The natural rate of interest is generally defined as the level of the risk-free, short-term real interest rate that would prevail in the absence of business cycle fluctuations, with output at potential, saving equating investment and stable inflation.

It is a key concept in monetary economics as it indicates where interest rates are heading in the medium term. Such indication is particularly relevant at the current juncture, as the sharpest and most synchronised monetary tightening in decades has lifted policy rates from their decade-long historical lows. This has raised the question of whether they will converge back to their pre-pandemic lows or to a higher level – put differently, whether the natural rate has risen or not.

Views differ widely. Some contributions posit that real rates will most likely return to low levels as structural forces continue to hold them down (e.g. IMF 2023, Obstfeld 2023). On the other hand, higher long-term real bond yields suggest that at least investors may be expecting higher real interest rates in the future. Likewise, the surprising resilience of economic activity could be seen as an indication that the level of real policy rates that dampens demand is higher than previously thought.

In Benigno et al. (2024), we assess the post-pandemic natural rate of interest (r*) from different perspectives. We review estimates of r* as well as the development of key underlying drivers. We also consider the possibility that r*, rather than being a purely exogenous guidepost, may itself be affected by the conduct of monetary policy over time and may therefore have risen on the back of the monetary tightening.

Natural rate measurement

The natural rate is an analytical concept, making any measurement of it a model-dependent exercise. Furthermore, operationalising the concept empirically requires taking a stand on what the long run without shocks corresponds to in calendar time. It is often assumed to refer to a horizon of five to ten years.

One type of estimate that is easily available for a broad group of countries is based on term structure models which generate a path of expected future short-term rates by filtering out the term premium from long-term yields. Combining this with indicators of future (expected) inflation provides an estimate of market participants’ views of expected short-term real rates. The specific estimates considered here refer to the average level expected five to ten years from now.

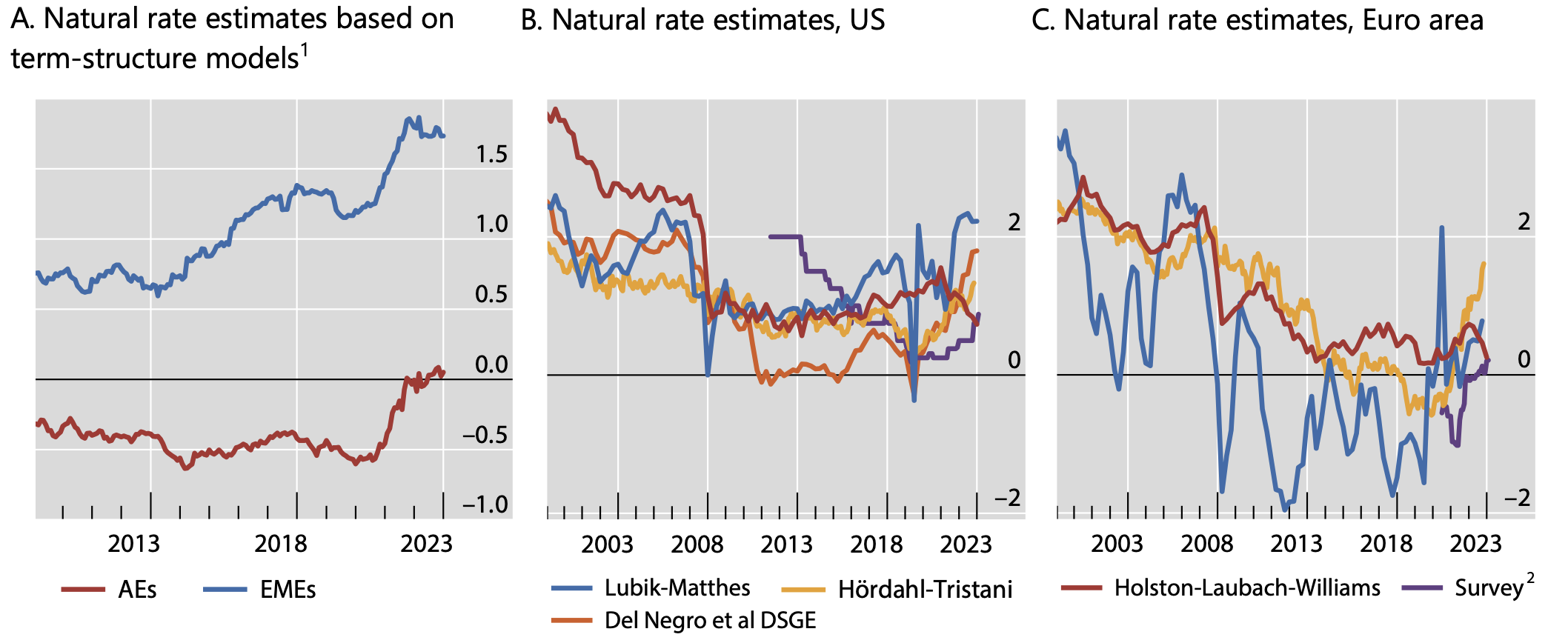

On balance, the estimates point to an increase in natural rates relative to pre-pandemic levels, in both advanced and emerging markets (Figure 1A).

Figure 1 Natural rate estimates in percent

Notes: 1 Five-year/five-year forward expected real short-term interest rates (deflated using six to ten year consensus inflation forecasts). Simple averages across economies. AEs = AU, CA, CH, EA, GB, JP, SE and US; EMEs = BR, CL, CO, CZ, HK, ID, IL KR, MX, PE, PL, SG, TH and ZA. 2 Survey of primary dealers for the US; survey of monetary analysts for the euro area.

Sources: Del Negro et al. (2017), Holston et al. (2023), Hördahl and Tristani (2014), Joslin et al. (2011), Lubik and Matthes (2015), ECB, Federal Reserve Bank of Richmond, Federal Reserve Bank of New York, Bloomberg, Consensus Economics, Refinitiv Datastream, BIS.

In the case of the US and the euro area, a larger number of r* estimates are available (Figures 1B and 1C):

- a semi-structural model-based estimate from Holston et al. (2023) (HLW)

- a time series model-based measure from Lubik and Matthes (2023) (LM)

- a dynamic stochastic general equilibrium (DSGE) model-based measure from Del Negro et al. (2017) (only for the US)

- a term structure model-based measure from Hördahl and Tristani (2014)

- a survey-based measure from central-bank surveys of market participants.

Several key observations emerge from the estimates. First, estimates at times vary widely. The difference between the highest and lowest estimates is sometimes over 2 percentage points. Second, natural rate estimates trended down over the pre-pandemic decades. Third, this downward trend reversed post-pandemic: most measures display a significant increase, in some cases to pre-Great Financial Crisis (GFC) levels. Lastly, the current juncture is marked by a high level of uncertainty regarding estimates of r*. The width of the range of estimates is about 1–2 percentage points. At the same time, there is also a high degree of uncertainty around the individual estimates due to large statistical confidence bands (Benigno et al. 2024).

Natural rate drivers

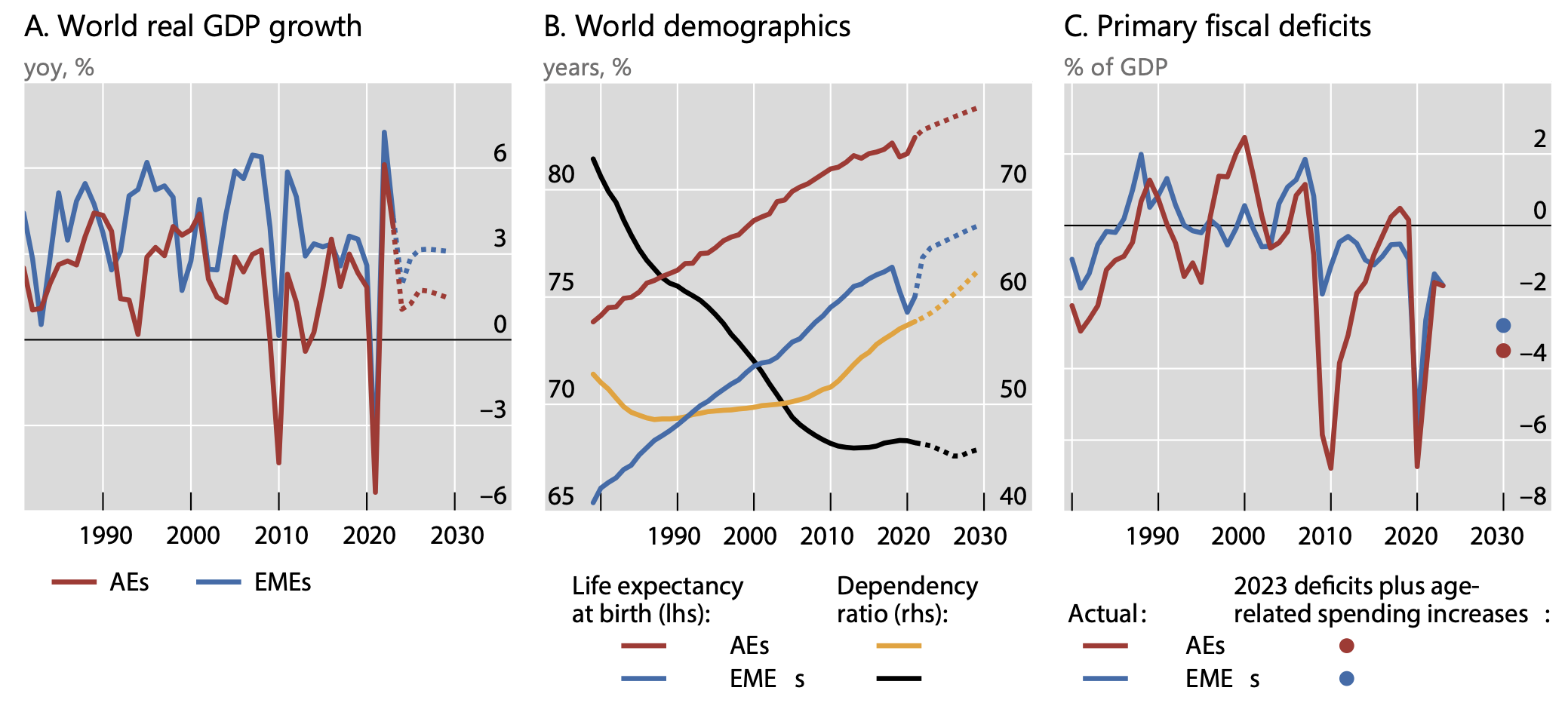

How could a higher natural rate be rationalised from the perspective of its underlying drivers working through the saving-investment balance? The picture is mixed. Some developments point to r* remaining low. Trend real growth, a key factor driving r* conceptually, has been anaemic globally for two decades and does not show signs of acceleration (Figure 2A). The widespread adoption of artificial intelligence may boost productivity growth, but it is too early to assess how realistic these hopes are. Life expectancy keeps increasing, pointing to continued high saving needs to support a longer retirement (Figure 2B).

Other developments point to a higher r*. Dependency ratios are rising in advanced economies and flattening out in emerging market economies, indicating lower saving since the elderly tend to dissave (Figure 2B). Fiscal deficits are poised to increase further on the back of higher age-related spending (Figure 2C), as well as due to investment in the green transition and higher defence spending. The adoption of new technologies, green or digital, may also boost private investment. Furthermore, growing geopolitical fragmentation could roll back financial globalisation, potentially pushing up real rates.

In sum, a qualitative assessment of the evolution of saving-investment drivers suggests that few are pointing towards continued low r* and a number are pointing towards higher r*. On balance, a higher post-pandemic r* can therefore not be ruled out, but uncertainty again looms large.

Figure 2 Evolution of possible drivers of r*

Note: Dotted lines in panels A and B indicate forecasts.

Sources: IMF, OECD, UN, authors’ calculations.

Monetary policy and the natural rate

The assessment of r* is further complicated by the possibility that the natural rate, or at least perceptions of it, are influenced by monetary policy. Standard macroeconomic theory rules this out based on models in which money is ‘neutral’, i.e. it cannot have an impact on real variables in steady state. However, it is possible that monetary policy has at least very long-lasting effects on real variables, which would be quite similar to, or hardly distinguishable from, changes in r*.

In a recent Vox column, Fernández-Villaverde et al. (2024) highlight how monetary policy strategies may influence the natural rate through its implications for the constraints posed by the effective lower bound (ELB). They suggest that the monetary policy strategy reviews of 2020-21 have raised inflation expectations and thereby raised the natural rate by reducing the likelihood of hitting the ELB in the future.

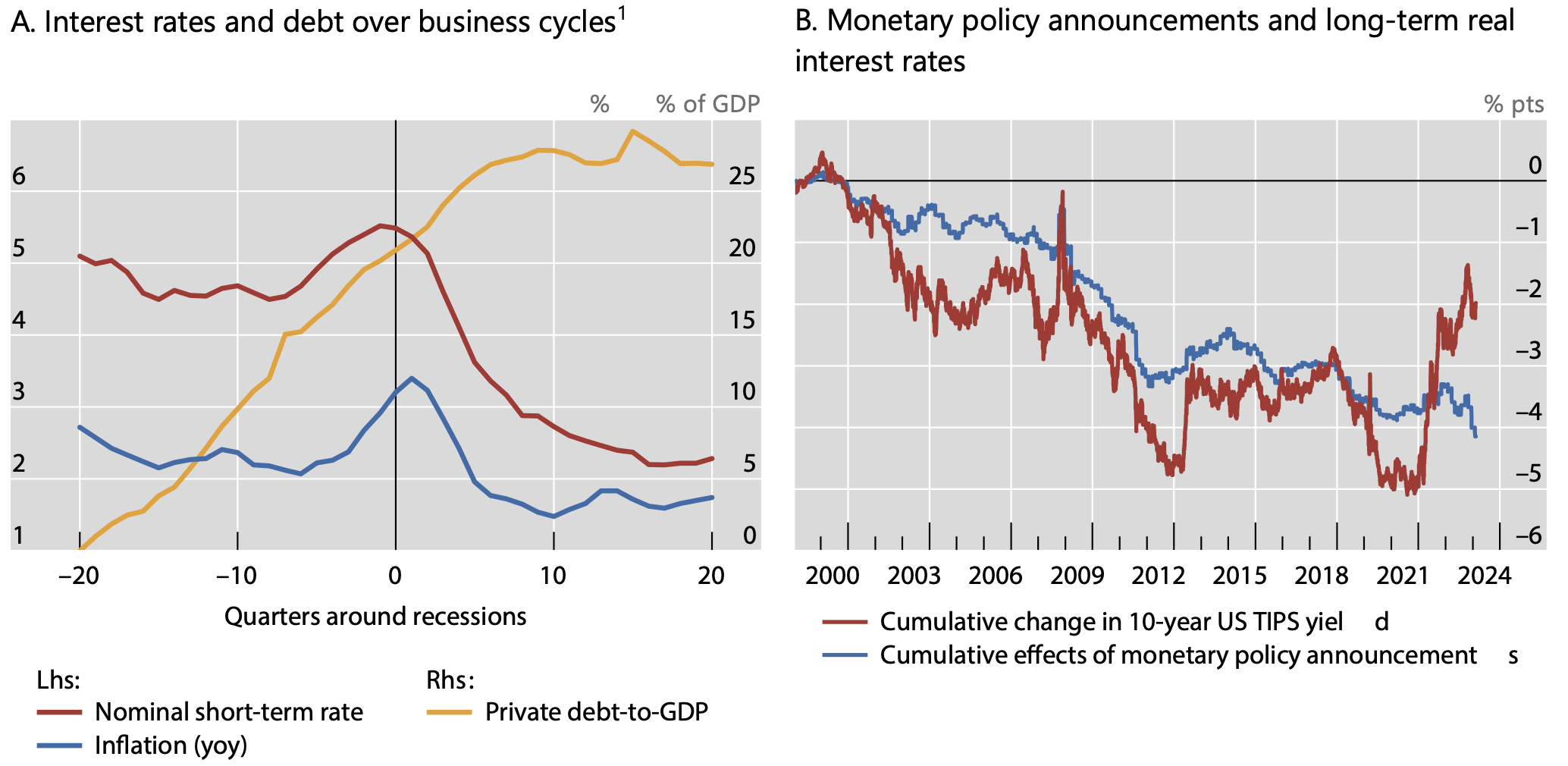

In Benigno et al. (2024), we discuss how the conduct of monetary policy over time may affect r*. One way is the interaction with the financial cycle, through which prolonged expansionary monetary policy could lower r* over long horizons by fuelling debt accumulation and financial imbalances. High debt burdens can weigh heavily on demand, pushing down r* (Mian et al. 2021). At the same time, financial imbalances often usher in financial crises, which have very persistent, if not permanent, effects on economic activity (Borio and Disyatat 2014). The risk of such developments playing out is higher when inflation remains subdued and fails to signal unsustainable expansions, owing to structural forces such as globalisation keeping it down. Based on such considerations, Borio (2021) and BIS (2023) suggest that low pre-pandemic interest rates largely reflected progressive monetary policy easing over sequential business cycles pushing real interest rates down and indebtedness up in a context of low inflation (Figure 3A)

Figure 3 Monetary policy and the natural rate

Note: 1 The horizontal axis denotes quarters around recessions in the business cycles, with the peak date set at zero (vertical line). Lines show the mean evolution of the time series across 16 AEs and events from 1985 to 2019.

Sources: Gürkaynak et al. (2008), Board of Governors of the Federal Reserve, IMF, OECD, National Bureau of Economic Research, Bloomberg, Datastream, Economic Cycle Research Institute, Global Financial Data, Refinitiv, national data, BIS, authors’ calculations.

A role for monetary policy in affecting r* could also be suggested by the apparent long-lasting influence of monetary policy on long-term real interest rates. The overall decline in US long-term real yields since the late 1990s appears to have been driven largely by yield changes around monetary policy announcements (Figure 3B). This indicates that financial market participants take a cue from policy decisions when assessing where real rates will go over long horizons – implicitly, r* – and that, over time, those changes do not vanish.

These considerations have two main implications. First, the possibility that r* may be influenced by monetary policy further complicates the operationalisation of the concept. Second, r* (or at least perceptions thereof) may have risen relative to pre-pandemic years because of expectations of a prospectively tighter monetary policy in a structurally more inflationary environment. This may restrict monetary policy’s leeway to remain accommodative during expansion phases, limiting the accumulation of financial imbalances and their long-term negative impact on r*.

Conclusion

The analysis in this column suggests that r*, or at least perceptions of it, may have risen post-pandemic, but that its assessment is surrounded by a very high degree of uncertainty. Moreover, measured r* may in part reflect monetary policy. These findings are important for the coming round of monetary policy strategy reviews by major central banks around the world.

Authors’ note: The views expressed here are exclusively those of the authors and do not necessarily represent the views of the ECB, the BIS, the Bank of Spain, or the Eurosystem.

References

Bank for International Settlements (BIS) (2023), “Monetary and fiscal policy: safeguarding stability and trust”, Annual Economic Report 2023, Chapter 2.

Benigno, G, B Hofmann, G Nuño and D Sandri (2024), "Quo vadis, r*? The natural rate of interest after the pandemic", BIS Quarterly Review, March.

Borio, C (2021), “Navigating by r*: safe or hazardous?”, BIS Working Papers, no 982.

Borio, C and P Disyatat (2014), “Low interest rates and secular stagnation: is debt a missing link?”, VoxEU.org, 25 June.

Borio, C, P Disyatat, M Juselius and P Rungcharoenkitkul (2022), “Why so low for so long? A long-term view of real interest rates”, International Journal of Central Banking 18(3): 47–87.

Del Negro, M, D Giannone, M Giannoni and A Tambalotti (2017), “Safety, liquidity, and the natural rate of interest”, Brookings Papers on Economic Activity 48, Spring, 235–316.

Fernández-Villaverde, J, J Marbet, G Nuno and O Rachedi (2024), "Monetary policy strategy and the natural rate", VoxEU.org, 26 February.

Hamilton, J, E Harris, J Hatzius and K West (2016), “The equilibrium real funds rate: past, present, and future”, IMF Economic Review 64(4): 660–707.

Hillenbrand, S (2023), “The Fed and the secular decline in interest rates”, mimeo.

Holston, K, T Laubach and J Williams (2023), “Measuring the natural rate of interest after COVID‑19”, Federal Reserve Bank of New York Staff Reports, no 1063.

Hördahl, P and O Tristani (2014), “Inflation risk premia in the euro area and the United States”, International Journal of Central Banking 10(3): 1–47.

International Monetary Fund (IMF) (2023), “The natural rate of interest: drivers and implications for policy”, World Economic Outlook, April, Chapter 2.

Joslin, S, K Singleton and H Zhu (2011), “A new perspective on Gaussian dynamic term structure models”, Review of Financial Studies 24(3), 926–70.

Lubik, T and C Matthes (2023), “The stars our destination: An update on our r* measure”, Federal Reserve Bank of Richmond Economic Brief, no. 23–32, September.

Lunsford, K and K West (2019), “Some evidence on secular drivers of US safe real rates”, American Economic Journal: Macroeconomics 11(4): 113–39.

Mian, A, L Straub and A Sufi (2021), “Indebted demand”, Quarterly Journal of Economics 136(4): 2243–307.

Obstfeld, M (2023), “Natural and neutral real interest rates: past and future”, NBER Working Paper No. 31949.

Rungcharoenkitkul, P and F Winkler (2021), “The natural rate of interest through a hall of mirrors” BIS Working Paper No. 974, November.

Taylor, J (1993), “Discretion versus policy rules in practice”, Carnegie-Rochester Conference Series on Public Policy 39, 195–214.

Wicksell, K (1898), Geldzins und Güterpreise. Eine Untersuchung über die den Tauschwert des Geldes bestimmenden Ursachen (English translation: Interest and prices: a study of the causes regulating the value of money), Macmillan, 1936.