Editors' note: This column is a lead commentary in the VoxEU debate on euro area reform.

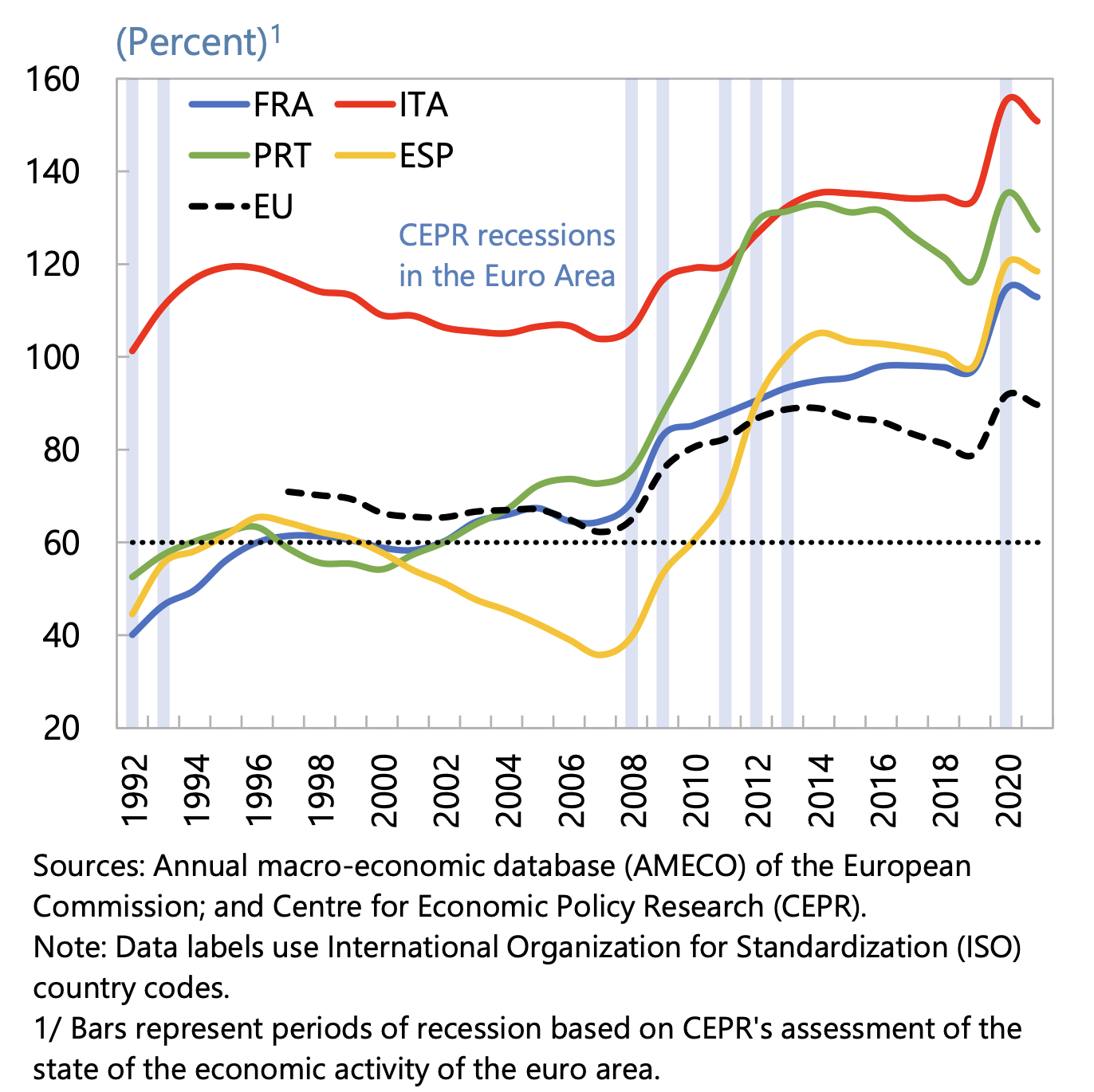

The EU’s Stability and Growth Pact (SGP), built around a deficit ceiling of 3% and debt ceiling of 60%, has been in place since 1997, with its last major reform in 2011-13. There is evidence that the framework created incentives to keep fiscal deficits around 3% (Caselli and Wingender 2021). But these incentives have not generated sufficient debt reduction in relatively good times, such as 1998–2007 or 2015–19, to buffer shocks in bad times (Figure 1). High sovereign debt was a contributing factor to the 2010–12 euro area debt crisis, and it is a significant source of vulnerability today, leading to high fiscal sustainability risk for several countries (European Commission 2022). It is difficult to avoid the conclusion that, notwithstanding several reform attempts, the rules have failed in their most basic objective, namely, preserving fiscal sustainability and preventing debt crises and their associated negative spillovers across member countries.

Figure 1 Public debt to GDP ratios in selected countries

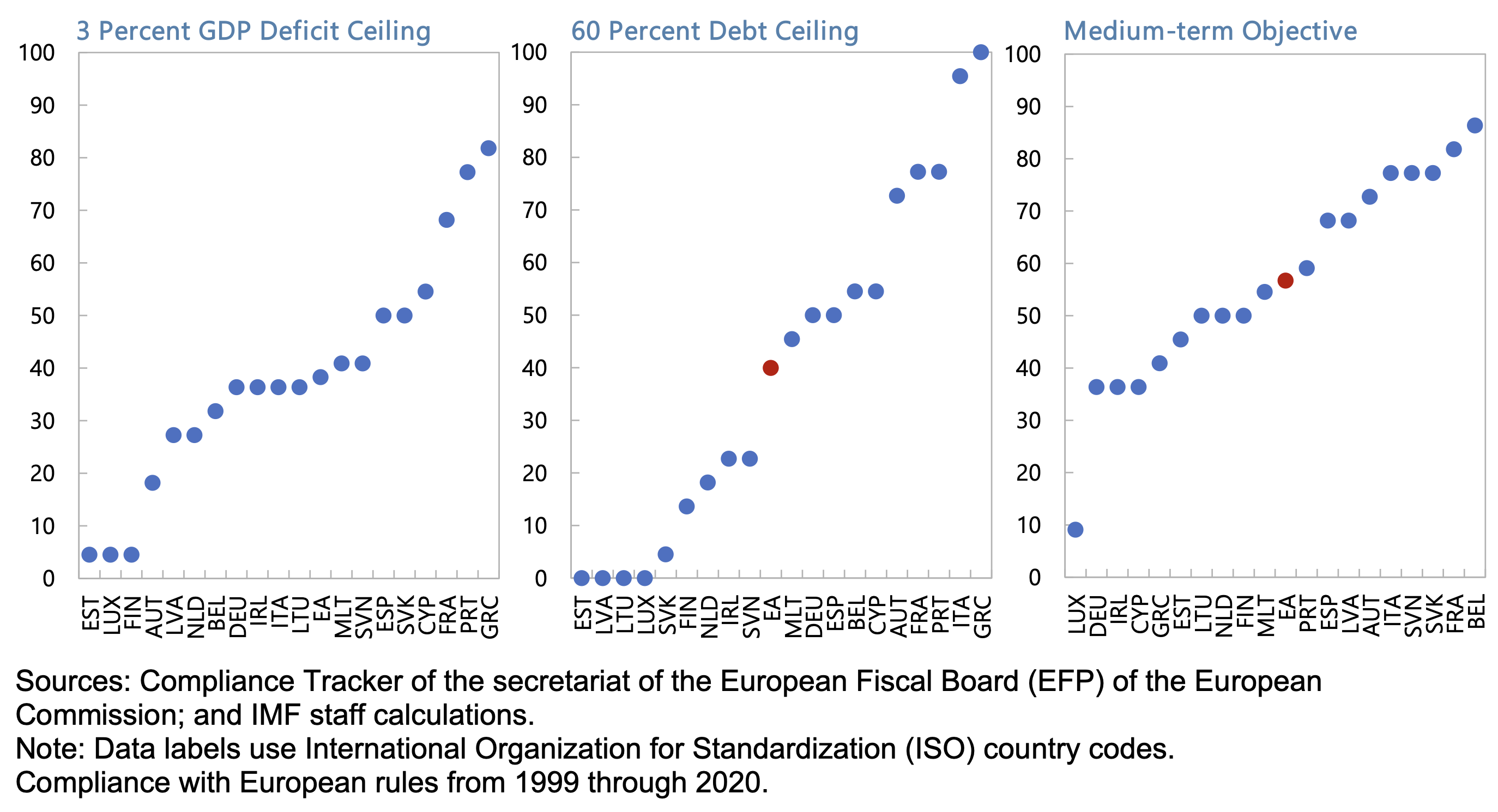

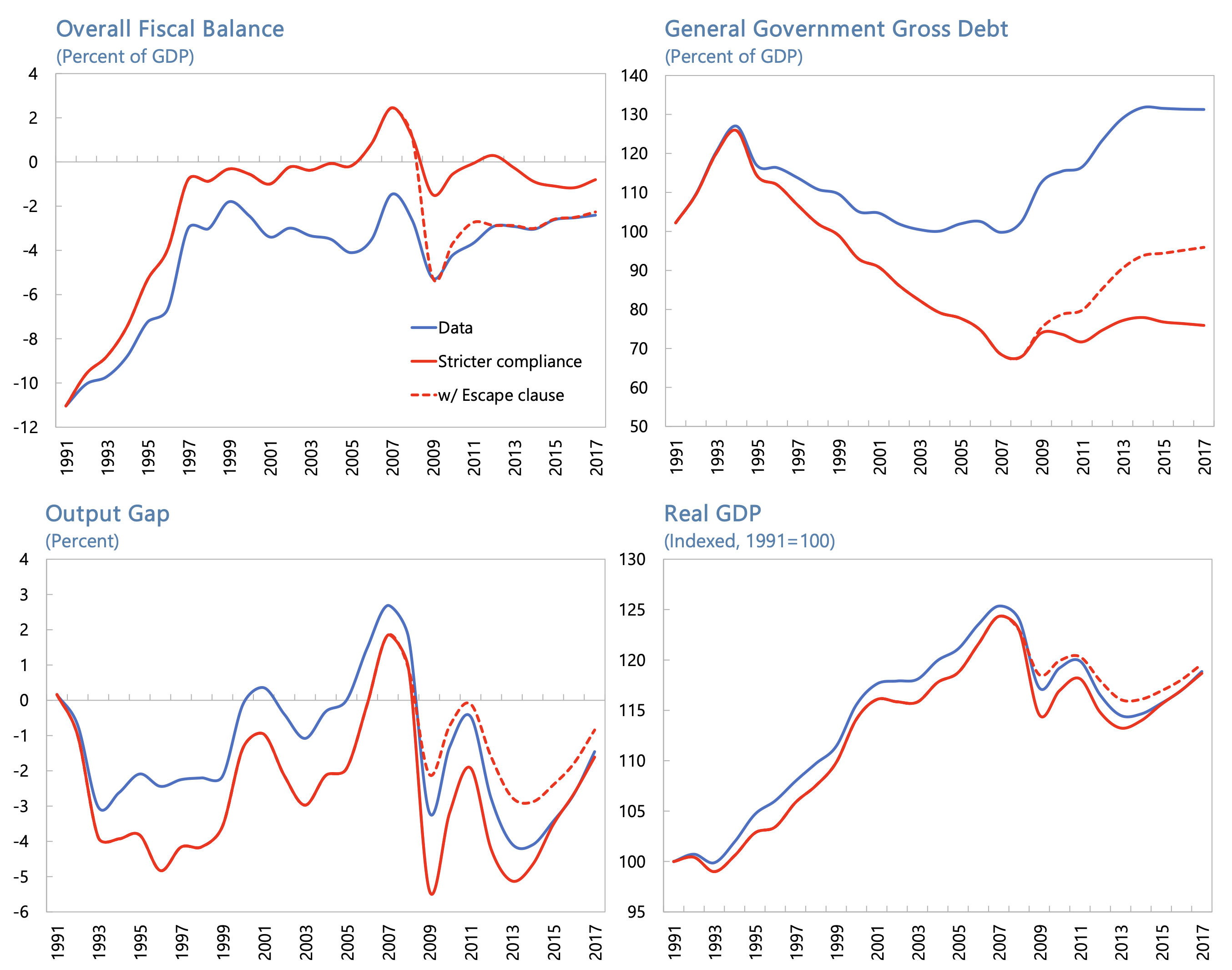

The main reason behind the failure to keep debt risks in check is that the rules have not been followed (Figure 2). This lack of compliance, together with a focus on yearly budgets rather than credible medium-term plans (Larch et al. 2021a), has resulted in continued debt accumulation. Countries such as France, Italy, and Portugal could have seen substantially lower debt if they had respected the rules. Simulations suggest that if Italy, for example, had adhered to the rules it could have entered the euro area debt crisis with a debt ratio of 70% of GDP instead of 100% of GDP (Figure 3).

The successive reforms have also led to a multiplicity of rules that have been criticised for hampering implementation. However, given the need for well-defined common fiscal rules and the difficulty in enforcing common EU rules, some degree of complexity is unavoidable (Deroose et al. 2018).

Figure 2 Fiscal aggregates and reference values in the euro area

Figure 3 Macroeconomic simulations for Italy

Given low compliance, the fiscal framework has resulted in procyclical fiscal policy. Larch et al. (2021b) show that compliance with the EU fiscal rules reduces the risk of running procyclical policies by allowing the build-up of fiscal space. Moreover, while debt levels were rising after the global crisis, countries faced historical low real interest rates, undermining the plausibility of the 60% debt anchor and leading to calls for a better assessment of debt vulnerabilities and the appropriate size of fiscal buffers (Blanchard et al. 2021).

Furthermore, the fiscal framework lacks a tool that can contribute to macroeconomic stabilisation of the euro area as a whole and help avoid procyclical policies during downturns. This is especially important when monetary policy is constrained by the effective lower bound, as was the case during the euro area’s low-inflation period during 2013–20. Fiscal policy could be particularly effective to tackle exceptional shocks, such as the pandemic, or concerns with secular stagnation (Debrun et al. 2021).

However, during 2013–20, the EU countries with fiscal space were the ones with positive output gaps. Addressing this problem requires a central fiscal capacity for macroeconomic stabilisation at the EU level.

The pandemic, climate change, and the war in Ukraine have brought new challenges. Several EU countries would face important challenges implementing the rules due to pandemic-related surges in debt and sizeable public investment needs. The application of the current rules, once the escape clause is lifted, would require unrealistically large – and counterproductive – adjustments by some high-debt countries. For example, in the case of Italy, the 1/20th debt reduction rule would imply debt reduction of about 5% of GDP every year for 20 years. Large public investments are also needed to support energy security and the green transition. Yet EU public investment has declined significantly since 2010 and is well below levels seen in Japan and the US.

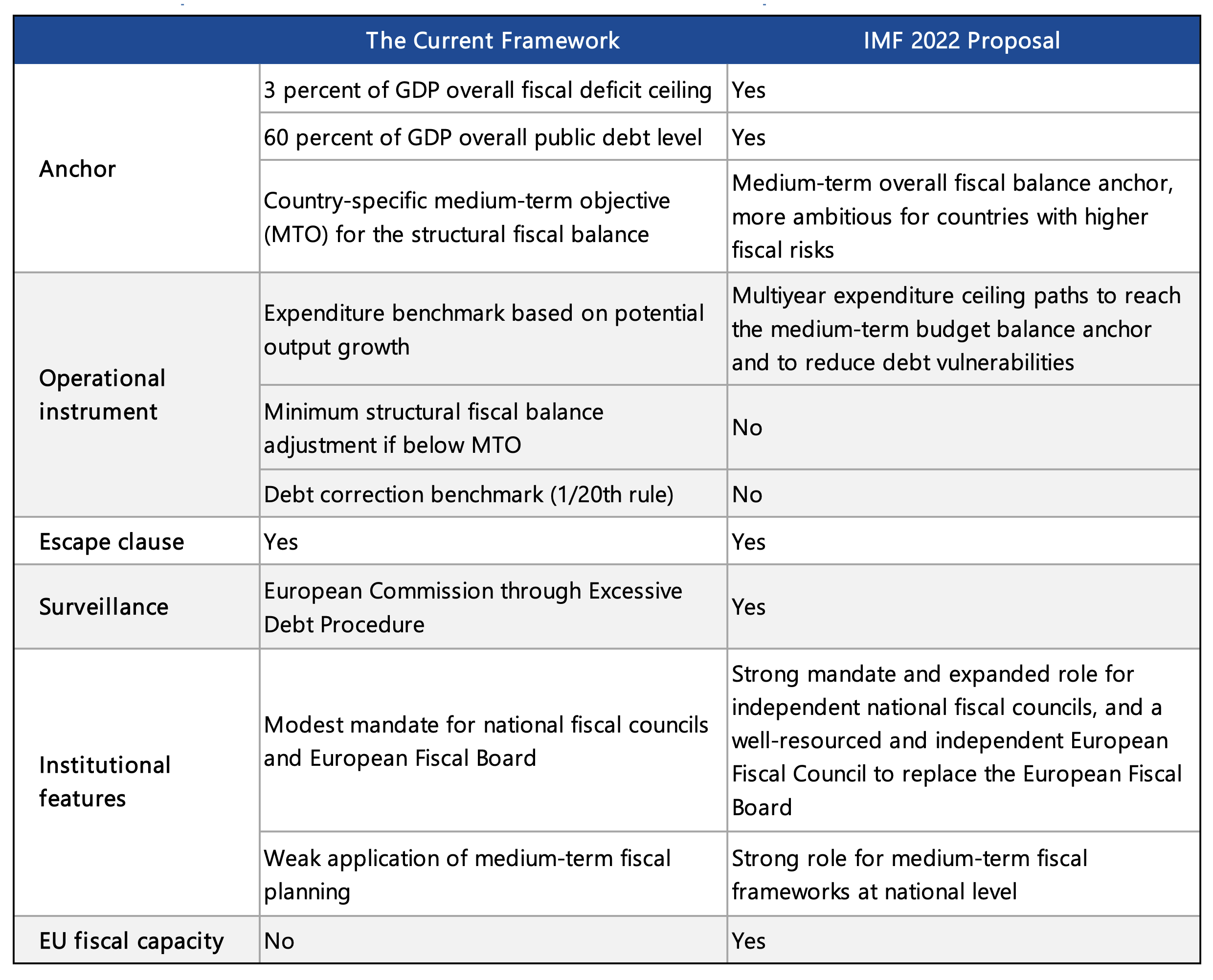

A new proposal

A new IMF proposal (Arnold et al. 2022) offers a blueprint designed to address the problems highlighted above and, more generally, strengthen fiscal governance at both the national and EU levels (Table 1). While the proposal would replace the Fiscal Compact and the SGP, it would not require changes to either the EU Treaties or the treaty protocol. This reflects our judgement (and that of many others) that reaching the required unanimity on such changes would be politically extremely difficult at this juncture. Hence, the 60% debt-to-GDP and 3% deficit-to-GDP reference values would be maintained within the new framework. The 3% deficit would work as a true limit (and not an anchor) to help navigate mild economic downturns.

The proposal is based on three main ideas, which recast and extend recent proposals by academics, fiscal experts, and institutions, as well as the IMF itself:

- Risk-based EU-level fiscal rules. These rules would link the speed and ambition of fiscal consolidation to the level and horizon of fiscal risks, as identified by debt sustainability analysis (DSA) using a common methodology developed by a new and independent European Fiscal Council, in consultation with the European Commission and other stakeholders. High-risk countries would be required to enact expenditure ceilings consistent with a zero or positive overall fiscal balance over the medium term (three to five years). Countries with fiscal risks that are not assessed to be high but with debt above 60% of GDP would be required to enact expenditure ceilings consistent with an anchor based on the overall balance that, while not necessarily zero or positive, leads to declining debt over the medium term. Countries with fiscal risks that are not assessed to be high, and with debt below 60% and not projected to rise above 60% of GDP, would have more flexibility but would still need to consider fiscal risks when formulating their medium-term fiscal plans. Such a framework would imply a reduction in debt vulnerabilities and the building of buffers in good times, providing space for countercyclical policy within the 3% of GDP deficit ceiling in response to shocks. An escape clause could be activated for large shocks, including those impacting individual countries. To avoid disruptive adjustment following a large widening of deficits, the escape clause could include a transition period after its activation, giving countries more time to gradually return to the fiscal anchor.

- A much stronger role for national fiscal frameworks and institutions. The proposal brings greater flexibility at the national level when setting fiscal plans, but for those to be credible it requires reforms to promote greater national ownership. All member countries would be required to enact medium-term fiscal frameworks, which would effectively constrain annual budgets, consistent with the EU-level rules. National fiscal councils would be required to undertake or endorse macroeconomic projections, undertake debt sustainability analyses and assess fiscal risks, and take a view as to whether the expenditure ceilings and fiscal plans proposed by governments are consistent with these risks. To play this role, national fiscal councils would need to be upgraded to a common EU-wide standard. The Commission would continue to play its key surveillance role as articulated in the Maastricht Treaty. The European Fiscal Council would complement this by providing technical support to the national fiscal councils, reviewing and commenting on their assessments and recommendations, including on fiscal risks, and being the centre of a peer network of fiscal councils.

- An EU fiscal capacity funded by common debt issuance and an income stream to service this debt. The fiscal capacity would have two key roles. The first is improving euro area macroeconomic stabilisation in the face of adverse shocks. It could help smooth country-specific shocks and facilitate an appropriate mix of fiscal and monetary support for the union, including when monetary policy is operating at the effective lower bound. One possibility is a rainy-day fund, which builds assets in good times and makes transfers to support countries in bad times. The second role is allowing the provision of common public goods at the EU level – a task that has become more urgent given the green transition and energy security concerns. This could include a climate investment fund to complement ongoing national carbon pricing reforms that would help maintain robust incentives for energy efficient and low-carbon investments. Overall, by enhancing resilience and reducing the potential for adverse spillovers, an EU fiscal capacity should help improve the implementation of fiscal rules.

Table 1 Comparison of the EU fiscal rules with the IMF staff proposal

The logic behind the proposal is that the quality of EU-wide rules and the quality of national-level implementation should be mutually reinforcing. The main reason the present framework has failed to contain debt risks has been weak national-level implementation. Strengthening implementation requires both better national ownership of the rules and their application and greater congruence of national-level frameworks with EU-level rules. The former can only be achieved by rules that convincingly balance the needs of members with the avoidance of negative externalities across members. This argues for a risk-based approach – the first pillar of our proposal – with increasing flexibility in setting fiscal plans as risks decline. The latter requires a stronger role for national-level frameworks, acting in a coordinated fashion – the second pillar of our proposal.

The credibility and transparency of the proposed reforms depend materially on improving the quality of government finance statistics and fiscal information. Europe should commit to a major revamp in the quality of government finance statistics and the comprehensiveness of easily available information on medium-term fiscal frameworks, budgets and policy plans, even though understandably it would take time to fully implement. This should include consolidated EU-level fiscal statistics, alignment of budgets with outturn information, comprehensive public sector balance sheets, accrual accounting reform, and upgraded information sharing with the European Commission for surveillance and publication.

Reform of the EU fiscal framework cannot wait. Multiple unprecedented shocks on top of already high debt levels are complicating the conduct of fiscal policy. Interest rates have been rising, and monetary policy normalisation continues apace. In this context, agreeing a timely reform of the EU fiscal framework is essential to navigate the difficult trade-offs among the tasks of reducing fiscal risks, accommodating new spending mandates, and executing them at the most efficient level (EU or national). The extension of the general escape clause through the end of 2023 provides a window of opportunity to do just this; further delays would force countries to go back to the old rules with all of their problems. It should not be wasted.

References

Allard, C, J Bluedorn and F Bornhorst (2014), “Lessons from the Crisis: Minimal Elements for a Fiscal Union in the Euro Area”, in C Cottarelli and M Guerguil (eds.), Designing a European Fiscal Union, London: Routledge.

Arnold, N, B Barkbu, H E Ture, H Wang and J Yao (2018), “A Central Fiscal Stabilization Capacity for the Euro Area”, IMF Staff Discussion Note 18/03.

Arnold, N, R Balakrishnan, B Barkbu, H Davoodi, A Lagerborg, W R Lam, P Medas, J Otten, L Rabier, C Roehler, A Shahmoradi, M Spector, S Weber and J Zettelmeyer (2022), “Reforming the EU Fiscal Framework. Strengthening the Fiscal Rules and Institutions”, IMF Departmental Paper DP/2022/014.

Baqaee, D and E Farhi (2020), “Supply and Demand in Disaggregated Keynesian Economies with an Application to the COVID-19 crisis”, NBER Working Paper No 27152.

Beetsma, R, M Bordignon, X Debrun, M Szczurek and N Thygesen (2022), “Making the EU and National Budgetary Frameworks Work Together”, VoxEU.org, 13 September.

Berger, H, G Dell’Ariccia and M Obstfeld (2018), “Revisiting the Economic Case for Fiscal Union in the Euro Area”, IMF Departmental Paper 2018/003.

Blanchard, O, A Leandro and J Zettelmeyer (2021), “Redesigning EU fiscal rules: From Rules to Standards”, Economic Policy, Washington, DC: Peterson Institute for International Economics.

Caselli, F and P Wingender (2021), “Heterogeneous Effects of Fiscal Rules: The Maastricht Fiscal Criterion and the Counterfactual Distribution of Government Deficits”, European Economic Review 136(C).

Christiano, L, M Eichenbaum and S Rebelo (2011), “When Is the Government Spending Multiplier Large?”, Journal of Political Economy 119(1), February.

Debrun, X and W H Reuter (2022), “Fiscal is Local: EU Standards for National Fiscal Frameworks”, VoxEU.org, 24 January.

Debrun, X, K Masuch, G Ferrero, I Vansteenkiste, M Ferdinandusse, L von Thadden, S Hauptmeier, M Alloza, C Derouen and K Bańkowski (2021), "Monetary-fiscal policy interactions in the euro area", ECB Occasional Paper Series 273.

Deroose, S, N Carnot, L R Pench and G Mourre (2018), “EU Fiscal Rules: Root Causes of Its Complexity”, VoxEU.org, 14 September.

EFB - European Fiscal Board (2019), Annual Report 2019, Brussels.

EFB (2021), Annual Report 2021, Brussels.

Eggertsson, G, N Mehrotra and J Robbins (2019), “A Model of Secular Stagnation: Theory and Quantitative Evaluation”, American Economic Journal: Macroeconomics 11(1): 1-48.

European Commission, Secretariat-General (2019), “European Fiscal Board workshop 2019: Independent Fiscal Institutions in the EU Fiscal Framework”, Brussels.

European Commission (2022), Fiscal Sustainability Report 2021, Institutional Paper 171, Brussels.

EU Network of Independent Fiscal Institutions (2021), “EU Fiscal and Economic Governance Review: Contribution from the Network of Independent EU Fiscal Institutions”.

Gaspar, V (2021), “The Future of the EU Fiscal Governance Framework”, Keynote Address at The Future of the EU Fiscal Governance Framework, virtual, 9 November.

Larch, M, J Malzubris and M Busse (2021a), “Optimism is Bad for Fiscal Outcomes”, SUERF The European Money and Finance Forum Policy Brief No. 234, November.

Larch, M, E Orseau and W van der Wielen (2021b), “Do EU Fiscal Rules Support or Hinder Countercyclical Fiscal Policy”, Journal of International Money and Finance 112.

Martin, P, J Pisani-Ferry and X Ragot (2021), “A New Template for the European Fiscal Framework”, VoxEU.org, 26 May.

Mian, A, L Straub and A Sufi (2021), “Indebted Demand”, The Quarterly Journal of Economics 136(4): 2243–2307.

Pench, L, S Ciobanu, M Zogala and C B Manescu (2019), “Beyond Fiscal Rules: How Domestic Fiscal Frameworks Can Contribute to Sound Fiscal Policy”, VoxEU.org, 14 October.

Woodford, M (2022), "Effective Demand Failures and the Limits of Monetary Stabilization Policy", American Economic Review 112(5): 1475-1521.

Wyplosz, C (2005), “Fiscal Policy: Institutions versus Rules”, National Institute Economic Review 191: 64–78.