In the days following the UK vote on 23 June 2016 to leave the EU, almost $3 trillion was wiped off global markets. This suggests that investor expectations were largely in line with the dire predictions of Dhingra et al. (2016), for example, whose computable general equilibrium analysis predicted negative effects from rising trade barriers, with a hard Brexit (where tariffs rise to WTO most-favoured nation levels) lowering UK income as much as 9.5%. That said, despite a 7% decline in markets around the world in the first two trading days post-referendum (including the UK's FTSE 350 index, the German HDAX, and the US's S&P 500), most of the losses were reversed within a week.

While this might suggest that investors expect small effects from Brexit, these aggregate movements mask significant variation both across and within industries. In a recent study (Davies and Studnicka 2018), we find significant heterogeneity in the market's post-referendum valuation of FTSE 350 firms. Further, a large amount of this variation is explainable by the vulnerability of a company's global value chain (GVC).

Abnormal returns in unusual times

In our analysis, we employ an event study. This is a standard methodology which develops a prediction of a given firm's return based on overall conditions – in our case, based on the market return, and on industry trade-share weighted exchange rate movements. We compare it with the firm's actual return. This generates an ‘abnormal return’ for the days following the referendum. A negative abnormal return indicates that a firm performed worse relative to the (already dismal) expectations captured in the overall fall in the market. In contrast, a firm with a positive abnormal return might still have lost value, just not as much as expected.

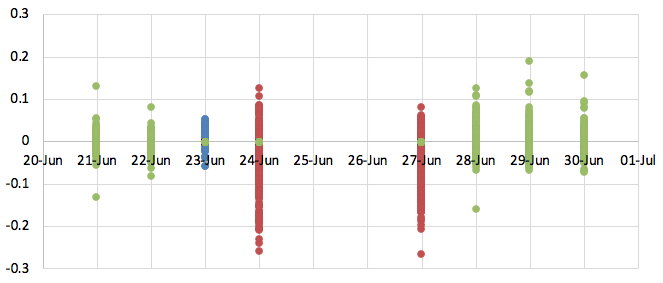

Figure 1 shows that,when examining these abnormal returns, there is a clear spike in their size and statistical significance following the referendum. Before the announcement of the referendum's results, abnormal returns were small and clustered around zero. This includes on 23 June, the day of the vote itself (in blue).

Figure 1 Abnormal returns by day for FTSE 350 firms, 20-30 June 2016

Source: Davies and Studnicka (2018).

When the results of the referendum were revealed (which occurred after the close of trading on 23 June), average abnormal returns were well below zero for the next two trading days and there was a large increase in their variation (the market was closed on 25 and 25 June). This implies that the outcome of the referendum was unexpected, a fact consistent with both polling data (in which ‘Remain’ led prior to the vote) and betting agencies (whose odds were 7/1 against Brexit). These changes are only found in the first two trading days after the vote, after which the overall pattern in abnormal returns reverts to its pre-referendum norm. This indicates that the market's reaction was swift.

Rising barriers and falling returns

The return to normal trading, however, does not mean that there were no lasting impacts. Significant differences remained across firms. In particular, our analysis shows that it was firms with at-risk GVCs who tended to perform worse than expected during the first two trading days. Furthermore, the gap that was created between a ‘safe’ and a ‘vulnerable’ firm during those days persisted a month later.

We use information on where the firm's global affiliates are located to calculate its share of UK and EU27 affiliates (with those outside the EU28 forming the remainder). Here, our estimates indicate that a 10% increase in a firm's UK affiliate share corresponds to a 12.1% more negative abnormal return, in other words, a 12.1% bigger shortfall in actual relative to expected returns. A 10% increase in the share of EU affiliates, meanwhile, means a 3.4% decline in the abnormal return.

These differences are for firms within an industry. They indicate that even if post-Brexit trade barriers rise equally for all firms in a given sector, this will be particularly damaging when a company's affiliate structure suggests important EU-UK trade.

The referendum also led to changes in the value of the pound. On the day after the vote, the pound fell by 7.8% against the dollar and by 5.8% against the euro. This has several potential effects on firms. First, it increases the pound-denominated cost of imported intermediates, a detrimental effect particularly severe in industries where such imports are a significant source of inputs. This negative effect is partially avoided if those imports are intra-firm, because a multinational can alter internal prices to offset currency fluctuations. Similarly, the higher flexibility of intra-firm prices would enable a multinational to take advantage of the increased profitability of exports following depreciation.

By combining data on firm-specific changes in the pound (based on affiliate locations) with that on the role of intermediates in exports and imports, we find evidence of these three effects. While secondary to the affiliate location results, these estimates show that UK firms that rely on imported intermediates are vulnerable. This vulnerability is partially offset by intra-firm trade.

Our estimates show three things:

- Even though the market fell steeply immediately following the referendum, this was not equally spread across firms.

- The shift against vulnerable GVCs happened primarily in the first two trading days.

- This change was persistent, with the gaps still present after a month.

HDAX and other events

To reinforce our analysis, we repeated the process for firms on the German HDAX index, Here, we would not expect to find a significant explanatory power from GVCs because unlike firms on the British FTSE, HDAX firms have little affiliate structure in the UK. Also, post-Brexit, nothing would have changed in the trading relationship within the EU27.

Despite the fact that the HDAX had a pattern of decline and recovery mirroring the FTSE, the GVC variables hold no explanatory power in the HDAX. The heterogeneous effects we find are specific to the vulnerable British GVCs.

Finally, we examine the market's response to other Brexit related events, including the triggering of Article 50 on 29 March 2017 which began the two-year countdown to the UK's exit. We find little reaction to these subsequent events suggesting that, unlike the referendum, there is little information inspeeches that proclaim "Brexit means Brexit".

Bottom line

While the negotiation process surrounding the Brexit vote may be charitably described as confused, one thing is clear – Brexit is likely to generate significant barriers to the flow of commerce between the UK and the rest of the EU. Even within industries, Brexit's effects are likely to be uneven. While this presents the possibility of implementing targeted policy to protect the most vulnerable firms. A lack of progress so far suggests that such efforts are unlikely.

References

Davies, R B and Z Studnicka(2018), "The Heterogeneous Impact of Brexit: Early Indications from the FTSE", European Economic Review 110:1-17.

Dhingra, S, G Ottaviano, T Sampson, J van Reenen (2016a), "The Consequences of Brexit for UK Trade and Living Standards", CEP Brexit Analysis 2.