Central bank announcements are crucial for communicating policy decisions and ensuring the stability of an economy's financial system (Jansen et al. 2022). It has been shown that the sentiment in such announcements and even the voice of the speaker can influence financial markets (Gorodnichenko et al. 2021, Takeda and Keida 2020). In the past, the credibility of central banks has been tested in the context of significant negative exogenous shocks, including financial crises and the Covid-19 pandemic (Vayid 2013, Unsal and Garbers 2021). However, neither of those shocks is comparable to a full-scale war when both the economy and people shift to survival mode. In that light, has the National Bank of Ukraine’s (NBU) communication remained effective during the Russian–Ukrainian War? In a recent paper (Gao et al. 2023), we sought to answer that question. Unlike most previous studies, which have examined the reaction of the stock market, we instead looked at the unofficial foreign exchange (FX) market.

On 24 February 2022, on the morning of Russia’s invasion of Ukraine, the National Bank of Ukraine took several measures to avoid an economy-wide sell-off. Among them was fixing the previously flexible exchange rate for hryvnia (UAH) at the latest pre-war level, a fixed regime that continued throughout 2022 and into part of 2023 and was adjusted only once, on 21 July 2022. In the days following the invasion, generally negative expectations about the prospect of the war decreased the demand for UAH relative to USD, and the official UAH became overvalued. As a consequence, people were restricted to selling their cash USD for UAH at an unfavourable official rate, while legally buying USD became next to impossible. In response, a black currency market emerged that gave rise to the black-market premium (BMP): the difference between the unofficial and official exchange rates. Since then, economists, the NBU, and the public have engaged in a heated discussion on whether to keep the UAH fixed or revert to its previously floating status.

In that context, the National Bank of Ukraine’s announcements have been watched especially closely, for their sentiment can either hint at a return to the UAH’s floating status or cement ideas that the fixed rate will persist for the foreseeable future. Each announcement has made professional actors as well as the public adjust their behaviour, which has consequently raised and lowered the black-market premium. Thus, though the stock and official foreign exchange markets have remained largely non-functioning, it has been possible to study the effect of the NBU’s communication on the economy by looking at the arguably more important black market.

To quantify the sentiment in the NBU’s announcements, we downloaded all 220 announcements made by the NBU in 2022 from the NBU’s official website (www.bank.gov.ua) and, using ChatGPT, classified them into expressing either a fixed or float sentiment toward the UAH’s exchange rate. That classification was our main policy variable.

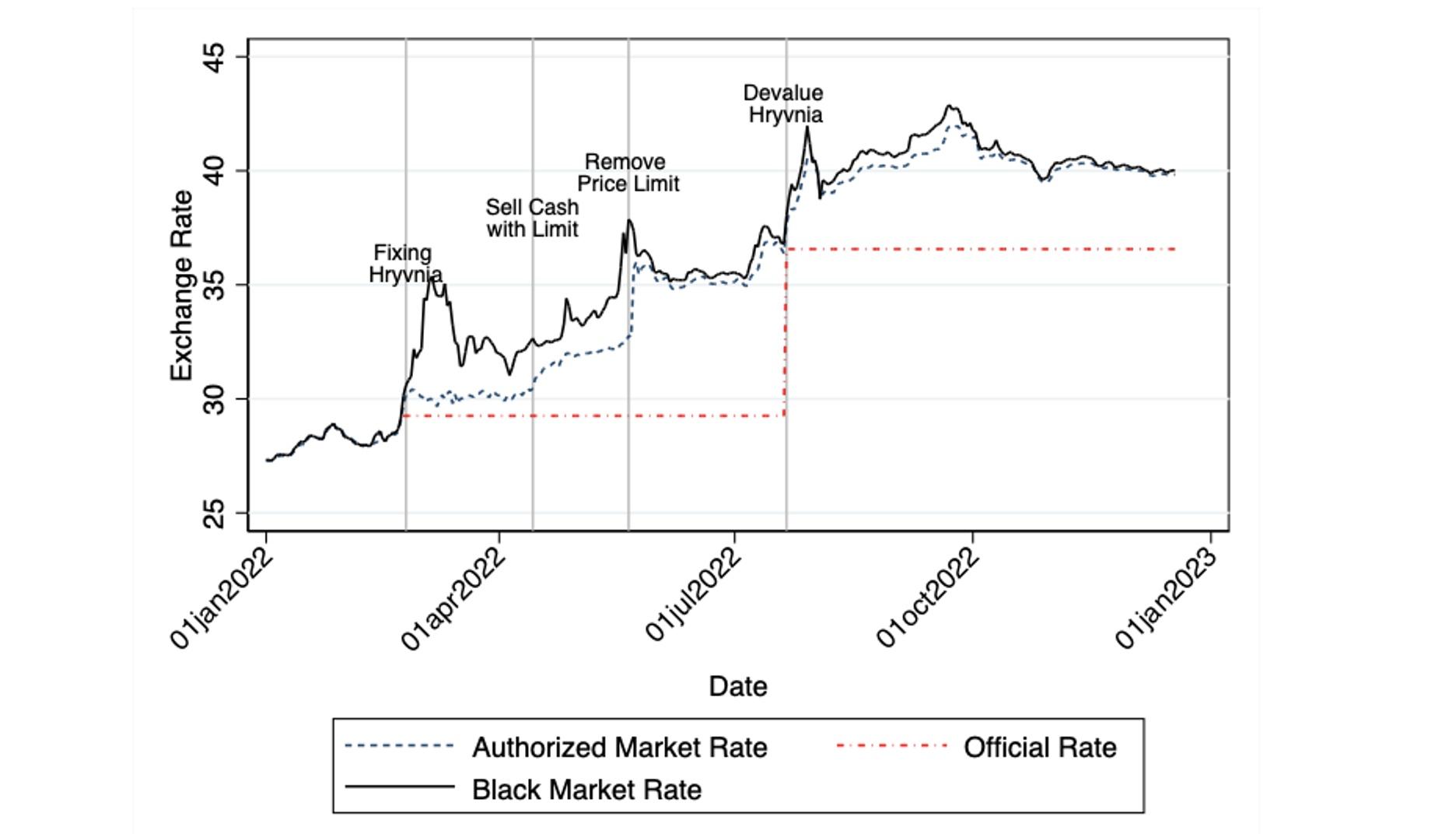

To calculate our main response variable, the black-market premium, we first downloaded data from www.finance.ua, a foreign exchange currency platform that allows banks and other financial institutions authorised by the NBU to list their sell and buy prices. While the NBU’s official interbank rate remained fixed, financial institutions were allowed to slightly deviate from the rate while transacting with the public. The website contains daily UAH and USD quotes from 84 authorised agents in 20 Ukrainian cities. Second, we obtained daily black-market foreign exchange quotes from www.minfin.ua, which allows non-institutional traders to post advertisements containing offers to privately buy or sell USD in various cities. The quotes listed on the website are not authorised by the currency authority, and no transactions between sellers and buyers are traced or recorded by the website. The difference between those black-market quotes and the authorised market prices comprise the black-market premium (Figure 1).

Figure 1 Evolution of the medians of the three UAH to USD exchange rates

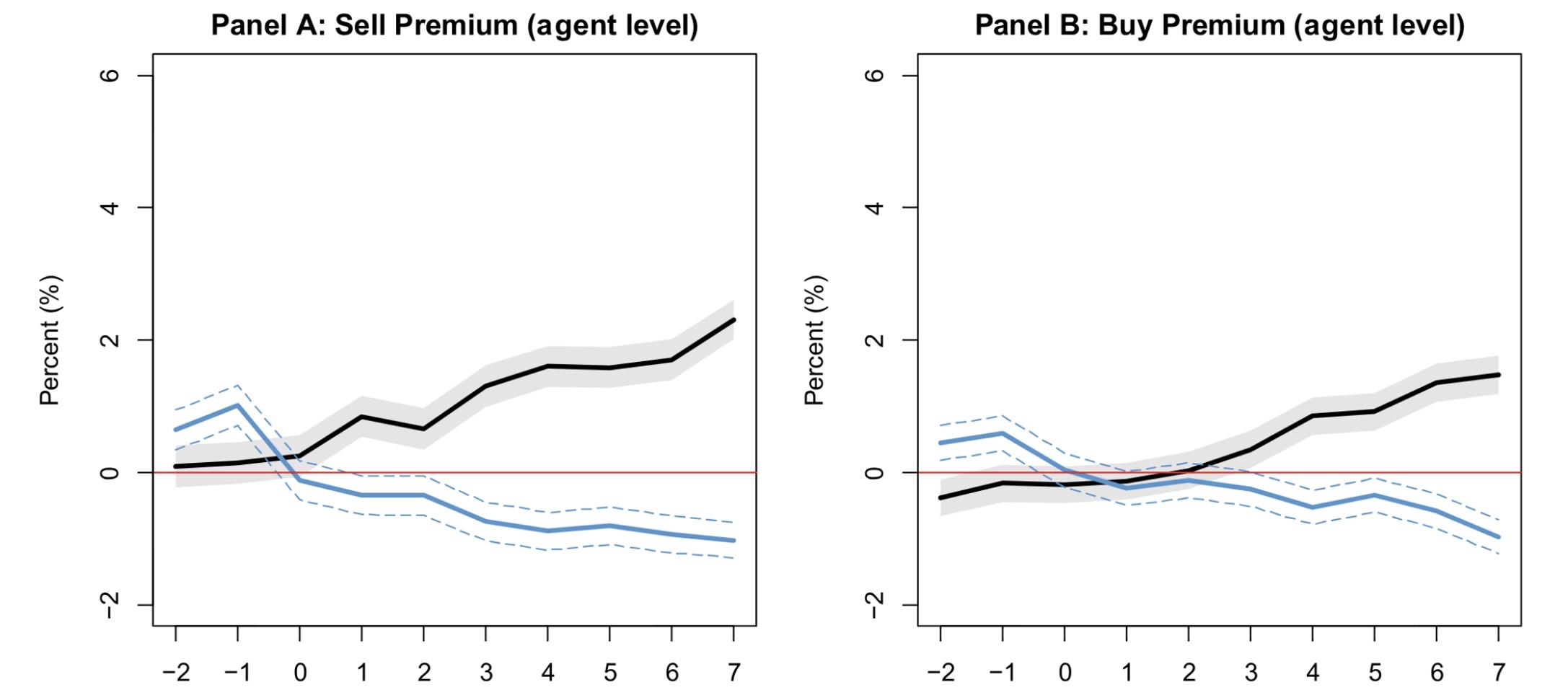

To examine relationships between changes in the black-market premium and the NBU’s announcements, we used regression analysis. In particular, we estimated how much and in which direction the black-market premium moved in N days following a fixed- or float-sentiment announcement, with N being as large as seven days. The results for the buy and sell sides are presented in Figure 2.

Our findings suggest that central bank communications continue to be a powerful tool, even in times of heightened distress. That result shows that, contrary to anecdotal evidence, both the general public and non-institutional entities pay heed to central banks, including semi‐legal black-market traders and authorised small currency exchange shops, all of which adjust their prices in response to relevant announcements released by the NBU.

Our results also show that, in response to a fixed-sentiment announcement, the black-market premium increased by 2% and, in response to a float-sentiment announcement, decreased by 1%. That asymmetry suggests that the market perceives fixed-sentiment announcements as being more credible than float-sentiment announcements and, consequently, responds more vigorously to them. Indeed, since the start of the Russian–Ukrainian War, the NBU has consistently maintained a fixed exchange rate. Moreover, the response on the buy side appeared to be muted and delayed compared with the sell side’s response. One explanation is that, during wartime, when the official exchange rate is lower than the market equilibrium, the black market becomes the preferred option for parties seeking to buy USD. Indeed, anecdotal evidence suggests that, in 2022, it was next to impossible to purchase USD on the authorised market, which gave the black market significant market power. By contrast, all authorised institutions were ready to purchase foreign currency from the public.

Figure 2 Evolution of the sentiment response coefficient for the sell and buy sides

Notes: Response of the black-market premium to a fixed-sentiment (black line) and float-sentiment (blue line) announcement for the sell and buy sides of the foreign exchange market. On the horizonal axis is the number of days after an National Bank of Ukraine announcement, and the area around each line represents the 95% confidence interval.

Further analysis revealed that the black-market premium’s response was four times greater in frontline regions compared with that of traders located in non-combat areas. Indeed, people have been willing to pay a significant black-market premium to convert UAH into USD amid the real possibility that their city could be seized and that Ukrainian currency may consequently lose value. Additionally, in our sample, 50% of the authorised agents are non-bank institutions (i.e. currency exchange shops) and the rest are banks. We found that banks responded faster and more strongly to the National Bank of Ukraine’s announcements than non-bank agents, an effect observed for both the sell and buy sides of the market. That trend likely indicates the lower level of expertise at currency exchange shops compared with banks.

Conclusions

In our article (Gao et al. 2023), we have discussed the effectiveness of the communications of Ukraine’s central bank, the NBU, about the foreign exchange market and highlighted some of its successes and failures during the Russian–Ukrainian war. Evidence shows that, even under the highest level of stress, the public and non-institutional agents still listen to central banks. Foreign exchange announcements issued by the NBU, even without indicating any actual changes to the exchange rate regime, lead to significant movements in the black-market premium.

References

Gao, G, A Nikolsko‐Rzhevskyy and O Talavera (2023), “Can Central Banks Be Heard Over the Sound of Gunfire?”, Journal of Financial Research 46(S1): S183-S203.

Gorodnichenko, Y, T Pham and O Talavera (2021), “The voice of monetary policy”, VoxEU.org, 25 April.

Jansen, D-J, J De Haan, M Ehrmann and A Blinder (2022), “Central bank communication with the general public: Challenging, yet worthwhile”, VoxEU.org, 6 October.

Takeda, Y and M Keida (2020), “The art of central bank communication: Old and new”, VoxEU.org, 17 April.

Unsal, F and H Garbers (2021), “Central bank communication through COVID-19-focusing on monetary policy”, IMF Special Series on COVID-19.

Vayid, I (2013), “Central bank communications before, during and after the crisis: from open-market operations to open-mouth policy”, Technical Report 2013-41, Bank of Canada.