Over the past 70 years, institutional investors’ ownership of publicly traded US companies has increased dramatically, from just 6% in 1950 to 65% in 2017. As a result, a large fraction of the US economy is now in the hands of a relatively small number of asset management companies (Bebchuk and Hirst 2019). The ‘Big Three’ – BlackRock, Vanguard, and State Street Global Investors – held more than 20% of S&P 500 shares in 2017, compared to just 5% in 1998.

This sea change in the ownership of US corporations has prompted a discussion among academics and policymakers over its consequences. On the one hand, the replacement of small dispersed owners by large institutional investors may reduce the standard agency problem of the Berle and Means (1932) corporation. This may improve welfare if active, concentrated shareholders act primarily as effective monitors of management at the level of the portfolio firm. This shift may also reduce welfare if control is used to maximise profits across all (possibly competing) firms in concentrated shareholders’ portfolios, as some in the common ownership literature have argued (Azar and Vives 2021, Anton et al. 2022). On the other hand, institutional investors – especially those managing index funds or ‘closet indexer’ active funds – lack the financial incentives to actively monitor management, given their fee structures and business model (Bebchuk et al. 2017). Proponents of this view often highlight how few resources even the largest institutional investors spend on stewardship activities for the companies in their portfolios.

In a new paper (Bertrand et al. 2023), we focus on a particular concern over the rise of institutional shareholders: has the concentration of ownership also led to a concentration of political influence? Researchers – ourselves included (Bertrand et al. 2020) – have traditionally assumed that companies’ political strategies were simply an extension of their profit-maximising business strategies. Under this view, firms make campaign donations or lobby regulators to secure laws and regulations that are good for company profits. Yet, a vast body of research on corporate governance has shown that companies’ goals are driven not by a single-minded focus on corporate profits, but rather by a collection of disparate interests belonging to those who wield control over the firm’s resources.

Most obviously, major shareholders – both current and potential – hold enormous sway. Top managers at fund families like Blackrock don’t necessarily own a lot of stock themselves, but they effectively control trillions of dollars of investors’ shareholdings. If funds run for the exit, the stock price will fall, and executive compensation will fall along with it. Even executives who are invested for the long term have enormous incentive to stay on the good side of shareholders and try to ensure that their shares vote with management on board appointments, share buybacks, merger proposals, and matters of political influence.

If company executives try to keep fund managers happy by, say, ‘wining and dining’ them at Michelin-starred restaurants, we might care a little bit (though we imagine Larry Fink can afford to cover his own dinner bill). We’d be more concerned if portfolio companies devoted firm resources to appealing to fund managers’ political interests.

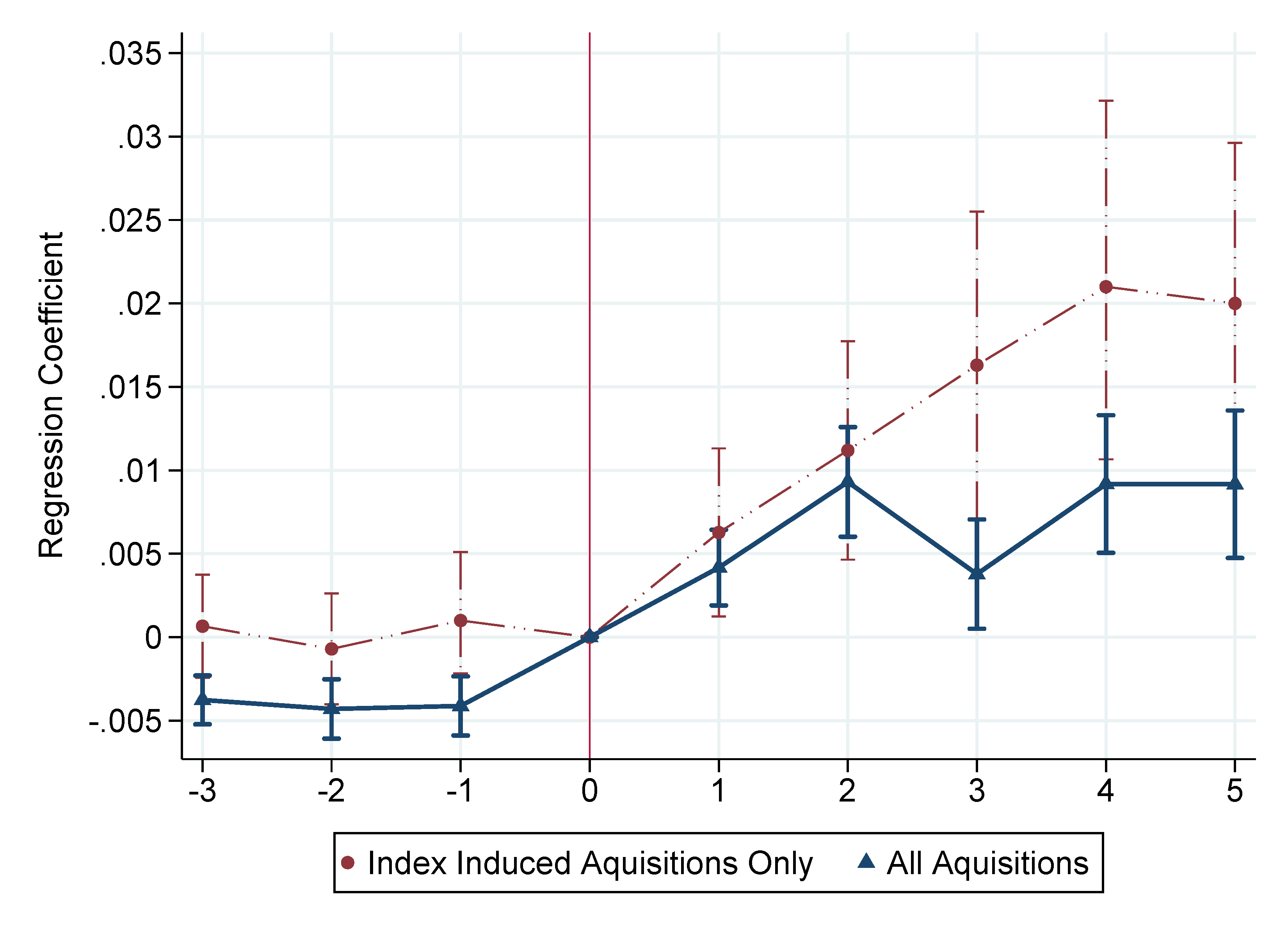

In our paper, we ask whether the rise in institutional ownership raises concerns with respect to the concentration of political influence (much as others have raised the alarm on the rise of institutional investing and the resultant concentration of economic power). We do so by examining changes in portfolio companies’ political action committee (PAC) spending when block purchases in those companies are made by large institutional investors. Specifically, we examine how the relationship between the PAC giving of 13-F institutional investors (those with at least $100 million in assets under management) and the PAC giving of a portfolio firm changed when the investor acquired a large stake in the firm during the period 1980–2018. We show that when these acquisition events take place, there is a large and discrete increase in the likelihood that the investor and firm both give to the same politician, as illustrated in Figure 1. Conversely, when divestments happen, the opposite is true.

Figure 1 Firm and investor PAC giving: Event study

Notes: This figure captures the change in correlation between investor and firm political action committee (PAC) giving around an election cycle in which the investor buys a large (greater than 1%) stake in the company. The pattern shows an increased similarity in giving after an acquisition takes place. The blue line shows the change around all acquisitions, while the red line shows the change around acquisitions that occur because a company is added to an index that the investor tracks in their fund. See Bertrand et al.(2023) for details.

Naturally, investors may decide to buy stakes in companies for which they have a convergence of interests or perspectives. Such a coming together of interests, which is not observable to us as researchers, could account for the increased similarity in political giving around an acquisition. To address these and related challenges, we focus on a subset of investors that are relatively unaffected by such confounds: acquisitions driven by stock index inclusions that lead passive investors to acquire stakes in companies simply because their mandate is to track a particular index, like the S&P500 or Russell 2000. We again see in Figure 1 a post-acquisition convergence in political giving, which cannot easily be attributed to some unobserved convergence of economic interests or ideology.

Based on the results described thus far, it’s impossible to say whether investors influence portfolio company giving or vice-versa. Perhaps investors adjust their political strategy to reflect and reinforce the economic interests of the companies they own. In a further set of analyses, we argue that influence goes in the other direction, as we find that investor giving remains relatively stable around acquisition events, whereas company giving experiences greater change – exactly what we would expect to see if influence went from an investor to a newly acquired firm that had to adjust its giving to match that of its new owner.

It is certainly possible that the apparent influence of large investors takes place without any direct effort on their part. Portfolio companies may pre-emptively cater to investors’ preferences (political or otherwise) in the hope of gaining their support, for example, in important votes at shareholder meetings. However, consistent with a more active voice from institutional investors, we show that the correlation in political giving increases even more sharply after an investor gets a seat on the board.

Our main results don’t speak to the benefits that asset managers might obtain by amplifying their political preferences. These may be financial, if the PAC giving of institutional investors is driven primarily by their attempts to influence the legislative and regulatory process to increase their profits. But the benefits could be non-pecuniary, to the extent that institutional investors’ PAC giving reflects the personal preferences of their managers and owners. We offer suggestive evidence that personal preferences may play a role: specifically, we find that our main result on the convergence in political giving is more pronounced for investors that are more partisan in their own PAC political giving. To the extent that such partisanship reflects investors’ personal agendas, rather than efforts at influencing legislative and regulatory processes to increase profits, this result suggests an amplification of the personal politics of those who run asset management companies.

We opened with the observation that institutional investors hold an ever-larger share of publicly traded firms. This trend was accompanied from 1980 to 2018 by an increase of nearly a factor of six in total expenditure on political activity by the firms we study. While there are surely many factors that contribute to these patterns, we conclude by observing that increased institutional investment may be at least partly responsible for the expansion in the corporate political footprint. We show that higher institutional ownership is associated with an increase in giving by the firm, and that this expansion is unrelated to portfolio firms’ own financial interests (which we measure by assessing whether donations go to members of committees lobbied by the firm). These final results reinforce the view that the ownership-driven shifts in political donations may not serve to increase firm profits, but rather serve fund managers’ own political agendas.

The rise of institutional ownership is rightly attracting a lot of scrutiny aimed at the implications for financial markets and the economy more broadly. Our findings suggest that these concerns are well-grounded, in the sense that institutional owners do impact the policies of portfolio firms rather than passively allowing corporate executives to do as they please. Furthermore, our findings indicate that concerns over institutional investors’ takeover of US corporations should extend to the political sphere as well.

Editors’ note: This column is largely based on a post on the Harvard Law School Forum on Corporate Governance website.

References

Anton, M, F Ederer, M Gine and M Schmalz (2022), “Common ownership, competition, and top management incentives”, Journal of Political Economy.

Azar, J and X Vives (2021), “General equilibrium oligopoly and ownership structure”, Econometrica 89(3): 999–1048.

Azar, J and X Vives (2022), “Revisiting the anticompetitive effects of common ownership”, VoxEU.org, 15 June.

Bebchuk, L A, A Cohen and S Hirst (2017), “The agency problems of institutional investors”, Journal of Economic Perspectives 31(3): 89–102.

Bebchuk, L A and S Hirst (2019), “The specter of the giant three”, Technical report, National Bureau of Economic Research.

Berle, A and G Means (1932), Private property and the modern corporation.

Bertrand, M, M Bombardini, R Fisman and F Trebbi (2020), “Tax-exempt lobbying: Corporate philanthropy as a tool for political influence”, The American Economic Review 110(7): 2065–2102.

Bertrand, M, M Bombardini, R Fisman, F Trebbi and E Yegen (2023), “Investing in influence: Investors, portfolio firms, and political giving”, Technical report, National Bureau of Economic Research.

Zhang, C, L Zicheng, J Rocholl and R Albuquerque (2016), “Institutional investors and corporate political activism”, VoxEU.org, 9 July.