zhou (2023) and with the relatively stronger role of demand shocks in bolstering US inflation (Visco 2023). In the euro area, instead, energy shocks account for one-third of core inflation at the end of the sample. Importantly, the impact of past energy prices on core inflation in the euro area appears not to have peaked yet. Considering that energy prices peaked in mid-2022 and that the maximum response of euro area core inflation occurs after 20 months, it is likely that the energy price shock has not yet been fully translated into core prices in the euro area.

Figure 3 Contribution of energy and other price shocks to core inflation

Source: own calculations; Refinitiv, Eurostat, Bureau of Labor Statistics.

Note: This figure reports the historical decomposition of core inflation. The coloured bars show the contribution of energy inflation, while the grey bars represent the contribution of the other variables included in the VAR (see Appendix B for further details).

Two conclusions emerge from the analysis. First, core inflation in the US is unlikely to benefit from the normalisation of energy prices. US core inflation is currently bolstered by the sustained pace of growth of shelter prices and of the prices of several items such as garments, furniture, and some non-shelter services. It will take time, and probably some slack in the labour market before these prices start decelerating durably (see also Leigh et al. 2022). Second, in the euro area there is scope for a deceleration of core prices due to lower energy prices. Both goods and services prices are still influenced by past energy price shocks. As these prices have started to fall, they should contribute meaningfully to cooling down core prices.

Authors’ note: This column does not necessarily reflect the view of the Bank of Italy or ESCB.

References

Cavallo A, F Lippi and K Miyahara (2023), “Inflation and misallocation in New Keynesian models”, ECB Forum on Central Banking, Sintra, 27 June.

De Guindos L (2023), “The inflation outlook and monetary policy in the euro area”, Keynote speech, King’s College London, 7 July.

Böck M and T Zörner (2023), “Natural gas prices and unnatural propagation effects: The role of inflation expectations in the euro area”, VoxEU.org, 30 Apr.

Goujard A and P Beynet (2022), “The surge in inflation dispersion in the euro area: Key drivers and policy responses”, VoxEU.org, 12 Sep.

Ilzetzki E and S Jain (2023), “Prospects for euro area inflation in 2023”, VoxEU.org, 10 Mar.

Kilian L and X Zhou (2023), “The inflationary impact of energy prices”, VoxEU.org, 10 Feb.

Leigh D, P Mishra and L Ball (2022), “Understanding US inflation in the COVID era”, VoxEU.org, 22 Nov.

Powell, J H (2023), “Inflation and the labour market”, 30 November.

Visco, I (2023), “Monetary policy and the return of inflation: Questions, charts and tentative answers”, CEPR Policy Insight 122.